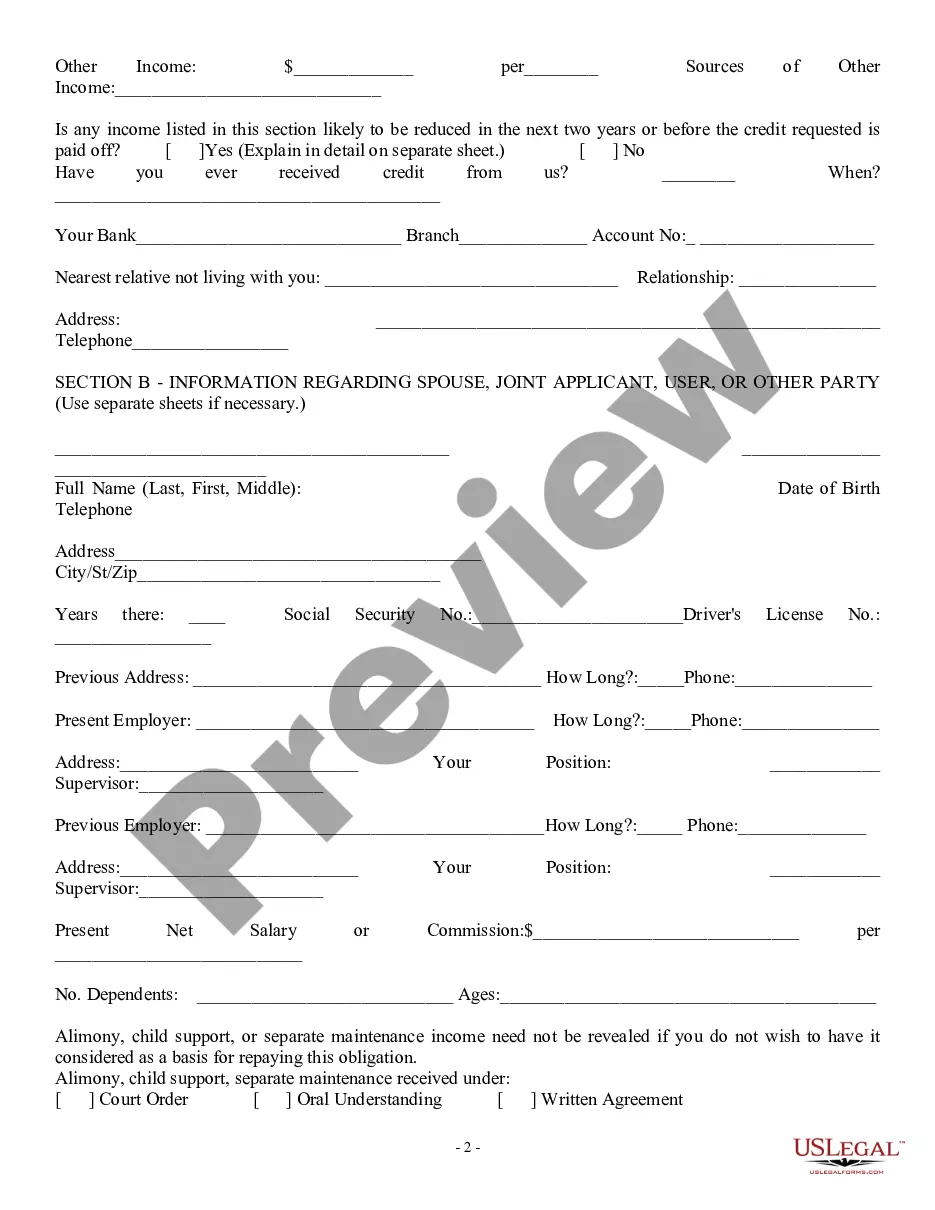

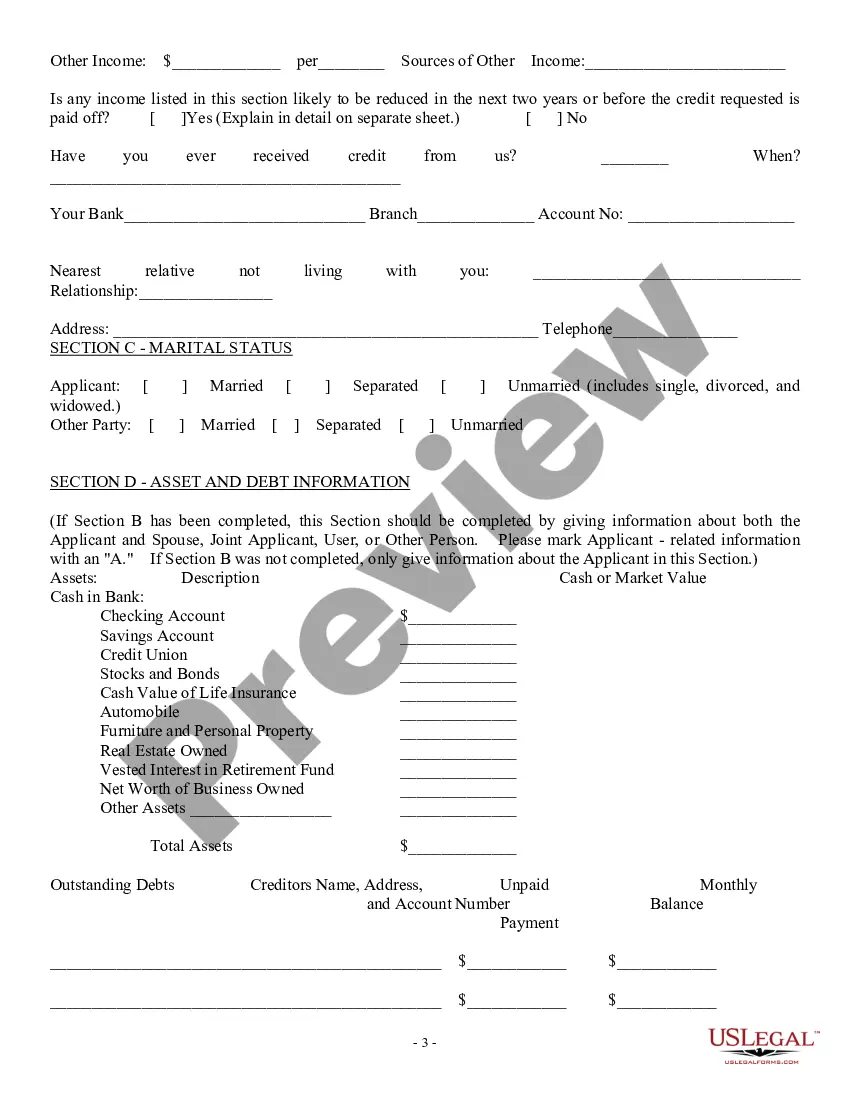

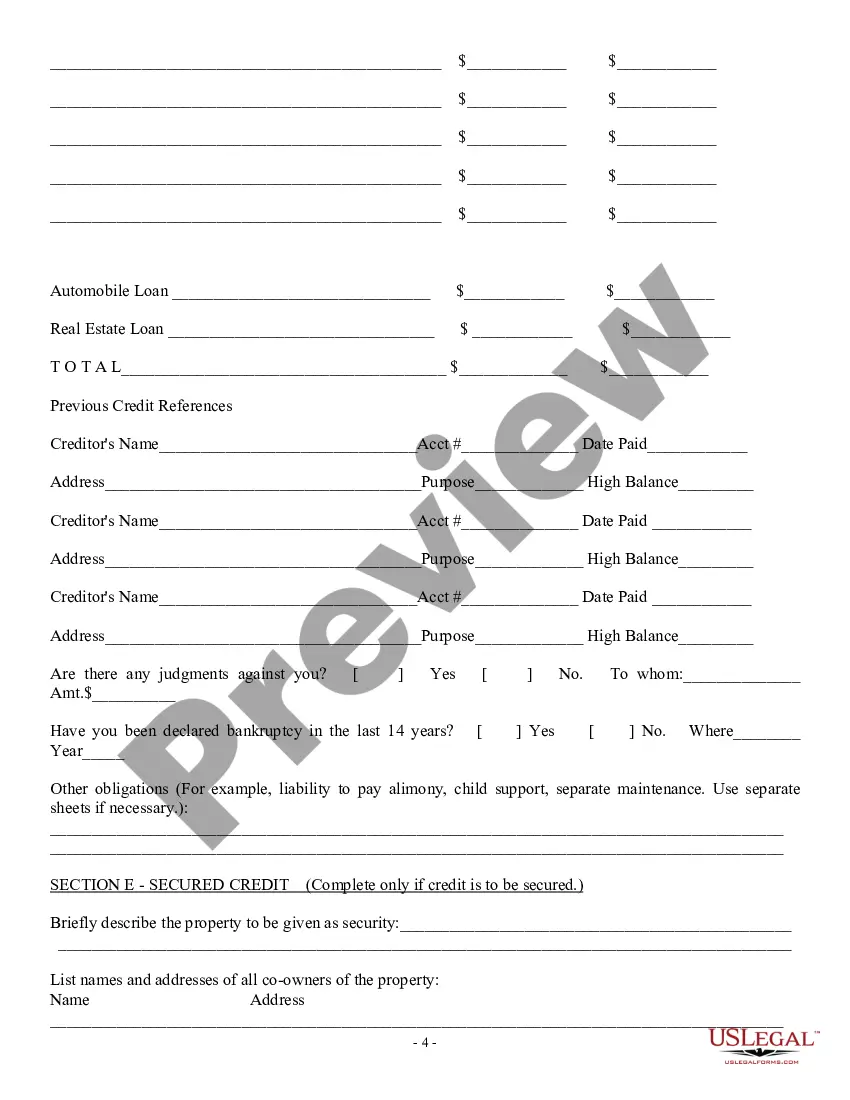

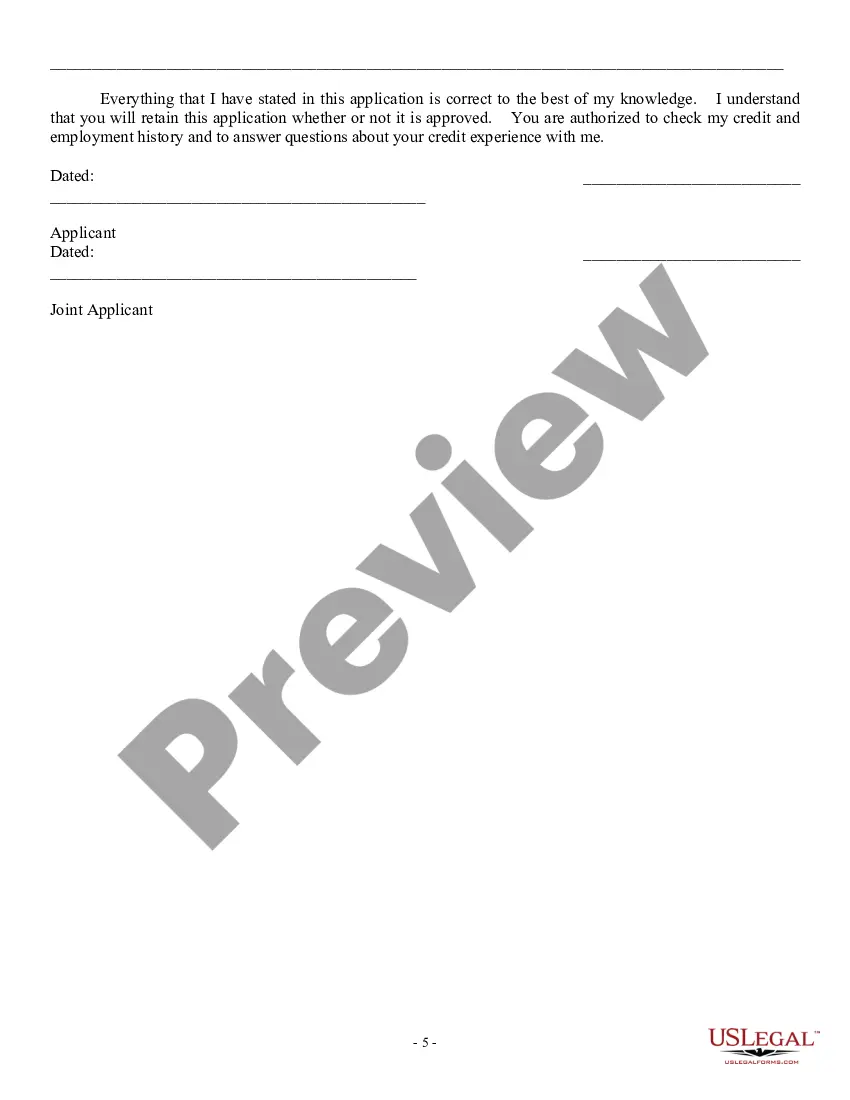

North Carolina Consumer Loan Application — Personal Loan Agreement is a legal document used by individuals in North Carolina when applying for a personal loan. This agreement outlines the terms and conditions for borrowing money and serves as a binding contract between the borrower and the lender. The North Carolina Consumer Loan Application — Personal Loan Agreement includes various sections such as: 1. Personal Information: This section requires the borrower to provide their personal details, including full name, address, contact information, employment status, and monthly income. The lender uses this information to assess the borrower's financial stability. 