Keywords: North Carolina, liquidation agreement, debtor's collateral, satisfaction of indebtedness. In North Carolina, a liquidation agreement regarding a debtor's collateral in satisfaction of indebtedness is a legally binding arrangement that allows creditors to recover their outstanding debts by liquidating the debtor's collateral assets. This agreement serves as a means to protect creditors' rights while facilitating the resolution of financial obligations. There are two main types of liquidation agreements regarding a debtor's collateral in North Carolina: 1. Voluntary Liquidation Agreement: This type of agreement occurs when the debtor willingly agrees to liquidate their collateral assets to satisfy the outstanding debts. In this case, the debtor and creditor negotiate and draft an agreement that outlines the terms and conditions of the liquidation process. The agreement may detail the specific collateral assets to be liquidated, the method of liquidation (e.g., auction, sale, or private negotiation), and the distribution of proceeds to the creditor(s). 2. Involuntary Liquidation Agreement: This type of agreement is initiated by the creditor(s) when the debtor defaults on their loans or fails to meet their financial obligations. In such cases, the creditor(s) can pursue legal action to obtain a court order allowing them to liquidate the debtor's collateral to recover the outstanding debts. Once granted, the court oversees the process and ensures the equitable distribution of the liquidation proceeds to the creditor(s). Both voluntary and involuntary liquidation agreements provide guidelines and standards to protect the interests of the debtor, creditor(s), and any other stakeholders involved. These agreements typically require: — Detailed documentation of the collateral assets involved, such as real estate, vehicles, inventory, or equipment. — Clear identification of the outstanding debts owed by the debtor to the creditor(s). — A prescribed liquidation process to ensure fair and transparent asset disposal. — Compliance with legal requirements regarding the sale or disposal of specific types of collateral assets. — Distribution of the liquidation proceeds among the creditor(s) based on their respective claims. It is crucial for debtors and creditors in North Carolina to consult legal professionals specializing in commercial law or bankruptcy to draft or review the liquidation agreement. These professionals can ensure that the agreement aligns with the state's legal framework while protecting the rights of all parties involved.

North Carolina Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

How to fill out North Carolina Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

You can spend hrs on-line attempting to find the authorized papers design that meets the federal and state demands you require. US Legal Forms provides thousands of authorized kinds which can be analyzed by pros. You can actually obtain or produce the North Carolina Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness from my assistance.

If you have a US Legal Forms profile, it is possible to log in and then click the Obtain option. Next, it is possible to comprehensive, edit, produce, or signal the North Carolina Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness. Each authorized papers design you buy is the one you have forever. To acquire yet another copy of the bought develop, go to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms internet site the first time, follow the straightforward instructions beneath:

