The North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions under which the sale of a business by a sole proprietorship, with leased premises, will take place in the state of North Carolina. This agreement is essential for both the buyer and the seller to protect their rights and ensure a smooth transfer of ownership. The North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises generally includes the following key details: 1. Parties Involved: The agreement identifies the names and addresses of the buyer (purchaser) and seller (sole proprietor). It confirms that the business being sold is operated as a sole proprietorship, with leased premises, within the state of North Carolina. 2. Business Assets: This agreement specifies the assets being transferred as part of the sale, such as inventory, equipment, client lists, intellectual property, trade secrets, and goodwill. It may also address any exclusions or limitations on the transfer of certain assets. 3. Purchase Price and Payment Terms: The total purchase price of the business is mentioned in the agreement. It includes the down payment, if any, and the remaining balance to be paid by the buyer. The payment terms, such as installments or lump-sum payment, are also outlined. 4. Lease Agreement: If the sole proprietorship operates on leased premises, the agreement will address the existing lease terms, including the landlord's consent for the sale and assignment of the lease to the buyer. It also specifies any obligations or liabilities associated with the lease that the buyer will assume. 5. Representations and Warranties: Both parties provide representations and warranties regarding the accuracy of information related to the business, financial statements, tax obligations, compliance with laws and regulations, and any ongoing litigation or disputes. 6. Closing and Transfer of Ownership: The agreement details the closing date, at which point the ownership and possession of the business will be transferred from the seller to the buyer. It may also include provisions for non-competition agreements, where the seller agrees not to compete in the same industry for a specified period in a defined geographical area. 7. Indemnification and Dispute Resolution: The agreement may contain provisions for indemnification, stating that either party will be held responsible for any losses or damages arising from a breach of the agreement. It may also include clauses specifying the applicable laws and dispute resolution mechanisms, such as arbitration or mediation, to resolve any disagreements. Different types or variations of the North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises may exist based on specific industry requirements or unique circumstances. However, these names would depend on individual lawyer or legal firm preferences and are not standardized. Examples could be "North Carolina Agreement for Sale of Restaurant Business by Sole Proprietorship with Leased Premises" or "North Carolina Agreement for Sale of Retail Business by Sole Proprietorship with Leased Premises." It is crucial to consult with a qualified attorney or legal professional when drafting or entering into any agreement related to the sale of a business to ensure compliance with North Carolina laws and to address specific details relevant to the transaction.

North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

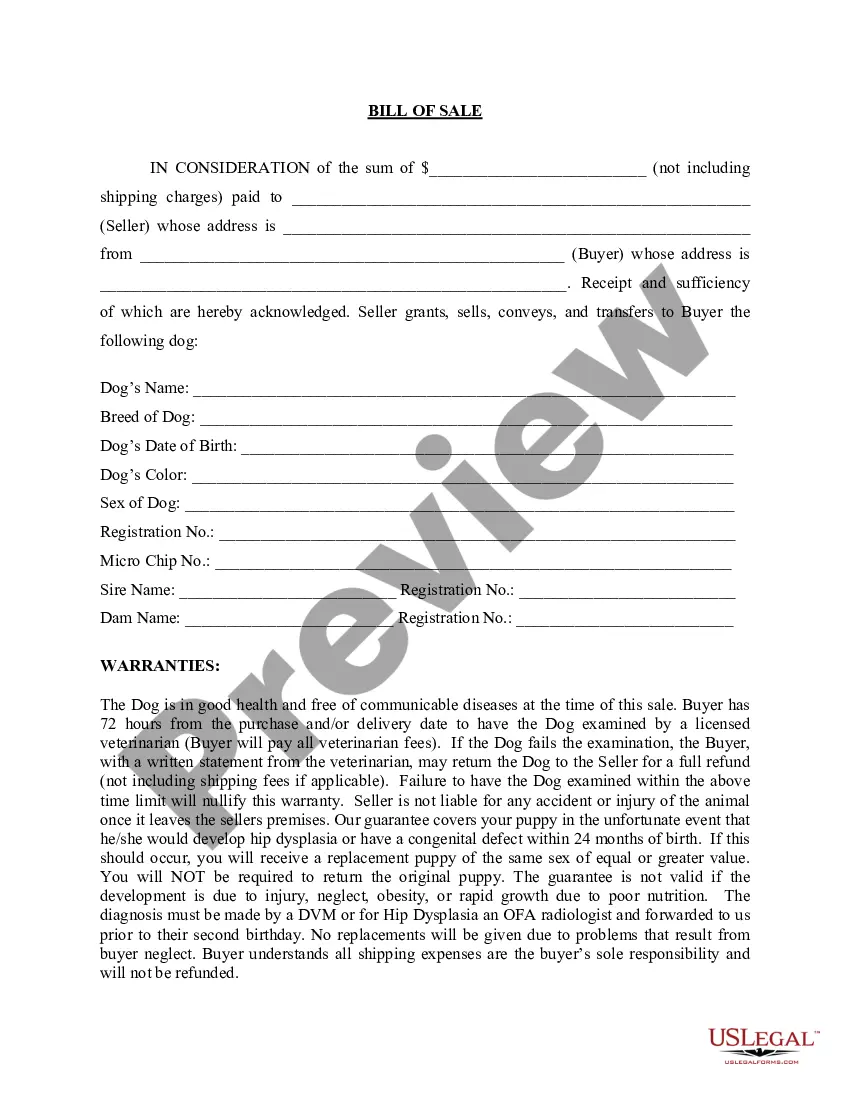

How to fill out North Carolina Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

It is possible to devote hrs on the web looking for the legal papers design that suits the state and federal specifications you will need. US Legal Forms provides a huge number of legal forms that happen to be evaluated by experts. You can easily obtain or print out the North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises from our service.

If you currently have a US Legal Forms profile, you can log in and click the Obtain button. Afterward, you can total, edit, print out, or signal the North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Each legal papers design you acquire is your own property forever. To have yet another duplicate of the bought type, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site for the first time, stick to the basic recommendations below:

- Initially, be sure that you have selected the correct papers design for the area/metropolis that you pick. Browse the type outline to ensure you have chosen the correct type. If offered, make use of the Preview button to search from the papers design as well.

- If you would like find yet another version of your type, make use of the Research area to discover the design that meets your requirements and specifications.

- When you have discovered the design you would like, click Acquire now to continue.

- Choose the pricing plan you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal profile to purchase the legal type.

- Choose the format of your papers and obtain it to your system.

- Make adjustments to your papers if possible. It is possible to total, edit and signal and print out North Carolina Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Obtain and print out a huge number of papers web templates using the US Legal Forms Internet site, which provides the largest selection of legal forms. Use professional and condition-distinct web templates to handle your organization or person needs.