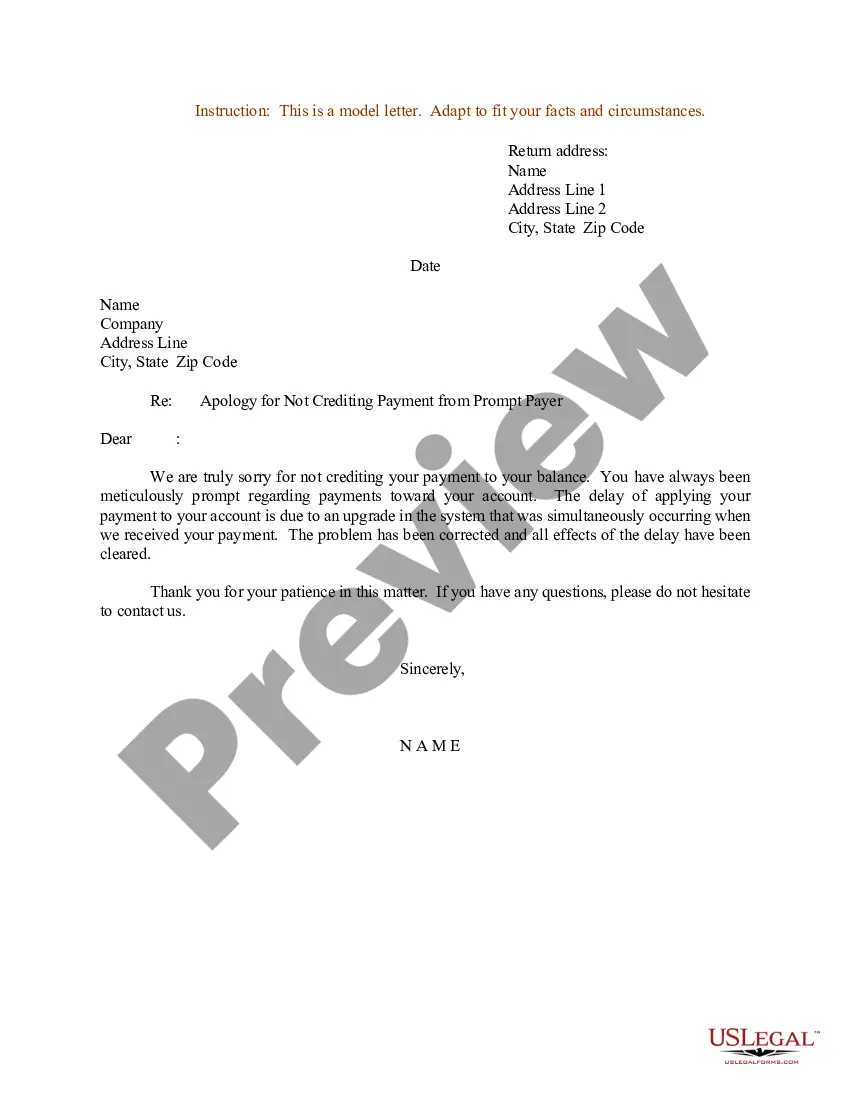

Title: North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer Introduction: When a prompt payer's payment is not credited correctly by a business based in North Carolina, it is essential to issue an apology letter to address the issue promptly and ensure customer satisfaction. This detailed description aims to provide an overview of what a North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer should encompass and may include variations for different industries or scenarios. Key Elements of the Apology Letter: 1. Salutation: Address the letter to the customer using an appropriate salutation such as "Dear [Customer's Name]". 2. Clear Statement of Apology: Begin the letter with a sincere and explicit apology for the error made in not crediting the prompt payer's payment accurately. Clearly express remorse for any inconvenience caused and acknowledge the importance of accurate financial transactions. 3. Description of the Error: Provide a concise and transparent explanation of the specific error that occurred, including any relevant details such as dates, payment amounts, and any contributing factors. This demonstrates accountability and helps the customer understand the issue. 4. Responsibility Acceptance: Take full responsibility for the mistake and accept accountability on behalf of the company or organization. This reassures the customer that their concerns are acknowledged and encourages trust in the business. 5. Clarification and Rectification Plan: Outline the steps the company is taking to rectify the error promptly. This could involve crediting the payment, adjusting account balances, or any other necessary actions to ensure the customer's financial account is accurately updated. 6. Assurance of Non-Recurrence: Reassure the customer that measures are being implemented to prevent similar errors from happening in the future. Highlight any specific procedures, quality checks, or system improvements the company is enacting. 7. Compensation or Gesture of Goodwill (if applicable): Depending on the severity or impact of the error, it may be appropriate to offer compensation or a gesture of goodwill to the affected customer. This can range from a discount on future purchases, a refund, additional services, or any other suitable accommodation as determined by the business. 8. Contact Information: Provide contact details, including a designated point of contact, phone number, email address, or any other relevant information to encourage open communication between the customer and company. 9. Closing: End the apology letter with a polite closing, such as "Sincerely" or "Yours faithfully," followed by the sender's name and title. This portrays professionalism and maintains a positive image for the business. Variations of North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer: 1. Retail Industry Apology Letter: Tailored specifically for businesses in the retail industry, this variation can include industry-specific language and reference common retail practices, such as online transactions or in-store refunds. 2. Financial Services Apology Letter: Designed for banks, credit unions, or any financial institutions, this variation may include references to regulatory compliance, financial regulations, or any specific factors that impacted the payment crediting error. 3. Utility Company Apology Letter: Adapted to address customers of utility companies, this variation can include insights into billing cycles, meter readings, or any specific issues related to the utility's payment processing system. Note: The aforementioned variations are just examples, and businesses should tailor the apology letters to suit their industry, customer base, and specific circumstances.

North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer

Description

How to fill out North Carolina Sample Letter For Apology For Not Crediting Payment From Prompt Payer?

Have you been inside a placement in which you will need paperwork for both business or individual purposes nearly every day? There are a lot of lawful papers web templates available online, but discovering kinds you can trust isn`t effortless. US Legal Forms offers thousands of develop web templates, like the North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer, which can be created to fulfill state and federal demands.

In case you are presently acquainted with US Legal Forms internet site and have an account, just log in. Next, you may download the North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer web template.

Unless you offer an bank account and would like to start using US Legal Forms, adopt these measures:

- Discover the develop you want and ensure it is for the proper town/area.

- Utilize the Preview key to review the form.

- Look at the outline to ensure that you have chosen the appropriate develop.

- In case the develop isn`t what you`re looking for, use the Search industry to find the develop that meets your needs and demands.

- Whenever you discover the proper develop, simply click Buy now.

- Pick the prices strategy you desire, submit the specified info to produce your money, and purchase an order utilizing your PayPal or charge card.

- Pick a hassle-free document structure and download your copy.

Discover all of the papers web templates you possess purchased in the My Forms menus. You can get a extra copy of North Carolina Sample Letter for Apology for Not Crediting Payment from Prompt Payer any time, if possible. Just click on the essential develop to download or produce the papers web template.

Use US Legal Forms, the most substantial collection of lawful forms, to save lots of time and stay away from errors. The support offers professionally created lawful papers web templates which can be used for a selection of purposes. Make an account on US Legal Forms and commence making your life a little easier.