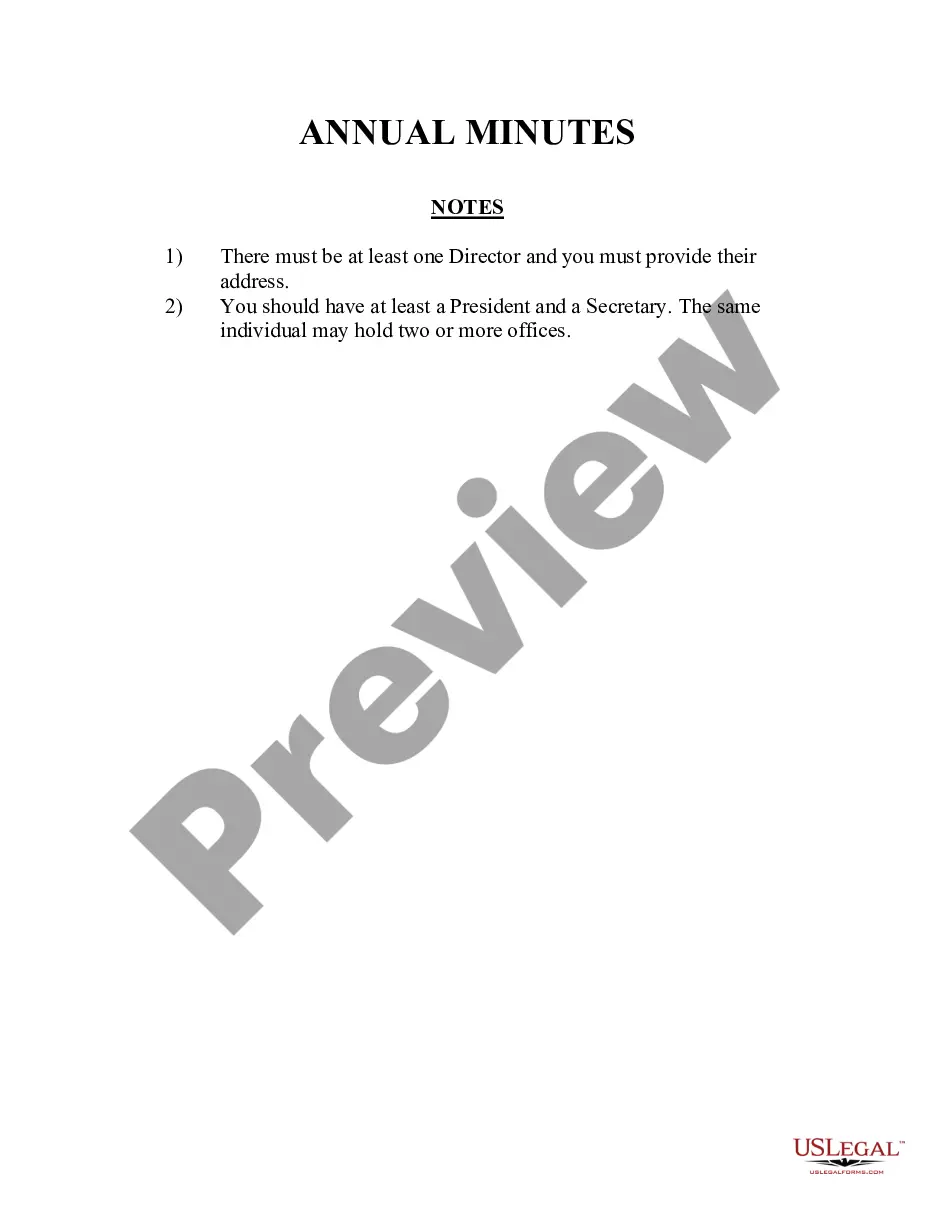

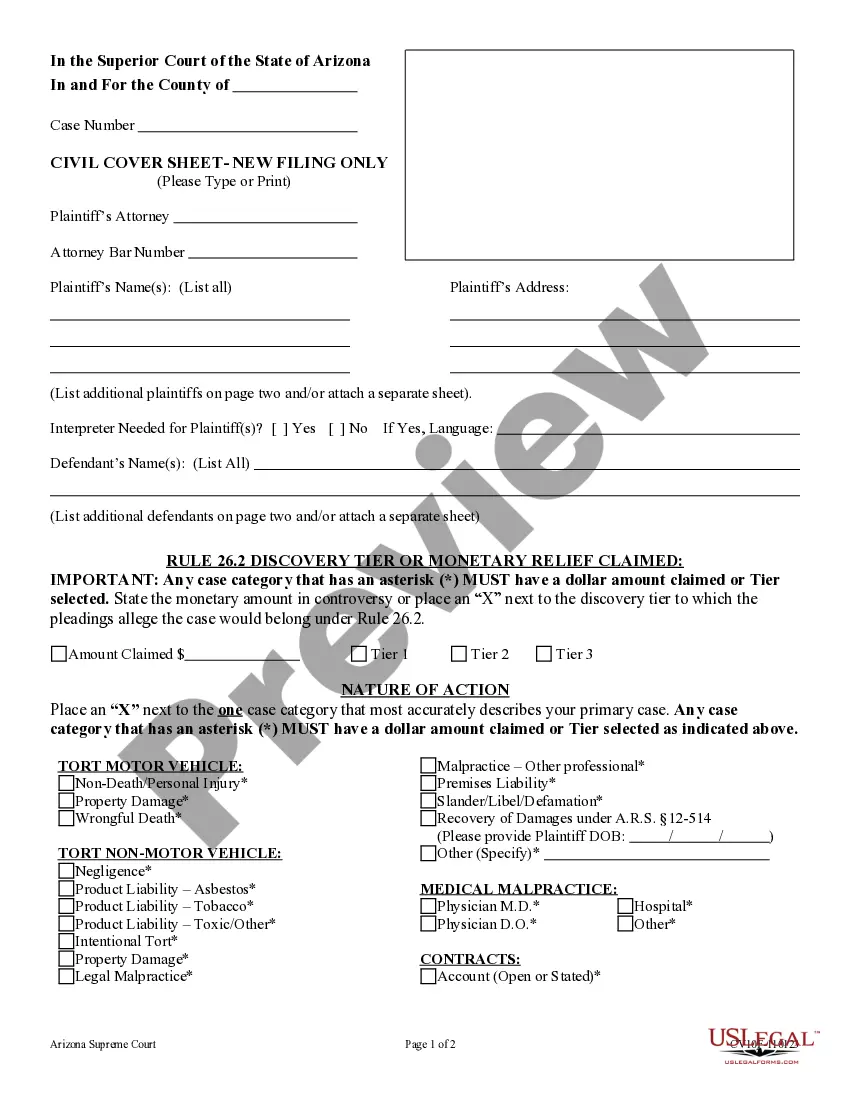

- Initial, make certain you have selected the proper papers design for your county/city of your liking. Look at the develop information to make sure you have chosen the right develop. If offered, take advantage of the Review option to look with the papers design at the same time.

- In order to discover yet another model in the develop, take advantage of the Lookup discipline to obtain the design that fits your needs and demands.

- When you have found the design you would like, click Purchase now to carry on.

- Find the costs plan you would like, type in your credentials, and register for an account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal profile to cover the authorized develop.

- Find the format in the papers and obtain it to the gadget.

- Make changes to the papers if required. You can comprehensive, edit and signal and produce North Carolina Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness.

Obtain and produce thousands of papers templates using the US Legal Forms website, that provides the biggest variety of authorized kinds. Use skilled and state-distinct templates to take on your small business or specific requires.