This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease With Mortgage Securing Guaranty?

If you have to comprehensive, download, or produce lawful record themes, use US Legal Forms, the biggest assortment of lawful varieties, which can be found online. Take advantage of the site`s basic and convenient look for to obtain the files you require. A variety of themes for business and personal reasons are categorized by groups and claims, or key phrases. Use US Legal Forms to obtain the North Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty in just a couple of clicks.

When you are currently a US Legal Forms client, log in for your profile and click the Obtain button to get the North Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty. You can even accessibility varieties you in the past acquired inside the My Forms tab of the profile.

Should you use US Legal Forms the first time, refer to the instructions beneath:

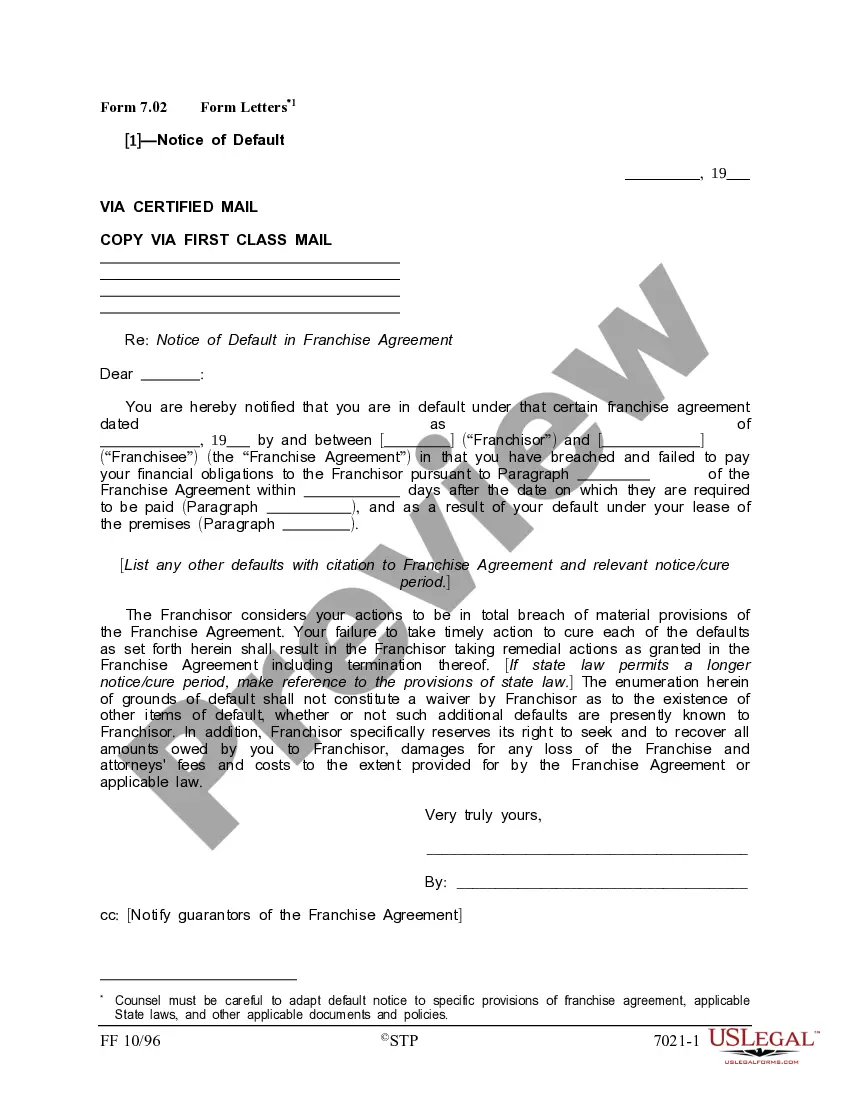

- Step 1. Be sure you have selected the form for that appropriate town/region.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Don`t forget to read the information.

- Step 3. When you are not satisfied using the form, make use of the Research area near the top of the screen to find other types in the lawful form format.

- Step 4. When you have identified the form you require, select the Buy now button. Choose the costs strategy you like and add your accreditations to register to have an profile.

- Step 5. Approach the purchase. You should use your charge card or PayPal profile to finish the purchase.

- Step 6. Select the format in the lawful form and download it in your product.

- Step 7. Full, change and produce or signal the North Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty.

Each lawful record format you buy is yours eternally. You possess acces to each form you acquired with your acccount. Click the My Forms portion and select a form to produce or download again.

Remain competitive and download, and produce the North Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty with US Legal Forms. There are millions of professional and express-certain varieties you can use to your business or personal needs.

