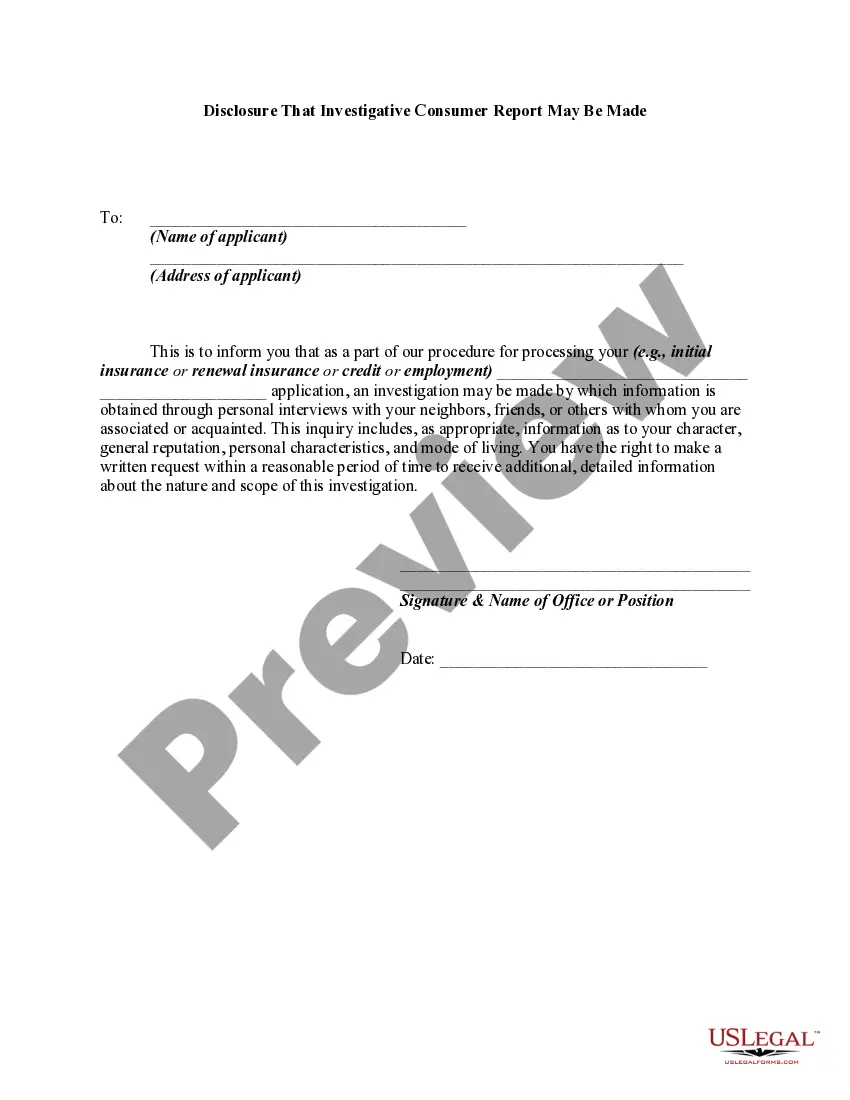

Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

North Carolina Disclosure: Understanding Investigative Consumer Reports In North Carolina, employers and background check agencies are required to follow strict guidelines when performing investigative consumer reports. Individuals applying for jobs or facing background checks are entitled to certain disclosures before these reports are made. This article will provide a detailed description of the North Carolina disclosure that investigative consumer reports may be made, ensuring you know your rights and what to expect. The North Carolina disclosure that an investigative consumer report may be made is a formal notification given to individuals before a background check takes place. This disclosure ensures transparency and allows candidates to understand that their personal information may be collected, investigated, and reported to the employer. Keywords: North Carolina, disclosure, investigative consumer report, background checks, employers, guidelines, personal information. Here are a few key points to consider regarding the North Carolina disclosure: 1. Purpose: The primary purpose of the North Carolina disclosure is to inform individuals that an investigative consumer report may be conducted as part of the employment screening process. It serves as a legal safeguard to prevent unauthorized background checks and protect individuals' privacy rights. 2. Contents: The disclosure typically includes information such as the name of the employer or background check agency intending to conduct the investigation, the nature and scope of the investigation, and the individual's rights under the Fair Credit Reporting Act (FCRA). It may also inform candidates of their right to request a copy of the report and challenge any inaccurate information found. 3. FCRA Compliance: The North Carolina disclosure ensures compliance with the FCRA, a federal law governing the collection, use, and dissemination of consumer information. Employers and background check agencies must adhere to FCRA guidelines to protect applicants' rights and avoid any legal ramifications. 4. Different Types: While the North Carolina disclosure itself may not have specific variations, the type of investigative consumer report being conducted may vary. These reports can delve into an individual's criminal history, credit history, employment verification, educational background, and more. Specific consent may be required for each type of investigation, depending on the nature of the employment position or industry involved. 5. Consent: The North Carolina disclosure must be provided to the individual in writing, and their consent to proceed with the investigative consumer report must be obtained. This ensures that the individual is fully aware and gives explicit permission for their personal information to be gathered and evaluated. Without proper consent, employers or background check agencies may be liable for violating privacy laws. In summary, the North Carolina disclosure that an investigative consumer report may be made is a vital step in the employment screening process. It ensures transparency, protects individuals' privacy rights, and guarantees compliance with the Fair Credit Reporting Act. By being aware of this disclosure and understanding your rights, you can confidently navigate background checks and make informed decisions regarding your personal information. Additional Keywords: NC, consumer reporting agencies, employment screening, background investigation, personal