A North Carolina Irrevocable Letter of Credit (LC) is a financial tool that provides a secure payment mechanism to facilitate various types of transactions, typically involving the exchange of goods or services. It acts as a guarantee from a bank or financial institution (known as the issuing bank) that the beneficiary will receive payment up to a specified amount, as long as the terms and conditions stated in the LC are met. Irrevocable signifies that the LC cannot be altered or canceled without the consent of all parties involved. This feature ensures the beneficiary's confidence in receiving payment, thus minimizing risks associated with non-payment or default. Furthermore, by engaging in an irrevocable LC, the issuing bank assumes the responsibility of making the payment, alleviating concerns for the seller or supplier. The North Carolina Irrevocable Letter of Credit can be classified into various types based on their intended purpose or mode of operation. Some common types include: 1. Commercial LC: This type of LC is primarily utilized in international trade to ensure secure and timely payment for goods or services. It serves as a means for the buyer's bank to guarantee payment to the seller or exporter upon presenting the required documents as per the LC terms. 2. Standby LC: Often used as a back-up or secondary payment option, standby LC's act as a guarantee for the beneficiary's performance or fulfillment of contractual obligations. If the applicant fails to meet their obligations, the standby LC can be drawn upon to provide compensation. 3. Revolving LC: Revolving LC's are commonly employed in repetitive or recurring transactions, where there is an ongoing business relationship between the buyer and the seller. They allow for multiple draws against the available credit, replenishing the available amount for subsequent transactions. 4. Transferable LC: Transferable LC's provide the option for the beneficiary to transfer all or a portion of the LC proceeds to one or multiple parties (second beneficiaries). This is often useful when intermediaries are involved in the transaction, allowing for smooth facilitation of the trade. 5. Back-to-Back LC: In complex trade scenarios involving intermediary parties, back-to-back LC's are utilized. It involves two separate LC's—one issued from the buyer's bank to an intermediary, and the other issued by the intermediary's bank to the supplier or seller. This arrangement facilitates the transaction and mitigates the risks involved. Irrevocable Letters of Credit play a crucial role in facilitating secure trade transactions, protecting the interests of both buyers and sellers. In North Carolina, these LC's are widely used across various industries, including manufacturing, export-import, and construction sectors. Their flexibility and guarantee of payment make them an indispensable tool for businesses engaging in both domestic and international commerce.

