North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate In North Carolina, the Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts is a common agreement entered into by landlords and tenants in the commercial real estate sector. This type of lease offers a flexible arrangement for both parties, as it combines a fixed base rent with an additional rent component based on a percentage of the tenant's gross receipts. This lease agreement provides numerous benefits for both landlords and tenants. For landlords, it ensures a steady cash flow through the fixed base rent, regardless of the tenant's sales performance. At the same time, the additional rent based on the percentage of gross receipts allows landlords to share in the tenant's success and obtain higher rental income when the tenant's business thrives. Tenants, on the other hand, benefit from the flexibility of paying a portion of their rental obligation based on their actual revenue. This arrangement is particularly advantageous for retail businesses that experience fluctuations in sales volume throughout the year. By aligning their rent with their business performance, tenants can better manage their cash flow and mitigate financial risks. There may be different variations of the North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts, tailored to the specific needs of landlords and tenants. Some examples include: 1. Graduated Percentage Rent: This type of lease incorporates a tiered structure where the percentage of gross receipts payable as additional rent increases as the tenant's revenue surpasses certain thresholds. It encourages tenants to strive for higher sales by mutually benefitting both parties. 2. Minimum Base Rent: In certain cases, landlords may set a minimum base rent that guarantees a certain level of income, even if the tenant's gross receipts fall below expectations. This ensures a basic level of financial stability for the landlord, while still allowing the tenant to participate in the upside potential. 3. Percentage Rent Cap: Landlords may include a rent cap in the lease agreement, limiting the maximum percentage of gross receipts payable as additional rent. This protects tenants from excessively high rental obligations in case their businesses experience phenomenal success. 4. Short-Term Percentage Rent: For tenants operating seasonal businesses or those seeking to test the market before committing to a long-term lease, short-term percentage rent leases offer flexibility. These leases have a fixed duration and provide the option to extend or renegotiate terms based on the tenant's performance. In summary, the North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts is a flexible arrangement beneficial to both landlords and tenants in the commercial real estate sector. By incorporating a fixed base rent and an additional rent component based on a percentage of gross receipts, this lease allows for a mutually beneficial relationship and fosters financial stability in a dynamic business environment.

North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

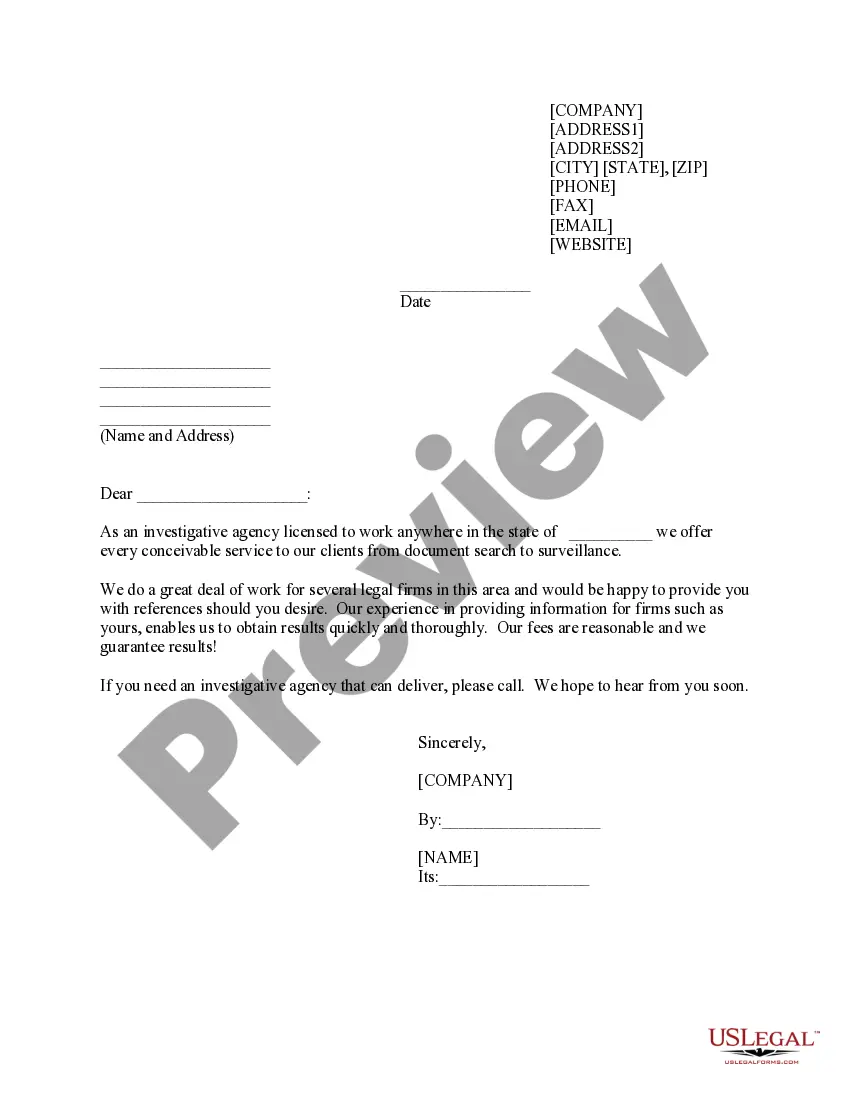

How to fill out North Carolina Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Have you been within a situation in which you need to have papers for either organization or person uses virtually every time? There are a lot of legitimate papers templates available on the net, but locating ones you can depend on is not simple. US Legal Forms provides a large number of develop templates, much like the North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, that happen to be created in order to meet state and federal needs.

Should you be previously knowledgeable about US Legal Forms web site and possess an account, just log in. Afterward, you are able to acquire the North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate format.

Should you not come with an profile and need to start using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for the correct city/state.

- Utilize the Preview option to check the shape.

- Read the explanation to actually have chosen the proper develop.

- In case the develop is not what you`re seeking, use the Search industry to obtain the develop that meets your requirements and needs.

- If you find the correct develop, click on Acquire now.

- Choose the prices program you would like, submit the necessary info to produce your account, and purchase your order using your PayPal or charge card.

- Choose a convenient file file format and acquire your version.

Locate every one of the papers templates you might have bought in the My Forms menus. You may get a further version of North Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate any time, if possible. Just select the required develop to acquire or produce the papers format.

Use US Legal Forms, one of the most considerable assortment of legitimate forms, to save efforts and stay away from mistakes. The services provides appropriately created legitimate papers templates that can be used for a range of uses. Produce an account on US Legal Forms and start creating your lifestyle easier.