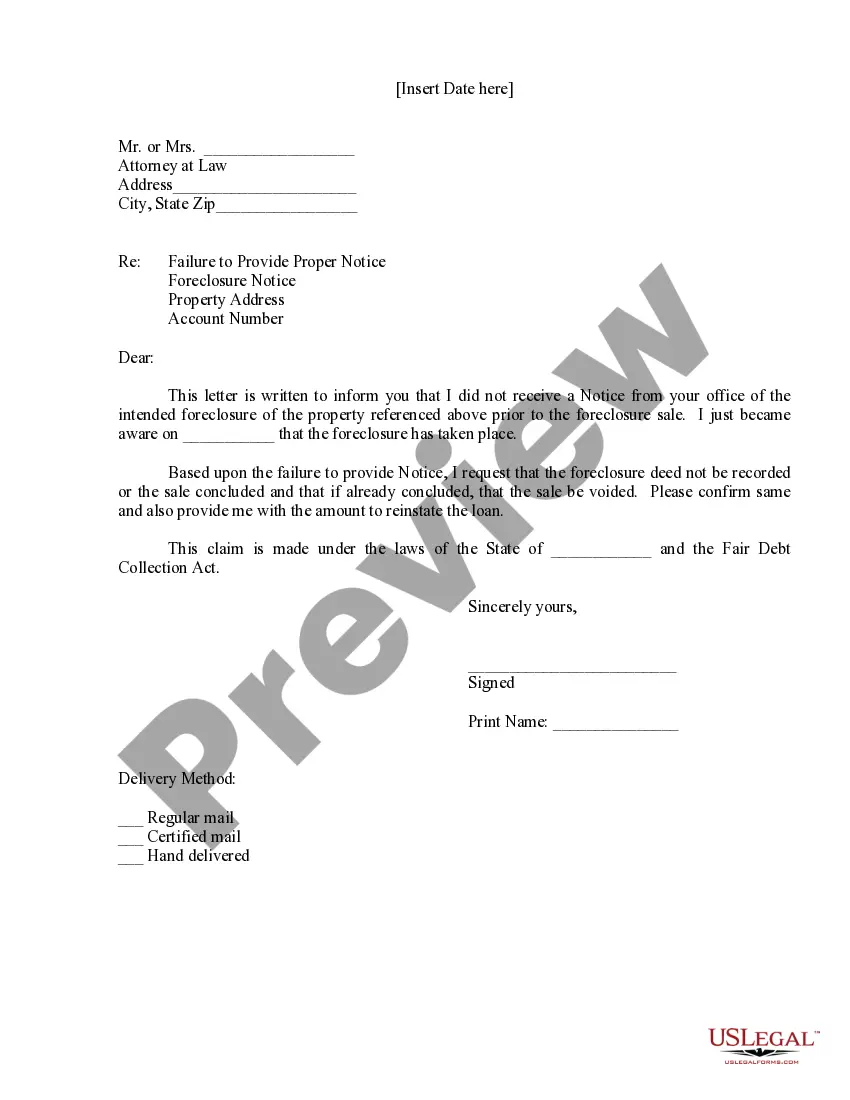

It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

North Carolina Promissory Note - Forgivable Loan

Description

