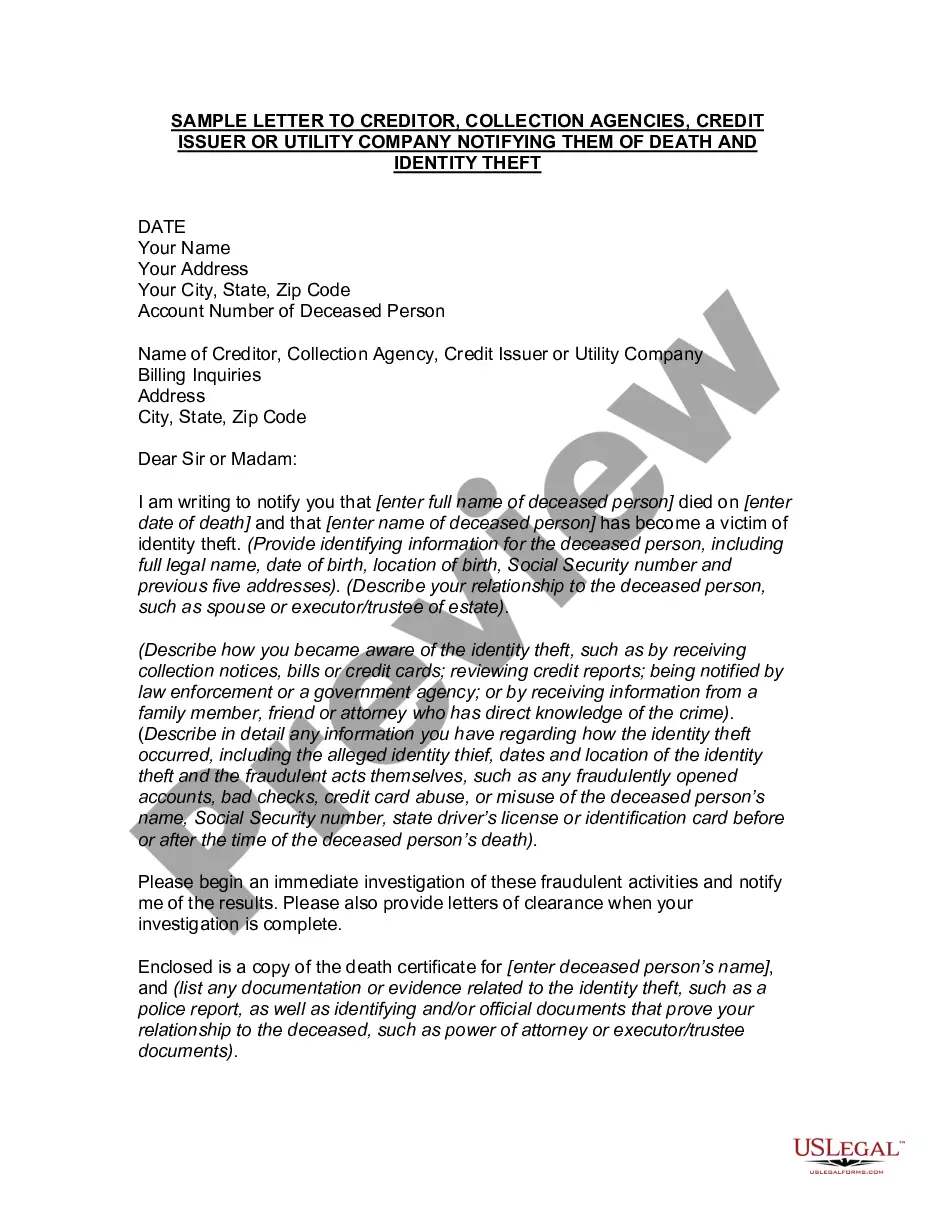

Title: North Carolina Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death: A Comprehensive Guide Introduction: When a loved one passes away, it is important to inform the relevant parties regarding their accounts or services to ensure a smooth transition. This article aims to provide a detailed description of a North Carolina Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of Death. Additionally, explore specific types of letters that may be required in different situations. 1. North Carolina Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company: This notification letter is an official document sent to creditors, collection agencies, credit issuers, or utility companies, informing them about the death of an individual. It is crucial to promptly inform such entities to avoid any unwanted financial or legal complications. Keywords: North Carolina, letter, creditor, collection agency, credit issuer, utility company, death notification, official document, financial complications, legal implications. 2. Letter to Creditors: This type of letter is specifically addressed to creditors informing them about the deceased's outstanding debts, loans, or any other financial obligations that need to be settled as part of the estate administration process. It serves as a formal notice to creditors that any claims against the deceased's estate should be submitted within a specified timeframe. Keywords: letter to creditors, outstanding debts, loans, financial obligations, estate administration process, formal notice, claims against the estate, specified timeframe. 3. Letter to Collection Agencies: In cases where the deceased had unpaid debts that were referred to collection agencies, a letter should be sent to inform them about the individual's passing. This letter should include information about the deceased, their account details, and a request to halt any collection activities immediately. Keywords: letter to collection agencies, unpaid debts, passing away, account details, halt collection activities. 