Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

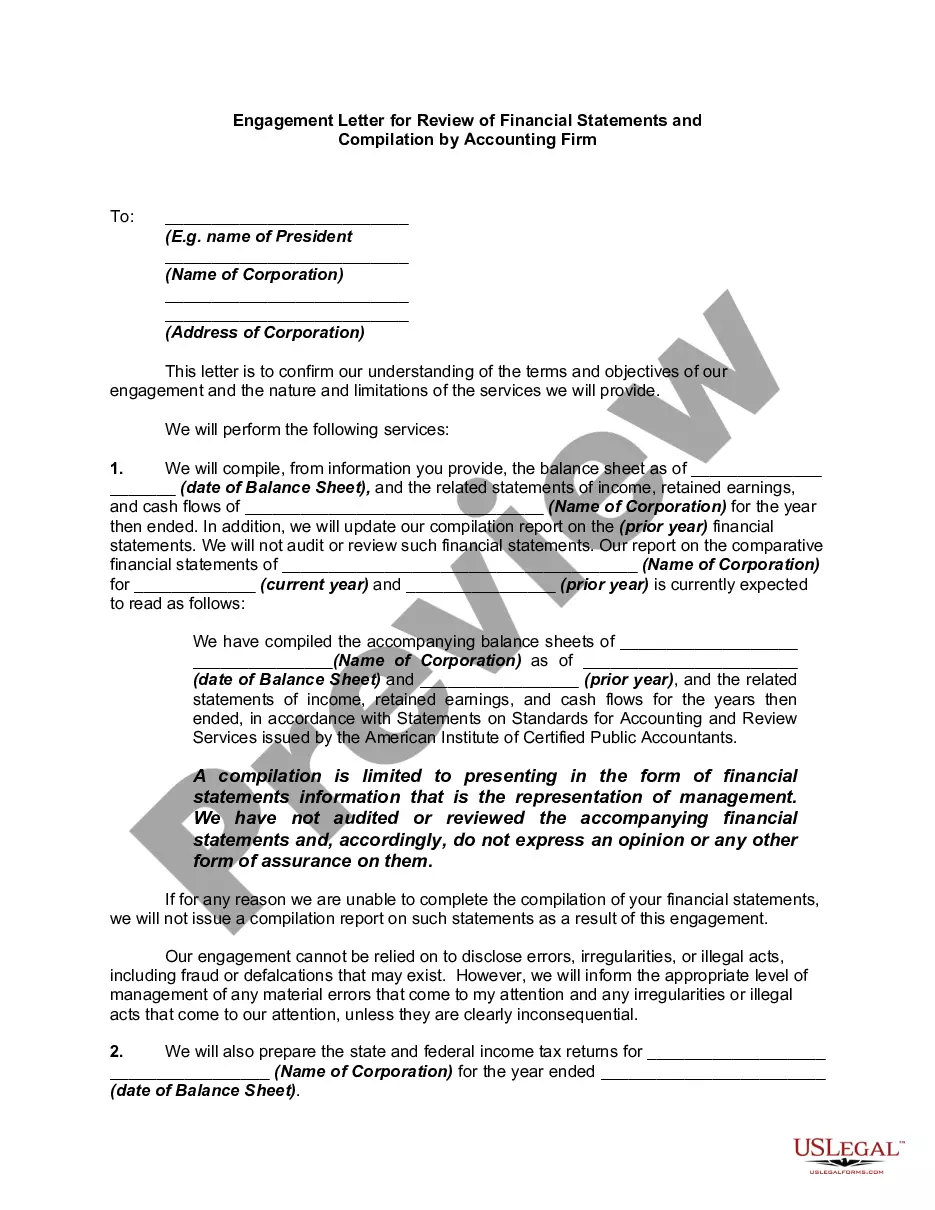

North Carolina Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legally binding document that outlines the terms and conditions of the engagement between an accounting firm and a client for conducting a review or compilation of financial statements. This letter is specific to engagements in the state of North Carolina and follows the guidelines set by the North Carolina State Board of CPA Examiners. The purpose of the engagement letter is to establish a clear understanding of the responsibilities and expectations of both parties involved in the financial statement review or compilation. It ensures that the accounting firm will adhere to the Generally Accepted Accounting Principles (GAAP) and comply with the regulations set forth by the North Carolina State Board of CPA Examiners. The key components typically included in a North Carolina Engagement Letter for Review of Financial Statements and Compilation are as follows: 1. Parties involved: The engagement letter specifies the names and contact information of the accounting firm and the client. Additionally, it highlights any affiliated parties or third-party beneficiaries. 2. Objective of engagement: The letter clearly outlines whether the engagement is for a review or compilation of the client's financial statements. A review engagement involves limited assurance, focusing on providing a moderate level of assurance that the financial statements are free from material misstatements. A compilation engagement aims at presenting the financial statement information in the form of a financial statement without expressing an opinion. 3. Scope of engagement: The engagement letter defines the specific services to be performed by the accounting firm, such as examination, inquiry, and analytical procedures. It also states the limitations of the engagement and details the procedures that will not be performed. 4. Responsibilities of the accounting firm: This section outlines the responsibilities of the accounting firm during the engagement, including compliance with professional standards, maintaining professional independence, and performing the review or compilation with due professional care and expertise. 5. Responsibilities of the client: The engagement letter outlines the client's responsibilities, such as providing complete and accurate financial records, granting access to necessary information, and acknowledging that the financial statements are their responsibility. 6. Reporting: The letter specifies how the results of the engagement will be communicated to the client, including the format, timing, and distribution of the review report or compiled financial statements. It also emphasizes that the accounting firm's report or statements are for the exclusive use of the client and should not be distributed to third parties without prior written consent. 7. Fees and payment terms: The engagement letter includes details about the fee structure for the services provided. It outlines the billing rates, expenses, terms of payment, and any additional expenses that may be incurred during the engagement. Different types of North Carolina Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm may exist based on the specific circumstances or needs of the engagement. These can include engagement letters for specific industries, engagements with non-profit organizations, or engagements requiring additional procedures beyond the standard review or compilation. It is essential for both the accounting firm and the client to carefully review and agree upon the terms outlined in the engagement letter to ensure clear communication, mutual