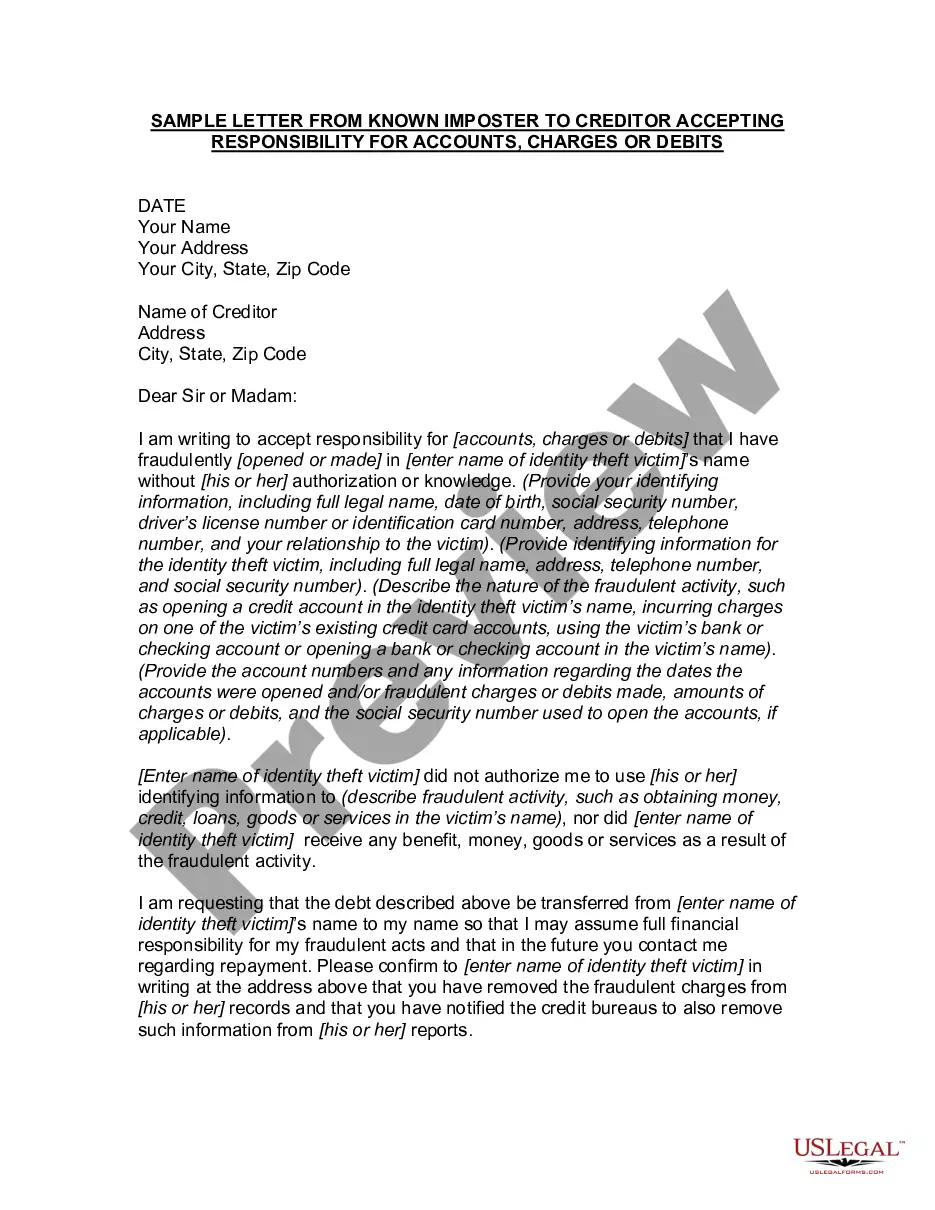

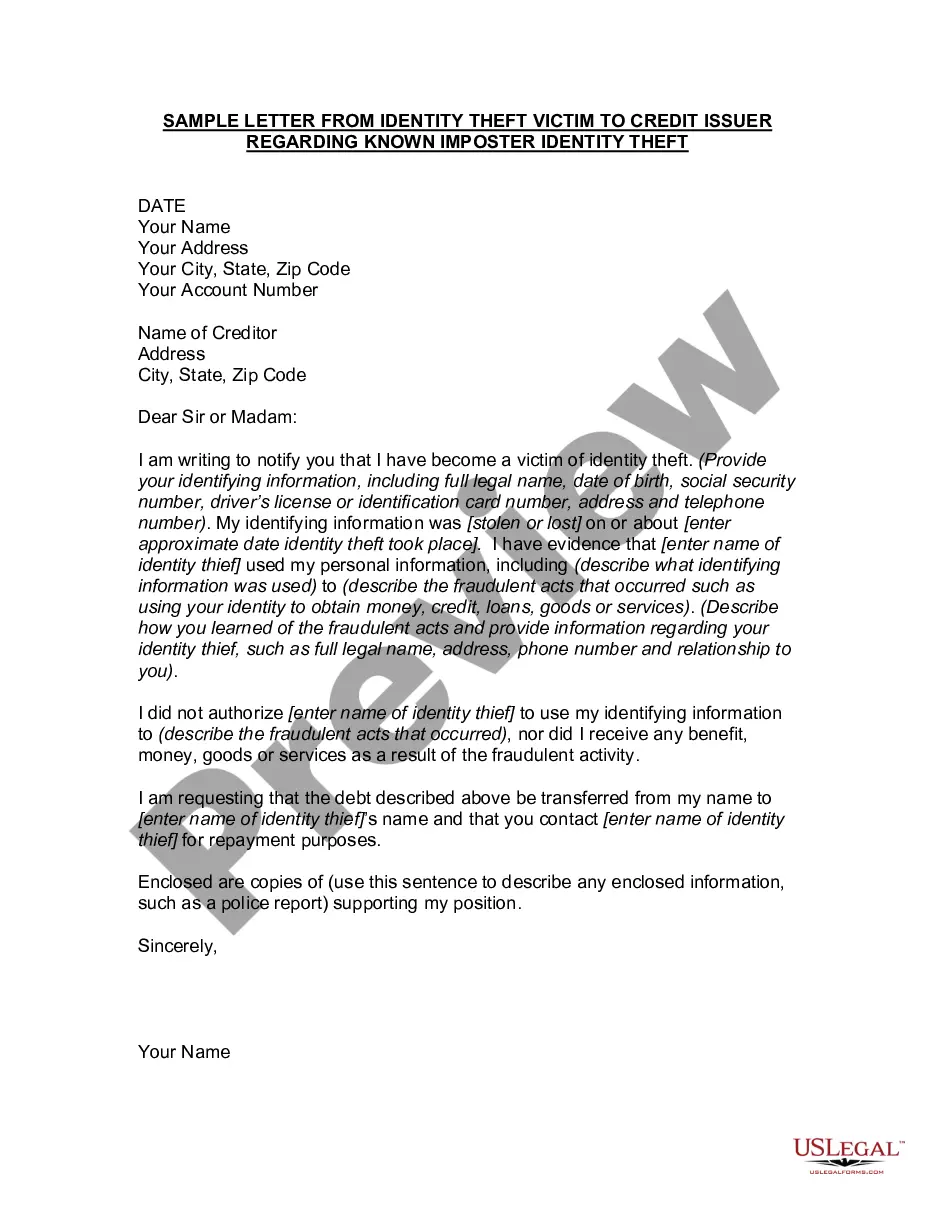

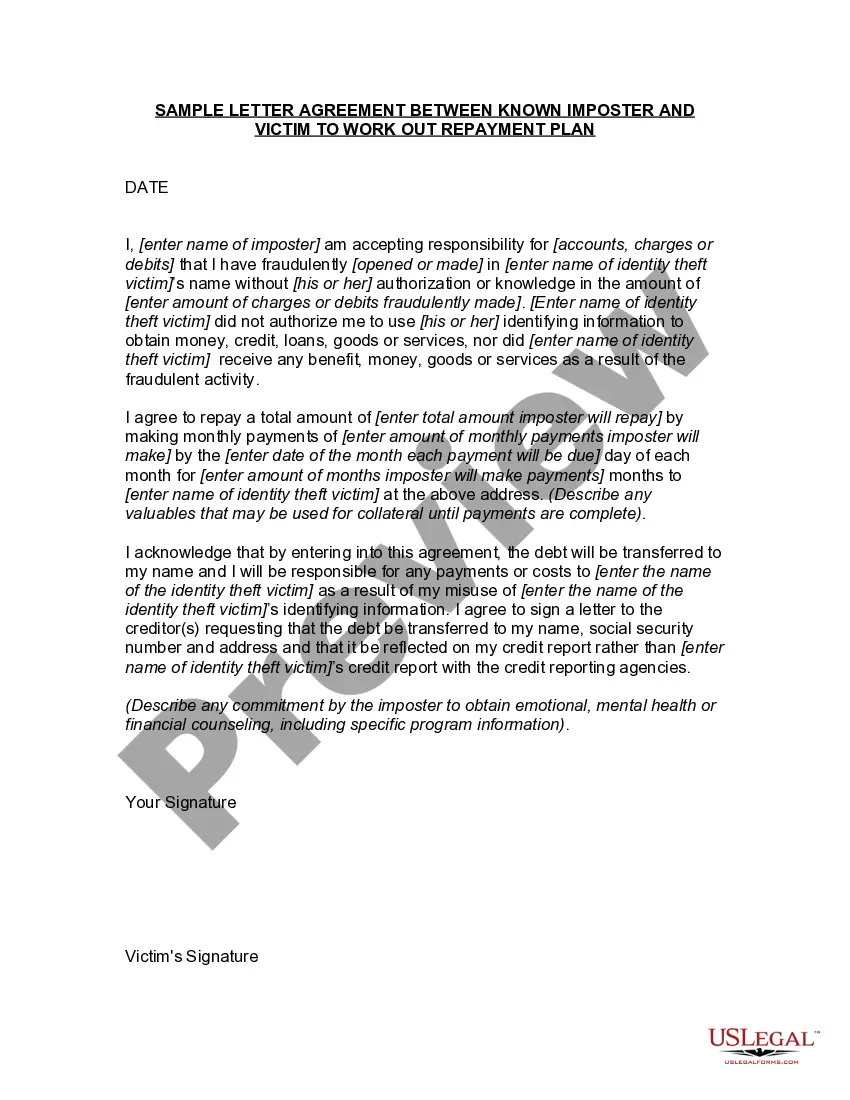

North Carolina Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

If you wish to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, select the Get now option. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finish the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Carolina Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

- Use US Legal Forms to obtain the North Carolina Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the North Carolina Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to review the form's content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms of the legal type design.

Form popularity

FAQ

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

The debt validation letter must include at least the following information: The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

You'll want to make sure that the debt is legitimate and that the debt validation letter doesn't contain any inaccuracies or mistakes ? those could lead to you paying off debt you don't actually owe. Debt validation letters also help protect you against scams and give you legal rights to dispute the debt.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.