North Carolina Proof of Residency for Mortgage: A Comprehensive Guide Keywords: North Carolina, proof of residency, mortgage, documentation, requirements, types, residency verification, reviews, process, eligibility, forms, guidelines Introduction: When applying for a mortgage in North Carolina, lending institutions require borrowers to provide proof of residency to establish their eligibility for the loan. This proof confirms that the borrower is a legal resident of North Carolina, guaranteeing the lender that the property serves as the borrower's primary residence. In this article, we will delve into the various types of North Carolina proof of residency for mortgages, the required documentation, and the process involved. Types of North Carolina Proof of Residency for Mortgage: 1. North Carolina Driver's License/Identification Card: The most commonly accepted form of proof of residency for a mortgage is a valid North Carolina driver's license or identification card. Lenders often require a photocopy or scan of the front and back of the license to verify the borrower's address. 2. Utility Bills: Utility bills, such as electricity, water, gas, or cable bills, can serve as additional proof of residency. Lenders generally request recent bills or statements with the borrower's name and current address clearly stated. 3. Lease/Rental Agreement: For individuals living in rented accommodations, a lease or rental agreement can be used as proof of residency. This document should include the borrower's name, the property address, and the tenancy period. 4. Voter Registration Card: A North Carolina voter registration card can be an acceptable form of proof of residency, as it verifies that the borrower is a legal resident of the state. The lender may request a copy or an original document. 5. Homeownership Documents: If the borrower already owns a property in North Carolina, documents such as the property deed, mortgage statement, or property tax statement may be required to establish residency. Documentation and Process: To prove residency for a mortgage in North Carolina, borrowers should provide clear copies of the relevant documents mentioned above. Additionally, lenders may require a completed and signed residency verification form, which can be obtained directly from the lending institution or downloaded from their website. Once all the necessary paperwork is gathered, borrowers can submit them to the lender either in person, by mail, or digitally, depending on the lender's guidelines. It's crucial to check with the specific lender regarding their preferred method of submission to avoid any delays or complications. Eligibility and Guidelines: To qualify for a mortgage in North Carolina, borrowers must meet specific residency requirements. These may include being a U.S. citizen or having a valid immigration status and residing in North Carolina as their primary residence. Considering that lenders' criteria may vary, borrowers are advised to review the specific residency requirements mentioned in their mortgage application or consult with their lender directly. It's essential to understand and fulfill these conditions to secure a mortgage successfully. In conclusion, North Carolina proof of residency for mortgages is crucial in establishing a borrower's eligibility for a home loan. By providing supporting documentation that proves legal residency in the state, borrowers can expedite the mortgage application process. Make sure to gather the required documentation, follow the lender's guidelines, and fulfill all residency requirements to increase the chances of obtaining a mortgage in North Carolina.

North Carolina Proof of Residency for Mortgage

Description

How to fill out North Carolina Proof Of Residency For Mortgage?

US Legal Forms - one of several greatest libraries of legal forms in the States - offers a variety of legal record layouts you may download or produce. Using the internet site, you will get a huge number of forms for business and personal purposes, sorted by classes, states, or keywords.You can get the latest types of forms just like the North Carolina Proof of Residency for Mortgage within minutes.

If you already have a registration, log in and download North Carolina Proof of Residency for Mortgage in the US Legal Forms local library. The Acquire switch will appear on every single type you view. You have access to all formerly acquired forms within the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, listed below are straightforward recommendations to obtain started out:

