North Carolina Account Stated for Construction Work

Description

How to fill out Account Stated For Construction Work?

Locating the appropriate valid document template can be a challenge.

Obviously, there is a multitude of templates accessible online, but how can you find the valid form you need.

Utilize the US Legal Forms website.

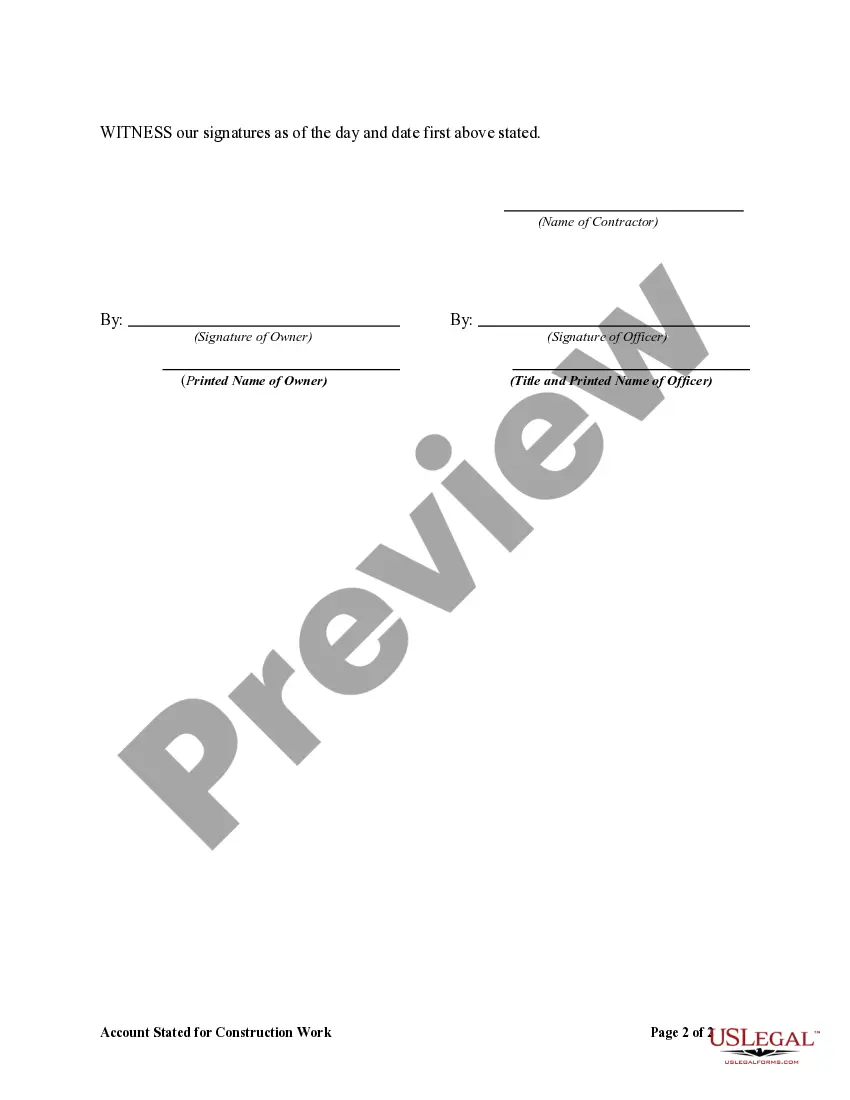

First, ensure you have chosen the correct form for your city/region. You can browse the document using the Review button and examine the form details to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are sure the form is accurate, click the Get now button to obtain the form. Select the pricing plan you desire and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired North Carolina Account Stated for Construction Work. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to obtain properly crafted documents that adhere to state requirements.

- The service offers a vast array of templates, including the North Carolina Account Stated for Construction Work, suitable for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log Into your account and click the Download button to obtain the North Carolina Account Stated for Construction Work.

- Use your account to access the legal forms you may have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

The N.C.G.S. 87-1 defines a general contractor as a person, firm or corporation who manages or oversees construction projects where the cost of the project is $40,000 or greater. The State General Contractors License is not required if a project is under $40,000.

In North Carolina, the statute of limitations for most construction disputes, such as breach of contract or implied warranty of plans, is generally three years from the date when the claimant knows or should know they have a claim.

Retention is an amount of money withheld from a contractor until a job is complete. This normally is 5-10% of the contract's sum. It acts as a kind of security deposit: if defects are left by the contractor that they fail to remedy, the money is rightfully retained by the employer to fix those defects.

Retainage, also called retention, is an amount withheld from the contractor until a later date. It's fairly common, especially on commercial and public construction projects, and typically ranges from 5 - 10% of the total contract price.

A common construction contract usually states that the amount of retention money is 5% of the contract's value or a 10% deduction for every progress payment you receive. You should see this amount of retention money in your payment invoice.

Does North Carolina limit the amount of retainage that can be withheld? Retainage is limited to 5% of each progress payment until 50% completion of the project. Upon 50% completion, retainage will not be withheld from any subsequent payments.

If the owner retains funds, the amount retained shall not exceed two and one-half times the estimated value of the work to be completed or corrected. Any reduction in the amount of the retainage on payments shall be with the consent of the contractor's surety.

A: There is no limit by law, but it should be a negotiated sum between the homeowner and contractor. Generally, deposits should be limited to around 10% of the contract price, but this also depends on the remaining pay schedule. Contractors typically ask for deposits for material costs.