Under the Uniform Commercial Code (UCC) Sec. 2-207(1), A definite expression of acceptance or a written confirmation of an informal agreement may constitute a valid acceptance even if it states terms additional to or different from the offer or informal agreement. The additional or different terms are treated as proposals for addition into the contract under UCC Sec. 2-207(2). Between merchants, such terms become part of the contract unless: a)the offer expressly limits acceptance to the terms of the offer, b)material alteration of the contract results, c)notification of objection to the additional/different terms are given in a reasonable time after notice of them is received.

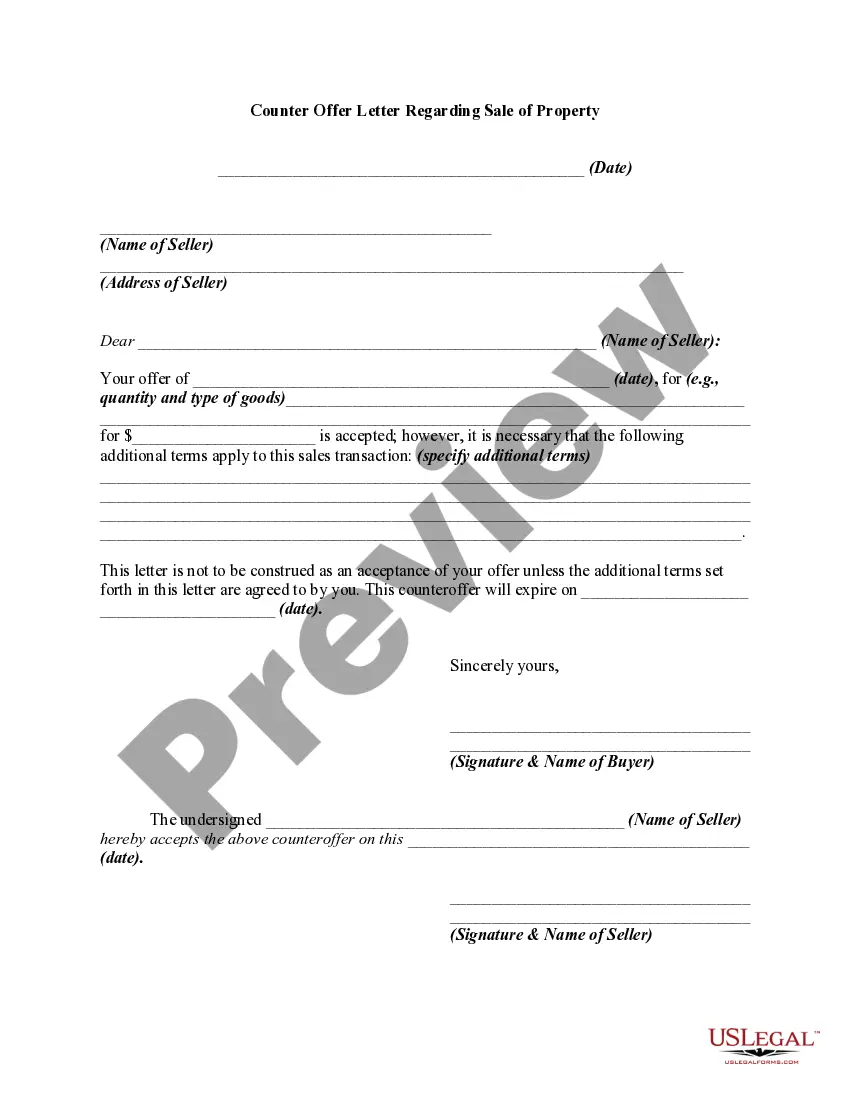

A North Carolina counter offer letter regarding the sale of property is a formal document used in real estate transactions to negotiate changes to the terms of an initial purchase offer. It is sent by the seller to the buyer, indicating their willingness to modify specific aspects of the original offer in hopes of reaching a mutually beneficial agreement. This letter is a crucial tool in the negotiation process and helps parties navigate the complex realm of real estate sales. Key elements commonly addressed in a North Carolina counter offer letter include the purchase price, earnest money deposit, closing costs, financing terms, contingencies, home inspection provisions, and the proposed closing date. It is essential for both parties to carefully review and understand the terms and conditions mentioned in the letter before accepting or presenting a counter offer. In North Carolina, there are a few variations of counter offer letters regarding the sale of property, each designed to target specific aspects of the agreement: 1. Price Counter Offer: This type focuses primarily on modifying the proposed purchase price to ensure it aligns with the seller's expectations or market value. It may involve either a reduction or increase in price, based on the property's condition, market conditions, or appraisal results. 2. Contingency Counter Offer: A contingency is a condition that must be fulfilled before the completion of the sale. A contingency counter offer letter may include changes to or removal of contingencies such as home inspection, mortgage approval, appraisal, or the sale of the buyer's current property. 3. Closing Date Counter Offer: This type addresses the proposed closing date mentioned in the original offer. The seller may request a different closing date to accommodate their needs, such as coordinating with the purchase of a new property, relocation, or other personal circumstances. 4. Financing Terms Counter Offer: The financial aspect of a real estate transaction can be subject to negotiation. A financing terms counter offer letter may involve modifying the down payment amount, interest rate, loan type, or requesting a higher pre-approval amount from the buyer. 