North Carolina Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

You can spend multiple hours online searching for the proper legal document template that meets the federal and state requirements necessary for you. US Legal Forms offers numerous legal forms that can be evaluated by experts.

You can effortlessly download or print the North Carolina Private Annuity Agreement from your service.

If you possess a US Legal Forms account, you can Log In and click on the Obtain button. Afterward, you can fill out, modify, print, or sign the North Carolina Private Annuity Agreement. Every legal document template you acquire is yours to keep indefinitely.

Choose the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Select the format of the document and download it to your system. Make changes to your document if possible. You can fill out, modify, sign, and print the North Carolina Private Annuity Agreement. Access and print thousands of document designs using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or individual requirements.

- To get another copy of any purchased document, visit the My documents tab and click on the corresponding button.

- If you're visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure that you have chosen the correct document template for your selected state/area.

- Review the document description to ensure you've selected the right form.

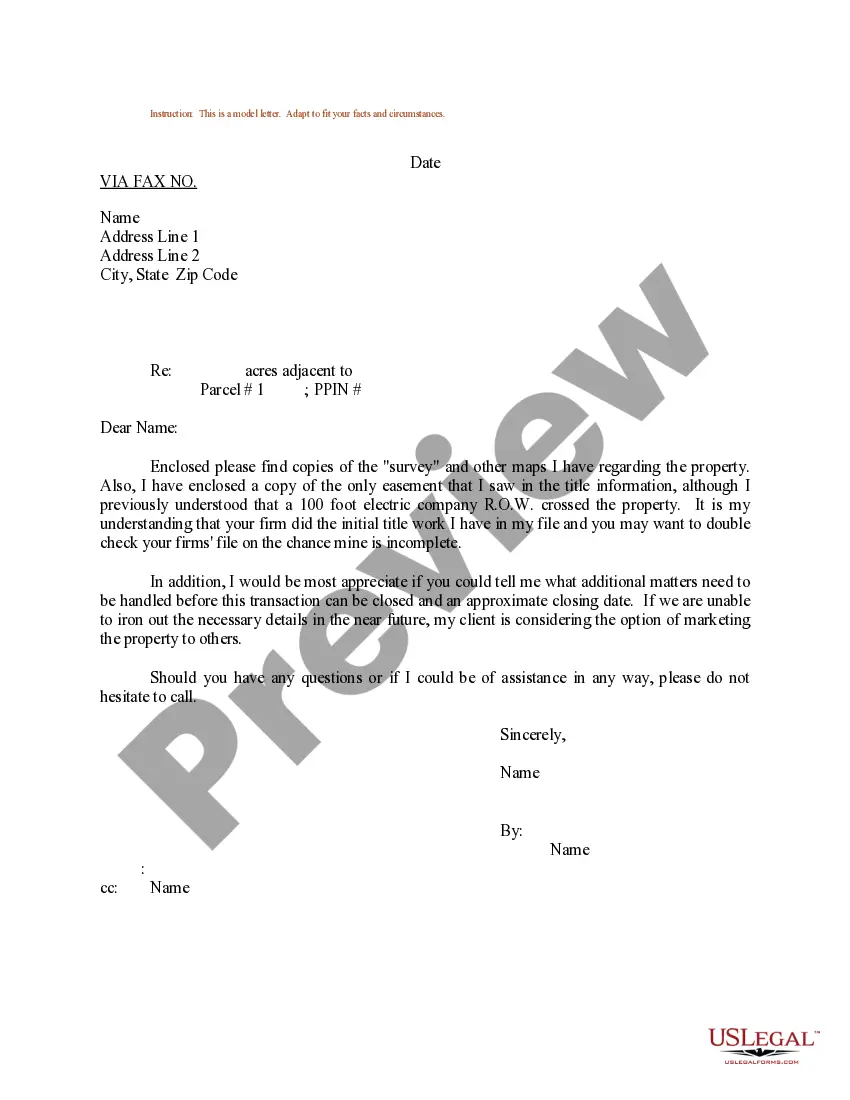

- If available, use the Preview button to view the document template as well.

- If you want to find another version of the form, utilize the Search field to locate the template that suits your needs and specifications.

- Once you’ve found the template you desire, click on Purchase now to proceed.

Form popularity

FAQ

While a private annuity can offer benefits, it also comes with disadvantages. One major downside includes the risk that the payments may end if the seller outlives their expected lifespan. Additionally, since a North Carolina Private Annuity Agreement involves legal complexities, it is essential to consult with professionals, like those at US Legal Forms, to navigate potential issues and ensure a favorable arrangement.

Suze Orman, a well-known financial expert, often emphasizes the importance of understanding annuities. She advises that while annuities can provide a guaranteed income stream, one should thoroughly evaluate the terms before committing. In her discussions about the North Carolina Private Annuity Agreement, she highlights the necessity of seeking professional advice to ensure these agreements align with financial goals.

A private annuity functions by creating a legal agreement between two parties, typically involving a seller and a buyer. The seller transfers an asset, such as real estate, to the buyer, who then makes regular payments to the seller for life. This strategy is often used in North Carolina Private Annuity Agreements to achieve tax benefits and ensure income stability while avoiding probate.

Yes, you can set up your own annuity by creating a North Carolina Private Annuity Agreement. This empowers you to define the terms and conditions uniquely suited to your circumstances. With the right resources and guidance, it's quite feasible to establish an annuity that meets your long-term financial goals. Consider using platforms like US Legal Forms for templates and support, ensuring you adhere to all legal requirements.

Starting a private annuity involves identifying the asset you plan to transfer and creating a North Carolina Private Annuity Agreement. You can begin by consulting with a financial advisor or an attorney experienced in these matters. Once you have a clear understanding of the terms, you can draft the agreement and convey all necessary details to the other party involved. Remember, this step is crucial for ensuring compliance and protecting your interests.

To set up a private annuity, you must first draft a North Carolina Private Annuity Agreement. This document outlines the terms of the annuity, including payment amounts and duration. Next, you should calculate the fair market value of the asset you are transferring. Finally, after both parties agree to the terms and finalize the document, you can execute the agreement.

Filling out NC Form 4P requires understanding the nuances of your financial and tax situation. This form is used to report annuity income and can vary in requirements based on your agreement type. When you utilize a North Carolina Private Annuity Agreement, careful documentation is key to completing NC 4P accurately. Seeking assistance from professionals can enhance accuracy and compliance with state tax laws.

A private annuity agreement is a contract between two parties, where one party makes a lump-sum payment to another in exchange for a series of future payments. This setup can be particularly useful for estate planning, allowing for asset transfer while generating income. By establishing a North Carolina Private Annuity Agreement, families can manage tax implications efficiently. However, legal guidance is recommended to navigate the complexities involved.

Filing an annuity involves reporting the income generated by the annuity on your tax return. You will need to include any taxable amounts reported on Form 1099-R from your annuity provider. If you set up a North Carolina Private Annuity Agreement, be sure to maintain all related paperwork for accurate filing. You may want to consult with a tax professional to ensure you meet all requirements.

Annuities must be reported to the IRS using specific forms, typically through Form 1099-R. When you receive payments from an annuity, the issuer sends this form to both you and the IRS, indicating the distributions made. If you choose to utilize a North Carolina Private Annuity Agreement, ensure you have all necessary documentation filed accurately to avoid any tax issues. Keeping detailed records can simplify this reporting process.