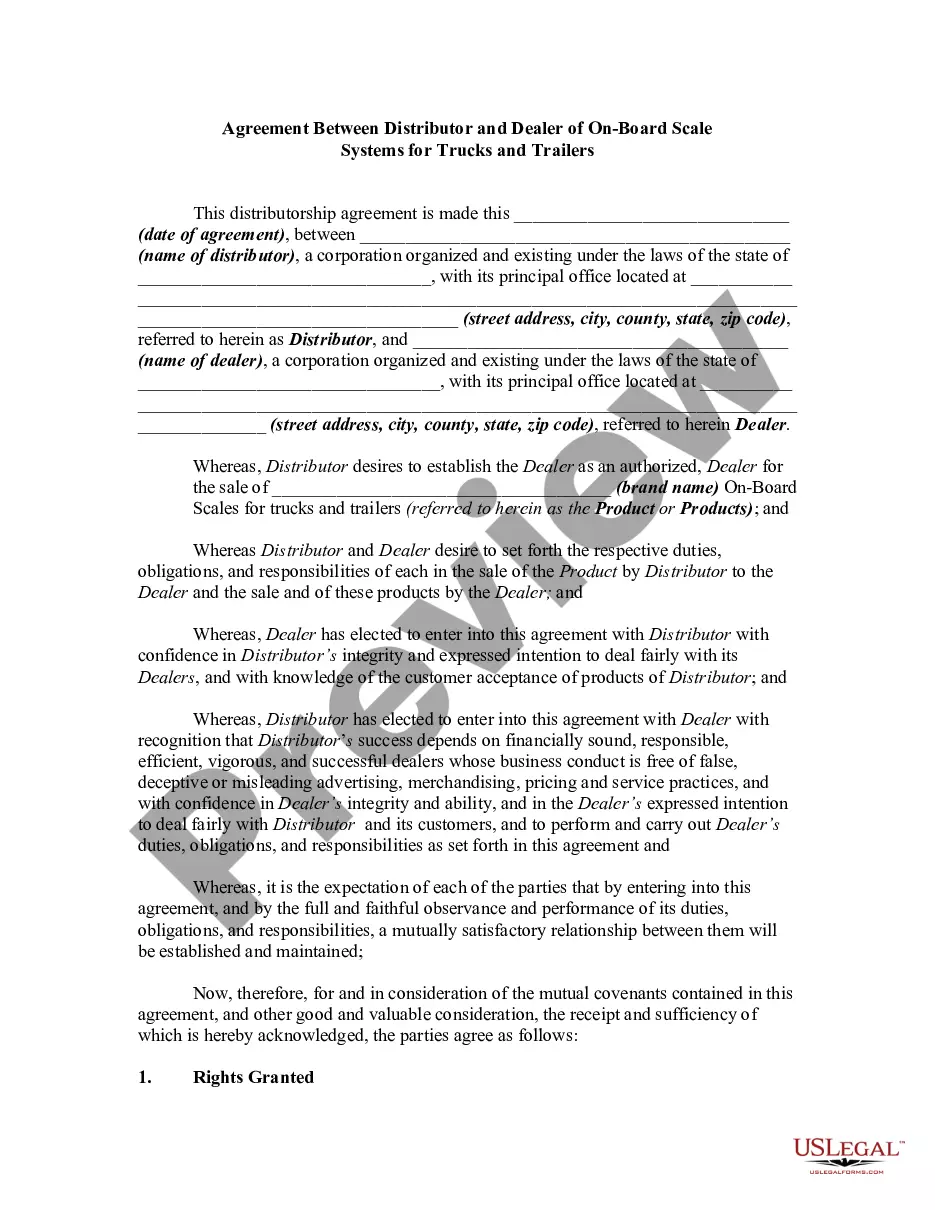

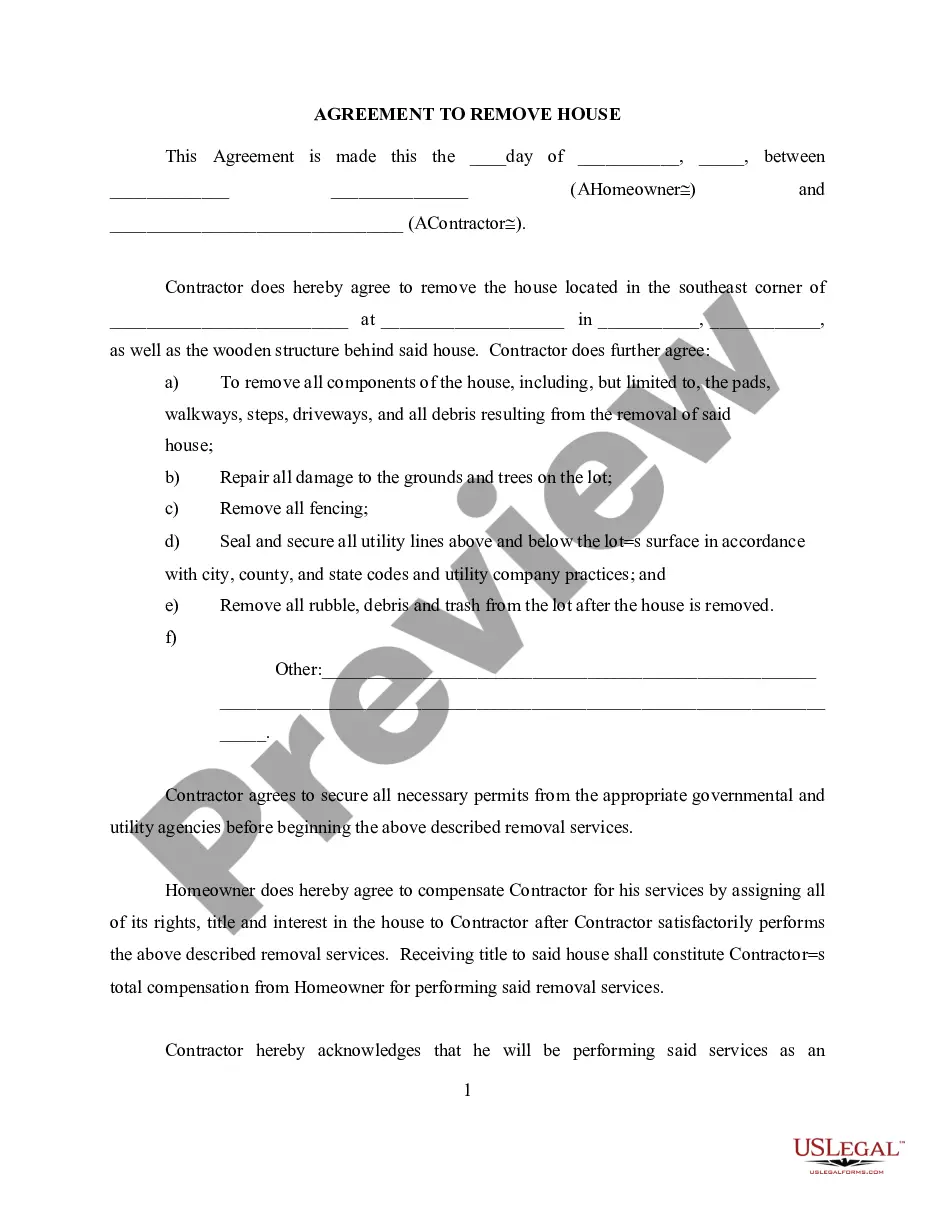

- Be sure you have picked the right type for your personal city/area. Select the Review switch to examine the form`s content material. Look at the type explanation to ensure that you have chosen the correct type.

- In the event the type doesn`t match your needs, make use of the Search area at the top of the monitor to obtain the one that does.

- Should you be pleased with the shape, verify your option by simply clicking the Get now switch. Then, select the prices plan you want and supply your accreditations to register on an profile.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal profile to perform the financial transaction.

- Find the file format and download the shape on your device.

- Make alterations. Fill up, edit and produce and signal the acquired North Carolina Proof of Residency for Mortgage.

Each template you put into your bank account does not have an expiration particular date and it is yours forever. So, if you would like download or produce yet another duplicate, just proceed to the My Forms section and click on on the type you will need.

Get access to the North Carolina Proof of Residency for Mortgage with US Legal Forms, probably the most substantial local library of legal record layouts. Use a huge number of skilled and status-distinct layouts that satisfy your organization or personal requires and needs.

Form popularity

FAQ

North Carolina Residency Any document issued by the state of North Carolina or a county or city in North Carolina or the federal government. North Carolina Vehicle Registration Card, insurance policy or title. North Carolina Voter Precinct Card. Military orders or military documents. Utility bill or cable bill.

1. A valid North Carolina drivers' license or other identification card issued by the North Carolina Division of Motor Vehicles. 2. A current lease, rent, mortgage payment receipt, or current utility bill in the name of the applicant, showing a North Carolina address.

Residency for Tuition Purposes 116-143.1(b)), a student qualifies as a resident for tuition purposes if he or she has: an established legal residency (domicile) in North Carolina. maintained that legal residence for at least 12 continuous months prior to being considered for in-state residency.

These might include: Driver's licenses/ID cards. Tax returns. Vehicle, voter or selective service registration. California State social benefits eligibility. Employment or housing verification. Bank statements.

Examples of these documents can include lease agreements, utility billings or receipts, and a current driver's license.

Under this law, to qualify for in-state tuition a student must prove they have established and continuously maintained legal residence in North Carolina for 12 months before they claim residency. A student must also prove you came to North Carolina for reasons other than attending college.

Under North Carolina law, to qualify for in-state residency, you must show that you: Have established your legal residence (domicile) in North Carolina, and. Have maintained that domicile for at least twelve (12) consecutive months before the beginning of the term, and. Have a residentiary presence in the state, and.