North Carolina Contract with Marketing Representative

Description

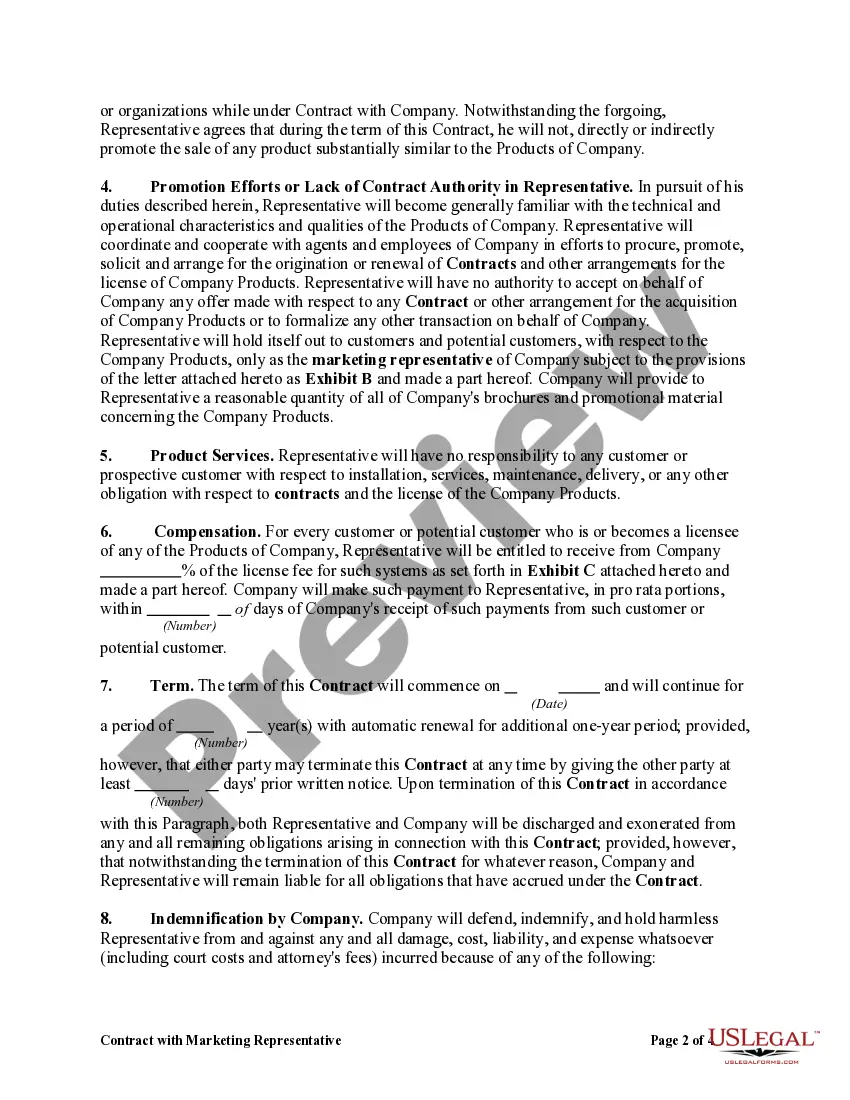

How to fill out Contract With Marketing Representative?

US Legal Forms - among the most prominent collections of legal documents in the United States - offers a wide range of legal document templates that you can download or create.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the North Carolina Contract with Marketing Representative in moments.

If you already have a registration, Log In to download the North Carolina Contract with Marketing Representative from the US Legal Forms library. The Acquire button will appear on every form you review.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Proceed with the purchase. Use your credit card or PayPal account to finalize the transaction.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you wish to utilize US Legal Forms for the first time, here are some simple tips to help you start.

- Ensure you have selected the appropriate form for your region/county.

- Click the Review button to inspect the form’s contents.

- Consult the form details to ensure you have selected the correct form.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

