North Carolina Demand Bond

Description

How to fill out Demand Bond?

Locating the appropriate legal document template can be quite a challenge. Naturally, there are numerous designs available online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers a multitude of templates, including the North Carolina Demand Bond, which can be used for both business and personal purposes. All forms are reviewed by experts and adhere to state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to access the North Carolina Demand Bond. Use your account to search through the legal forms you have previously acquired. Visit the My documents tab of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the correct form for your area/county. You can preview the form using the Preview button and review the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the suitable form. Once you are certain that the form will work, click the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained North Carolina Demand Bond. US Legal Forms boasts the largest collection of legal forms where you can discover various document templates. Utilize the service to download professionally crafted documents that comply with state regulations.

US Legal Forms boasts the largest collection of legal forms where you can discover various document templates.

- Finding the right legal record template can be quite a challenge.

- Utilize the US Legal Forms website.

- The service offers a multitude of templates.

- All forms are reviewed by experts.

- If you are already registered, Log In to your account.

- If you are a new user of US Legal Forms, here are simple instructions.

Form popularity

FAQ

To obtain a surety bond in North Carolina, you typically start by identifying the type of bond you need, such as a North Carolina Demand Bond. Next, you can gather necessary documentation, including personal and business information. After that, you can approach a licensed surety bond provider or use platforms like US Legal Forms, which simplify the application process. They can help you understand the requirements and ensure you complete your application correctly.

The Little Miller Act in North Carolina is legislation that requires contractors on public projects to secure performance and payment bonds. This act protects subcontractors and suppliers by ensuring they receive payment for their work. By understanding the implications of the Little Miller Act, you can better navigate the bonding requirements for public construction projects in North Carolina. Utilizing a North Carolina Demand Bond can help you comply with these regulations efficiently.

A demand bond and a surety bond serve different purposes in North Carolina. A North Carolina Demand Bond ensures prompt payment upon request, often used in trade and construction contexts. In contrast, a surety bond involves a three-party agreement where a surety guarantees the contractor's performance to the project owner. Understanding these differences can help you select the right bond for your needs.

Yes, certain situations in North Carolina require a surety bond. For example, public construction projects often mandate a surety bond to protect against potential financial loss. If you are engaging in such projects, securing a North Carolina Demand Bond can help you meet the legal requirements and provide peace of mind to all parties involved. Knowing the specific requirements for your project can save you from future complications.

In North Carolina, a bond serves as a financial guarantee that promises payment for specific obligations. When a contractor needs to ensure compliance with legal requirements or project specifications, they may secure a North Carolina Demand Bond. This bond protects the interests of project owners and stakeholders by ensuring that funds are available if the contractor fails to meet their responsibilities. Understanding how bonds work can help you navigate project risks effectively.

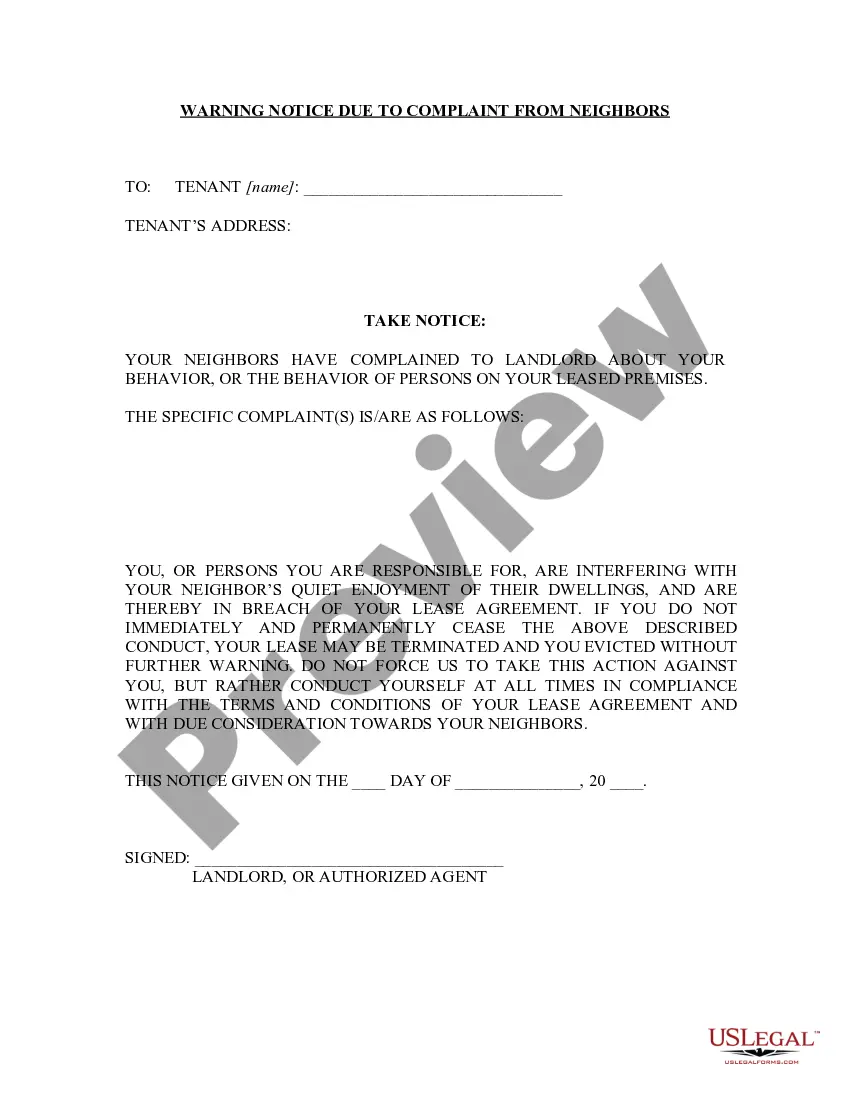

When filling out a bond form, first ensure you have the correct version for a North Carolina Demand Bond. Gather information such as the person's legal name, address, and any relevant case numbers. Clearly write or type your answers, and avoid leaving any sections blank unless specified. After completing the form, it’s wise to review it once more to confirm that everything is accurate and ready for submission.

Completing a bond form for a North Carolina Demand Bond involves several steps. Begin by carefully reading the instructions provided with the form. Fill in the required fields with accurate information, including the defendant's details and the bond amount. Double-check your entries for any mistakes before submitting the form to ensure a smooth processing experience.

To fill a bond form for a North Carolina Demand Bond, start by gathering all necessary information about the individual being bonded. You will typically need their full name, date of birth, and the specific charges they are facing. Make sure to provide accurate details to avoid any processing delays. Once you complete the form, review it for accuracy before submission.

To obtain a surety bond in North Carolina, start by researching the specific requirements for the bond you need, such as the North Carolina Demand Bond. After understanding these requirements, you can fill out an application with a surety bond company, providing them with the necessary information about your financial status. The process usually involves a quick review and approval if your qualifications meet their standards. Consider using US Legal Forms to access resources and templates that can help you navigate this process effectively.

To get a surety bond in North Carolina, you must first identify the specific type of bond required for your situation. Once you know the type, you can apply through a licensed surety bond provider. It's important to gather necessary documentation, such as financial statements and personal identification. Using US Legal Forms can streamline this process, making it easier to find the right bond for your needs.