North Carolina Irrevocable Letter of Credit

Description

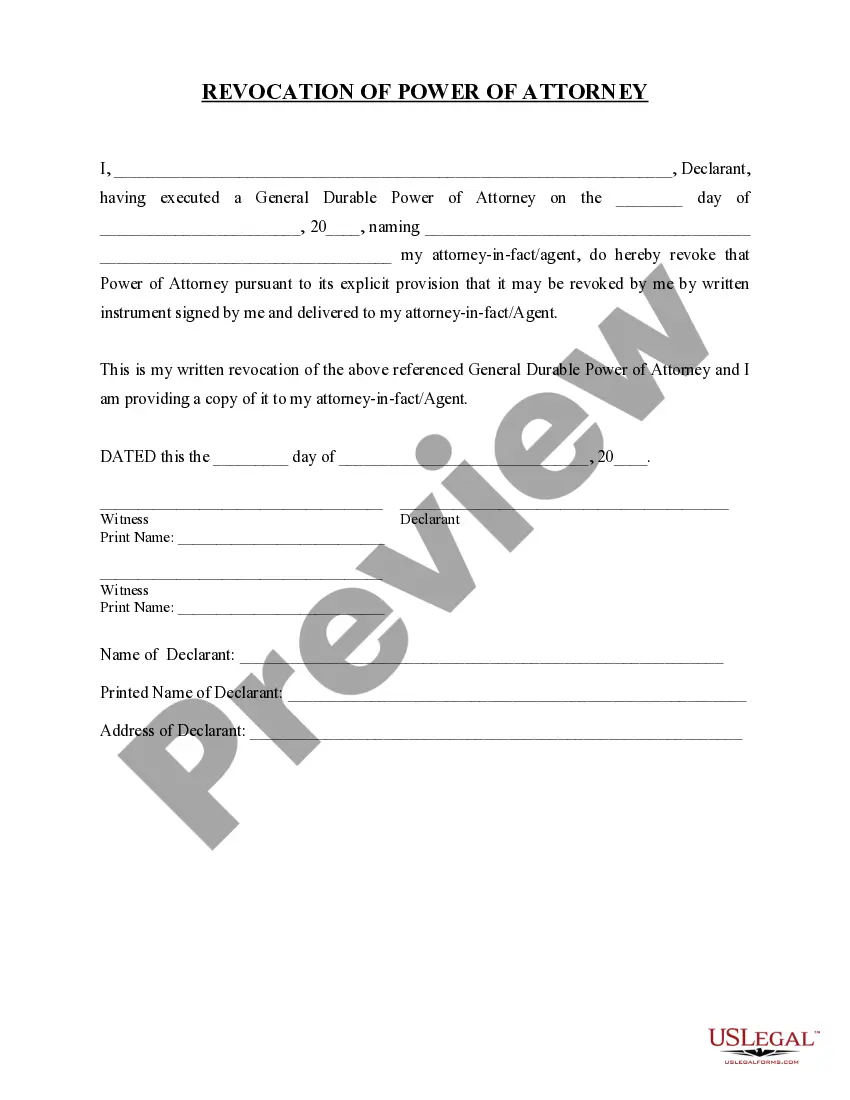

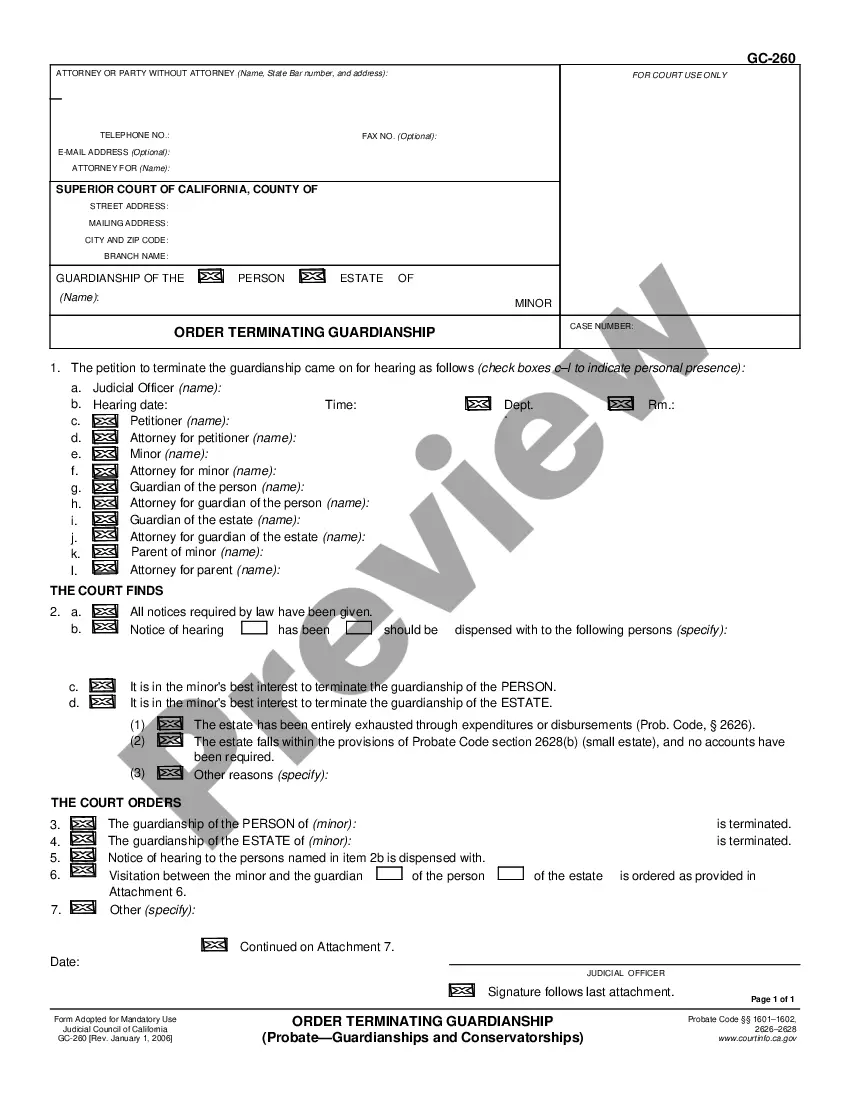

How to fill out North Carolina Irrevocable Letter Of Credit?

Choosing the right lawful record format might be a battle. Of course, there are tons of layouts available on the Internet, but how can you get the lawful type you need? Use the US Legal Forms internet site. The assistance delivers 1000s of layouts, for example the North Carolina Irrevocable Letter of Credit, which can be used for enterprise and private needs. Each of the kinds are inspected by pros and fulfill federal and state requirements.

In case you are presently listed, log in for your bank account and then click the Acquire key to find the North Carolina Irrevocable Letter of Credit. Make use of bank account to search throughout the lawful kinds you may have bought in the past. Visit the My Forms tab of the bank account and get one more copy from the record you need.

In case you are a whole new user of US Legal Forms, listed below are basic instructions that you should follow:

- First, ensure you have chosen the appropriate type for your personal area/state. It is possible to check out the shape utilizing the Preview key and look at the shape description to ensure it is the right one for you.

- When the type does not fulfill your requirements, make use of the Seach industry to obtain the proper type.

- Once you are certain that the shape is suitable, click on the Purchase now key to find the type.

- Choose the pricing prepare you need and enter in the needed information. Design your bank account and pay for your order making use of your PayPal bank account or bank card.

- Opt for the file format and obtain the lawful record format for your system.

- Comprehensive, change and print and signal the received North Carolina Irrevocable Letter of Credit.

US Legal Forms will be the most significant local library of lawful kinds that you can discover various record layouts. Use the company to obtain expertly-produced papers that follow status requirements.

Form popularity

FAQ

An irrevocable letter of credit is a financial instrument used in international trade to ensure payment security for sellers and provide assurance to buyers. It is issued by a bank on behalf of the buyer, guaranteeing that the seller will receive payment upon complying with the specified terms and conditions.

An irrevocable letter of credit must be obtained through the bank. You should not try to craft a letter or adapt somebody else's letter of credit. Doing so can put you at risk of an expensive legal battle, potentially overseas.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

What Is a Letter of Credit? A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

(a) "Irrevocable letter of credit" (ILC), as used in this clause, means a written commitment by a federally insured financial institution to pay all or part of a stated amount of money, until the expiration date of the letter, upon presentation by the Government (the beneficiary) of a written demand therefor.

For a secured revocable letter of credit, the buyer has to give a personal guarantee or mortgage security. For an unsecured revocable letter of credit, the bank checks the creditworthiness of the buyer. Please note in both instances, the bank can revoke the LC.

Disadvantages of a letter of credit: Usually covers single transactions for a single buyer, meaning you need a different letter of credit for each transaction. Expensive, tedious and time consuming in terms of absolute cost, working capital, and credit line usage.