5. Repair Request Counter Offer: If the home inspection reveals certain issues or repairs required, the seller may present a counter offer letter suggesting adjustments to repair responsibilities or the associated costs. Remember, a North Carolina counter offer letter should be drafted meticulously to ensure clarity and precision in the negotiated terms. Both parties should consult their respective real estate agents or attorneys to ensure compliance with North Carolina real estate laws and regulations.A North Carolina counter offer letter regarding the sale of property is a formal document used in real estate transactions to negotiate changes to the terms of an initial purchase offer. It is sent by the seller to the buyer, indicating their willingness to modify specific aspects of the original offer in hopes of reaching a mutually beneficial agreement. This letter is a crucial tool in the negotiation process and helps parties navigate the complex realm of real estate sales. Key elements commonly addressed in a North Carolina counter offer letter include the purchase price, earnest money deposit, closing costs, financing terms, contingencies, home inspection provisions, and the proposed closing date. It is essential for both parties to carefully review and understand the terms and conditions mentioned in the letter before accepting or presenting a counter offer. In North Carolina, there are a few variations of counter offer letters regarding the sale of property, each designed to target specific aspects of the agreement: 1. Price Counter Offer: This type focuses primarily on modifying the proposed purchase price to ensure it aligns with the seller's expectations or market value. It may involve either a reduction or increase in price, based on the property's condition, market conditions, or appraisal results. 2. Contingency Counter Offer: A contingency is a condition that must be fulfilled before the completion of the sale. A contingency counter offer letter may include changes to or removal of contingencies such as home inspection, mortgage approval, appraisal, or the sale of the buyer's current property. 3. Closing Date Counter Offer: This type addresses the proposed closing date mentioned in the original offer. The seller may request a different closing date to accommodate their needs, such as coordinating with the purchase of a new property, relocation, or other personal circumstances. 4. Financing Terms Counter Offer: The financial aspect of a real estate transaction can be subject to negotiation. A financing terms counter offer letter may involve modifying the down payment amount, interest rate, loan type, or requesting a higher pre-approval amount from the buyer. 5. Repair Request Counter Offer: If the home inspection reveals certain issues or repairs required, the seller may present a counter offer letter suggesting adjustments to repair responsibilities or the associated costs. Remember, a North Carolina counter offer letter should be drafted meticulously to ensure clarity and precision in the negotiated terms. Both parties should consult their respective real estate agents or attorneys to ensure compliance with North Carolina real estate laws and regulations.