North Carolina Letter to Insurance Company Notifying Them of Death

Description

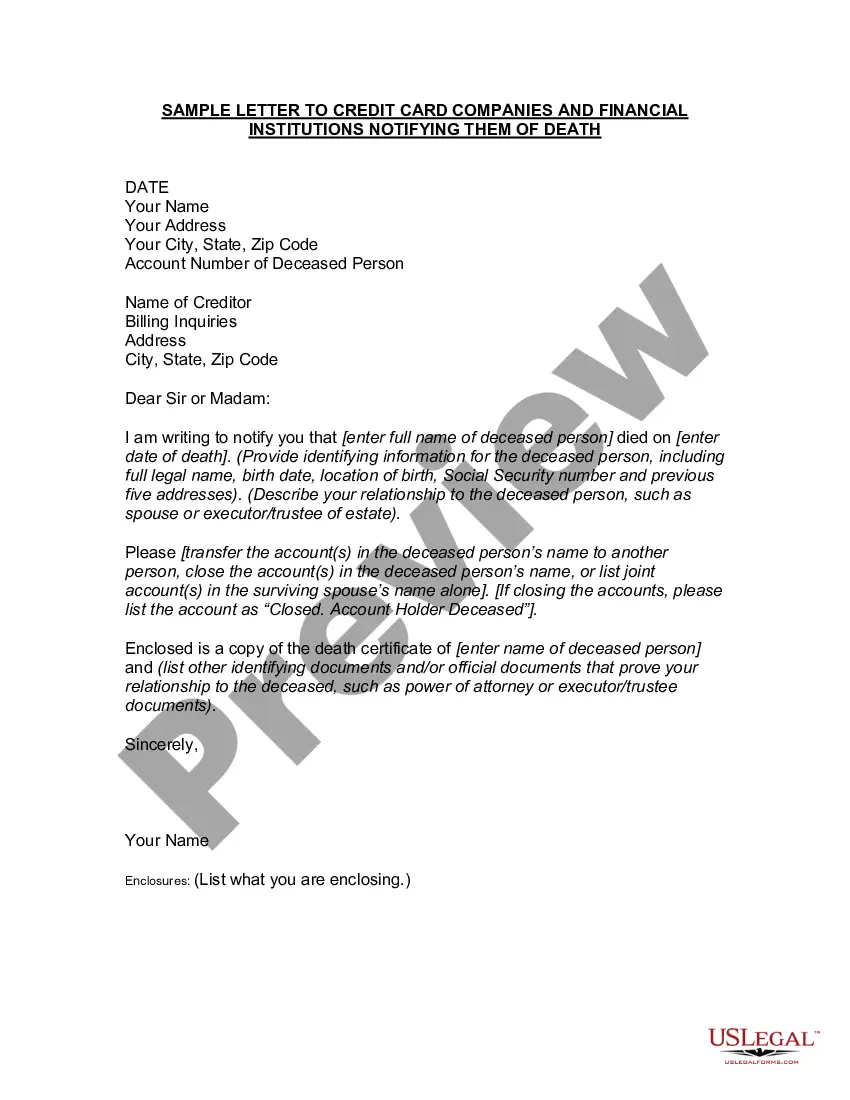

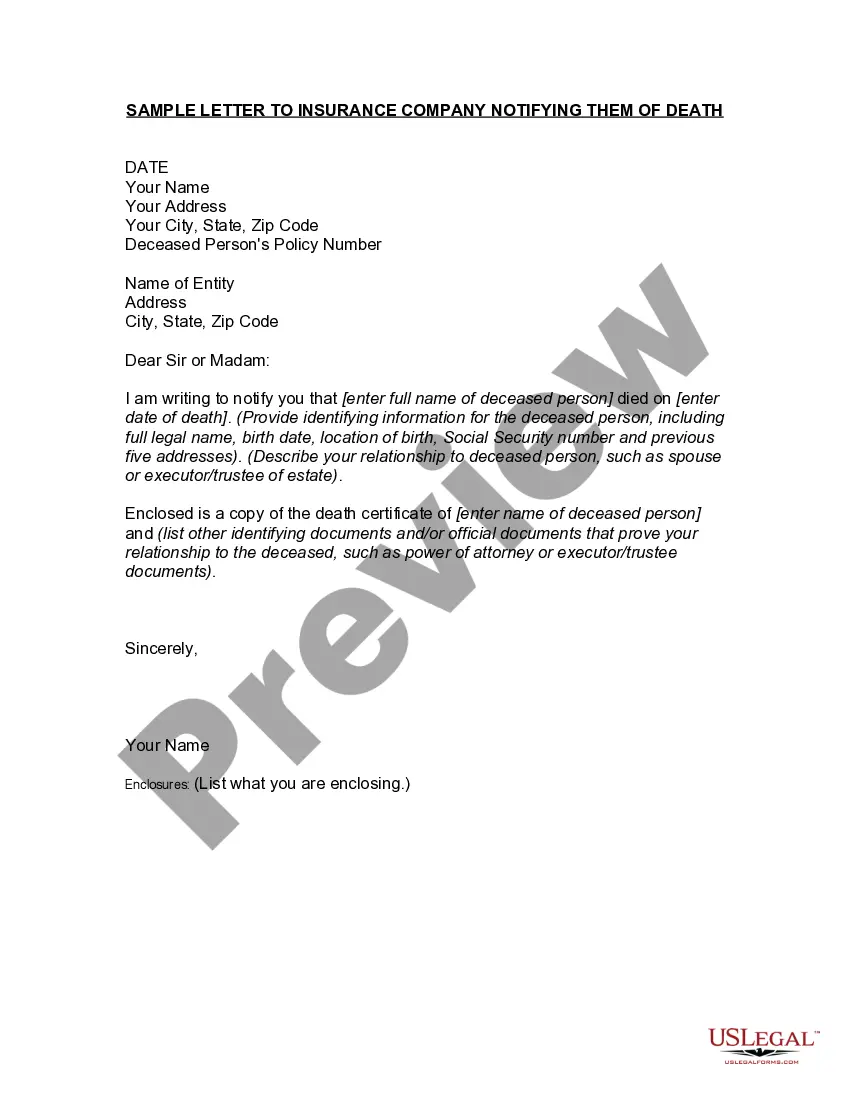

How to fill out Letter To Insurance Company Notifying Them Of Death?

Have you been within a position where you require files for sometimes business or personal reasons just about every day? There are a variety of authorized document templates available online, but getting types you can depend on isn`t effortless. US Legal Forms delivers a large number of type templates, such as the North Carolina Letter to Insurance Company Notifying Them of Death, which are published to satisfy state and federal needs.

When you are currently informed about US Legal Forms web site and get a free account, merely log in. Following that, it is possible to acquire the North Carolina Letter to Insurance Company Notifying Them of Death web template.

If you do not offer an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the type you want and make sure it is for that correct city/state.

- Take advantage of the Review key to review the form.

- Read the explanation to actually have selected the correct type.

- In case the type isn`t what you`re trying to find, take advantage of the Search field to obtain the type that meets your requirements and needs.

- Once you discover the correct type, click Get now.

- Pick the pricing plan you need, complete the necessary info to generate your money, and pay money for an order with your PayPal or bank card.

- Pick a hassle-free document structure and acquire your backup.

Locate each of the document templates you may have purchased in the My Forms food list. You may get a additional backup of North Carolina Letter to Insurance Company Notifying Them of Death at any time, if necessary. Just click on the essential type to acquire or produce the document web template.

Use US Legal Forms, probably the most substantial variety of authorized kinds, to save lots of time as well as steer clear of errors. The support delivers skillfully created authorized document templates that can be used for a selection of reasons. Create a free account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

