North Carolina Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

Selecting the optimal legal document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the North Carolina Agreement to Arbitrate Disputed Open Account, suitable for both business and personal purposes.

All of the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the North Carolina Agreement to Arbitrate Disputed Open Account.

- Use your account to search through the legal forms you have previously purchased.

- Proceed to the My documents tab in your account and retrieve another version of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Review button and check the form details to verify it is the correct one for you.

- If the form does not meet your requirements, use the Search field to find the right form.

- Once you are confident that the form is accurate, click the Acquire now button to download the form.

- Choose the payment plan you prefer and provide the required information.

- Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Finally, edit, print, and sign the received North Carolina Agreement to Arbitrate Disputed Open Account.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to obtain properly-crafted documents that meet state standards.

Form popularity

FAQ

Qualifications for arbitration typically include having a written arbitration agreement and a clear outline of the issues at hand. The North Carolina Agreement to Arbitrate Disputed Open Account may specify the types of disputes suitable for arbitration. Additionally, parties may require qualified arbitrators with particular expertise related to the dispute. Understanding these qualifications ensures a fair resolution process that meets both parties' needs.

Essential conditions of an arbitration agreement include mutual consent, well-defined terms of arbitration, and compliance with state laws. The North Carolina Agreement to Arbitrate Disputed Open Account exemplifies the need for both parties to understand their obligations fully. It is important to ensure that neither party feels misled about the agreement's terms. This mutual understanding fosters trust and cooperation.

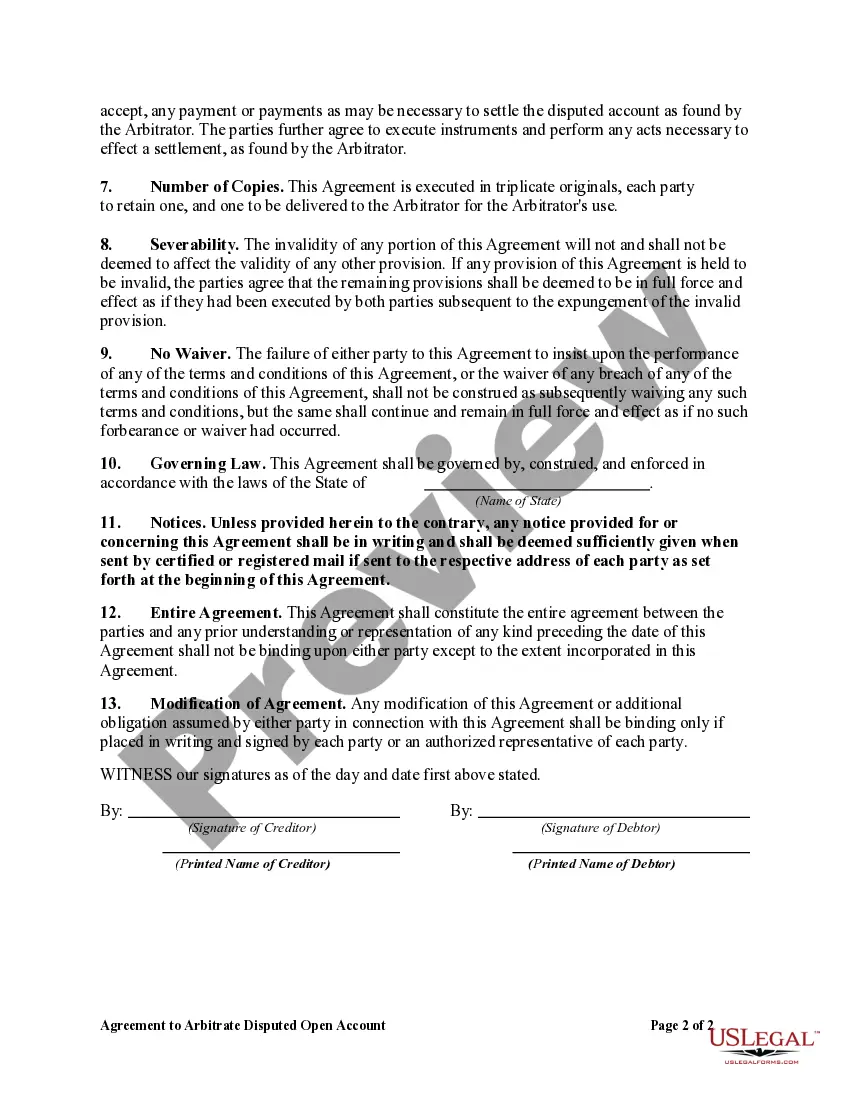

An effective arbitration agreement should include clear identification of the parties involved, a statement of the disputes covered, and the arbitration procedures. In the North Carolina Agreement to Arbitrate Disputed Open Account, also consider specifying the location and governing rules of arbitration. Clarity and detail in these sections lead to smoother arbitration processes. Ensuring that all necessary elements are present is key to avoiding future disputes.

Arbitration is typically required when both parties have agreed to the terms stated in their arbitration agreement. In the context of the North Carolina Agreement to Arbitrate Disputed Open Account, conditions may include disputes arising from contractual relationships or specific disagreements outlined in the agreement. Recognizing these conditions early can be crucial for sound decision-making. It helps avoid unnecessary litigation.

For an arbitration agreement to be valid, it must be clear, mutually accepted, and specific about the disputes covered. In the case of the North Carolina Agreement to Arbitrate Disputed Open Account, clarity on how disputes will be resolved is paramount. The agreement should also detail the arbitration process and any associated rules. Consulting legal resources can help solidify these requirements.

Invoking an arbitration agreement typically involves submitting a written request to the other party, stating your intention to resolve the dispute through arbitration. The North Carolina Agreement to Arbitrate Disputed Open Account will guide the steps you need to take. Ensure you follow any stipulated procedures outlined in the agreement to formalize the invocation. Additionally, you may want to notify an arbitration institution to initiate the process.

Yes, arbitration clauses are enforceable in North Carolina. The courts uphold the North Carolina Agreement to Arbitrate Disputed Open Account, ensuring that parties adhere to the terms outlined in their agreement. This enforcement reflects a commitment to alternative dispute resolution methods, supporting parties in resolving conflicts outside of the courtroom. It is essential to draft these clauses carefully to ensure their enforceability.

In general, bypassing an arbitration agreement is not straightforward. The North Carolina Agreement to Arbitrate Disputed Open Account serves as a binding contract that both parties have agreed to. If a party wishes to contest this agreement, they must provide a compelling legal reason to do so. Additionally, consulting with a legal professional can provide guidance on the available options.

Deciding whether to opt out of an arbitration agreement requires careful thought. While opting out of the North Carolina Agreement to Arbitrate Disputed Open Account may give you more control over your legal rights, it could also lead to higher costs and longer resolution times. Consulting a professional, such as those at uslegalforms, can provide valuable insights to guide your decision.

Some individuals may choose not to agree to arbitration because it often limits their ability to appeal decisions. Furthermore, the North Carolina Agreement to Arbitrate Disputed Open Account might restrict your rights to participate in class actions, which can be crucial for collective claims. Carefully consider these factors and consult a legal expert if need be.