[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] North Carolina State Tax Commission Department of Revenue [Address] [City, State, ZIP Code] Subject: Payment for North Carolina State Taxes Dear Sir/Madam, I am writing to make a payment towards my North Carolina state taxes for the taxable period [mention the specific period here, for example, calendar year 2021]. Enclosed with this letter, please find my payment of [EX, XXX.XX], representing the amount due for the said period. I have calculated my taxes based on the guidelines provided by the North Carolina Department of Revenue. The breakdown of the payment is as follows: — [Specify the amount allocated to state income tax] — [Specify the amount allocated to sales and use tax] — [Specify the amount allocated to other applicable taxes] Please ensure that the payment is credited to the correct taxpayer identification number [mention your taxpayer identification number or social security number]. For further verification, I have included a copy of my tax return for the relevant period. Additionally, I kindly request you to update my tax account records with this payment and confirm the receipt of funds. You may contact me via phone or email provided above for any correspondence related to this matter. Furthermore, I would like to take this opportunity to inquire about any upcoming deadlines or obligations relating to my state taxes. Kindly inform me if there are any pending filings, registrations, or payments that require my attention. If I have inadvertently made any errors in my tax filing or this payment, please notify me promptly so that I can rectify any issues. Thank you for your prompt attention to this matter. I appreciate your assistance and cooperation throughout the tax process. If there are any additional forms or documents needed, please let me know, and I will be more than willing to provide them accordingly. Yours sincerely, [Your Name]

North Carolina Sample Letter to State Tax Commission sending Payment

Description

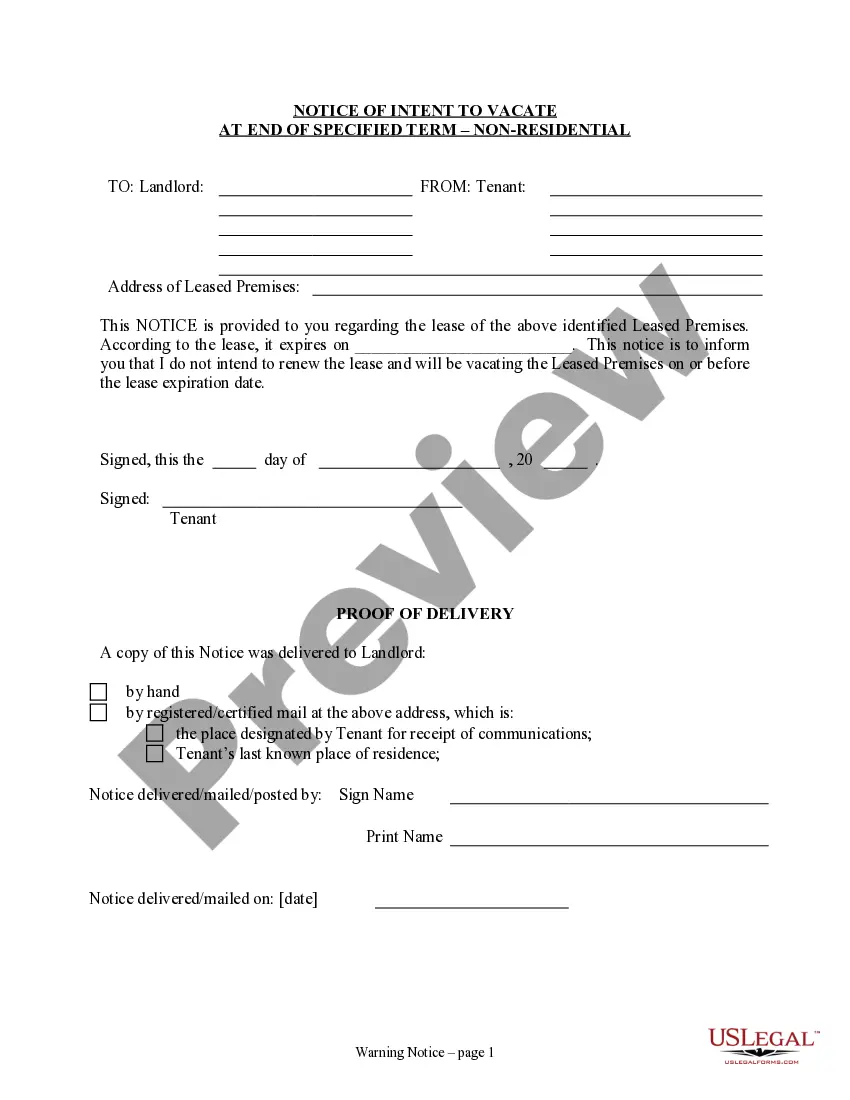

How to fill out North Carolina Sample Letter To State Tax Commission Sending Payment?

Are you in a place that you require papers for possibly company or personal reasons just about every time? There are a lot of lawful record templates available online, but getting kinds you can rely on isn`t simple. US Legal Forms delivers thousands of kind templates, just like the North Carolina Sample Letter to State Tax Commission sending Payment, that happen to be written in order to meet state and federal requirements.

If you are currently familiar with US Legal Forms web site and also have your account, just log in. Next, you may down load the North Carolina Sample Letter to State Tax Commission sending Payment format.

If you do not offer an profile and would like to start using US Legal Forms, follow these steps:

- Discover the kind you require and ensure it is for the right area/region.

- Utilize the Preview option to examine the form.

- Look at the description to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are seeking, make use of the Look for area to get the kind that meets your needs and requirements.

- Once you get the right kind, click Get now.

- Select the costs prepare you would like, submit the desired information to generate your bank account, and pay for your order utilizing your PayPal or charge card.

- Decide on a convenient document structure and down load your version.

Get all of the record templates you may have purchased in the My Forms food selection. You may get a more version of North Carolina Sample Letter to State Tax Commission sending Payment anytime, if required. Just select the essential kind to down load or produce the record format.

Use US Legal Forms, by far the most extensive assortment of lawful kinds, to save some time and prevent blunders. The service delivers appropriately made lawful record templates that you can use for a selection of reasons. Generate your account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

I was not aware that I owe the Department. Who can I call to get more information? You can call toll-free at 1-877-252-3052 to get information about your balance with the Department.

Notices are sent out when the department determines taxpayers owe taxes to the State that have not been paid for a number of reasons.

Go to the NC Dept of Revenue website for making a tax payment. Select 'File & Pay'. Scroll down to the 'Commonly Filed Taxes' section. Select the type of tax you are paying ? ... Complete your contact information, click next. Complete your tax payment information, click next.

If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue.

Your account ID number will be issued within ten business days and a notice that includes your account ID number will be mailed to you. You should retain the confirmation or tracking number for your records until you receive your account ID number information by mail.

Once you have received the Notice of Collection, you can call the North Carolina Department of Revenue at (877) 252-3052 or visit our website at the link below to request a payment agreement.

Taxpayers may pay their tax by using a credit/debit card (Visa/MasterCard) or bank draft via our online payment system, or by contacting an agent at 1-877-252-3252. Taxpayers may also pay their tax with a personal check, money order or cashier's check.

Estimated Income Tax eFile - file Form NC-40 and your estimated tax payments using a tax professional or commercial tax preparation software (see list of approved eFile vendors). ... Online File and Pay - file Form NC-40 and your associated tax payment using the NCDOR website (no access to federal filing and paying).