North Carolina Consent to Release of Financial Information

Description

How to fill out Consent To Release Of Financial Information?

Selecting the finest valid documents template can be challenging.

It goes without saying, there are numerous designs accessible online, but how can you locate the authentic type you require.

Utilize the US Legal Forms website.

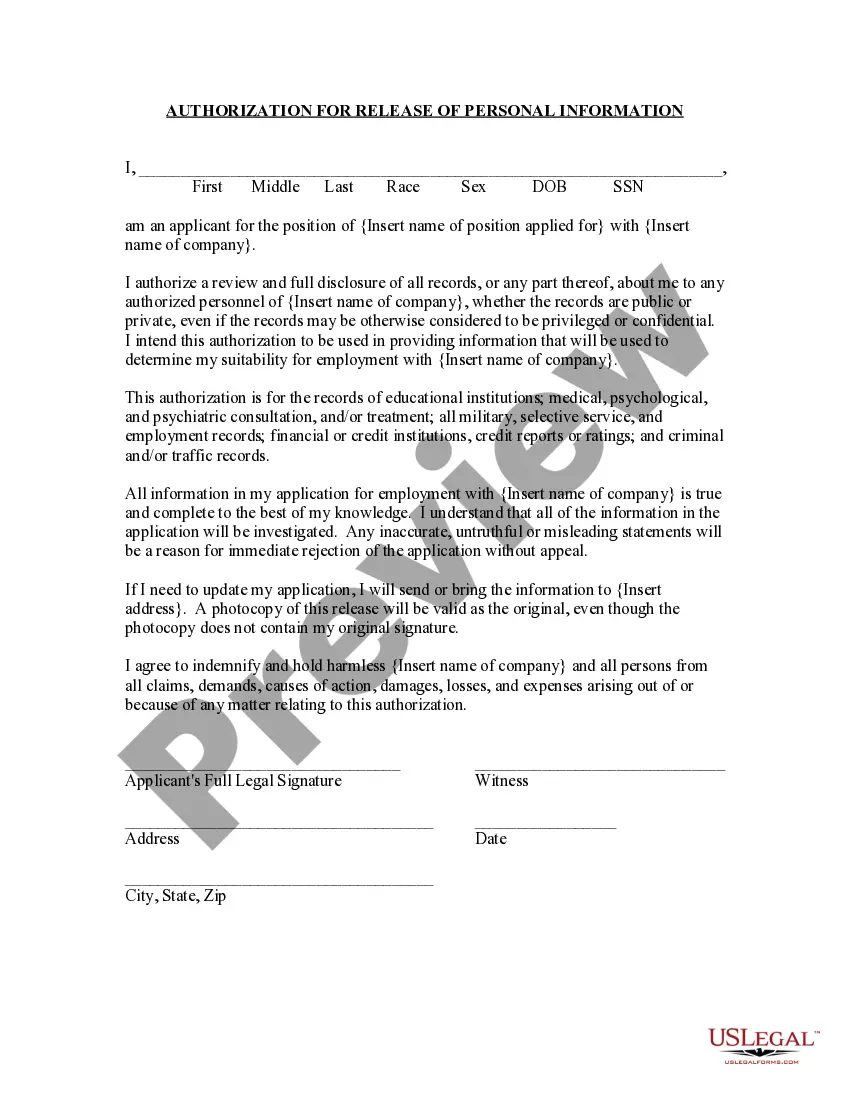

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/county. You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- The service provides thousands of designs, including the North Carolina Consent to Release of Financial Information, which you can utilize for business and personal needs.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the North Carolina Consent to Release of Financial Information.

- Use your account to browse the legal forms you may have purchased previously.

- Navigate to the My documents tab in your account and acquire another copy of the documents you need.

Form popularity

FAQ

A financial release refers to the process of permitting another party to view or use your financial information. It typically involves a signed document that outlines the scope of access granted. The North Carolina Consent to Release of Financial Information is crucial in this process, as it specifies the terms under which your financial data can be shared, protecting both you and the entities involved.

A release form is used to give permission for a specified third party to access or use your information. In finance, these forms are particularly important when dealing with loans, credit checks, or any situation that requires disclosure of financial history. By utilizing the North Carolina Consent to Release of Financial Information, you ensure that your data is shared responsibly and in accordance with state regulations.

A financial release form is a document that grants permission to share your financial information with another party. This form is essential for situations where you need to authorize a bank, employer, or service provider to access your financial data. The North Carolina Consent to Release of Financial Information serves as a formal acknowledgment of your approval and helps maintain transparency between all parties involved.

The financial information privacy law protects personal financial details from unauthorized access or disclosure. In North Carolina, the law ensures that your financial information remains confidential unless you provide consent. Therefore, understanding the North Carolina Consent to Release of Financial Information is crucial for individuals and organizations alike, as it outlines how and when your data may be shared.

Yes, consent can be taken away after the fact. Even if you previously authorized the sharing of your financial information, the North Carolina Consent to Release of Financial Information gives you the right to withdraw your consent later. This flexible option empowers you to protect your financial privacy whenever you feel it necessary. Utilizing platforms like USLegalForms can simplify the process of managing your consent effectively.

Yes, you can withdraw consent in North Carolina. The North Carolina Consent to Release of Financial Information allows you to revoke your consent whenever you choose. By formally notifying the involved entities, you can regain control over your financial information. It’s always wise to follow up with the party that received your consent to ensure they respect your decision.

The right to withdraw consent refers to your ability to revoke permission for the sharing of your financial information at any time. This is particularly important when discussing the North Carolina Consent to Release of Financial Information. By understanding this right, you ensure that you maintain control over who has access to your sensitive data. When you decide to withdraw consent, you must inform the relevant parties in writing.

Filling out a release of information consent requires you to begin with your contact information and a precise title indicating what financial information you are permitting to be shared. Next, make sure to include the recipient’s details and your signature to validate the consent. By utilizing the North Carolina Consent to Release of Financial Information form, you can easily understand what details are required and how to proceed.

A release of information request typically includes your identification information, the name of the party receiving the data, and a clear description of the financial records you wish to release. It should also articulate the intent behind the request. If you opt for the North Carolina Consent to Release of Financial Information form, you will cover all necessary components effortlessly.

To fill out a consent form, start by reading the entire document carefully. Make sure to enter your personal details, specify the financial information you wish to release, and sign the form at the designated area. If you use the North Carolina Consent to Release of Financial Information template, it will guide you through each section to avoid mistakes.