data, privacy rights, legal compliance.North Carolina Disclosure: Understanding Investigative Consumer Reports In North Carolina, employers and background check agencies are required to follow strict guidelines when performing investigative consumer reports. Individuals applying for jobs or facing background checks are entitled to certain disclosures before these reports are made. This article will provide a detailed description of the North Carolina disclosure that investigative consumer reports may be made, ensuring you know your rights and what to expect. The North Carolina disclosure that an investigative consumer report may be made is a formal notification given to individuals before a background check takes place. This disclosure ensures transparency and allows candidates to understand that their personal information may be collected, investigated, and reported to the employer. Keywords: North Carolina, disclosure, investigative consumer report, background checks, employers, guidelines, personal information. Here are a few key points to consider regarding the North Carolina disclosure: 1. Purpose: The primary purpose of the North Carolina disclosure is to inform individuals that an investigative consumer report may be conducted as part of the employment screening process. It serves as a legal safeguard to prevent unauthorized background checks and protect individuals' privacy rights. 2. Contents: The disclosure typically includes information such as the name of the employer or background check agency intending to conduct the investigation, the nature and scope of the investigation, and the individual's rights under the Fair Credit Reporting Act (FCRA). It may also inform candidates of their right to request a copy of the report and challenge any inaccurate information found. 3. FCRA Compliance: The North Carolina disclosure ensures compliance with the FCRA, a federal law governing the collection, use, and dissemination of consumer information. Employers and background check agencies must adhere to FCRA guidelines to protect applicants' rights and avoid any legal ramifications. 4. Different Types: While the North Carolina disclosure itself may not have specific variations, the type of investigative consumer report being conducted may vary. These reports can delve into an individual's criminal history, credit history, employment verification, educational background, and more. Specific consent may be required for each type of investigation, depending on the nature of the employment position or industry involved. 5. Consent: The North Carolina disclosure must be provided to the individual in writing, and their consent to proceed with the investigative consumer report must be obtained. This ensures that the individual is fully aware and gives explicit permission for their personal information to be gathered and evaluated. Without proper consent, employers or background check agencies may be liable for violating privacy laws. In summary, the North Carolina disclosure that an investigative consumer report may be made is a vital step in the employment screening process. It ensures transparency, protects individuals' privacy rights, and guarantees compliance with the Fair Credit Reporting Act. By being aware of this disclosure and understanding your rights, you can confidently navigate background checks and make informed decisions regarding your personal information. Additional Keywords: NC, consumer reporting agencies, employment screening, background investigation, personal data, privacy rights, legal compliance.