The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

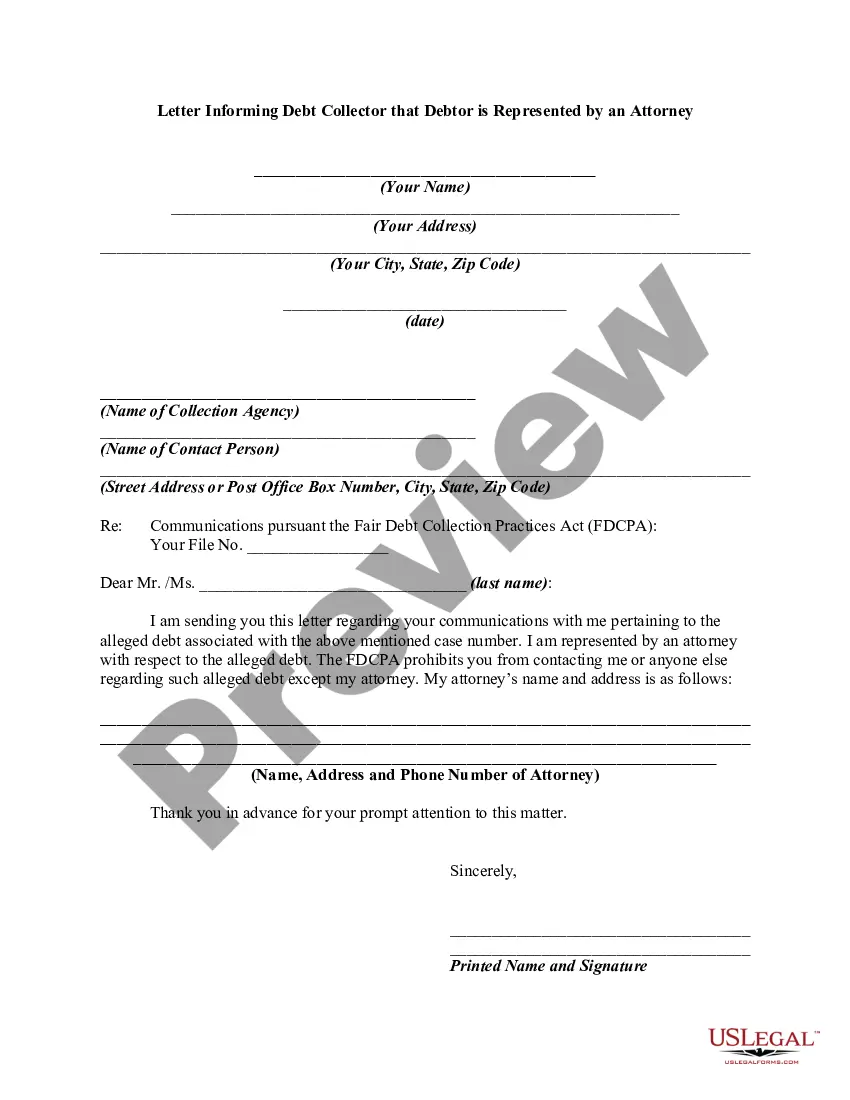

Title: North Carolina Letter Informing Debt Collector of Attorney Representation: Understanding the Process and Types of Letters Introduction: When it comes to debt collection practices, debtors in North Carolina have certain rights and protections. One crucial step to assert those rights is by informing debt collectors that you are represented by an attorney. In this article, we will provide a comprehensive overview of the North Carolina Letter Informing Debt Collector that Debtor is Represented by an Attorney. We will cover the importance of attorney representation, the process of sending such a letter, and highlight the two types of letters commonly used in North Carolina. Keywords: North Carolina, Letter Informing Debt Collector, Debtor, Attorney, Representation, Debt Collection Practices, Rights, Protections, Process, Types. Section 1: Why Attorney Representation Matters in Debt Collection Cases — Debtors in North Carolina have the right to legal representation during debt collection processes. — An attorney can navigate complex legal matters, safeguard debtor rights, negotiate with collectors, and potentially resolve the debt suitably. — Attorney representation provides knowledgeable guidance and can help prevent harassment or unfair practices by debt collectors. — By notifying the collection agency of attorney representation, the debtor establishes a clear boundary and ensures all future communications are directed through their legal representative. Section 2: The Process of Sending a North Carolina Letter Informing Debt Collector of Attorney Representation — To send a letter informing debt collectors about attorney representation, it is crucial to gather relevant details, including the debtor's name, account number, and the creditor's information. — The letter must be drafted on the debtor's behalf by their attorney, customized to address the particular case, and comply with North Carolina laws. — The letter should clearly state the debtor's representation, provide the attorney's contact information, and request that all future communications be directed to the attorney instead. — The letter should be sent via certified mail with a return receipt, ensuring proof of delivery and receipt by the debt collector. Section 3: Types of North Carolina Letters Informing Debt Collectors of Attorney Representation 1. General Letter: This is a standard letter format used to inform debt collectors that the debtor is represented by an attorney. It includes essential details about the debtor's representation, contact information, and a request for all future communications to be directed to the attorney. 2. Cease and Desist Letter: This type of letter goes beyond simply informing the debt collector of attorney representation. It emphasizes the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and demands the creditor to cease all communication attempts except those required by applicable laws or for providing necessary legal information. Conclusion: Sending a North Carolina Letter Informing Debt Collector of Attorney Representation is a crucial step in ensuring debtor rights are protected and legal matters are handled appropriately. By promptly notifying the debt collector in writing and utilizing the proper legal channels, debtors in North Carolina can navigate the debt collection process with the support and guidance of their attorney, while minimizing