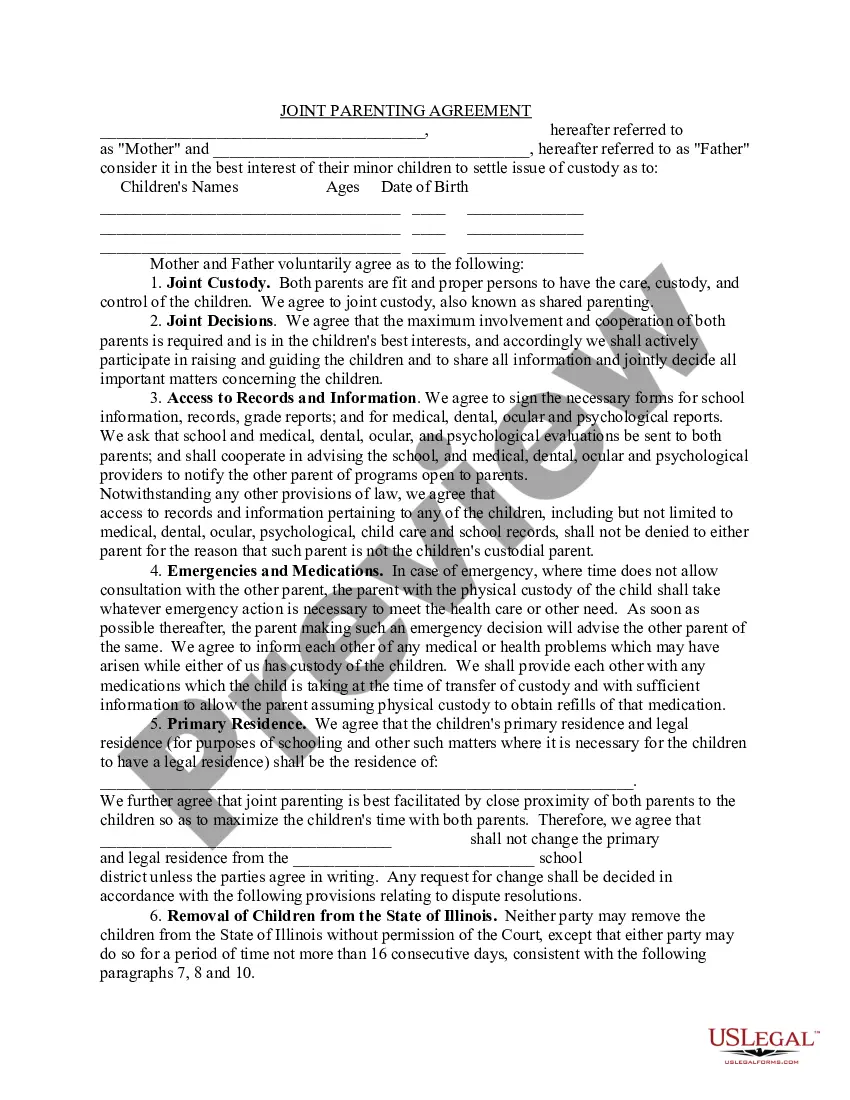

Title: North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner Keywords: North Carolina, Limited Partnership Agreement, Limited Liability Company, Limited Partner Introduction: A North Carolina Limited Partnership Agreement is a legally binding document between a Limited Liability Company (LLC) and a Limited Partner, outlining the terms and conditions of their partnership. This agreement serves as a blueprint for establishing the roles and responsibilities of each party involved. In North Carolina, there are variations of limited partnership agreements, including general limited partnerships, limited liability partnerships, and limited liability limited partnerships. 1. General Limited Partnership Agreement: A General Limited Partnership (GLP) Agreement in North Carolina is a contractual arrangement between an LLC and a Limited Partner. It delineates the structure, objectives, and management of the partnership, defining the responsibilities and voting rights of each party. This type of agreement enables the Limited Partner to maintain liability protection while offering opportunities for passive investment. 2. Limited Liability Partnership Agreement: A Limited Liability Partnership (LLP) Agreement in North Carolina is an alternative form of partnership where all partners have limited liability protection. This structure allows professional service providers, such as accountants, lawyers, architects, and engineers, to form a partnership without exposing each partner to unlimited personal liability for the actions of their co-partners. 3. Limited Liability Limited Partnership Agreement: A Limited Liability Limited Partnership (LL LP) Agreement in North Carolina combines the advantages of a limited partnership and a limited liability partnership. It provides personal liability protection to all partners, including general partners, who ordinarily would have unlimited liability in a general partnership. LL LP is specifically suitable for businesses, real estate investments, or other ventures where personal liability protection is crucial. Key Elements of a North Carolina Limited Partnership Agreement: — Identification of the LLC and Limited Partner: Names, addresses, and contact information of the parties involved. — Purpose and Powers: States the objectives and powers granted to the partnership. — Capital Contributions: Specifies the capital contributions made by each partner. — Profit and Loss Sharing: Outlines how profits and losses will be allocated between partners. — Management and Voting Rights: Defines the authority, roles, and decision-making processes of the parties involved. — Dissolution and Termination: Provides procedures and conditions for terminating the partnership. — Indemnification and Liability: Clarifies the extent of personal liability protection for partners. — Dispute Resolution: Outlines methods for resolving disputes or conflicts. Conclusion: A North Carolina Limited Partnership Agreement bridges the gap between an LLC and a Limited Partner, establishing a clear framework for their business partnership. Whether it be a General Limited Partnership, Limited Liability Partnership, or Limited Liability Limited Partnership, a well-drafted agreement can ensure that the rights, duties, and expectations of both parties are effectively communicated and legally protected.

