This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

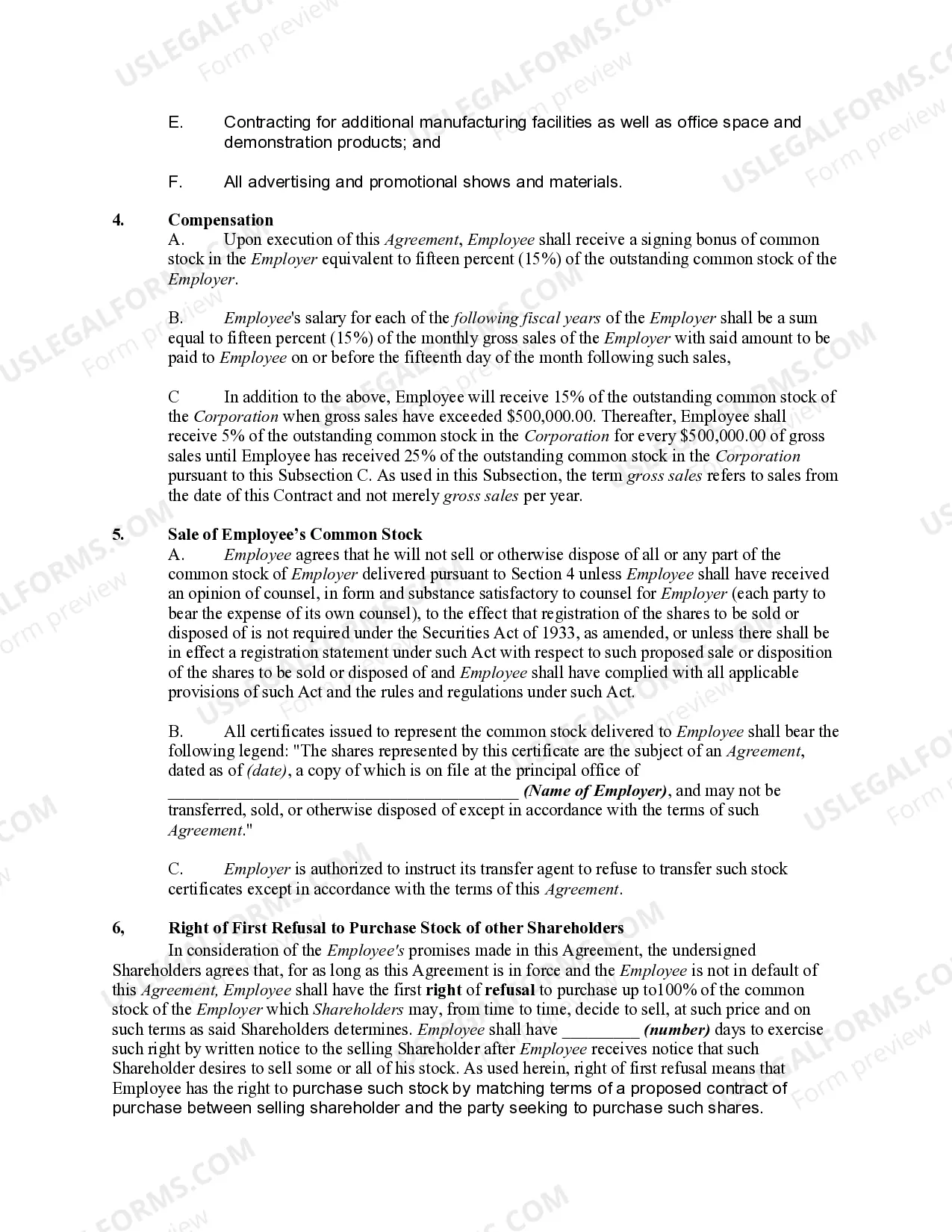

North Carolina Employment Contract with Executive Receiving Commission Salary Plus Common Stock With Right of Refusal to Purchase Shares of Other Shareholders in Close Corporation

Description

How to fill out Employment Contract With Executive Receiving Commission Salary Plus Common Stock With Right Of Refusal To Purchase Shares Of Other Shareholders In Close Corporation?

Selecting the appropriate valid document template can be quite challenging. Naturally, there are numerous templates accessible online, but how can you find the right one you require.

Utilize the US Legal Forms website. The service offers a vast collection of templates, including the North Carolina Employment Agreement with Executive Receiving Commission Salary Plus Common Stock With Right of Refusal to Purchase Shares of Other Shareholders in Close Corporation, which you can use for business and personal purposes.

All of the templates are reviewed by professionals and comply with federal and state regulations.

