North Carolina Withdrawal of Partner refers to the legal process by which a partner leaves or withdraws from a partnership in the state of North Carolina. This action can have significant implications for both the withdrawing partner and the remaining partners involved in the business. The withdrawal typically requires adherence to specific legal procedures and may vary depending on the type of partnership. There are two main types of partnerships in North Carolina: general partnerships and limited partnerships. 1. General Partnership Withdrawal: A general partnership is formed when two or more individuals unite to carry out a business activity for profit. In this type of partnership, each partner is considered personally liable for the debts and obligations of the business. When a partner decides to withdraw, they must follow certain procedures outlined by the North Carolina General Statutes (Chapter 59). The withdrawal might necessitate revising the partnership agreement or dissolving the partnership altogether, depending on the circumstances. 2. Limited Partnership Withdrawal: A limited partnership is formed when one or more general partners manage the business's operations and assume personal liability, while one or more limited partners contribute capital but have limited liability. Limited partners are typically passive investors who do not engage in day-to-day business operations. If a limited partner wishes to withdraw, they must refer to the partnership agreement to understand the specific terms and conditions governing withdrawal. Regardless of the type of partnership, the withdrawal of a partner generally involves several steps: 1. Notification: The withdrawing partner must provide written notice of their intention to withdraw to the other partners. This notice should include relevant details such as the effective date of withdrawal and the reason for the withdrawal. 2. Revising or Dissolving the Partnership Agreement: Depending on the partnership agreement, the withdrawal may require amending the partnership agreement to reflect the partner's departure or dissolve the entire partnership. This process typically involves obtaining unanimous consent from the remaining partners. 3. Valuation of the Partner's Interest: If the withdrawing partner holds a financial interest in the partnership, the process usually involves assessing the value of their interest. The partnership agreement or state laws may outline the method for valuation, such as using an appraiser or following predetermined formulas. 4. Distribution of Assets or Liabilities: After valuing the partner's interest, the partnership must distribute or allocate the assets and liabilities accordingly. This may involve redistributing ownership shares, transferring assets, or assuming the withdrawing partner's share of liabilities. 5. Legal Filings: In certain cases, legal filings may be required to formalize the withdrawal, such as updating the partnership's registration with the North Carolina Secretary of State or filing dissolution documents if applicable. It is important to consult with an attorney specializing in business and partnership law to ensure compliance with all legal requirements and to protect the rights and interests of all parties involved in the North Carolina Withdrawal of Partner process.

