Title: North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor — Types and Detailed Description Introduction: Identity theft is a grave concern affecting individuals of all ages, including minors. If you suspect that a minor's identity has been compromised, it is crucial to take immediate action to protect their financial security and future. Writing a concise and detailed letter to the credit reporting company or bureau can help address this issue effectively. In North Carolina, individuals have specific rights and guidelines to follow when reporting such identity theft cases. Types of North Carolina Letters to Credit Reporting Companies or Bureaus Regarding Identity Theft of Minors: 1. Initial Notification Letter: The initial notification letter is the first step in reporting identity theft of a minor. This letter aims to inform the credit reporting company or bureau about the unauthorized use of a minor's personal information. It is crucial to mention the minor's details, including their name, date of birth, and social security number, along with specific details about the suspected identity theft. This letter serves as an essential tool to initiate the investigation process. 2. Fraudulent Accounts Dispute Letter: If any fraudulent accounts or transactions have been identified, victims of identity theft must send a disputing letter to the credit reporting company or bureau. This letter should specify the fraudulent accounts, transactions, or charges that are not associated with the minor. Including relevant documentation such as police reports, identity theft affidavits, and any supporting evidence can strengthen the case against the fraudulent activities. 3. Request for Security Freeze Letter: Requesting a security freeze is another important step in preventing further identity theft activities. This letter should be sent to the credit reporting company or bureau to temporarily freeze the minor's credit information, making it inaccessible to potential identity thieves. By including the minor's personal information and request for this security measure, individuals can ensure protection against unauthorized credit inquiries and new accounts being opened using the minor's details. 4. Follow-up and Progress Update Letter: It is integral to maintain communication with the credit reporting company or bureau to monitor progress and updates regarding the identity theft case. A follow-up and progress update letter can be sent to request information about the ongoing investigation, any changes made, or remedies taken against the fraud. This letter helps in keeping the minor and their family informed about potential legal actions, settlements, or resolutions reached in their case. Conclusion: Identity theft of a minor is a serious matter that requires immediate attention and action. Composing a well-crafted and detailed North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor can significantly aid in resolving the issue effectively. By mentioning the specific types of letters such as initial notification, fraudulent accounts dispute, request for security freeze, and follow-up and progress update letters, individuals can navigate the reporting process more efficiently and protect the minor's financial future.