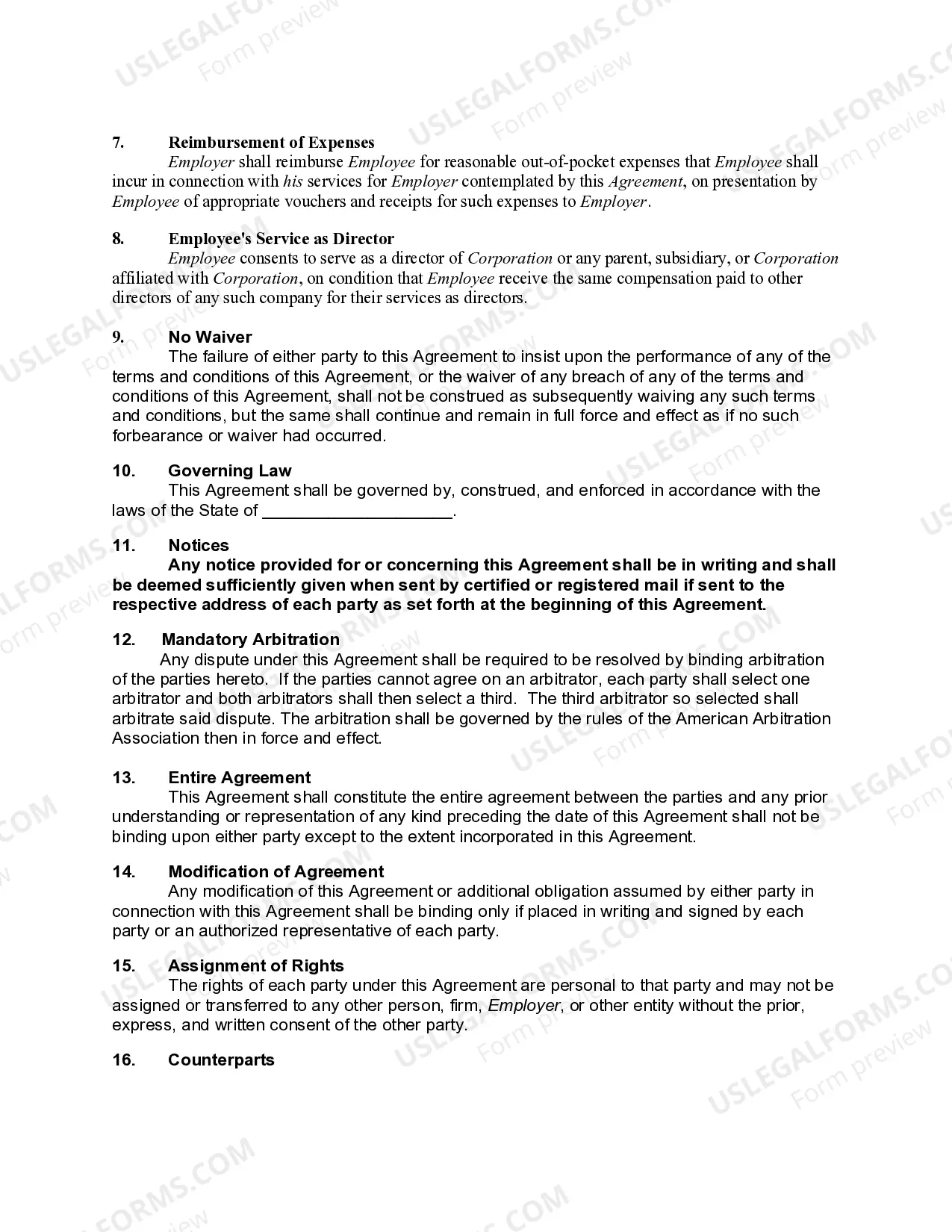

Once you are confident that the template is correct, click the Buy now button to get the template. Choose the payment method you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, review, and print and sign the acquired North Carolina Employment Agreement with Executive Receiving Commission Salary Plus Common Stock With Right of Refusal to Purchase Shares of Other Shareholders in Close Corporation. US Legal Forms is the largest collection of legal templates where you can find various document forms. Utilize the service to acquire professionally crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Employment Agreement with Executive Receiving Commission Salary Plus Common Stock With Right of Refusal to Purchase Shares of Other Shareholders in Close Corporation.

- Use your account to search for the legal templates you have acquired previously.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct template for your city/county. You can check the form using the Preview button and review the document details to confirm it is the right one for you.

- If the template does not meet your requirements, use the Search field to find the appropriate template.

Form popularity

FAQ

An executive's employment agreement typically will set an effective date and state that the initial term of employment will be for a period of years subject to earlier termination under other provisions of the agreement.

An executive employment contract is a written employment agreement, usually made between a highly compensated executive and an employer, that contains more expansive terms and conditions than an ordinary employment agreement. Executive Employment Contracts from the Executive's Perspective.

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.

Thus, an employment agreement is simply a type of contract formed between an employee and employer, which governs the terms of employment. Once both parties have signed the employment agreement, the contract will become binding and legally enforceable in court.

Bylaws work in conjunction with a company's articles of incorporation to form the legal backbone of the business and govern its operations. A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations.

A shareholders' agreement will usually contain provisions requiring directors and shareholders to keep confidential all matters relating to company business. In addition, it may contain provisions preventing shareholders starting competing businesses or dealing with customers of the company.

A Compensation Agreement is used by an employer to record a negotiated change in wage or earning potential for an employee. As an example, after a new employee completed their probationary period, the employer and employee agree to a new wage amount in the form of a raise.

5 Key Considerations When Negotiating an Executive Employment AgreementProtect the Company's Confidential Information and Property.Restrictive Covenants Are Important, But Should Not Overreach.Set Clear Grounds and Procedures for Termination of the Agreement.More items...?

An executive compensation agreement is a binding contract between a company and one of its most important and powerful employees.

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.