A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

North Carolina Guaranty of Collection of Promissory Note

Description

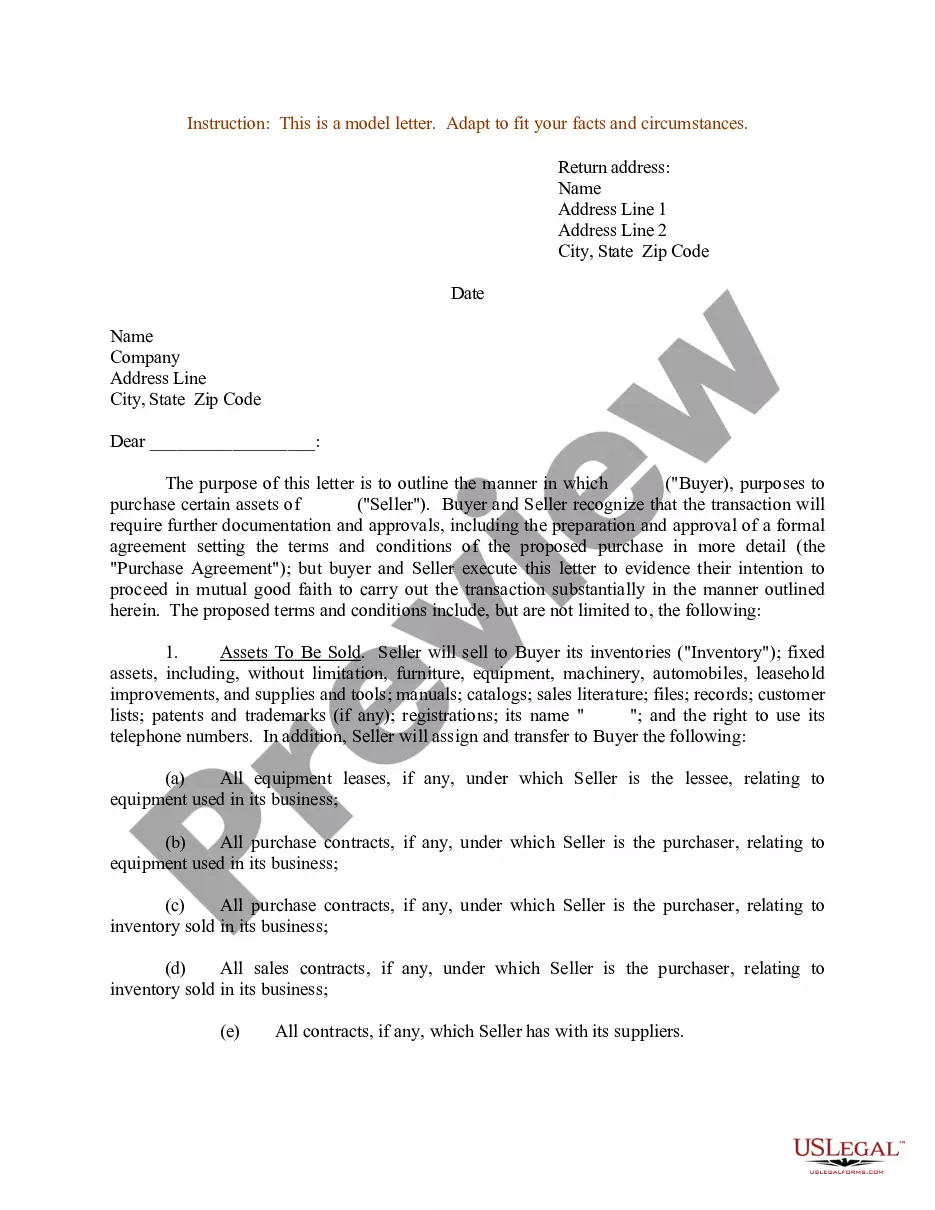

How to fill out Guaranty Of Collection Of Promissory Note?

If you need to download or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms, which are available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

A variety of templates for business and personal use are categorized by type and state, or keywords.

Step 4. Once you have located the form you need, click on the Get now button. Choose your preferred pricing plan and enter your details to register for the account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the North Carolina Guaranty of Collection of Promissory Note with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to get the North Carolina Guaranty of Collection of Promissory Note.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to check the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations in the legal form catalog.

Form popularity

FAQ

In North Carolina, the validity of a promissory note is generally determined by the terms set within the document itself. Often, a promissory note remains valid for three to ten years depending on the conditions stated. Referencing the North Carolina Guaranty of Collection of Promissory Note helps clarify any limitations on enforceability and can guide proper handling of such documents.

Typically, a guarantor, who may be a trusted individual or business entity, guarantees a promissory note. This person agrees to cover the payment if the primary borrower does not fulfill their obligations. The North Carolina Guaranty of Collection of Promissory Note assists in clearly outlining the roles of the guarantor and the protections involved, helping to ensure all parties are informed.

To guarantee a promissory note, a guarantor signs the note, agreeing to fulfill the payment obligations if the maker fails to do so. This additional assurance enhances the security of the note for the bearer. Utilizing the framework of the North Carolina Guaranty of Collection of Promissory Note can simplify this process, ensuring both the maker and guarantor understand their responsibilities.

The maker of the promissory note is primarily liable for repayment. This means that if the note defaults, the bearer can seek payment directly from the maker. In North Carolina, understanding the Guaranty of Collection of Promissory Note is vital for all parties involved, as it delineates the roles and risks associated with liability.

The bearer of a promissory note is the individual or entity that possesses the note. In other words, the bearer has the right to collect the payment specified in the note. Understanding the North Carolina Guaranty of Collection of Promissory Note helps clarify the responsibilities and rights of the bearer in the collections process.

The guarantee of a promissory note typically refers to the assurance that the borrower will repay the borrowed amount as agreed. In North Carolina, this may involve additional mechanisms such as guarantees from third parties or collateral agreements. Understanding the specific guarantees that can be applied is crucial for both lenders and borrowers in protecting their rights. Utilizing the North Carolina Guaranty of Collection of Promissory Note can provide further security in your lending transactions.

In North Carolina, a promissory note does not legally require notarization to be valid. However, having a notary public witness the signing can add an extra layer of assurance and credibility. Notarization can help in case of disputes, showing that both parties agreed to the terms. Therefore, while not mandatory, notarizing your note can be beneficial, especially in the context of the North Carolina Guaranty of Collection of Promissory Note.

The entry of the promissory note refers to the actual recording of the note's details within a financial system or accounting journal. This entry includes identifying the parties, the principal amount, any applicable interest, and payment schedule. Accurate entries are vital for tracking financial obligations, especially with the North Carolina Guaranty of Collection of Promissory Note, ensuring all parties remain informed of their commitments.

An example of a simple promissory note can be a document stating that John Doe borrows $5,000 from Jane Smith, with a 5% interest rate to be repaid in monthly installments over two years. This straightforward language avoids confusion and clearly defines the agreement. Utilizing examples like this promotes clarity, especially when considering a North Carolina Guaranty of Collection of Promissory Note.