understanding, and a successful engagement process.North Carolina Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legally binding document that outlines the terms and conditions of the engagement between an accounting firm and a client for conducting a review or compilation of financial statements. This letter is specific to engagements in the state of North Carolina and follows the guidelines set by the North Carolina State Board of CPA Examiners. The purpose of the engagement letter is to establish a clear understanding of the responsibilities and expectations of both parties involved in the financial statement review or compilation. It ensures that the accounting firm will adhere to the Generally Accepted Accounting Principles (GAAP) and comply with the regulations set forth by the North Carolina State Board of CPA Examiners. The key components typically included in a North Carolina Engagement Letter for Review of Financial Statements and Compilation are as follows: 1. Parties involved: The engagement letter specifies the names and contact information of the accounting firm and the client. Additionally, it highlights any affiliated parties or third-party beneficiaries. 2. Objective of engagement: The letter clearly outlines whether the engagement is for a review or compilation of the client's financial statements. A review engagement involves limited assurance, focusing on providing a moderate level of assurance that the financial statements are free from material misstatements. A compilation engagement aims at presenting the financial statement information in the form of a financial statement without expressing an opinion. 3. Scope of engagement: The engagement letter defines the specific services to be performed by the accounting firm, such as examination, inquiry, and analytical procedures. It also states the limitations of the engagement and details the procedures that will not be performed. 4. Responsibilities of the accounting firm: This section outlines the responsibilities of the accounting firm during the engagement, including compliance with professional standards, maintaining professional independence, and performing the review or compilation with due professional care and expertise. 5. Responsibilities of the client: The engagement letter outlines the client's responsibilities, such as providing complete and accurate financial records, granting access to necessary information, and acknowledging that the financial statements are their responsibility. 6. Reporting: The letter specifies how the results of the engagement will be communicated to the client, including the format, timing, and distribution of the review report or compiled financial statements. It also emphasizes that the accounting firm's report or statements are for the exclusive use of the client and should not be distributed to third parties without prior written consent. 7. Fees and payment terms: The engagement letter includes details about the fee structure for the services provided. It outlines the billing rates, expenses, terms of payment, and any additional expenses that may be incurred during the engagement. Different types of North Carolina Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm may exist based on the specific circumstances or needs of the engagement. These can include engagement letters for specific industries, engagements with non-profit organizations, or engagements requiring additional procedures beyond the standard review or compilation. It is essential for both the accounting firm and the client to carefully review and agree upon the terms outlined in the engagement letter to ensure clear communication, mutual understanding, and a successful engagement process.