Form popularity

FAQ

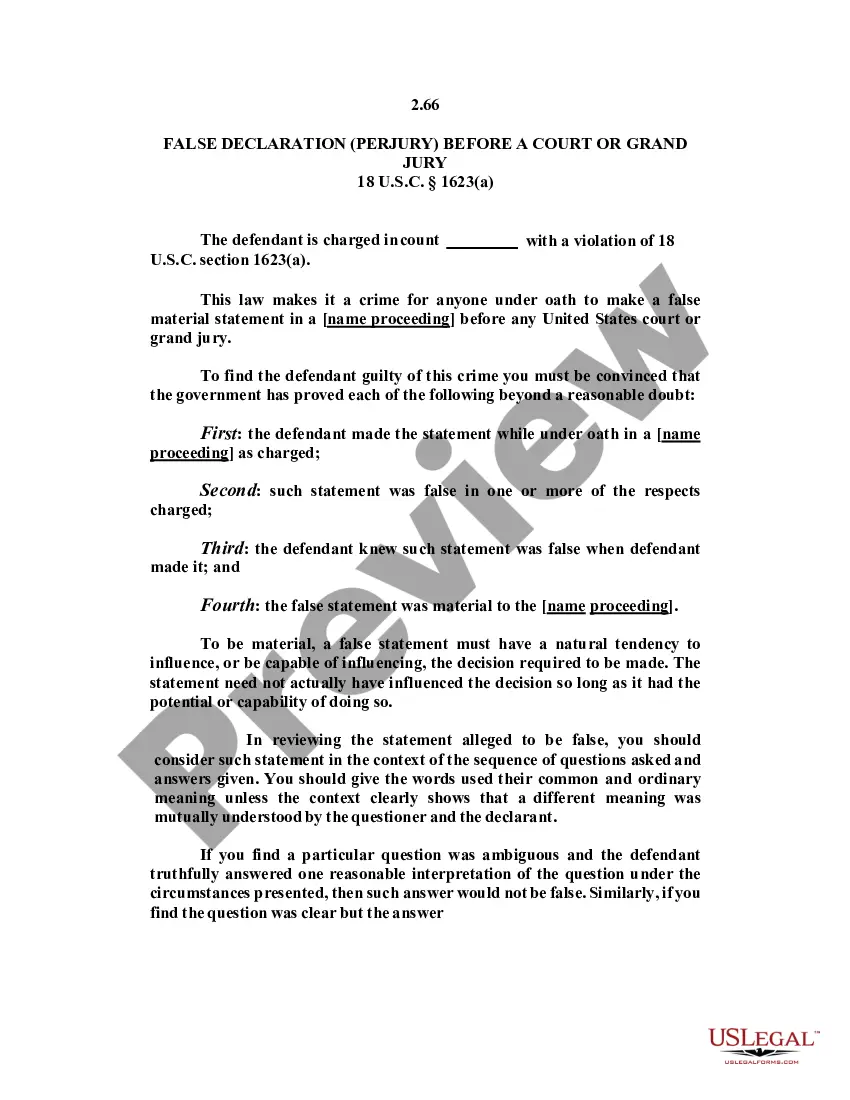

A commercial lease guaranty is an agreement signed by the landlord, tenant, and a third party who meets the landlord's standards of financial trustworthiness. In the leasing context, this is usually the corporation(s) that owns or controls the tenant's business, but it can also be a bank or an individual.

The Guarantor hereby fully and unconditionally guarantees to each Holder the due and punctual payment of the Guarantee Payments, as and to the extent applicable (without duplication of amounts theretofore paid by the Issuer) when and as the same shall become due and payable, ing to the terms of the Preferred ...

A lease guaranty is a contract between an individual or entity (guarantor) that is typically related to the tenant. The guarantor promises to pay the landlord any and all payments due under the lease in the event the tenant defaults under its lease obligations and otherwise cure the tenant's defaults.

Last summer, we wrote about New York City Administrative Code Section 22-1005, known as the Guaranty Law. This was a pandemic-era prohibition on enforcement of personal guaranties supporting commercial leases for defaults that occurred between March 7, 2020, and June 30, 2021.

A personal guarantee clause is a common provision in commercial lease agreements that requires the tenant or a third party to be liable for the rent and other obligations of the lease in case of default or breach by the tenant.

A guarantor is a person who will co-sign an apartment lease alongside a tenant, guaranteeing to pay the rent if the tenant fails to do so. The guarantor is usually a parent, family member, or close friend who is willing to be legally responsible for the rental apartment.