North Carolina Letter to Creditors Notifying Them of Identity Theft of Minor

Description

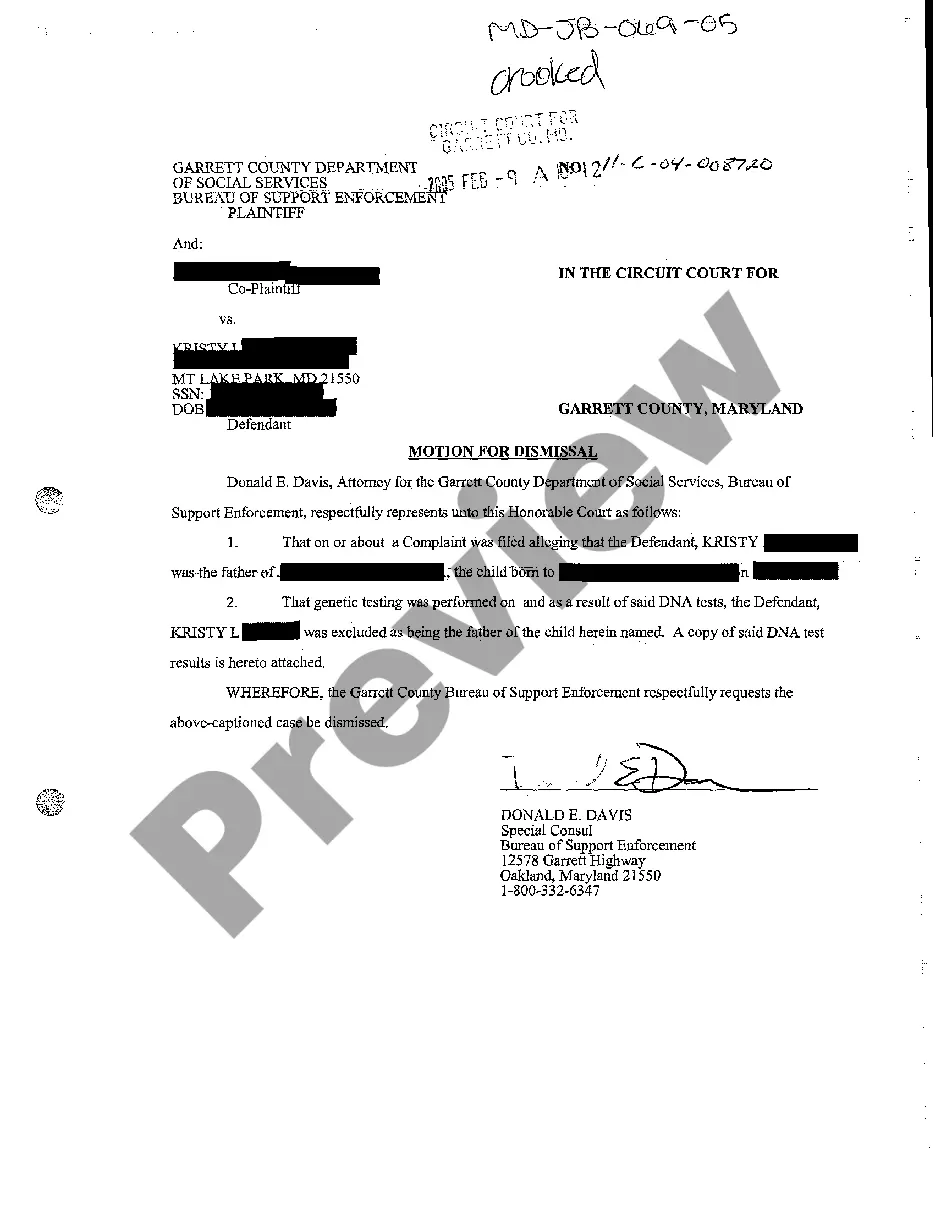

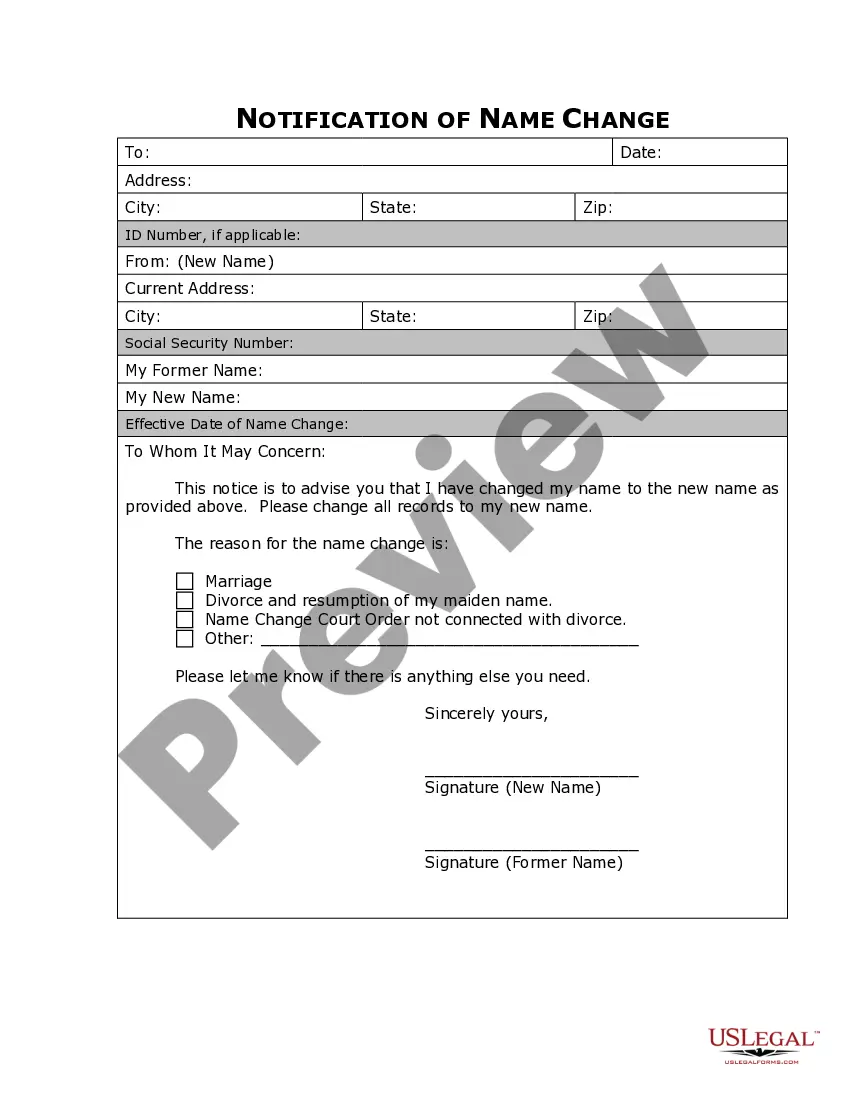

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor?

If you want to total, download, or print legal document formats, utilize US Legal Forms, the largest repository of legal templates available online.

Take advantage of the site’s straightforward and convenient search to find the documents you require.

A range of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the North Carolina Letter to Creditors Notifying Them of Identity Theft of Minor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the North Carolina Letter to Creditors Notifying Them of Identity Theft of Minor.

- You can also access forms you have previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not pleased with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt. Taking action quickly is important, so don't delay. Create a personalized recovery plan at IdentityTheft.gov that walks you through each step of the process.

File a report with the Federal Trade Commission (FTC). If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law).

This crime can be committed by either stealing a person's identity or by possessing someone else's identity information with the intent to use it fraudulently. Identity theft in North Carolina is a class G felony, meaning that the penalty for conviction may include a maximum of 47 months imprisonment.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

(a) A person who knowingly obtains, possesses, or uses identifying information of another person, living or dead, with the intent to fraudulently represent that the person is the other person for the purposes of making financial or credit transactions in the other person's name, to obtain anything of value, benefit, or ...

North Carolina law provides that identity theft is a felony. Report the fraud to your local police department, and, if known, the police department in the location where your identity was used for illegal purposes. Get a copy of the police report.

Identity Theft In North Carolina Under North Carolina's identity theft laws even a first offense is charged as a felony, punishable by up to 80 months in prison and a fine of up to $50,000. The state also allows victims to seek damages in civil court.

It is the unlawful violation of an individual's right to the protection of his/her privacy. This illegitimate acquisition of your information can be performed in a variety of ways. Most commonly, identity theft includes stealing, misrepresenting or hijacking the identity of another person or business.