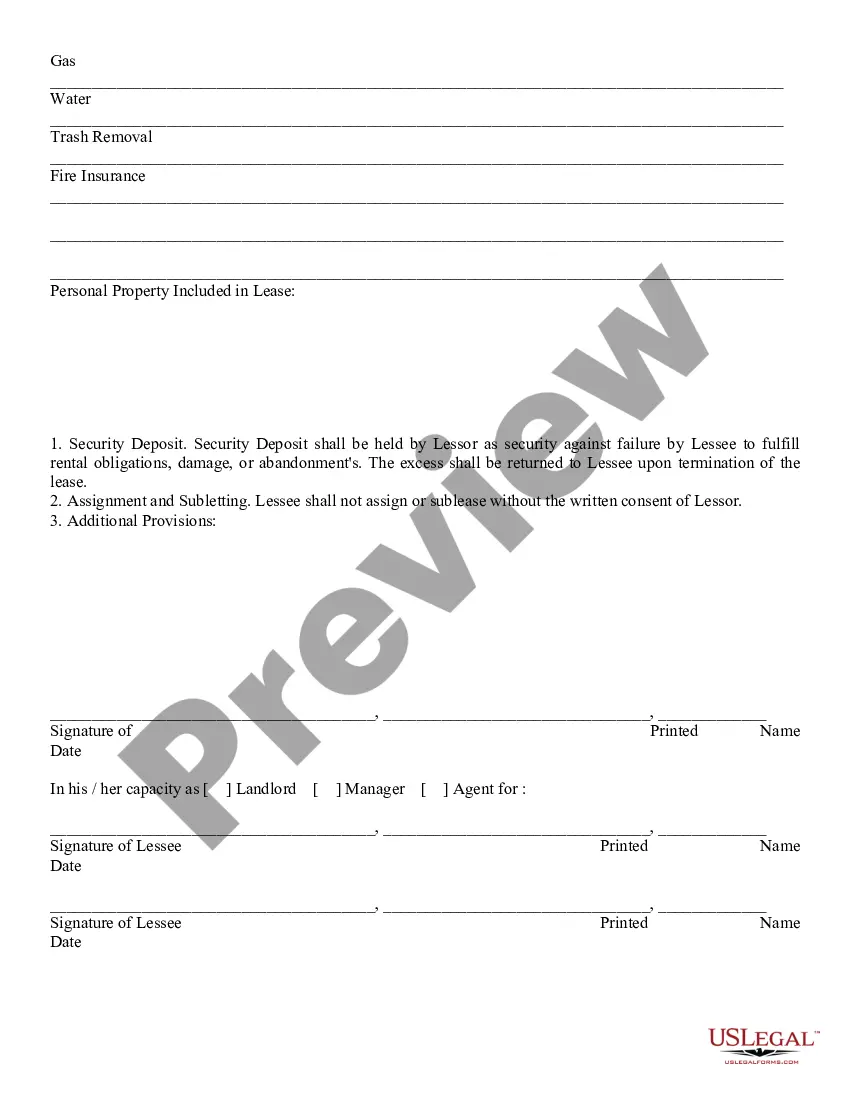

North Carolina Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

It is feasible to spend numerous hours online searching for the legal document template that complies with the state and federal standards you require.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can easily obtain or print the North Carolina Nonresidential Simple Lease from their platform.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Get button.

- After that, you can complete, modify, print, or sign the North Carolina Nonresidential Simple Lease.

- Each legal document template you obtain belongs to you indefinitely.

- To acquire another copy of a purchased form, navigate to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town you choose.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Typically, being on a lease means you have a legal agreement with the landlord regarding that property, regardless of your physical presence. However, not living there might have implications for your rights or responsibilities, especially if you are not fulfilling terms tied to occupancy. If you have questions about your situation under a North Carolina Nonresidential Simple Lease, seeking guidance from experts can help you clarify any doubts.

Yes, it's generally advisable to inform your landlord if someone will be moving in with you, including a girlfriend or boyfriend. Many lease agreements have clauses regarding additional occupants. Being upfront with your landlord helps maintain a good relationship and ensures your arrangement is in compliance with a North Carolina Nonresidential Simple Lease.

Non-residential real property refers to any property not used for residential purposes. Examples include commercial buildings, warehouses, and retail spaces. In essence, anything that's aimed at business activities falls under this category. If you're looking to engage in such activities under a North Carolina Nonresidential Simple Lease, understanding these properties will be crucial.

In North Carolina, a guest can be considered a tenant after residing in the property for a certain period and establishing a pattern of living there. This duration is typically around 30 days, but exact rules can vary based on the situation and lease terms. It's important to be cautious, as this may grant them rights to the property under North Carolina law. Understanding your rights under a North Carolina Nonresidential Simple Lease can clarify these ambiguities.

In North Carolina, you typically have the right to ask a roommate who is not on the lease to leave. This can involve communicating your request clearly and asserting your rights as the primary leaseholder. However, be sure to follow proper procedures to avoid potential legal complications. For further assistance with your specific situation related to a North Carolina Nonresidential Simple Lease, legal resources can help.

Yes, someone can live with you without being on the lease in North Carolina, but it is important to consult your lease agreement first. Many landlords have specific rules regarding guests and additional occupants. If you're unsure, you may want to contact your landlord to avoid any possible issues down the road, especially related to a North Carolina Nonresidential Simple Lease.

In most cases, you can have someone live with you even if they are not on the lease. However, this depends on your landlord's policies. It's best to check your lease agreement to see if it allows additional occupants. If you wish to clarify what is permissible under a North Carolina Nonresidential Simple Lease, consider consulting with a legal expert.

Living somewhere without being on the lease is not inherently illegal, but it may lead to complications. Landlords can enforce rules about who may reside in their properties. It's best to seek permission from your landlord to avoid issues. A North Carolina Nonresidential Simple Lease can help clarify who is authorized to live in the premises.

In North Carolina, a lease does not have to be in writing if it is for less than three years. However, having a written agreement is highly recommended as it provides a clear record of terms and conditions. A North Carolina Nonresidential Simple Lease can create a reliable framework for your agreement, minimizing potential disputes.

If your husband is not on the lease, you may have more options to address the situation; however, it's advisable to approach it carefully. Legal rights can vary based on your living situation and state laws. Consult legal counsel to ensure you understand your rights. A North Carolina Nonresidential Simple Lease can clarify rules about occupants and their rights.