2. Loan Amount and Interest Rate: Here, the borrower needs to specify the desired loan amount and the agreed-upon interest rate. This section also includes details about any additional fees or charges associated with the loan. 3. Repayment Terms: This section outlines the agreed-upon repayment plan, including the number of installments, the amount of each payment, and the due dates. It may also mention late payment penalties or prepayment options. 4. Collateral: If the loan is secured, the borrower must provide details about the collateral being used, such as a house, car, or other valuable assets. This section highlights the consequences of defaulting on the loan and potential repossession of the collateral. 5. Conditions and Obligations: This part lists additional obligations, such as maintaining proper insurance coverage on the collateral, notifying the lender of address changes, or providing updated financial information if requested. 6. Signatures and Notarization: The agreement requires the borrower's and lender's signatures to indicate their understanding and acceptance of the terms. It may also need to be notarized to make it legally valid and enforceable. It is essential to note that North Carolina law regulates consumer loans, so the terms and conditions outlined in this agreement must comply with the state's specific regulations. Some common types of personal loan agreements in North Carolina include: 1. Fixed-Rate Personal Loan Agreement: This type of agreement specifies a fixed interest rate that remains unchanged throughout the loan term, providing borrowers with predictable monthly payments. 2. Variable-Rate Personal Loan Agreement: In this agreement, the interest rate fluctuates over time, often tied to a specific benchmark rate. Borrowers should be aware that their interest payments might increase or decrease depending on market conditions. 3. Secured Personal Loan Agreement: This agreement requires the borrower to pledge collateral against the loan amount. Collateral serves as security for the lender and provides a lower interest rate compared to unsecured loans. 4. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured personal loan agreements do not require collateral. As a result, they typically have higher interest rates to compensate for the increased lending risk. By using the North Carolina Consumer Loan Application — Personal Loan Agreement, borrowers and lenders ensure transparency, protect their rights, and establish a legally binding agreement that governs their financial relationship.

