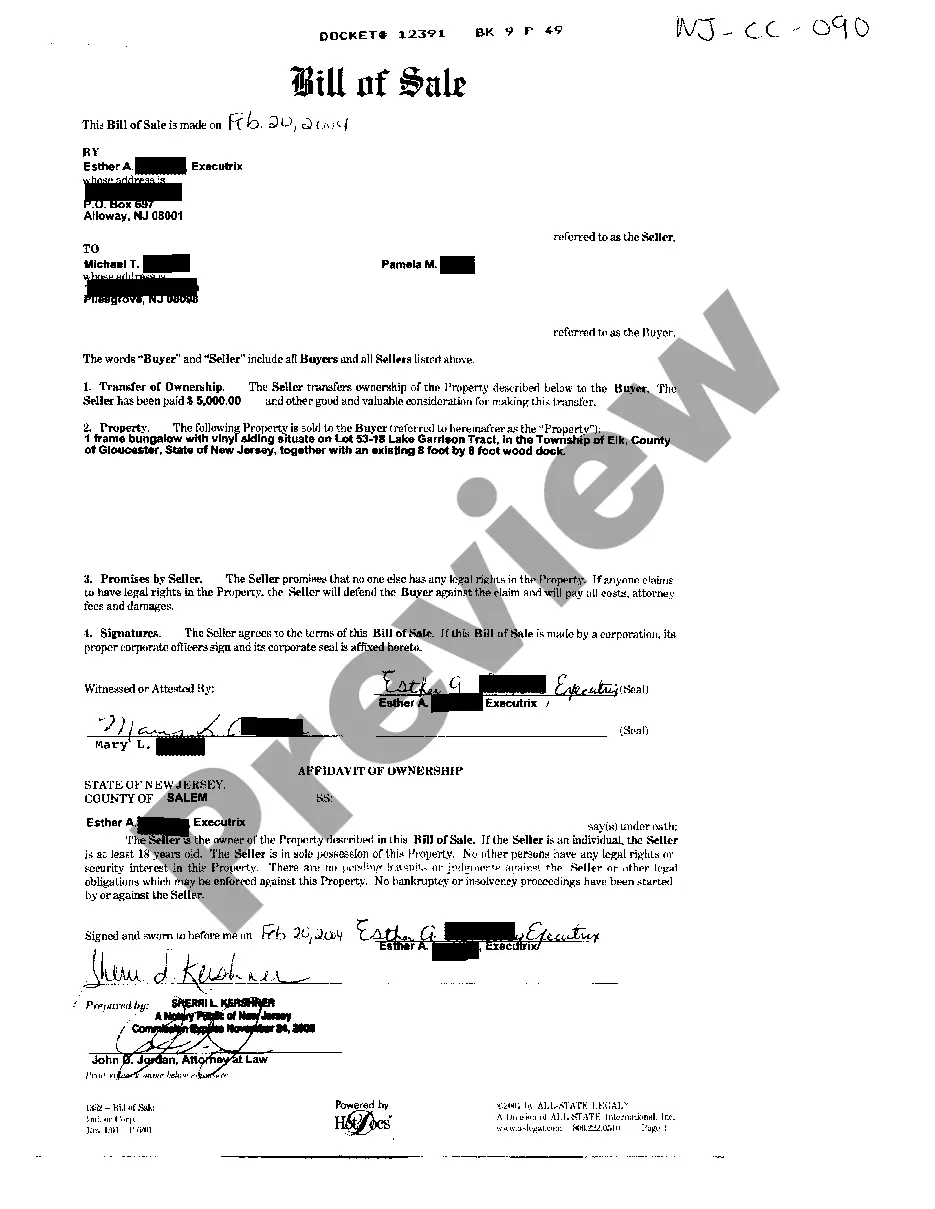

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The North Carolina Declaration of Gift Over Several Year periods is a legal document that allows individuals to make a gift of property or assets over a specified period of time. This declaration is important for individuals who wish to distribute their assets gradually and in a structured manner. By utilizing this document, individuals can ensure a smooth transfer of property to their intended recipients while maintaining control and flexibility over the distribution process. The North Carolina Declaration of Gift Over Several Year periods provides a detailed framework for the gradual transfer of gifts, outlining the terms and conditions under which the gifts will be given. It allows the donor to specify the time frame and distribution schedule of the gifts, ensuring that the recipient receives the designated amount or assets at specific intervals or on specific occasions. There are different types of North Carolina Declaration of Gift Over Several years Period, each catering to specific needs and circumstances. Some common variations include: 1. Gradual Property Transfer: This type of declaration allows donors to gradually transfer ownership of real estate or tangible assets to the recipient over a period of several years. It ensures a smooth transition while minimizing tax implications. 2. Financial Assets Distribution: This variant of the declaration focuses on transferring financial assets such as stocks, bonds, or funds incrementally. The document outlines the donor's intent to gift a specific amount or percentage of these assets over several years, providing a clear plan for their distribution. 3. Estate Planning: The North Carolina Declaration of Gift Over Several Year periods is often utilized as part of an estate planning strategy. This type of declaration enables individuals to distribute their assets, including real estate, financial assets, and personal belongings, gradually to their beneficiaries over several years. 4. Charitable Contributions: Some individuals may opt to utilize the North Carolina Declaration of Gift Over Several Year periods to make charitable donations over an extended period. This allows them to donate significant amounts to charities or nonprofit organizations in a structured manner, ensuring a lasting impact while maximizing tax benefits. 5. Trust Creation: In certain cases, the declaration may serve as a tool for creating a trust that will span several years. This type of declaration outlines the transfer of assets into a trust, ensuring its gradual distribution to the beneficiaries according to the donor's instructions. In conclusion, the North Carolina Declaration of Gift Over Several Year periods provides a legal framework for individuals to make gradual transfers of property, assets, or funds over time. It offers various types tailored to different circumstances, including gradual property transfer, financial assets' distribution, estate planning, charitable contributions, and trust creation. Utilizing this document can ensure a well-structured, tax-efficient, and controlled distribution of gifts according to the donor's wishes.