North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor

Description

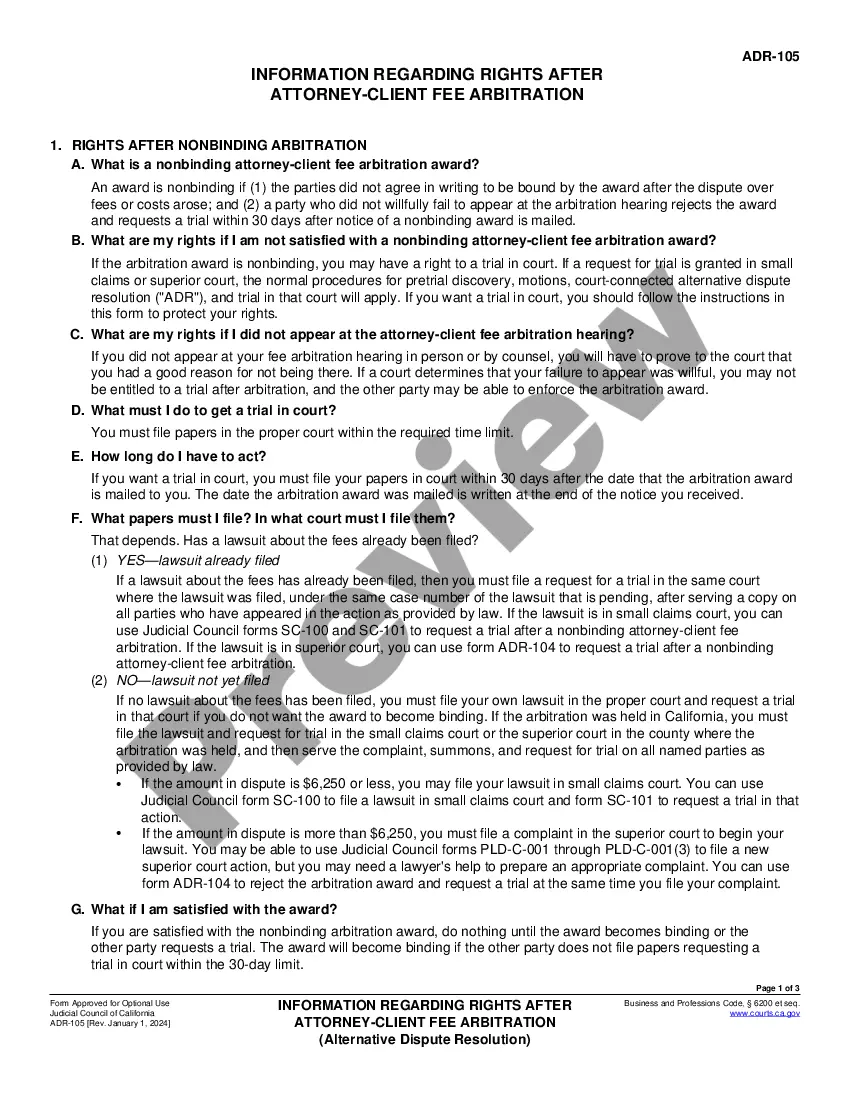

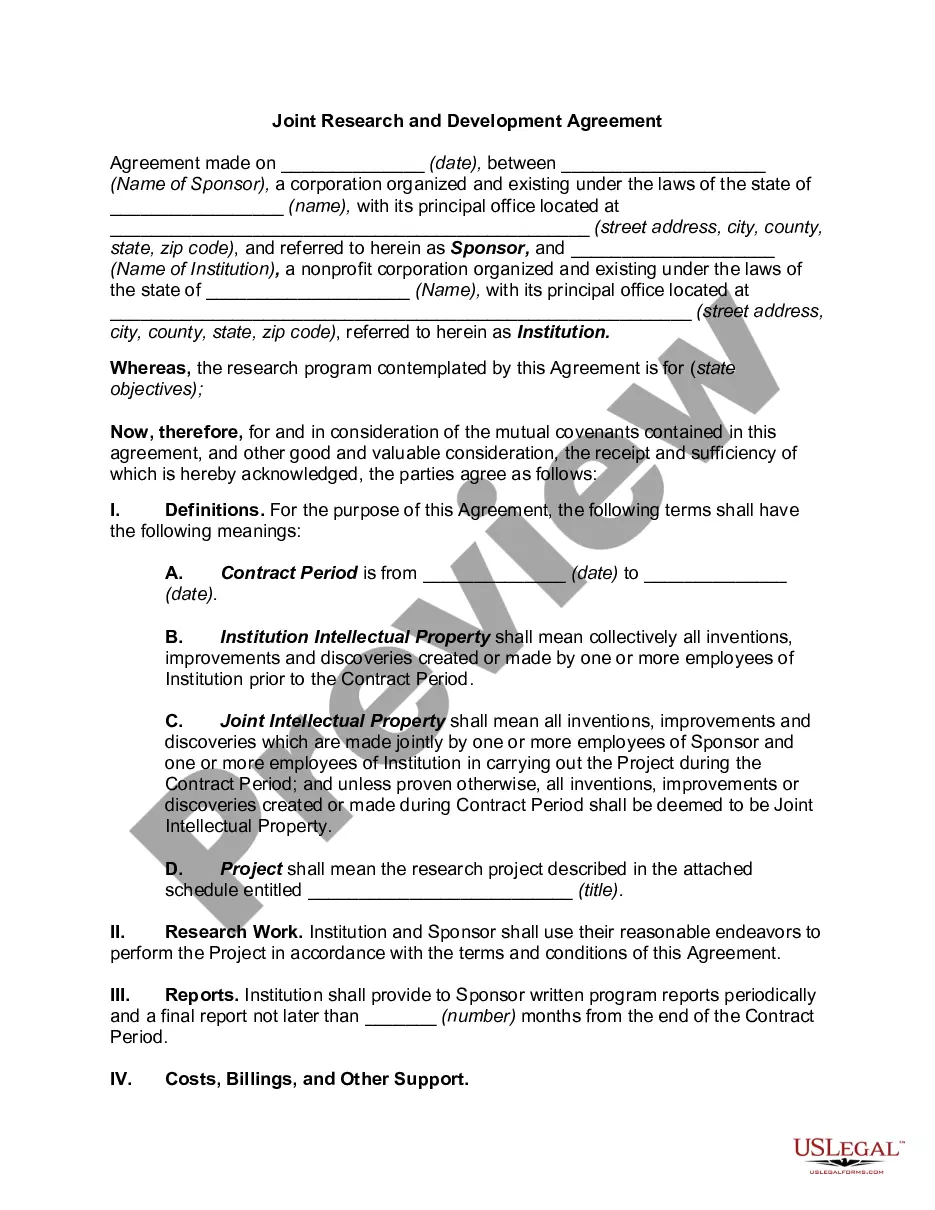

How to fill out North Carolina Letter To Credit Reporting Company Or Bureau Regarding Identity Theft Of Minor?

If you have to total, obtain, or print out authorized record themes, use US Legal Forms, the largest selection of authorized types, which can be found on the Internet. Use the site`s simple and handy look for to find the papers you want. Various themes for business and specific functions are sorted by classes and states, or key phrases. Use US Legal Forms to find the North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor in just a few click throughs.

If you are presently a US Legal Forms customer, log in in your account and click on the Download button to obtain the North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor. You may also gain access to types you previously saved inside the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the appropriate area/land.

- Step 2. Use the Preview method to look over the form`s articles. Never neglect to read the description.

- Step 3. If you are unhappy using the type, use the Lookup discipline near the top of the display to locate other variations of your authorized type format.

- Step 4. Once you have discovered the form you want, click on the Get now button. Opt for the costs program you prefer and add your references to register for the account.

- Step 5. Procedure the purchase. You can utilize your credit card or PayPal account to perform the purchase.

- Step 6. Find the format of your authorized type and obtain it in your product.

- Step 7. Complete, modify and print out or indicator the North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor.

Every single authorized record format you get is your own property forever. You might have acces to each type you saved with your acccount. Go through the My Forms segment and pick a type to print out or obtain yet again.

Contend and obtain, and print out the North Carolina Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor with US Legal Forms. There are millions of expert and status-certain types you may use for your personal business or specific requires.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

File a Police Report, Ideally Where the Crime Occurred If necessary, file it where you live or where the suspected thief lives. Filing a police report triggers helpful protections under both federal and state law, such as an extended fraud alert and a free security freeze, which stops access to new credit in your name.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.