North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out North Carolina Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

It is feasible to spend hours online attempting to discover the sanctioned document template that aligns with the state and federal guidelines you require.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can conveniently obtain or print the North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner from the service.

Select the payment plan you wish, enter your details, and create your account on US Legal Forms.

- If you currently have a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Every legal document template you acquire is yours permanently.

- To get an additional copy of the downloaded form, visit the My documents section and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the proper document template for your state/region that you choose.

- Check the document details to confirm you have selected the correct form.

- If available, use the Preview button to review the document template as well.

- If you wish to find another version of your form, utilize the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you desire, click Acquire now to continue.

Form popularity

FAQ

Yes, a limited company can coexist alongside a partnership. Often, businesses might choose this arrangement to utilize the benefits of both structures, such as limited liability and shared management. It's essential to draft a North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner to clearly define the roles and responsibilities across both entities.

No, a limited liability partnership (LLP) cannot serve as a partner in another LLP. Each LLP is composed of individual partners who share responsibilities and liabilities. The structure is designed to protect individual partners while allowing for operational flexibility within the partnership.

Yes, a limited liability partnership (LLP) is indeed a form of partnership. LLPs allow partners to limit their personal liability while participating actively in management. They blend the characteristics of partnerships and corporations, offering flexibility and protection beneficial to many business ventures.

While an LP is a type of partnership, it specifically refers to a limited partnership structure. In an LP, there are general partners who manage the business and limited partners who invest without liability exposure beyond their contributions. Therefore, it’s accurate to say all LPs are partnerships, but not all partnerships qualify as LPs.

A limited partner participates in a limited partnership but has restricted involvement in management. They contribute capital and share in profits without personal liability beyond their investment. In contrast, a limited liability partner, often within a limited liability partnership (LLP), enjoys similar protections but usually has a more active role in management.

Writing a limited partnership agreement involves several key steps. First, identify the partners and their specific roles and contributions. Next, outline the terms regarding profits, liabilities, and the procedure for handling disputes. Utilizing templates, such as the North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner offered on uslegalforms, can simplify this process.

Indeed, limited partnerships require partnership agreements to function effectively. A partnership agreement provides essential guidance on management, profit distribution, and decision-making processes. The North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner serves as a crucial document, detailing these important aspects.

Yes, Limited Partnerships (LPs) do have partnership agreements. These agreements outline the rights and responsibilities of both general and limited partners. A North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner ensures clarity and protects the interests of all parties involved.

Determining whether a limited company or a partnership is better depends on your business goals and circumstances. A limited company offers limited liability protection, while a partnership allows for simpler management and potentially more flexibility. Assess your long-term objectives and the types of investments you want to attract. In both scenarios, a North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner can serve as a valuable tool to set clear expectations and responsibilities.

As a limited partner in a limited partnership, you face limitations regarding control over business operations and decision-making. Your liability is limited to your investment, but you may miss out on a share of management insights. Furthermore, the partnership may require additional formalities, which can complicate operations. Crafting a North Carolina Limited Partnership Agreement Between Limited Liability Company and Limited Partner can help clarify these constraints.

Interesting Questions

More info

HTML /My Documents/index.html /home/user/Documents/My Documents/.html Documents/index.html /Documents/index.html /Users/user/Documents/.html Documents/index.