creditor harassment and securing a fair resolution.Title: North Carolina Letter Informing Debt Collector of Attorney Representation: Understanding the Process and Types of Letters Introduction: When it comes to debt collection practices, debtors in North Carolina have certain rights and protections. One crucial step to assert those rights is by informing debt collectors that you are represented by an attorney. In this article, we will provide a comprehensive overview of the North Carolina Letter Informing Debt Collector that Debtor is Represented by an Attorney. We will cover the importance of attorney representation, the process of sending such a letter, and highlight the two types of letters commonly used in North Carolina. Keywords: North Carolina, Letter Informing Debt Collector, Debtor, Attorney, Representation, Debt Collection Practices, Rights, Protections, Process, Types. Section 1: Why Attorney Representation Matters in Debt Collection Cases — Debtors in North Carolina have the right to legal representation during debt collection processes. — An attorney can navigate complex legal matters, safeguard debtor rights, negotiate with collectors, and potentially resolve the debt suitably. — Attorney representation provides knowledgeable guidance and can help prevent harassment or unfair practices by debt collectors. — By notifying the collection agency of attorney representation, the debtor establishes a clear boundary and ensures all future communications are directed through their legal representative. Section 2: The Process of Sending a North Carolina Letter Informing Debt Collector of Attorney Representation — To send a letter informing debt collectors about attorney representation, it is crucial to gather relevant details, including the debtor's name, account number, and the creditor's information. — The letter must be drafted on the debtor's behalf by their attorney, customized to address the particular case, and comply with North Carolina laws. — The letter should clearly state the debtor's representation, provide the attorney's contact information, and request that all future communications be directed to the attorney instead. — The letter should be sent via certified mail with a return receipt, ensuring proof of delivery and receipt by the debt collector. Section 3: Types of North Carolina Letters Informing Debt Collectors of Attorney Representation 1. General Letter: This is a standard letter format used to inform debt collectors that the debtor is represented by an attorney. It includes essential details about the debtor's representation, contact information, and a request for all future communications to be directed to the attorney. 2. Cease and Desist Letter: This type of letter goes beyond simply informing the debt collector of attorney representation. It emphasizes the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and demands the creditor to cease all communication attempts except those required by applicable laws or for providing necessary legal information. Conclusion: Sending a North Carolina Letter Informing Debt Collector of Attorney Representation is a crucial step in ensuring debtor rights are protected and legal matters are handled appropriately. By promptly notifying the debt collector in writing and utilizing the proper legal channels, debtors in North Carolina can navigate the debt collection process with the support and guidance of their attorney, while minimizing creditor harassment and securing a fair resolution.