North Carolina Business Credit Application

Description

How to fill out Business Credit Application?

Selecting the appropriate lawful document format can be quite challenging. Naturally, there are numerous templates accessible online, but how can you locate the proper form you need? Utilize the US Legal Forms website. The service offers a vast number of templates, such as the North Carolina Business Credit Application, which you can use for both business and personal needs. All of the forms are reviewed by experts and adhere to state and federal regulations.

If you are currently registered, Log In to your account and click the Obtain button to retrieve the North Carolina Business Credit Application. Use your account to browse the legal forms you may have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm this is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain the form is accurate, click the Get now button to acquire the form. Choose the payment plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the retrieved North Carolina Business Credit Application.

Take advantage of this resource to simplify your document preparation needs.

- US Legal Forms is the largest collection of legal forms where you can find numerous document templates.

- Utilize the service to download professionally crafted documents that comply with state requirements.

- Ensure you have the right document for your needs.

- Review the form and its details thoroughly.

- Use the search function for finding specific forms.

- Complete your purchase securely online.

Form popularity

FAQ

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

To qualify for a business line of credit, you will typically need to have at least a year in business, a 600+ FICO score, and a minimum of $120,000 in annual revenue. Collateral may also be required, but this requirement depends on the lender you're doing business with and your business's financial information.

The credit application (Application) is the. initial document used by Vendors to collect. information and establish contractual terms. with the Applicant. Some vendor/customer.

Eight steps to establishing your business credit Incorporate your business. ... Obtain an EIN. ... Open a business bank account. ... Establish a business phone number. ... Open a business credit file. ... Obtain business credit card(s) ... Establish a line of credit with vendors or suppliers. ... Pay your bills on time.

The amended Consumer Finance Act now applies to persons making consumer loans of $25,000 or less with APR that exceeds North Carolina's statutory 16% usury limit. Prior to October 1, the law applied only to loans of $15,000 or less with APR exceeding 16%.

Here's what you need to apply for a business credit card: Business name, address and phone number. Annual revenue, number of employees and years in business. Type of business, industry and legal structure. Estimated monthly spending. Employer identification number (EIN) if you have one.

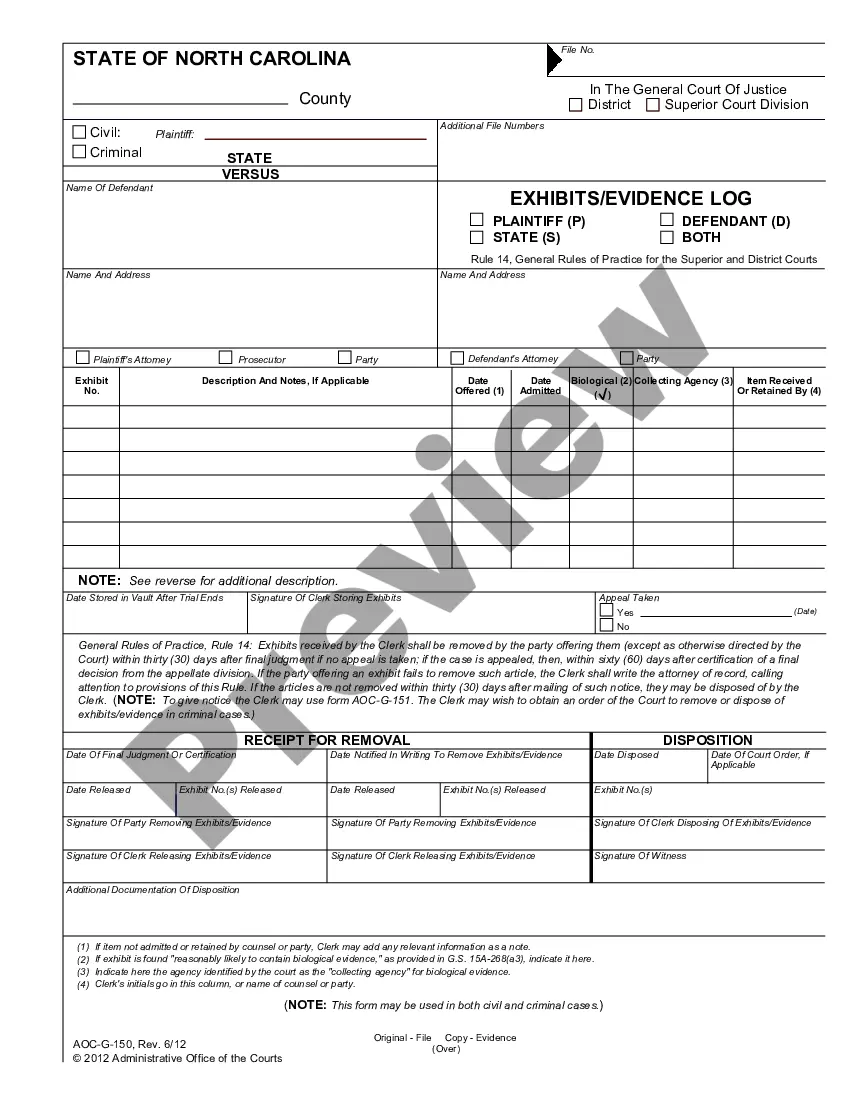

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip Or through many businesses that accept credit arrangements. The first step in completing the form isMoreOr through many businesses that accept credit arrangements. The first step in completing the form is to enter the destination. Contact. Information which in this case is EXFO.