A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

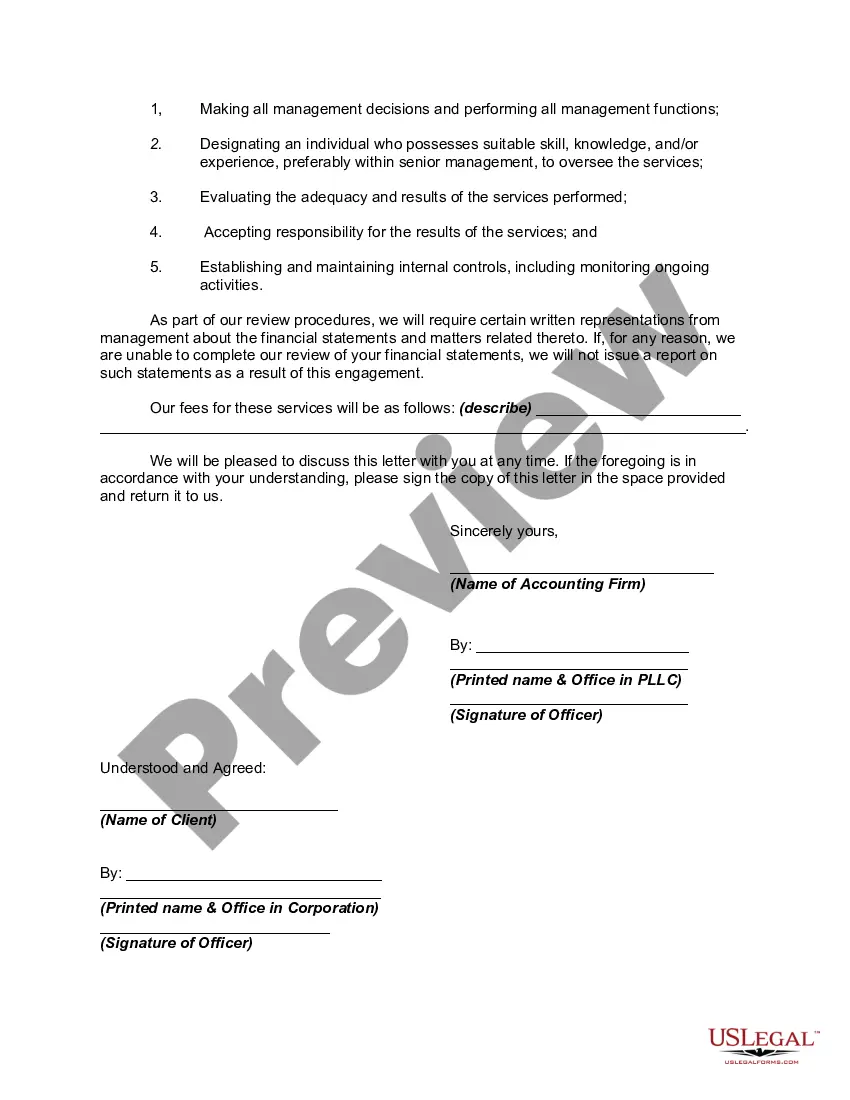

Keywords: North Carolina, Engagement Letter, Review of Financial Statements, Accounting Firm Title: Understanding North Carolina Engagement Letter for Review of Financial Statements by Accounting Firm Introduction: In the state of North Carolina, an Engagement Letter for Review of Financial Statements is a crucial document that governs the relationship between an accounting firm and its clients. This letter outlines the scope of services, responsibilities, and expectations of both parties during a financial statement review process. In this article, we will provide a detailed description of what a North Carolina Engagement Letter for Review of Financial Statements entails, discussing its purpose, key components, and any notable variations that may exist. Purpose: The primary purpose of a North Carolina Engagement Letter for Review of Financial Statements is to establish a clear understanding between the accounting firm and the client regarding the review engagement. It helps define the expectations and responsibilities of both parties, ensuring transparency, professionalism, and compliance with relevant laws and regulations. Key Components: 1. Identification of Parties: The engagement letter should clearly identify the accounting firm, its address, and contact information, alongside the client's details. 2. Objective and Scope: The letter should specify that the engagement is for a review of financial statements, rather than an audit or compilation. It should outline the timeframe and period under review. 3. Responsibilities: Both the accounting firm and the client's responsibilities should be detailed. The client is typically responsible for the preparation and accuracy of the financial statements, while the accounting firm is responsible for conducting the review in accordance with professional standards and issuing a review report. 4. Review Standards: The engagement letter should state that the review will be performed in accordance with the Statements on Standards for Accounting and Review Services (STARS) issued by the American Institute of Certified Public Accountants (AICPA). 5. Limitations: It is important to outline the limitations of a review engagement. Unlike an audit, a review provides limited assurance and does not offer an opinion on the financial statements' reliability. 6. Fees and Billing: The engagement letter must specify the fee structure, payment terms, and any additional charges that may apply during the review engagement. 7. Confidentiality and Data Protection: It is essential to include clauses regarding the safeguarding of confidential information and compliance with relevant data protection regulations. 8. Termination: The letter should outline the conditions under which either party can terminate the engagement and the procedures to be followed in such cases. Types of Engagement Letters: While the basic structure and components of a North Carolina Engagement Letter for Review of Financial Statements remain consistent, specific industries or circumstances may require additional tailored provisions. Some variations of engagement letter in North Carolina include: 1. Nonprofit Organizations: Engagement letters designed specifically for review engagements in the nonprofit sector, encompassing considerations such as compliance with applicable laws and regulations. 2. Government Entities: Engagement letters that address review engagements for governmental entities, incorporating governmental accounting standards and compliance requirements. 3. Industry-Specific: Some accounting firms may use engagement letters tailored to specific industries, such as healthcare, manufacturing, or technology, to address industry-specific accounting standards and regulations. Conclusion: A North Carolina Engagement Letter for Review of Financial Statements serves as a crucial document for ensuring clarity, professionalism, and compliance during financial statement reviews. By clearly defining the scope, responsibilities, and expectations of both the accounting firm and the client, this letter contributes to an effective and transparent engagement process. Understanding the key components and potential variations of engagement letters in North Carolina allows clients and accounting firms to establish a strong working