The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

North Carolina Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding Debtor's Financial Condition

Description

How to fill out Complaint Objecting To Discharge By Bankruptcy Court On The Grounds That Transaction Was Induced By Fraud Regarding Debtor's Financial Condition?

Choosing the right legitimate document web template could be a battle. Obviously, there are tons of themes available on the Internet, but how would you find the legitimate form you need? Utilize the US Legal Forms site. The support gives a large number of themes, including the North Carolina Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding, which can be used for enterprise and private needs. Each of the kinds are checked by pros and meet up with federal and state requirements.

When you are currently listed, log in to your bank account and click the Download option to obtain the North Carolina Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding. Utilize your bank account to look with the legitimate kinds you may have bought in the past. Go to the My Forms tab of your respective bank account and get yet another copy of the document you need.

When you are a fresh customer of US Legal Forms, listed below are straightforward guidelines so that you can adhere to:

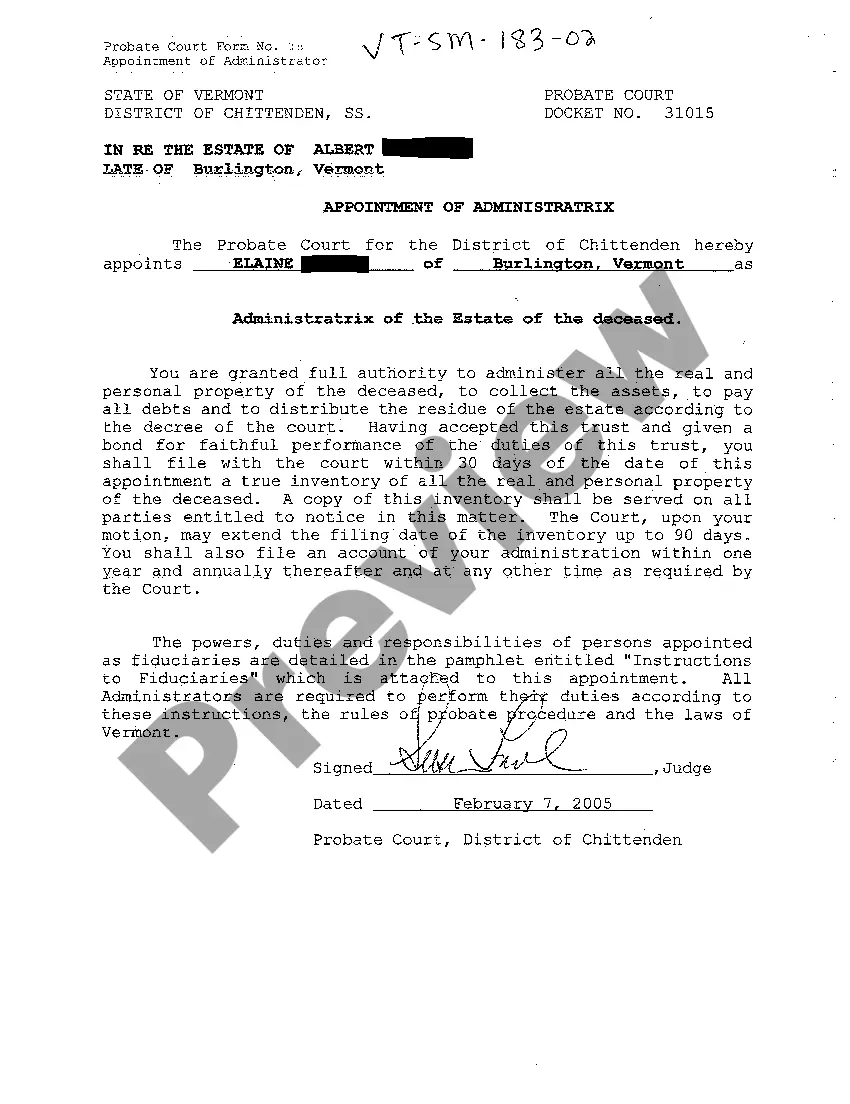

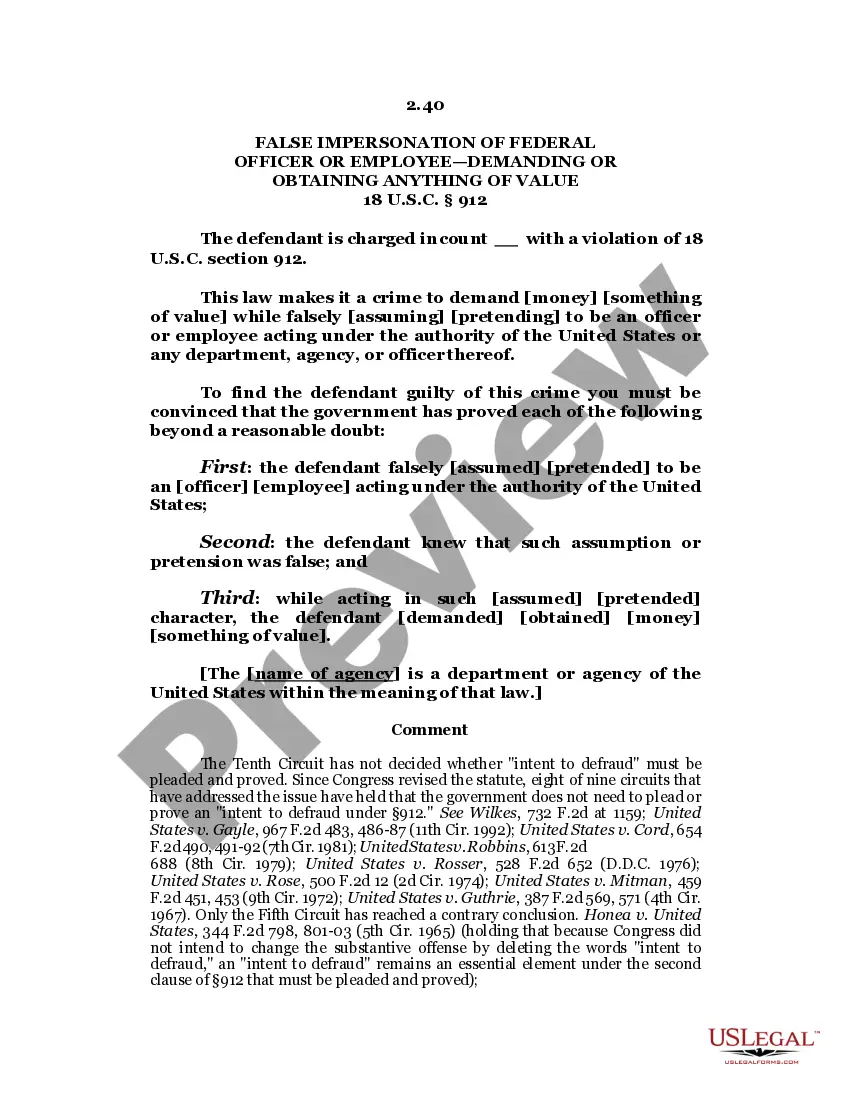

- Initial, ensure you have chosen the appropriate form for your city/state. You are able to check out the form making use of the Review option and look at the form description to make certain it will be the right one for you.

- In case the form will not meet up with your expectations, utilize the Seach field to obtain the right form.

- Once you are sure that the form would work, select the Acquire now option to obtain the form.

- Pick the costs plan you desire and type in the needed info. Build your bank account and buy the order using your PayPal bank account or Visa or Mastercard.

- Pick the submit format and acquire the legitimate document web template to your device.

- Complete, modify and print and signal the received North Carolina Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding.

US Legal Forms will be the greatest collection of legitimate kinds for which you will find different document themes. Utilize the service to acquire appropriately-created paperwork that adhere to express requirements.

Form popularity

FAQ

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

In a unanimous decision, the Supreme Court held that § 523(a)(2)(A) of the Bankruptcy Code precludes a debtor from discharging a debt obtained by fraud, regardless of the debtor's own culpability.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

Conditions for Denial of Discharge You've hidden, destroyed, or failed to keep adequate records of your assets and financial affairs. You lied or tried to defraud the court or your creditors. You failed to explain any loss of assets. You refused to obey a lawful order of the court.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

In a decision handed down on February 22, 2023, Bartenwerfer v. Buckley, the United States Supreme Court ruled that the bankruptcy process cannot be used to discharge debts incurred through fraud, even when the debtor was not the individual that defrauded creditors.