4. Letter to Credit Issuers: If the deceased had any active credit cards, lines of credit, or similar accounts, a letter should be sent to the respective credit issuers notifying them of the person's death. The letter should provide essential details such as the credit card/account number, date of death, and a request to close the account. Keywords: letter to credit issuers, active credit cards, lines of credit, account closure, essential details, date of death. 5. Letter to Utility Companies: To avoid accumulating utility bills and to transfer or terminate services, it is necessary to notify the utility companies about the individual's death. This letter should include the deceased's personal information, utility account details, and a request to finalize the account accordingly. Keywords: letter to utility companies, utility bills, transfer services, terminate services, personal information, utility account details, finalize the account. Conclusion: Taking the initiative to inform creditors, collection agencies, credit issuers, and utility companies about the death of a loved one is essential to prevent any unnecessary complications. Utilizing the appropriate North Carolina Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company helps streamline the process and ensures effective communication during this difficult time.

North Carolina Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

How to fill out North Carolina Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

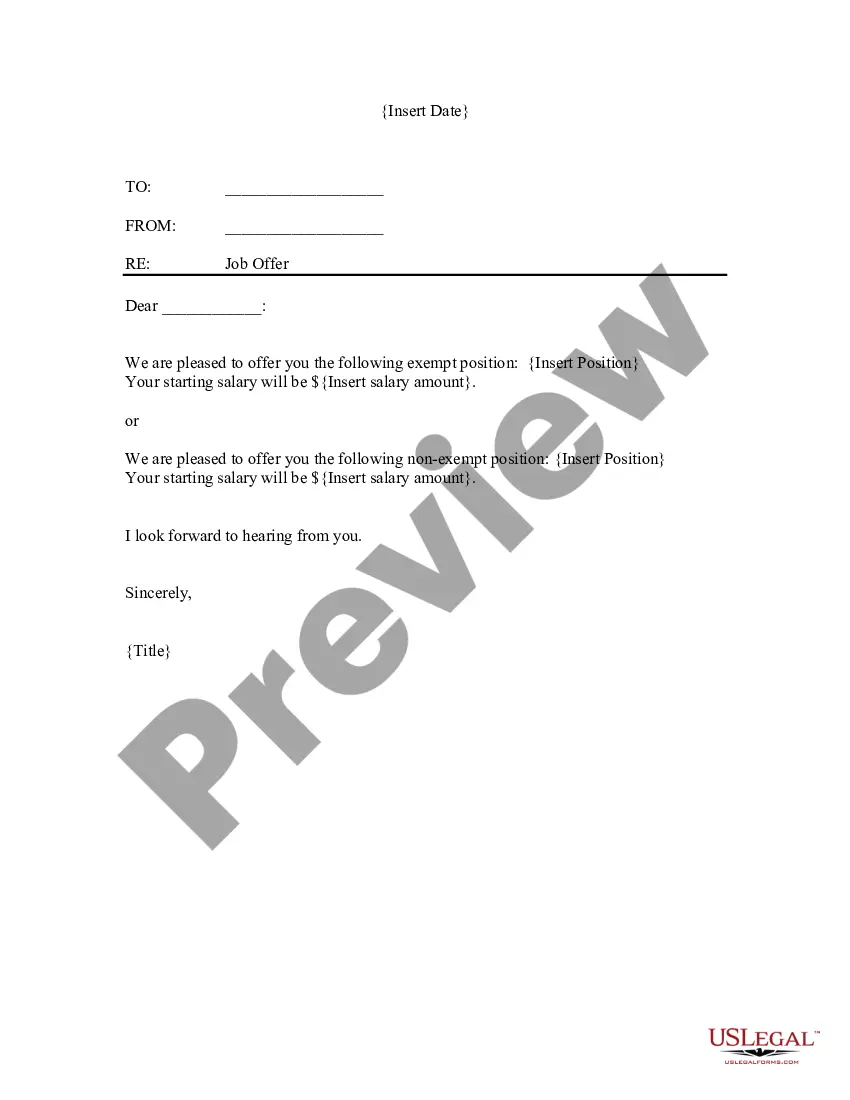

Are you inside a position in which you will need files for either business or person uses just about every day? There are tons of lawful record layouts available online, but locating types you can rely isn`t straightforward. US Legal Forms delivers a large number of form layouts, much like the North Carolina Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death, which can be created to satisfy state and federal needs.

When you are presently knowledgeable about US Legal Forms website and get your account, merely log in. After that, you are able to download the North Carolina Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death web template.