relationship and achieve reliable financial reporting.Keywords: North Carolina, Engagement Letter, Review of Financial Statements, Accounting Firm Title: Understanding North Carolina Engagement Letter for Review of Financial Statements by Accounting Firm Introduction: In the state of North Carolina, an Engagement Letter for Review of Financial Statements is a crucial document that governs the relationship between an accounting firm and its clients. This letter outlines the scope of services, responsibilities, and expectations of both parties during a financial statement review process. In this article, we will provide a detailed description of what a North Carolina Engagement Letter for Review of Financial Statements entails, discussing its purpose, key components, and any notable variations that may exist. Purpose: The primary purpose of a North Carolina Engagement Letter for Review of Financial Statements is to establish a clear understanding between the accounting firm and the client regarding the review engagement. It helps define the expectations and responsibilities of both parties, ensuring transparency, professionalism, and compliance with relevant laws and regulations. Key Components: 1. Identification of Parties: The engagement letter should clearly identify the accounting firm, its address, and contact information, alongside the client's details. 2. Objective and Scope: The letter should specify that the engagement is for a review of financial statements, rather than an audit or compilation. It should outline the timeframe and period under review. 3. Responsibilities: Both the accounting firm and the client's responsibilities should be detailed. The client is typically responsible for the preparation and accuracy of the financial statements, while the accounting firm is responsible for conducting the review in accordance with professional standards and issuing a review report. 4. Review Standards: The engagement letter should state that the review will be performed in accordance with the Statements on Standards for Accounting and Review Services (STARS) issued by the American Institute of Certified Public Accountants (AICPA). 5. Limitations: It is important to outline the limitations of a review engagement. Unlike an audit, a review provides limited assurance and does not offer an opinion on the financial statements' reliability. 6. Fees and Billing: The engagement letter must specify the fee structure, payment terms, and any additional charges that may apply during the review engagement. 7. Confidentiality and Data Protection: It is essential to include clauses regarding the safeguarding of confidential information and compliance with relevant data protection regulations. 8. Termination: The letter should outline the conditions under which either party can terminate the engagement and the procedures to be followed in such cases. Types of Engagement Letters: While the basic structure and components of a North Carolina Engagement Letter for Review of Financial Statements remain consistent, specific industries or circumstances may require additional tailored provisions. Some variations of engagement letter in North Carolina include: 1. Nonprofit Organizations: Engagement letters designed specifically for review engagements in the nonprofit sector, encompassing considerations such as compliance with applicable laws and regulations. 2. Government Entities: Engagement letters that address review engagements for governmental entities, incorporating governmental accounting standards and compliance requirements. 3. Industry-Specific: Some accounting firms may use engagement letters tailored to specific industries, such as healthcare, manufacturing, or technology, to address industry-specific accounting standards and regulations. Conclusion: A North Carolina Engagement Letter for Review of Financial Statements serves as a crucial document for ensuring clarity, professionalism, and compliance during financial statement reviews. By clearly defining the scope, responsibilities, and expectations of both the accounting firm and the client, this letter contributes to an effective and transparent engagement process. Understanding the key components and potential variations of engagement letters in North Carolina allows clients and accounting firms to establish a strong working relationship and achieve reliable financial reporting.