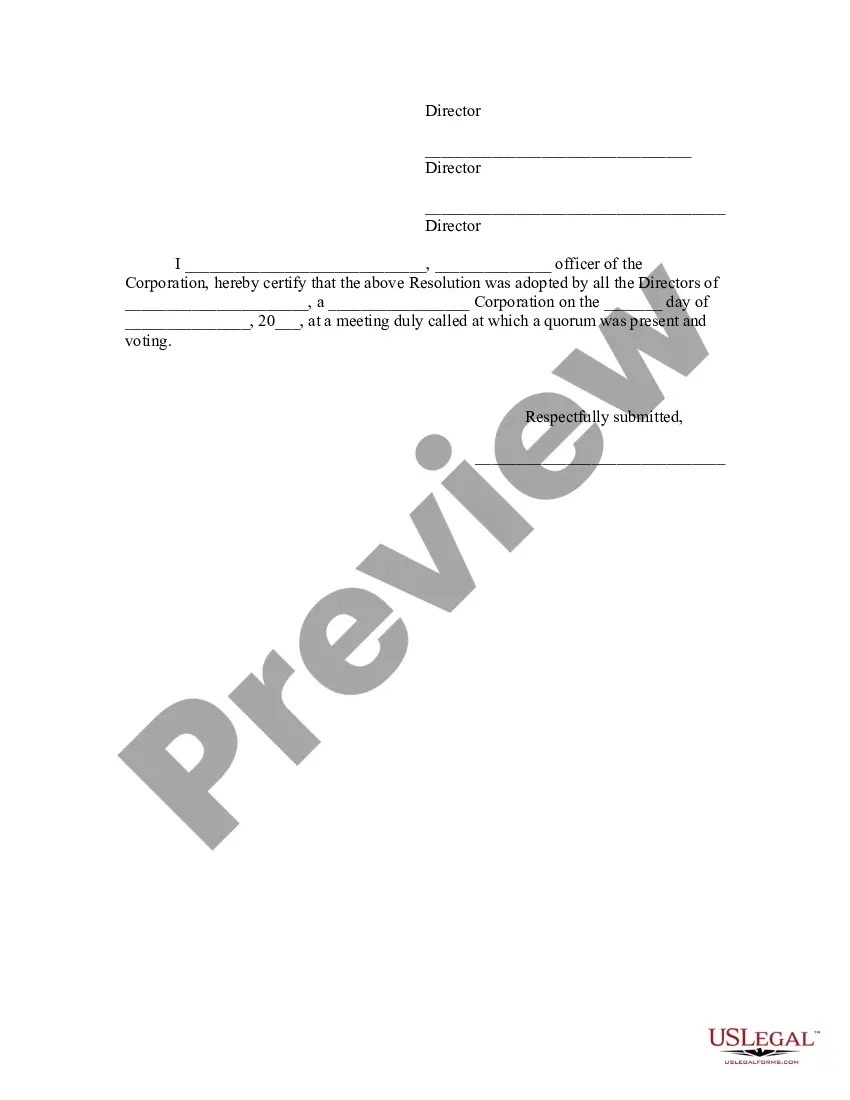

North Carolina Open a Bank Account — Corporate Resolutions Forms are crucial documents required by businesses when opening a bank account in the state of North Carolina. These forms serve as official resolutions that authorize the opening of a bank account on behalf of the company or corporation. They outline important details such as the authorized signatories, banking preferences, and any additional resolutions related to the account. There are various types of North Carolina Open a Bank Account — Corporate Resolutions Forms, each designed to cater to specific needs of different types of entities. Some common types of corporate resolutions forms associated with opening a bank account in North Carolina include: 1. Limited Liability Company (LLC) Bank Account Resolution Form: This form is specifically tailored for LCS operating in North Carolina. It includes essential information regarding the members and managers of the LLC, authorizing them to open a bank account. 2. Corporation Bank Account Resolution Form: This type of form is suitable for corporations, empowering the directors or officers of the corporation to establish a bank account in North Carolina. It outlines the authorized individuals and their positions within the corporation. 3. Partnership Bank Account Resolution Form: Partnerships, whether general partnerships or limited partnerships, require a customized bank account resolution form. This form specifies the partners' names, their respective ownership percentages, and their authority to open a bank account. 4. Nonprofit Organization Bank Account Resolution Form: Nonprofit organizations operating in North Carolina need to utilize a specific form to open a bank account. This form identifies the key individuals responsible for the organization, such as board members, officers, or trustees, who have the authority to open and manage the account. Regardless of the type of entity, North Carolina Open a Bank Account — Corporate Resolutions Forms typically contain sections articulating the purpose of the bank account, the intended signatories, the desired account features (e.g., checking, savings, treasury management services), and any additional resolutions or restrictions related to the account. It is crucial to use the appropriate form for your entity type to ensure compliance with North Carolina's banking regulations and provide accurate information when opening a bank account. Consulting with legal and financial professionals who specialize in North Carolina corporate law can help ensure that you utilize the appropriate form and successfully establish a bank account for your business in the state.

North Carolina Open a Bank Account - Corporate Resolutions Forms

Description

How to fill out North Carolina Open A Bank Account - Corporate Resolutions Forms?

Are you within a place in which you require papers for both business or individual functions virtually every time? There are tons of legitimate document templates available online, but getting kinds you can rely isn`t easy. US Legal Forms offers a huge number of form templates, like the North Carolina Open a Bank Account - Corporate Resolutions Forms, that happen to be composed to meet federal and state specifications.

In case you are already knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Following that, you may obtain the North Carolina Open a Bank Account - Corporate Resolutions Forms format.

If you do not have an account and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is for the proper area/area.

- Use the Review button to review the shape.

- Look at the information to actually have selected the proper form.

- In case the form isn`t what you are trying to find, use the Lookup industry to find the form that suits you and specifications.

- Whenever you obtain the proper form, click on Buy now.

- Select the pricing program you would like, fill in the necessary information to create your account, and purchase the order using your PayPal or charge card.

- Decide on a practical data file format and obtain your duplicate.

Locate each of the document templates you may have bought in the My Forms food list. You can get a more duplicate of North Carolina Open a Bank Account - Corporate Resolutions Forms at any time, if needed. Just select the essential form to obtain or print the document format.

Use US Legal Forms, by far the most substantial assortment of legitimate forms, to save lots of time as well as prevent mistakes. The service offers expertly produced legitimate document templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and commence generating your life easier.