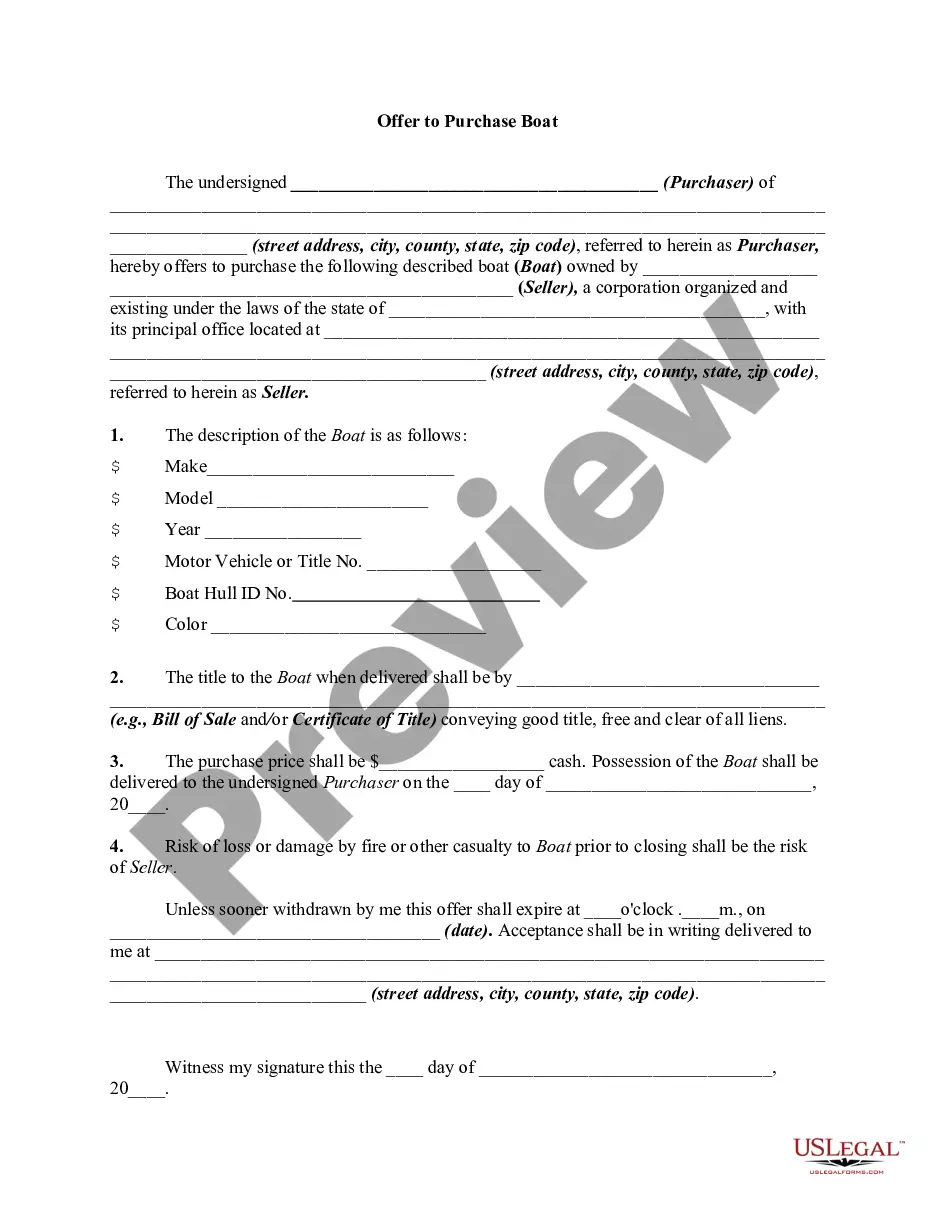

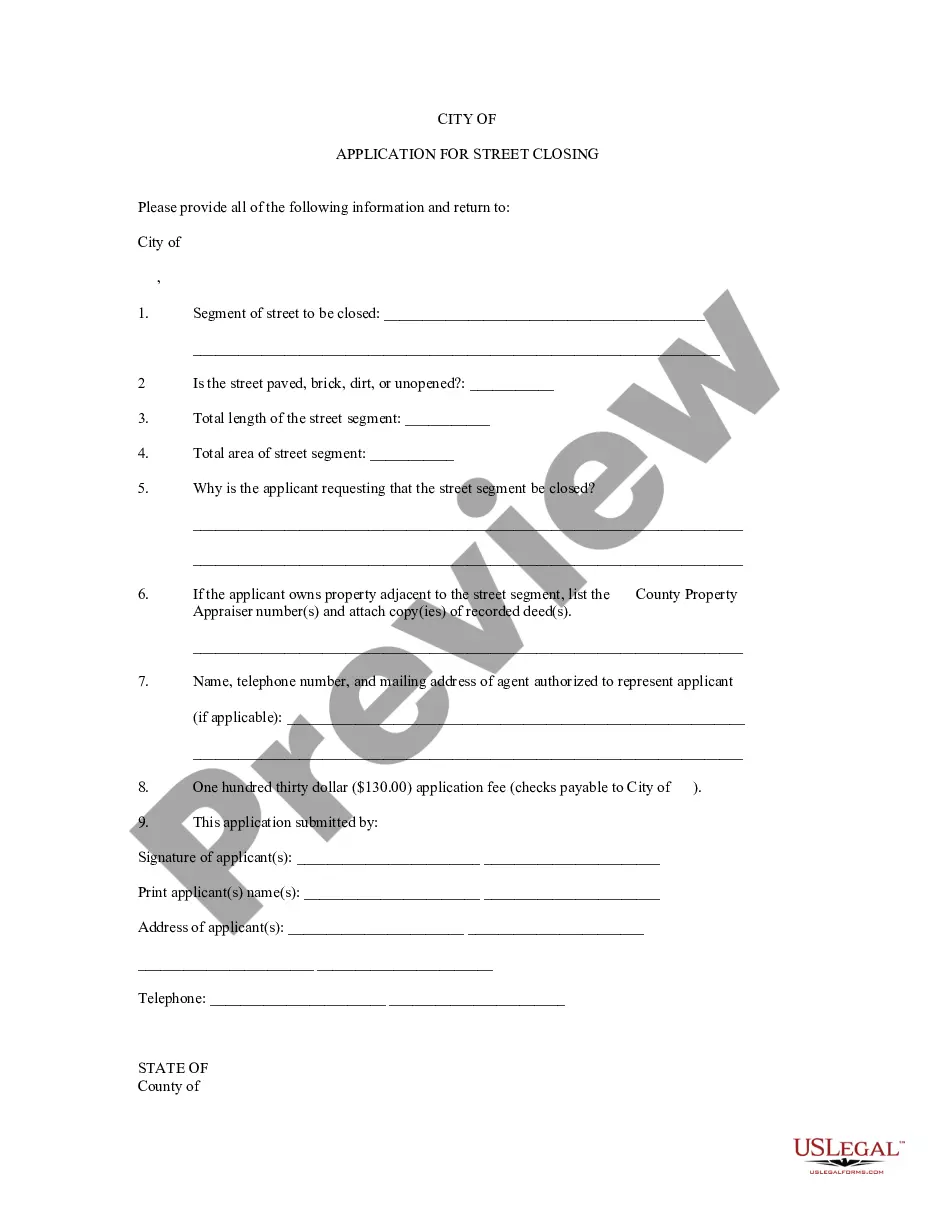

How to fill out Promissory Note - Forgivable Loan?

Finding the appropriate legal document layout can be quite challenging. Naturally, there are numerous templates available on the web, but how do you acquire the legal form you need.