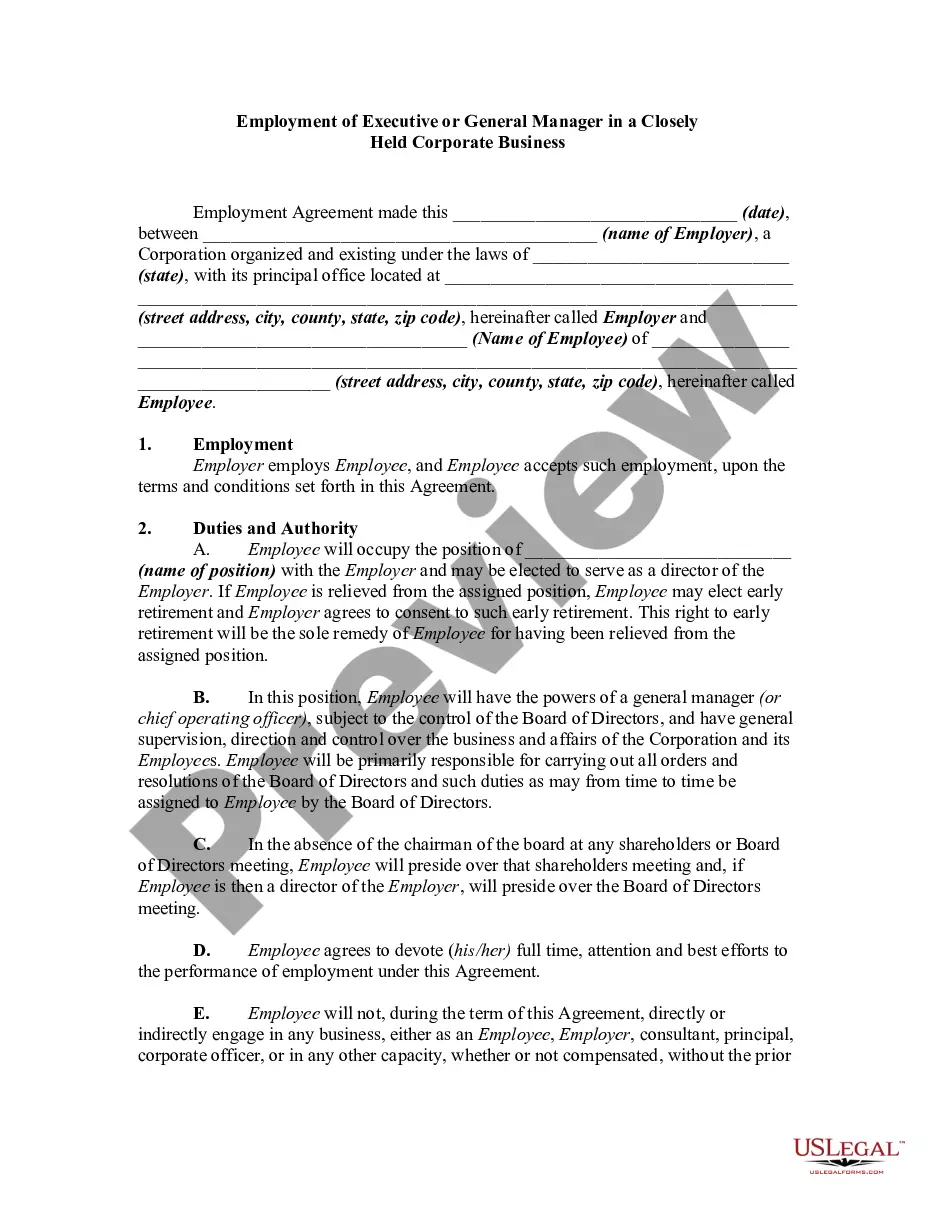

North Carolina Consumer Loan Application - Personal Loan Agreement

Description

How to fill out North Carolina Consumer Loan Application - Personal Loan Agreement?

Discovering the right authorized record template could be a battle. Obviously, there are a variety of layouts available on the Internet, but how can you find the authorized form you require? Take advantage of the US Legal Forms website. The support provides thousands of layouts, including the North Carolina Consumer Loan Application - Personal Loan Agreement, that can be used for organization and personal needs. Every one of the kinds are checked out by experts and meet state and federal requirements.

In case you are presently registered, log in to your accounts and click on the Obtain option to get the North Carolina Consumer Loan Application - Personal Loan Agreement. Utilize your accounts to appear from the authorized kinds you possess ordered in the past. Go to the My Forms tab of your accounts and acquire another version of your record you require.

In case you are a brand new user of US Legal Forms, here are easy guidelines that you can adhere to:

- First, make certain you have chosen the appropriate form for your personal metropolis/region. You may look through the shape utilizing the Review option and read the shape explanation to make certain this is basically the right one for you.

- When the form is not going to meet your requirements, use the Seach field to find the appropriate form.

- Once you are certain the shape is suitable, select the Acquire now option to get the form.

- Select the pricing strategy you want and enter in the needed info. Design your accounts and pay for your order making use of your PayPal accounts or charge card.

- Choose the data file formatting and download the authorized record template to your system.

- Total, edit and produce and signal the attained North Carolina Consumer Loan Application - Personal Loan Agreement.

US Legal Forms is definitely the greatest library of authorized kinds where you can find numerous record layouts. Take advantage of the company to download expertly-manufactured documents that adhere to status requirements.

Form popularity

FAQ

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Consumer installment loans, including car loans, student loans, and home mortgage loans, are examples of consumer loans. Other examples of consumer loans include certain revolving credit products, such as consumer credit cards and personal lines of credit.

Lenders offer two types of consumer loans ? secured and unsecured ? that are based on the amount of risk both parties are willing to take.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Consumer loans are structured in one of two key ways: either as a fixed loan that is repaid over a set period of time or as a revolving credit account that you can use at your own discretion. Closed loans are structured with a fixed interest rate, monthly payment amount, and repayment term.