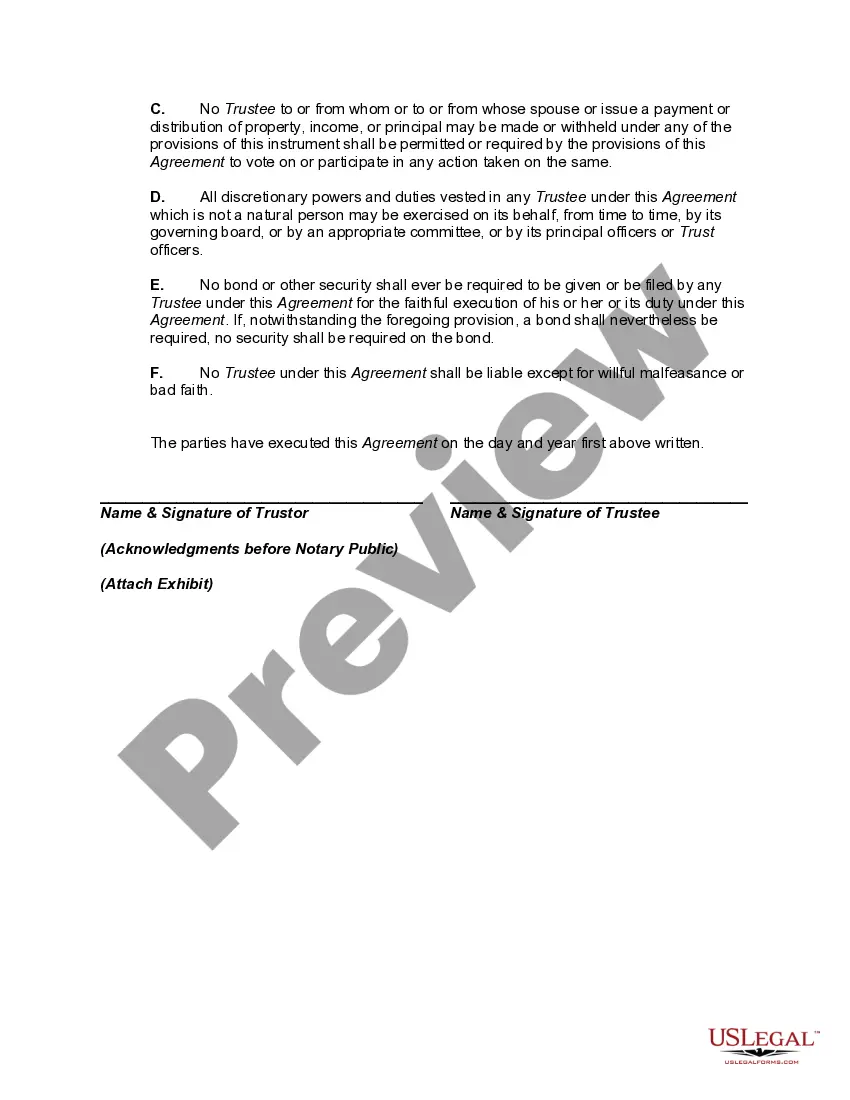

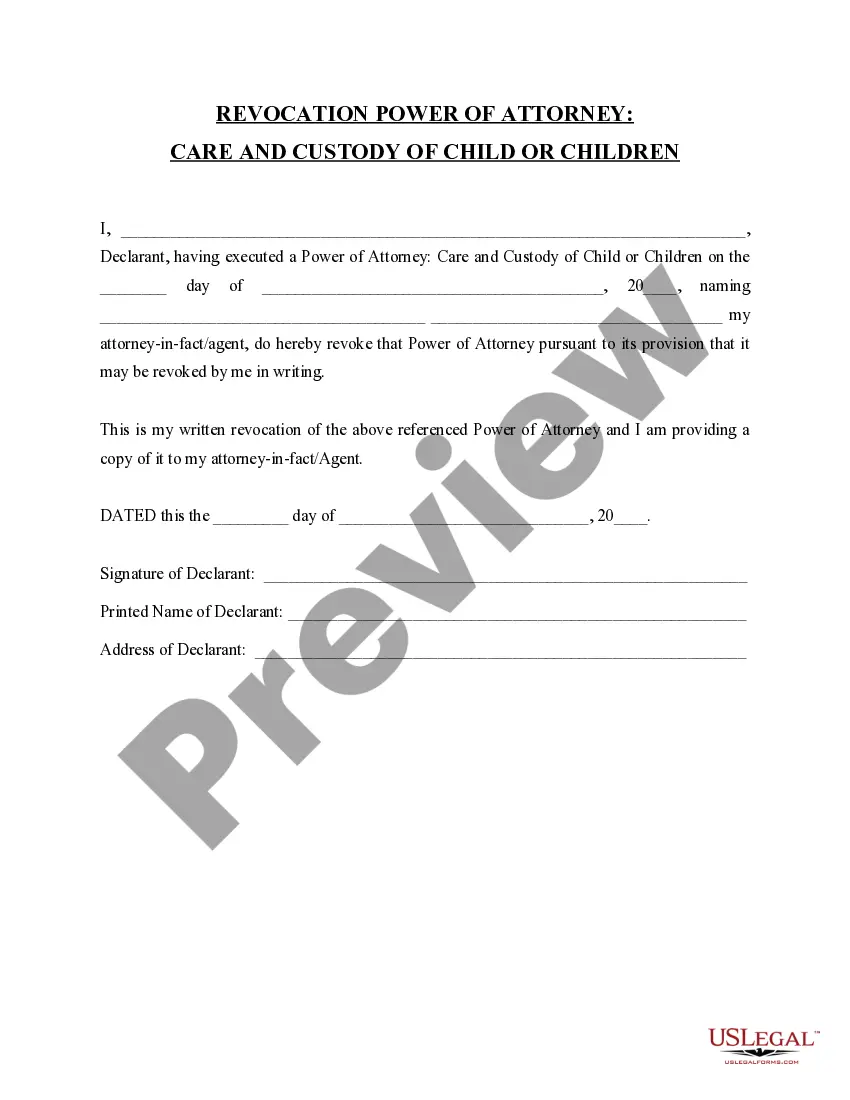

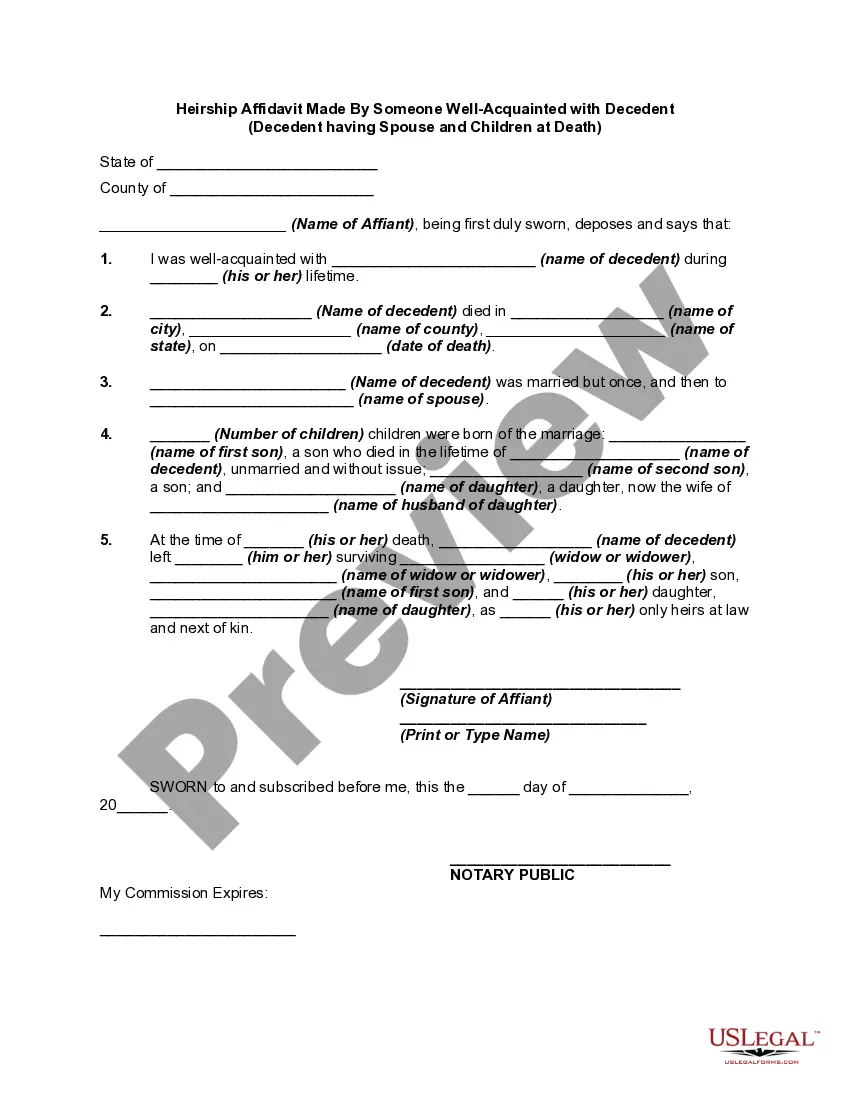

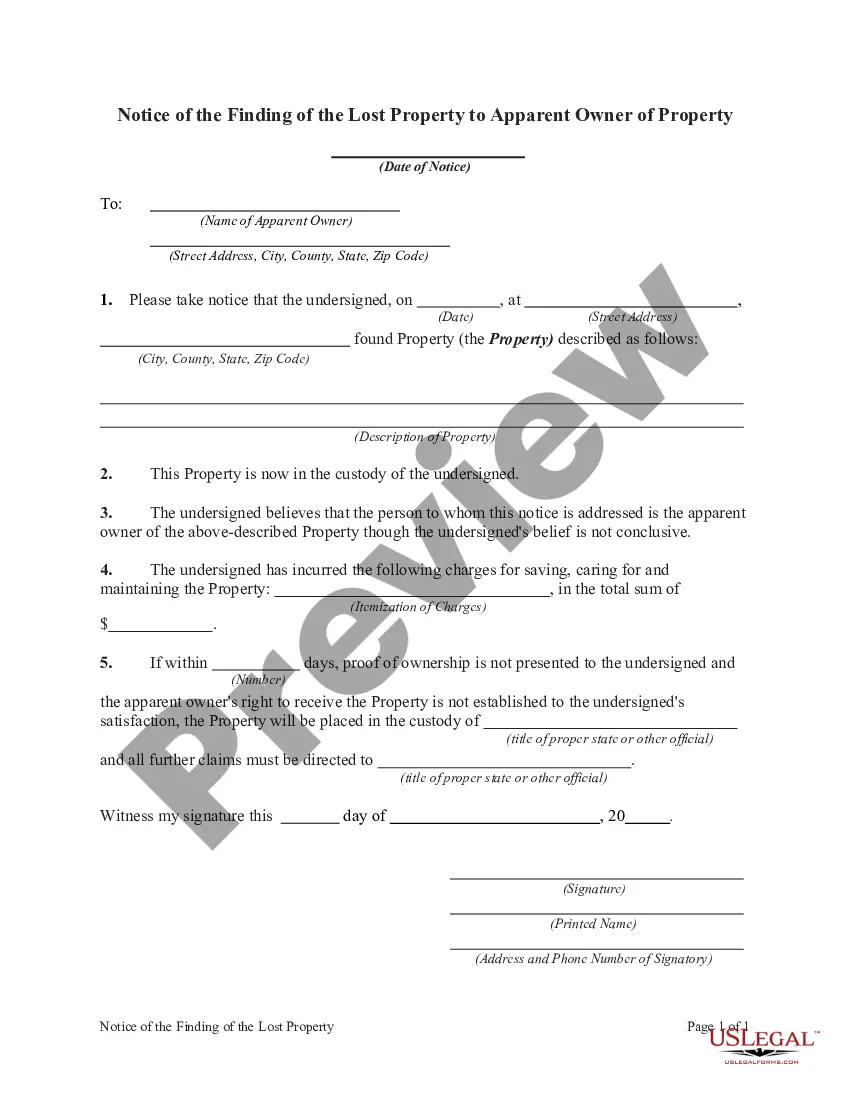

Selecting the appropriate legal document format can be challenging. Certainly, there are numerous web templates accessible online, but how do you locate the legal type you need? Visit the US Legal Forms website. The service offers a vast array of templates, including the North Carolina Irrevocable Trust Agreement for the Benefit of Trustor's Children Discretionary Distributions of Income and Principal, which can be utilized for business and personal purposes. All templates are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to receive the North Carolina Irrevocable Trust Agreement for the Benefit of Trustor's Children Discretionary Distributions of Income and Principal. Utilize your account to browse through the legal templates you have previously purchased. Navigate to the My documents tab in your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps you should follow: First, ensure you have chosen the correct template for your location/state. You can preview the form using the Preview button and review the form details to confirm it is suitable for your needs. If the template does not fulfill your requirements, use the Search field to find the correct type. Once you are confident the template is appropriate, select the Purchase now button to obtain the template. Choose the pricing plan you prefer and input the necessary information. Create your account and pay for the order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document to your device. Complete, modify, and print out and sign the received North Carolina Irrevocable Trust Agreement for the Benefit of Trustor's Children Discretionary Distributions of Income and Principal.

US Legal Forms is indeed the largest repository of legal templates where you will find a variety of document formats. Utilize the service to download professionally crafted documents that adhere to state regulations.

- Select the appropriate legal document format.

- Browse templates available online.

- Visit US Legal Forms for various legal document templates.

- Check compliance with state and federal regulations.

- Log in to download and manage your forms.

- Follow the instructions for new users.