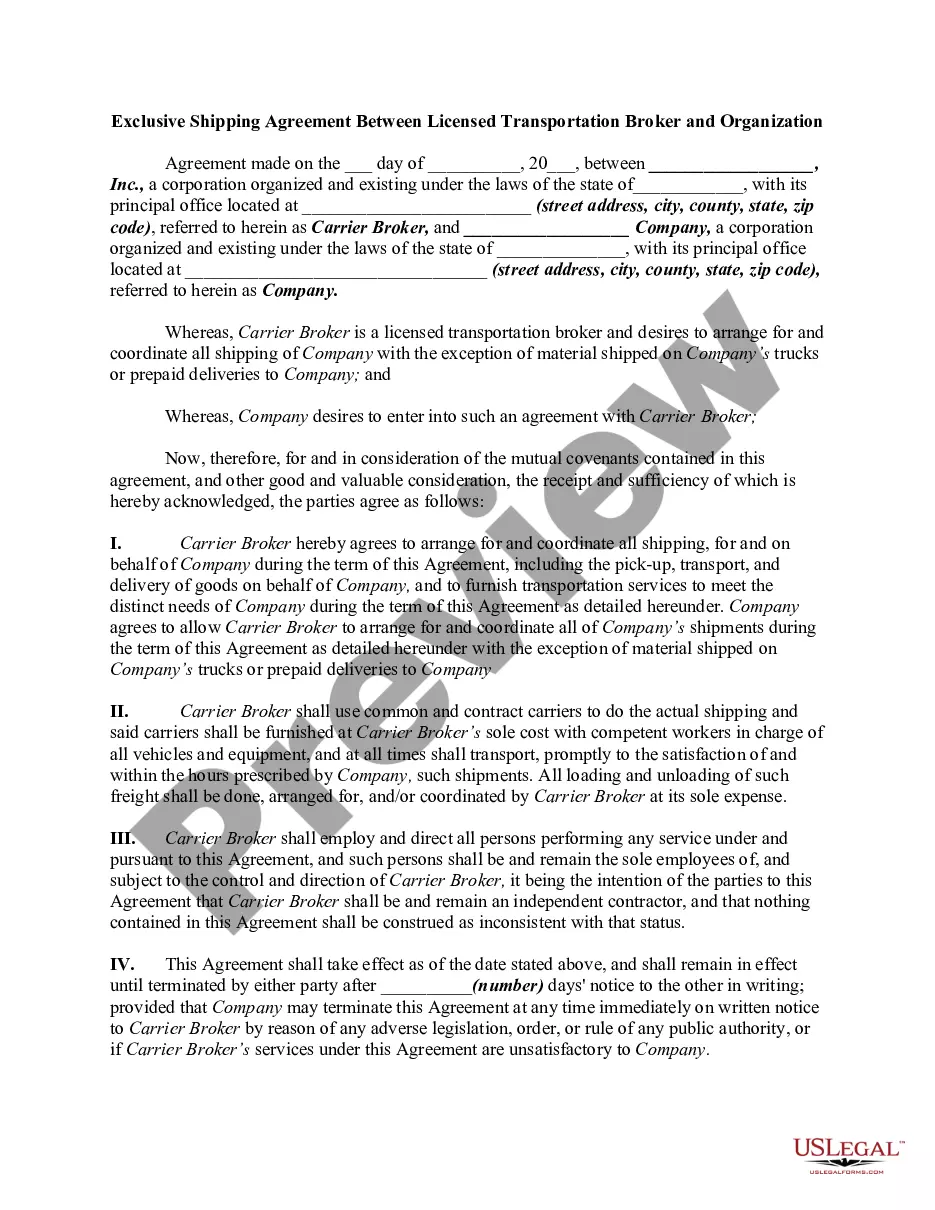

Utilize the US Legal Forms website. The platform offers thousands of templates, including the North Carolina Promissory Note - Forgivable Loan, suitable for both business and personal needs. All forms are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the North Carolina Promissory Note - Forgivable Loan. Use your account to browse the legal forms you have previously purchased. Proceed to the My documents section of your account to obtain another copy of the documents you need.

Finally, complete, revise, and print and sign the obtained North Carolina Promissory Note - Forgivable Loan. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to download expertly crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, make sure you have selected the correct form for your city or region. You can review the form using the Preview button and read the form description to ensure it is right for you.

- If the form does not meet your needs, utilize the Search feature to find the suitable form.

- Once you confirm that the form is correct, click the Buy now button to acquire the form.

- Choose your pricing plan and enter the necessary information. Create your account and make the payment using your PayPal account or credit card.

- Select the file format and download the legal document layout to your device.

Form popularity

FAQ

College Foundation of North Carolina Prior to 2010 when there was a major shift from state-funded loan programs to federal, CFNC made federal loans. While they still manage these loans online, they no longer offer them to new borrowers.

The loan doesn't have to be repaid to the extent it's used to cover the first 24 weeks (eight weeks for those who received their loans before June 5, 2020) of the business's payroll costs, rent, utilities and mortgage interest. However, at least 60% of the forgiven amount must be used for payroll.

Generally, PPP funds can be used for four purposes: payroll, mortgage interest, rent/lease, and utilities. Payroll should be the major use of the loan. The second stimulus bill also introduced four new categories of expenses that are allowed.

Therefore, when the loan is legally forgiven by the lender, the accounting entry would be a debit to a long-term liability account (i.e., PPP Loan Liability) and a credit to income.

How to get PPP loan forgivenessUse it for eligible expenses.Keep your employee headcount upDon't reduce an employee's wages by more than 25%Document everything.Talk with your lender.Apply for loan forgiveness.

Loan forgiveness is described in the FELS Rules. Generally, a loan for one academic year will be forgiven for one year of full-time employment. Loans will accrue interest at the rate of 7% per year from the date of the loan disbursement. Recipients cannot receive FELS funding concurrently with other state-funded loans.

Work full time for a government organization at any level (state, federal, local) or a tax-exempt nonprofit. Make 120 monthly on-time payments (they don't have to be consecutive; payments made during forbearance or in deferment don't count).

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.