US Legal Forms - one of many largest libraries of authorized varieties in America - offers a wide range of authorized document templates it is possible to down load or printing. While using site, you may get 1000s of varieties for enterprise and personal functions, categorized by groups, claims, or search phrases.You will discover the most recent variations of varieties like the North Carolina Homestead Declaration following Decree of Legal Separation or Divorce in seconds.

If you already have a subscription, log in and down load North Carolina Homestead Declaration following Decree of Legal Separation or Divorce from the US Legal Forms local library. The Acquire button can look on each and every develop you perspective. You gain access to all previously downloaded varieties from the My Forms tab of your respective bank account.

In order to use US Legal Forms initially, listed here are basic guidelines to obtain began:

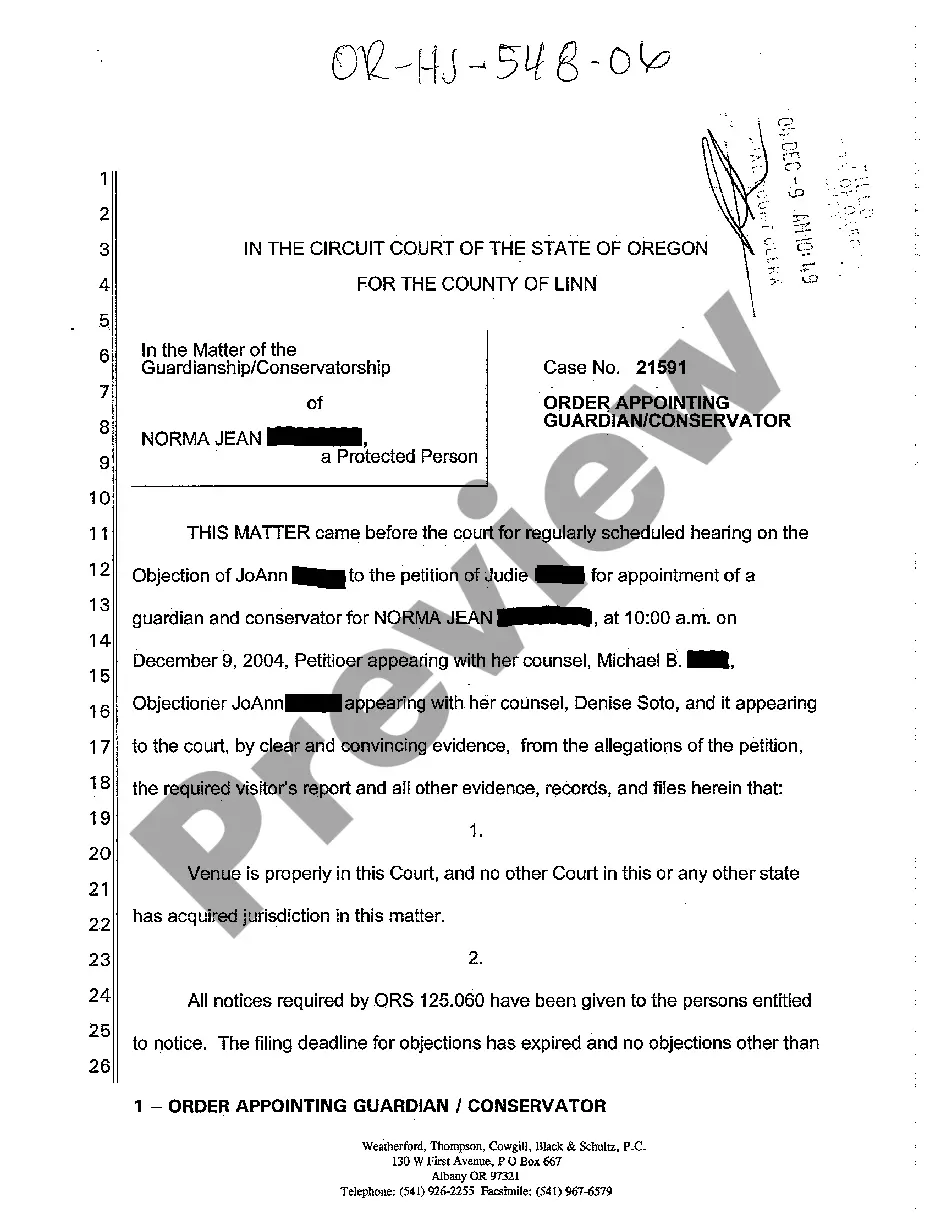

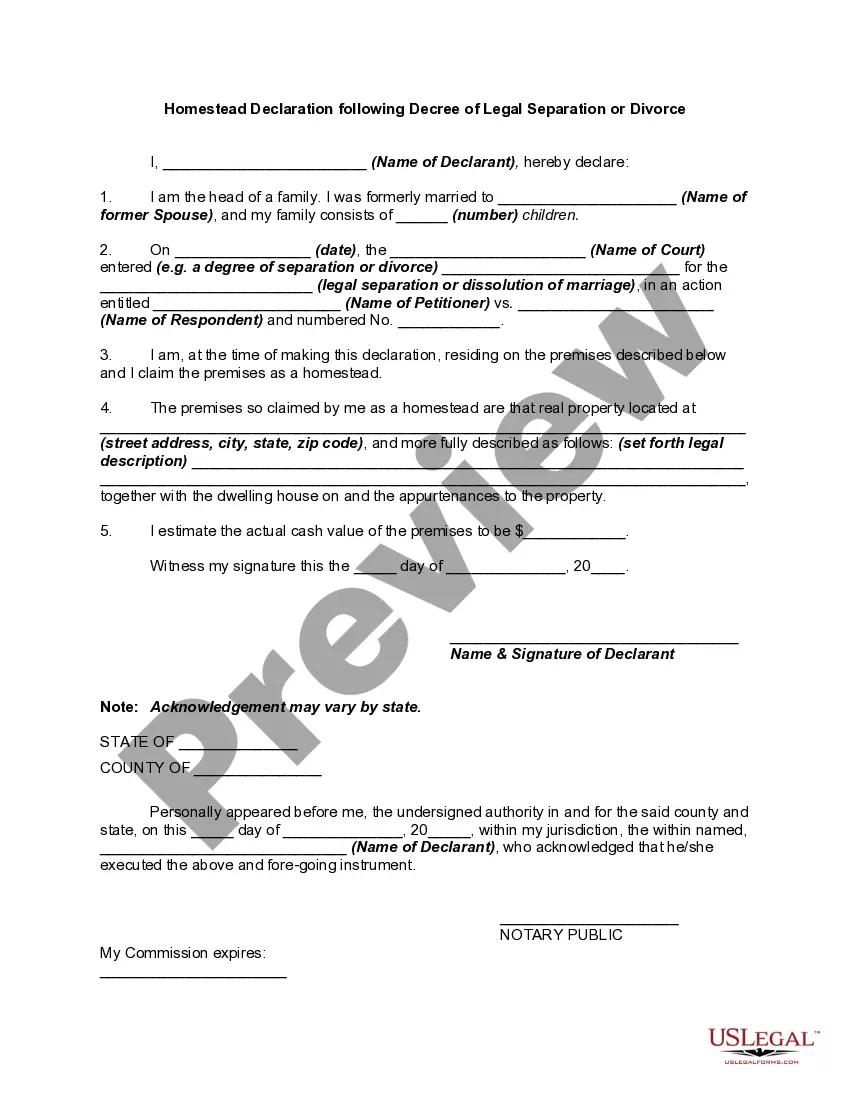

- Be sure to have chosen the proper develop for the town/region. Go through the Review button to review the form`s content material. Read the develop outline to actually have chosen the proper develop.

- In the event the develop does not fit your specifications, utilize the Search field towards the top of the display to get the the one that does.

- When you are content with the form, affirm your option by visiting the Get now button. Then, choose the costs prepare you favor and offer your credentials to sign up for the bank account.

- Method the financial transaction. Utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Find the formatting and down load the form on the product.

- Make adjustments. Fill out, edit and printing and signal the downloaded North Carolina Homestead Declaration following Decree of Legal Separation or Divorce.

Each format you included in your account lacks an expiration particular date and is also your own permanently. So, if you wish to down load or printing one more copy, just proceed to the My Forms segment and click on about the develop you need.

Get access to the North Carolina Homestead Declaration following Decree of Legal Separation or Divorce with US Legal Forms, one of the most considerable local library of authorized document templates. Use 1000s of expert and state-certain templates that meet your organization or personal requirements and specifications.