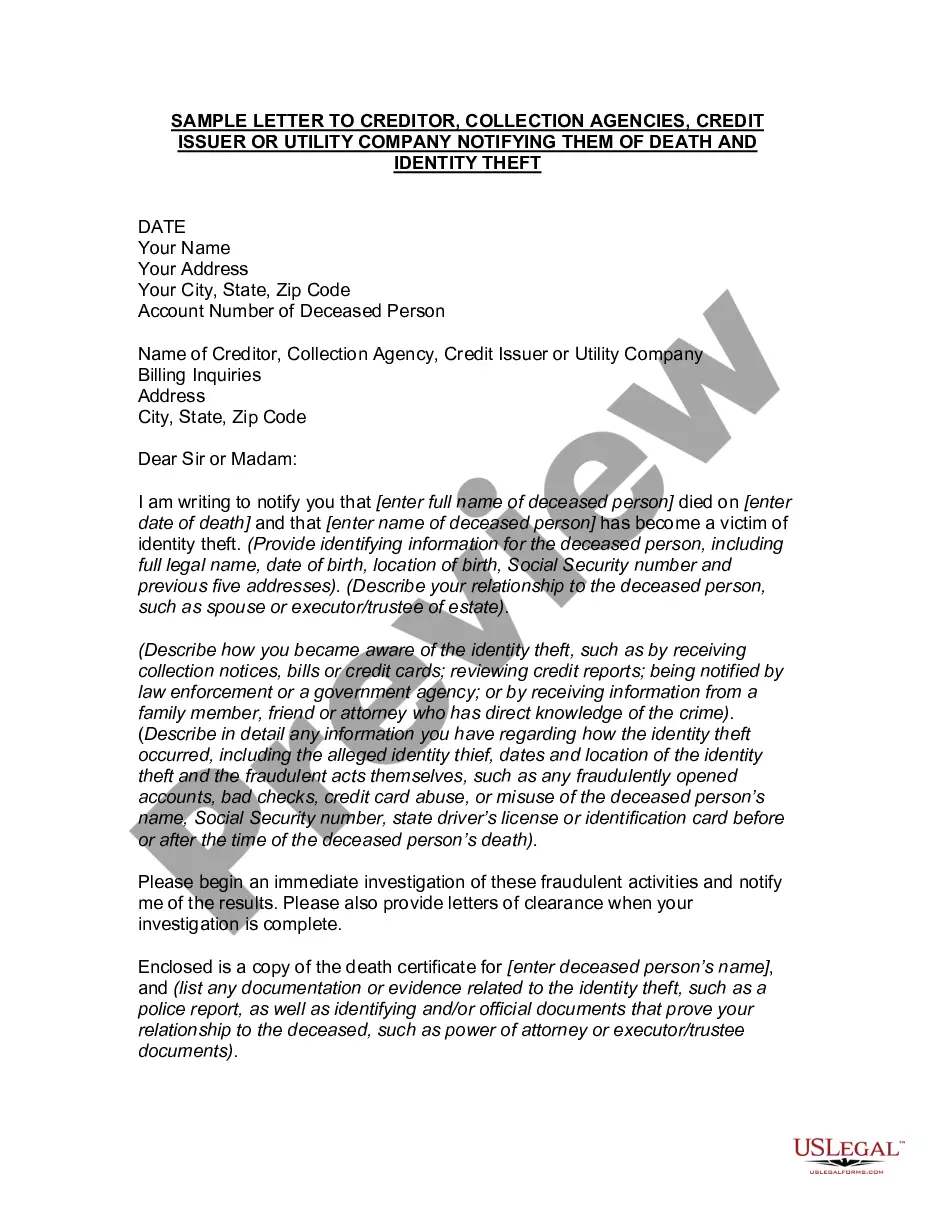

Also, death certificates are issued by local government agencies who aren't required to notify life insurance companies every time a citizen passes away. So, insurance companies typically don't even know that a policyholder has passed away until someone submits a beneficiary claim.

What do you write in a death notice? Who is the party to be notified? Whose death is the subject of this notice? What was the date of death? Do you wish to include any additional information or make any request?

Of course, an insurer may have no way of knowing about the homeowner's death right away ? but they'll eventually find out. That's why a surviving spouse, family member, or estate executor should contact the insurer and submit a death certificate within 30 days of the homeowner's death.

An insurer is responsible for delivery of the insurance policy to the insured or such person that the insured designates, but the insurer may delegate such task to either its insurance agent or the insurance broker.

At the death of an owner, the policy passes as a probate estate asset to the next owner either by will or by intestate succession, if no successor owner is named. This could cause ownership of the policy to pass to an unintended owner or to be divided among multiple owners.

Life Insurance. Life insurance is a contract with an insurance company that helps financially protect your loved ones if you pass away. You pay your premiums, and, if you pass away while coverage is in place, the company pays a lump sum (called a death benefit) to your beneficiaries.

I the undersigned ________ of Shri/Smt. __________________________________ here by inform you about the death of my_______________. I request you to settle the death claim under his policy no. _________________________________ at the earliest in my favour being the nominee of the above no.

The insurer must pay the death benefit when the insured dies if the policyholder pays the premiums as required, and premiums are determined in part by how likely it is that the insurer will have to pay the policy's death benefit based on the insured's life expectancy.