Unless you offer an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and ensure it is for the correct metropolis/area.

- Utilize the Review button to review the shape.

- Read the information to ensure that you have chosen the appropriate form.

- In case the form isn`t what you`re seeking, use the Search discipline to obtain the form that meets your needs and needs.

- If you discover the correct form, click Get now.

- Opt for the costs prepare you would like, fill out the desired details to create your money, and buy your order utilizing your PayPal or charge card.

- Pick a handy document formatting and download your duplicate.

Discover all the record layouts you have bought in the My Forms food selection. You can obtain a more duplicate of North Carolina Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death any time, if required. Just click on the required form to download or print out the record web template.

Use US Legal Forms, the most extensive assortment of lawful kinds, to save lots of time and prevent blunders. The service delivers skillfully produced lawful record layouts which can be used for an array of uses. Produce your account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

How to Write a Death Announcement Full name of the deceased. State that they have died. Date and location of death. Funeral and/or memorial date, time, and location. Optional information, such as for donations.

The next of kin must notify their banks of the death when an account holder dies. This is usually done by delivering a certified copy of the death certificate to the bank, along with the deceased's name and Social Security number, bank account numbers, and other information.

Death Intimation Letter Sample Dear Sir/Madam, I am Akash Reddy, holding a current account with number (mention your account number), beg to state that my mother passed away on 10th February, 2022 due to cardiac arrest. I kindly request you to update the information in my bank account at the earliest.

Start the letter with your introduction and the reason for writing the letter. Moreover, request the bank manager to settle the deceased account. Additionally, you have to provide details like account numbers and other documents. Signature ? Use ?Faithfully? or ?Sincerely? as signatures and then mention your name.

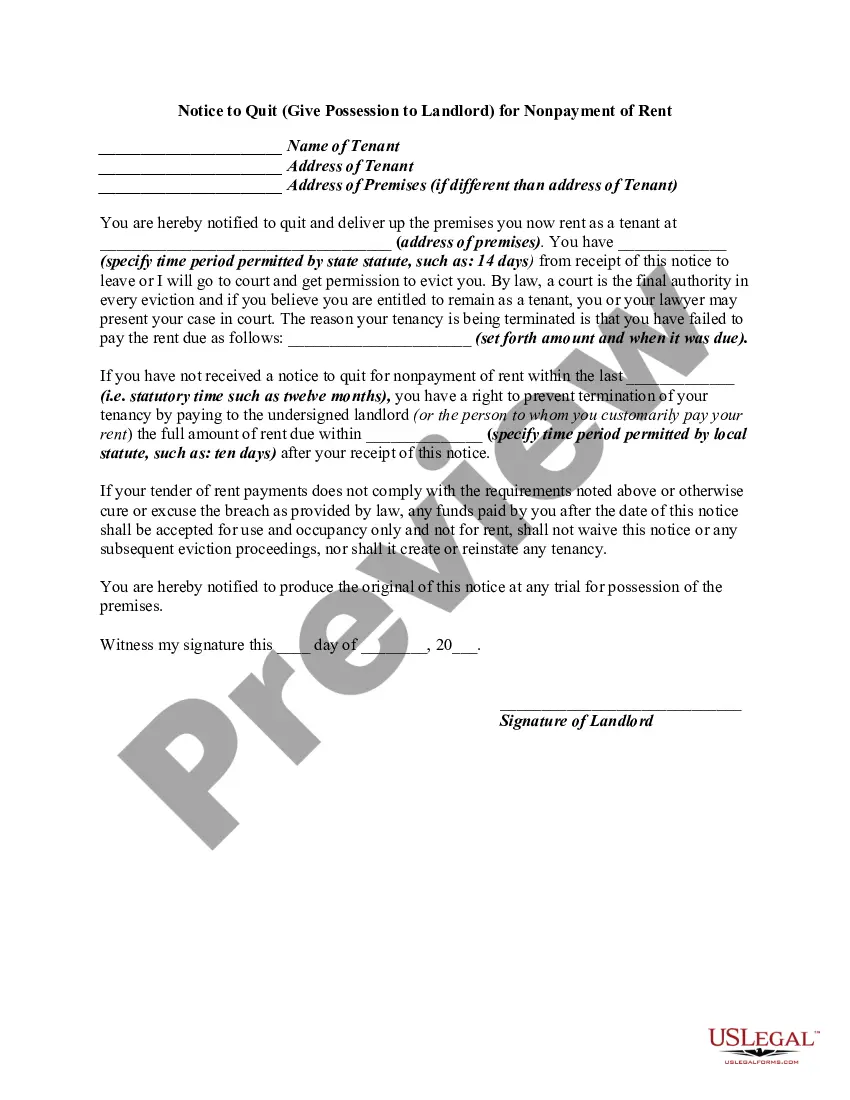

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.