North Carolina Withdrawal of Partner

Description

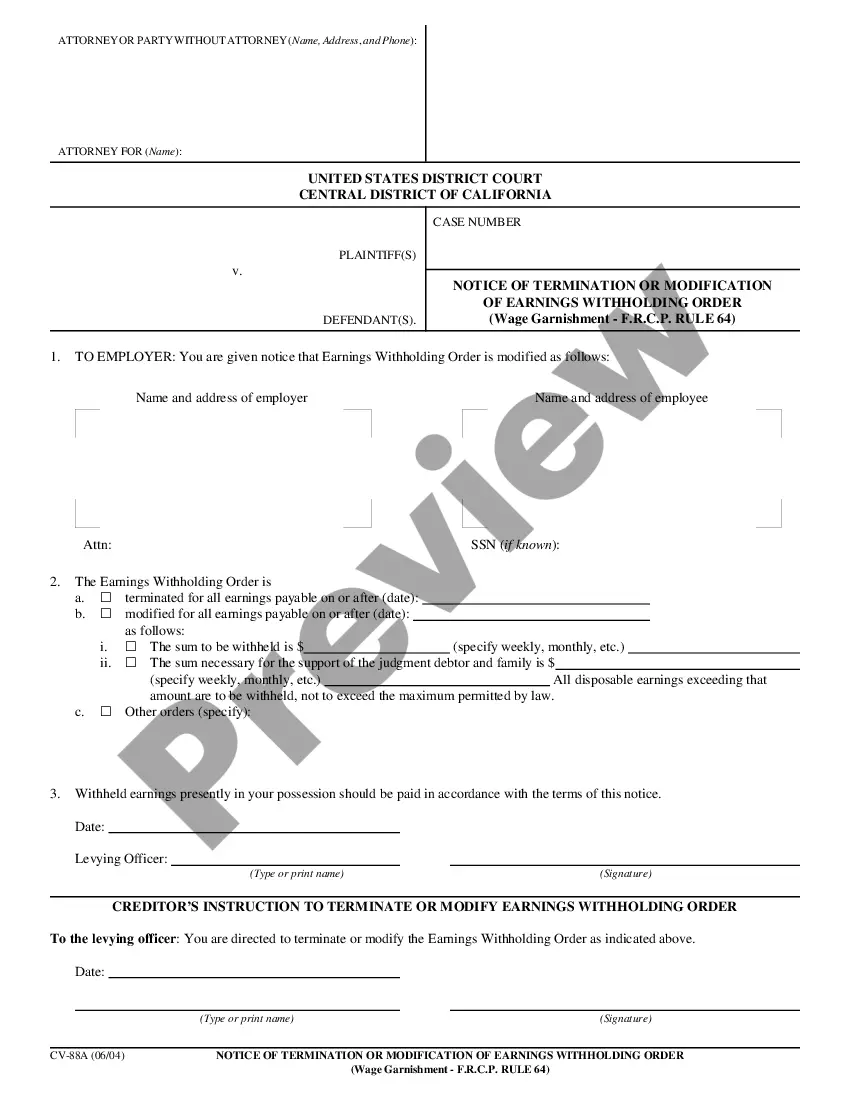

How to fill out North Carolina Withdrawal Of Partner?

You can spend hours online searching for the authentic document template that meets your state and federal requirements.

US Legal Forms offers thousands of authentic forms that are reviewed by experts.

You can easily acquire or print the North Carolina Withdrawal of Partner from our service.

If you wish to find another version of the form, use the Search field to locate the template that suits your requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Next, you can complete, modify, print, or sign the North Carolina Withdrawal of Partner.

- Every authentic document template you purchase is yours for a lifetime.

- To get another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the proper document template for the state/town of your choice.

- Review the form outline to confirm you have selected the correct document.

Form popularity

FAQ

When a partner withdraws from a partnership in North Carolina, it can affect the operation and structure of the business. The remaining partners may have to assess the partnership agreement to determine the next steps, including how to handle the withdrawing partner's financial interest. Often, the partnership must settle any outstanding debts and distributions. For a smooth transition, consider using the US Legal Forms platform, which provides resources for navigating the North Carolina Withdrawal of Partner process effectively.

A partner may withdraw from a partnership in North Carolina at any time that adheres to the provisions outlined in the partnership agreement. Standard reasons for withdrawal may include personal decisions or changes in business direction. It's crucial to communicate this decision with other partners promptly. Consulting legal resources can assist in navigating the complexities of the North Carolina withdrawal of partner.

To remove a partner from an LLC in North Carolina, begin by reviewing your LLC's operating agreement, as it typically outlines the removal process. If the agreement lacks clear directions, all members must agree on the removal. This might include buyout arrangements and settling of accounts. If complications arise, utilizing uslegalforms simplifies the procedures related to North Carolina withdrawal of partner issues.

A partner can withdraw from a partnership by following the terms set out in the partnership agreement, if applicable. If no terms exist, discussing the intention with other partners is important for a smooth withdrawal. It's also beneficial to address any financial matters upfront to avoid confusion later. Engaging with uslegalforms can provide valuable resources and templates related to North Carolina withdrawal of partner procedures.

Getting a partner out of a partnership in North Carolina typically starts with reviewing the partnership agreement. If the partner agrees to leave, you can negotiate terms such as asset buyouts or settlement of debts. If not, more formal measures may be necessary, potentially involving legal mediation or court proceedings as part of the North Carolina withdrawal of partner process. Legal guidance can support effective outcomes.

A partner may withdraw from a North Carolina partnership by following the terms stated in the partnership agreement. If the agreement lacks clear guidelines, open communication with other partners is vital to reach a consensus. Remember to discuss financial implications and division of assets, as these details form key parts of the North Carolina withdrawal of partner scenario. Professional advice can help ensure a smooth transition.

Withdrawing from a partnership requires you to first review your partnership agreement to identify the proper procedure. Generally, you’ll need to notify your partners of your intent to withdraw and potentially provide written notice. During the North Carolina withdrawal of partner process, it’s crucial to discuss how your withdrawal affects business operations and the remaining partners. Consulting a legal expert can simplify this process.

Dissolving a partnership in North Carolina involves several steps. First, review your partnership agreement to determine the specific process outlined for dissolution. If no agreement exists, partners may agree to dissolve the partnership by mutual consent. It is essential to notify all stakeholders and settle debts and asset distribution as part of the North Carolina withdrawal of partner process.

To remove a member from an LLC in North Carolina, start by reviewing your operating agreement for specific procedures related to withdrawals. If the agreement does not specify, gather support from other members and conduct a vote to approve the removal. It’s essential to file any necessary paperwork with the state to update your LLC's information. Consider utilizing US Legal Forms to ensure you have the correct documentation for North Carolina withdrawal of partner, allowing for a seamless transition.

Exiting a partnership agreement often involves reviewing the terms within the contract itself. Look for any clauses regarding withdrawal or termination of the agreement. If necessary, negotiate with your partners to reach an amicable resolution, and ensure you document your exit properly. US Legal Forms offers resources that can assist you with the North Carolina withdrawal of partner process, making it easier to exit your partnership smoothly.

Interesting Questions

More info

(Please include the partner's name and the terms used.