An assignment is the transfer of rights that one party has under a contract to another. The assigning party is called the assignor. The person receiving the assignment is called the assignee. This form is an offer to the purchaser under a real estate purchase and sale agreement to purchase said purchaser's rights under said agreement. The purchaser would be the assignor and the assignee would be the person making the offer to said purchaser.

North Carolina Offer to Purchase Real Estate regarding Purchase and Sale Agreement

Description

How to fill out Offer To Purchase Real Estate Regarding Purchase And Sale Agreement?

Should you desire to complete, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and user-friendly search feature to find the documents you need.

Many templates for business and personal purposes are categorized by types and jurisdictions, or by keywords.

Step 4. Once you have located the form you need, choose the Purchase now option. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the North Carolina Offer to Purchase Real Estate concerning Purchase and Sale Agreement in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Acquire button to get the North Carolina Offer to Purchase Real Estate concerning Purchase and Sale Agreement.

- You can also access forms you previously downloaded within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to inspect the form’s details. Don’t forget to read the summary.

- Step 3. If you aren’t satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

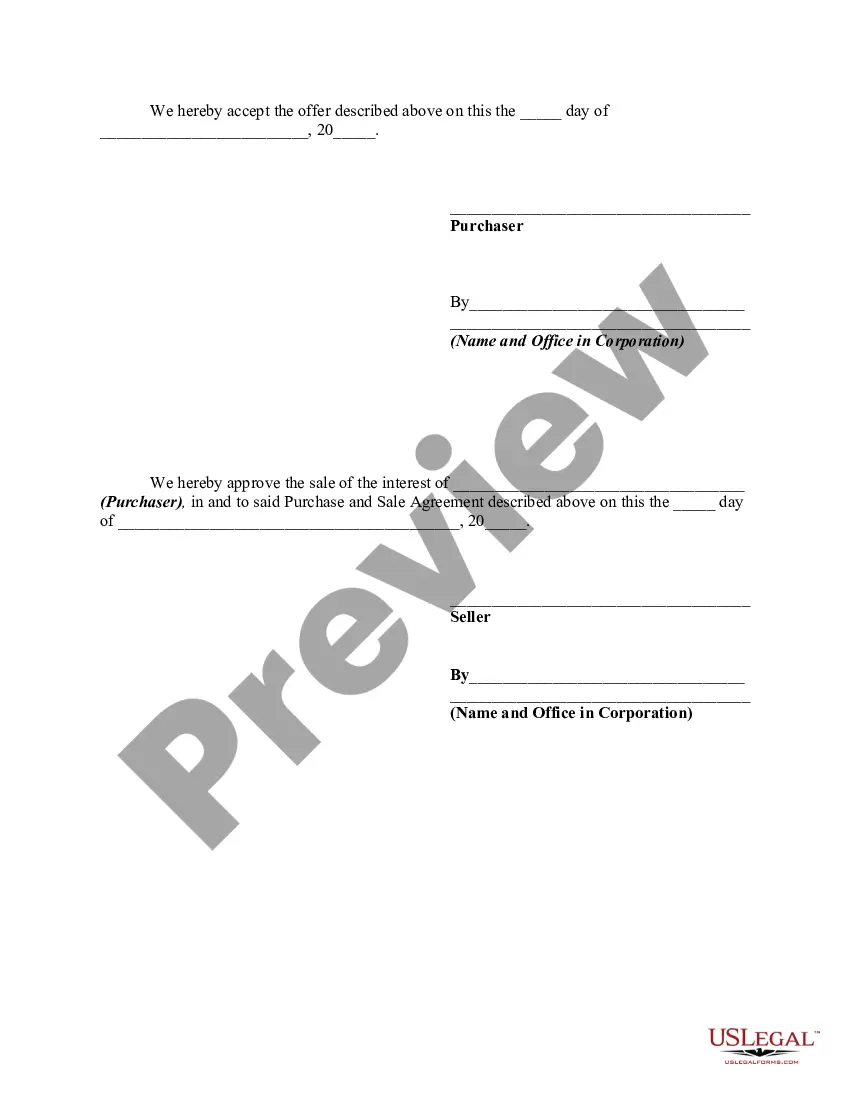

This is, perhaps, the most desired next step in the process for most buyers. For the purchase of property, an offer is considered under contract when it has been accepted in writing and signed by both parties. This written contract is called a purchase agreement.

If both parties come to terms and agree in writing the offer then becomes a contract, but both parties must sign the offer in order for it to become a contract, commonly referred to as an executed contract.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The North Carolina Offer to Purchase and Contract is also often called a due diligence contract. We have a due diligence period, and within this time frame, a buyer can terminate a contract for any reason. It doesn't have to be because of a bad inspection, loan, or other obvious problems.

What to Include in Your Offer LetterOfficial letterhead or logo. This is a formal document so you should consider it as formal correspondence.Formal letter guidelines.Opener.About the position.Salary and benefits.At-will status.Closer.

The Purchase & Sale Agreement (P&S) is a legally binding contract that dictates how the sale of a home will proceed. It comes after the Offer to Purchase, and supersedes that earlier document once it's signed. The P&S is more substantial than the offer and can seem pretty complicated, so I'm going to break it down.

How to Make an Offer on a House Purchase AgreementLean on Your Real Estate Agent.Current Market Analysis.Determine How Much to Offer.Determine Down Payment and Earnest Money Terms.Write an Offer Letter.Write Purchase Agreement: Assessment and Contingencies.Wait for Seller to Accept, Counter or Decline.

The Purchase and Sales agreement, commonly referred to as the P&S in real estate deals, is the contract that governs the transaction. Such documents are often long, detailed, full of legalese, and most significantly, binding, making it an essential item to familiarize yourself with before signing.

Let's break it down into five simple steps.Step 1: Decide How Much To Offer.Step 2: Decide On Contingencies.Step 3: Decide On How Much Earnest Money To Offer.Step 4: Write An Offer Letter.Step 5: Negotiate The Price And Terms Of The Sale.18-Jan-2022

For the purchase of property, an offer is considered under contract when it has been accepted in writing and signed by both parties. This written contract is called a purchase agreement.