North Carolina Direct Deposit Form for Unemployment

Description

How to fill out Direct Deposit Form For Unemployment?

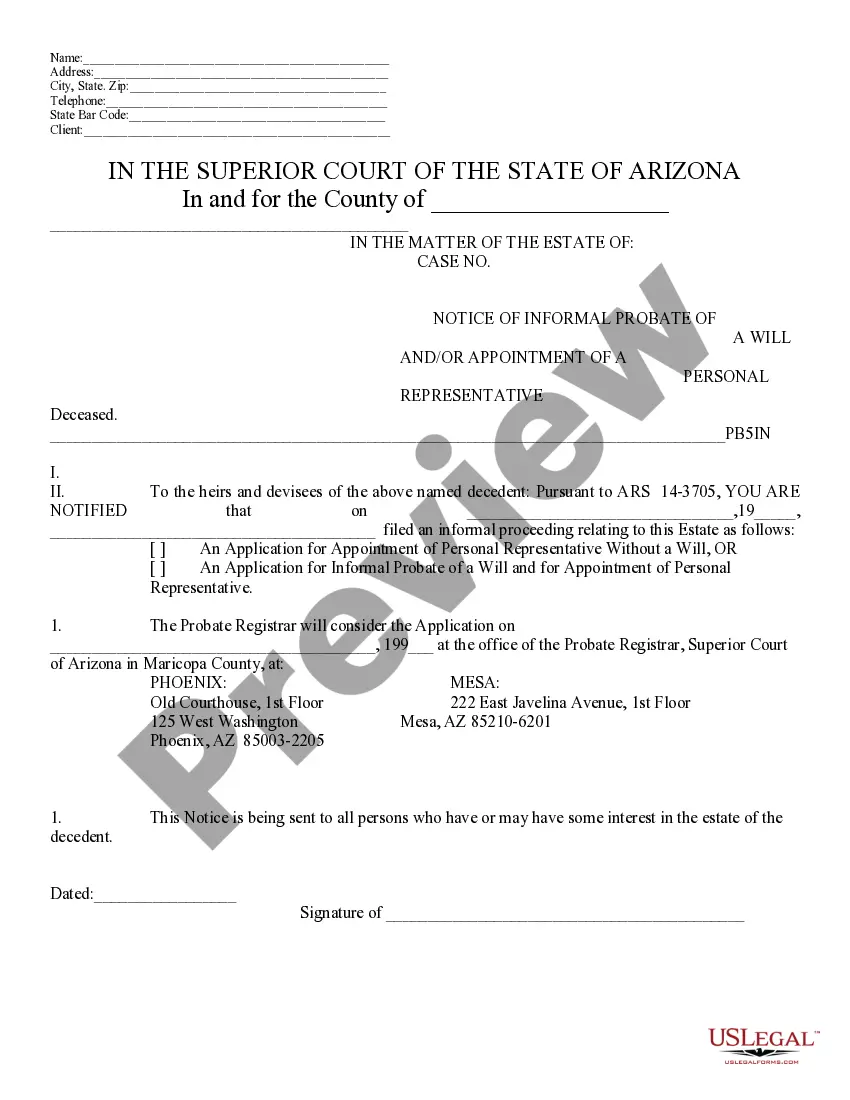

You are capable of investing time online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can conveniently download or print the North Carolina Direct Deposit Form for Unemployment from your services.

Review the document description to confirm you have selected the correct form. If available, utilize the Preview option to view the document template as well.

- If you currently possess a US Legal Forms account, you may Log In and select the Download button.

- Subsequently, you can fill out, modify, print, or sign the North Carolina Direct Deposit Form for Unemployment.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of the purchased document, go to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/city of your preference.

Form popularity

FAQ

Claimants can choose to receive benefits by direct deposit or by the use of a debit card. How Can I Check My Unemployment Check Status? If you select direct deposit, all benefits due you will be electronically deposited into your designated checking or savings account, and you will not receive a debit card.

When will I receive payment? After you have filed a claim, it usually takes about 14 days to receive your first payment. The additional $600 in federal benefits will be for weeks ending April 4 July 31.

Form NC-5 is used to file and pay withholding tax on a monthly or quarterly basis, based on your filing frequency. Form NC-5 is filed throughout the year, before you file Form NC-3. Based on your filing frequency.

You may change your preferred payment method in your DES online account at any time. At any time, you may change your payment method to direct deposit using the 'Change Personal Information' link in your DES online account.

Employers who withhold an average of at least $500 but less than $2,000 from wages each month must file a withholding return (Form NC-5) and pay the withheld taxes on a monthly basis.

If your DES account indicates that a benefit payment has been deposited, it may take your bank 48 hours to post the payment to your bank account. Your first debit card payment will be pre-loaded and should arrive by mail in seven business days.

If your DES account indicates that a benefit payment has been deposited, it may take your bank 48 hours to post the payment to your bank account. Your first debit card payment will be pre-loaded and should arrive by mail in seven business days.

For the Direct Deposit Option:Locate the direct deposit enrollment form that was mailed to you, or download the form from our website at . 2. Complete the enrollment form and mail it to the DES address printed on the form.

When will I receive payment? After you have filed a claim, it usually takes about 14 days to receive your first payment. The additional $600 in federal benefits will be for weeks ending April 4 July 31.

Any individual or entity that fails to provide their TIN to the payer, is subject to the 4% North Carolina income tax withholding requirement from the non-wage compensation paid to the individual or entity for services performed in North Carolina.