North Carolina Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

You can spend several hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been assessed by professionals.

You can easily download or print the North Carolina Security Agreement regarding Sale of Collateral by Debtor from my service.

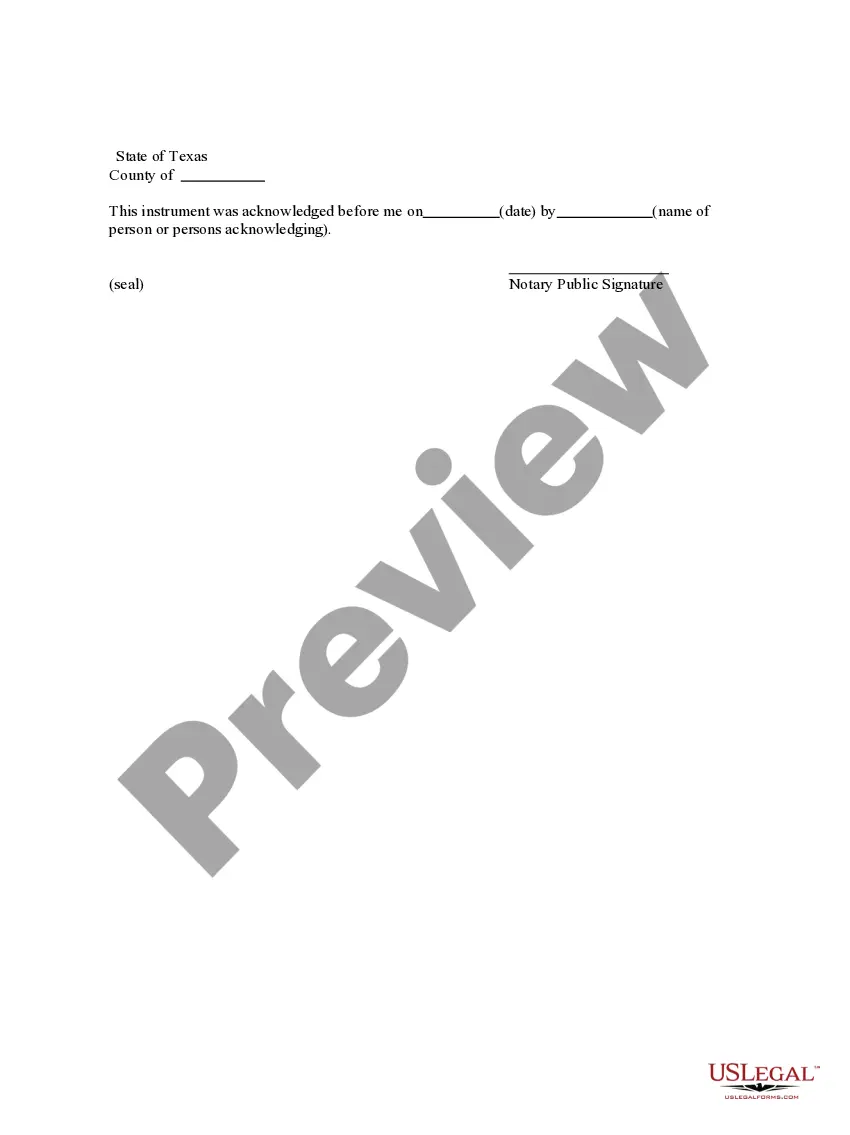

First, ensure that you have selected the correct document template for the state/city you choose. Review the form information to confirm you have selected the right form. If available, use the Review button to examine the document template as well.

- If you have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the North Carolina Security Agreement regarding Sale of Collateral by Debtor.

- Every legal document template you acquire is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, the debtor maintains certain rights in the collateral, even under a North Carolina Security Agreement involving Sale of Collateral by Debtor. These rights typically include the ability to use the collateral for its intended purpose. However, it’s crucial to understand that these rights are subject to the lender’s interests, which means that the debtor must adhere to the terms of the security agreement to avoid any potential disputes.

When collateral is sold, the rights of the secured party may change, depending on the terms of the North Carolina Security Agreement involving Sale of Collateral by Debtor. Generally, the debtor must use the sale proceeds to satisfy their obligations under the agreement. If not handled properly, the debtor risks losing both the collateral and potential claims for damages.

Yes, security agreements can be recorded, but the specifics depend on the type of collateral. In the context of a North Carolina Security Agreement involving Sale of Collateral by Debtor, registering your agreement ensures that your rights are legally acknowledged. Recording helps protect your interests and provides notice to others about your claim on the collateral.

A collateral security interest remains protected for a specific time even if the collateral moves between states. Typically, if your North Carolina Security Agreement involving Sale of Collateral by Debtor is properly perfected, you can retain your security interest for four months after the collateral’s relocation. After that period, you may need to perfect your interest again in the new state to ensure continued protection.

A UCC security agreement is a document that grants a secured party rights to specific collateral in the event the debtor defaults on their obligations. In the context of a North Carolina Security Agreement involving Sale of Collateral by Debtor, this agreement must comply with UCC regulations to be enforceable. Using platforms like uslegalforms can assist in creating a compliant UCC security agreement tailored to your needs.

A security agreement is a contract that establishes a security interest in specific collateral, while a lien is a legal right to keep possession of property until a debt owed by another party is discharged. In a North Carolina Security Agreement involving Sale of Collateral by Debtor, the security agreement provides the framework for the lien. Understanding these differences helps in structuring your agreements appropriately.

The Article 9 process pertains to the regulation of secured transactions under the Uniform Commercial Code (UCC). It outlines how security interests are created, perfected, and enforced, which is crucial in a North Carolina Security Agreement involving Sale of Collateral by Debtor. Familiarizing yourself with this process will help you navigate legal requirements and effectively manage your collateral.

Collateral enforceability refers to the legal ability of a secured party to claim collateral if a debtor defaults on their obligations. In a North Carolina Security Agreement involving Sale of Collateral by Debtor, enforceability hinges on proper documentation and adherence to state laws. Understanding how to define and secure your collateral enhances your position and reduces risks.

A security interest becomes enforceable when the debtor has rights in the collateral and when the secured party has taken necessary steps to perfect that interest. In the context of a North Carolina Security Agreement involving Sale of Collateral by Debtor, this usually includes filing a financing statement with the Secretary of State. Ensuring your security agreement meets these requirements is vital for protecting your rights.

An example of collateral security might include a company’s inventory used to secure a line of credit. In a North Carolina Security Agreement involving Sale of Collateral by Debtor, businesses often pledge assets like equipment or accounts receivable to secure financing. This practice enhances trust between lenders and borrowers, facilitating smoother transactions.