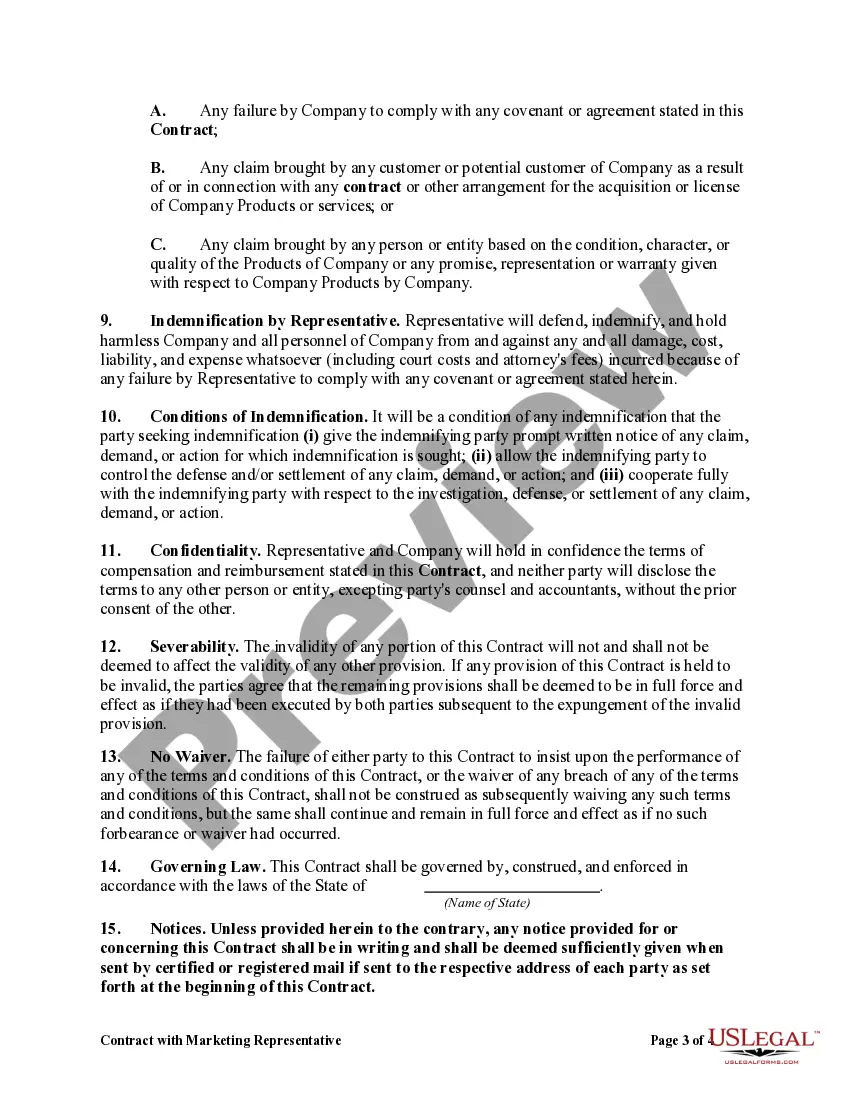

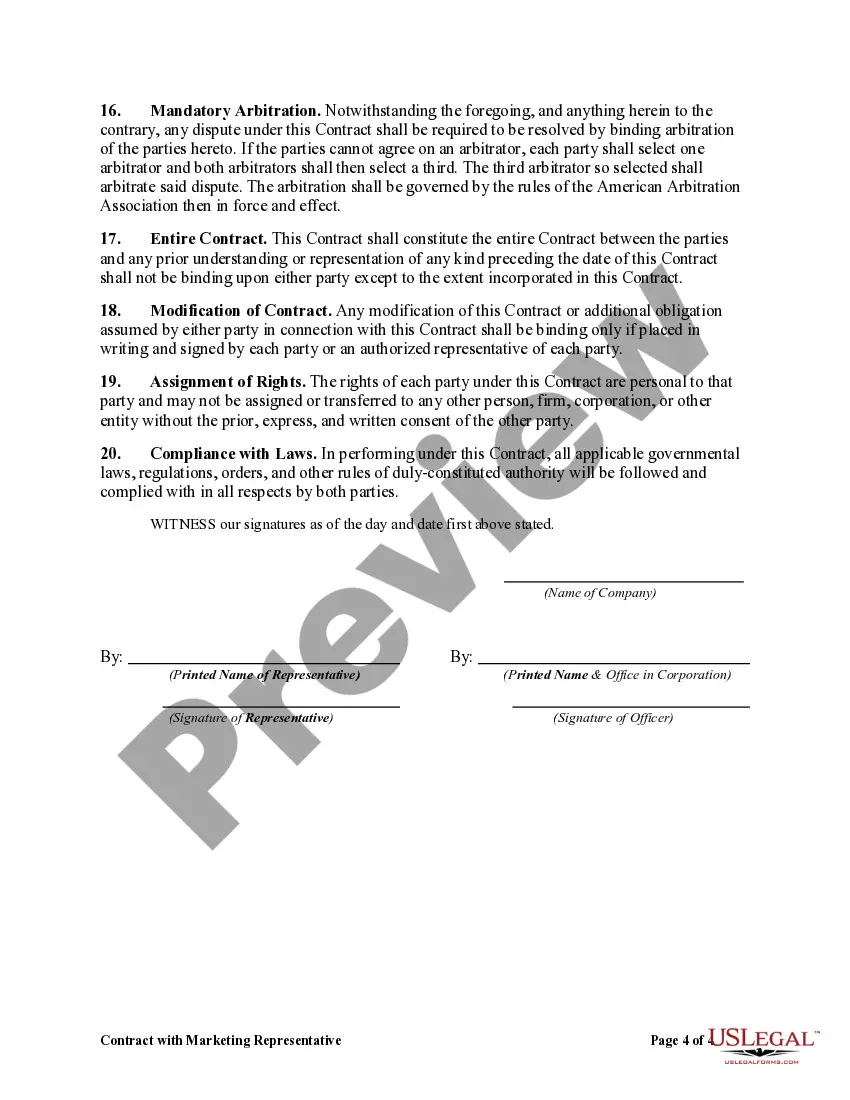

In North Carolina, all written agency agreements must include specific elements such as the names of the parties, the property details, the duration of the agreement, and the compensation structure. Additionally, it must clarify the nature of the relationship between the parties. Utilizing a North Carolina Contract with Marketing Representative ensures that your agreement is comprehensive and compliant with state regulations.

In North Carolina, a real estate sales contract does not mandate notarization to be legally binding. However, notarizing the document can provide an extra layer of protection and clarity during the transaction. Additionally, using a North Carolina Contract with Marketing Representative can streamline the process and emphasize the importance of clear documentation.

North Carolina is a market-based sourcing state, which means that income is taxed based on where the goods or services are delivered. This can significantly affect how businesses structure their contracts. If you're entering into a North Carolina contract with a marketing representative, consider how market-based sourcing impacts your sales and tax obligations.

North Carolina follows a destination-based sales tax system. This means that sales tax is based on the location of the purchaser, not the seller. When you draft a North Carolina contract with a marketing representative, understanding this tax structure is essential for compliance and accurate financial planning.

Not all states have marketplace facilitator laws, but many do, leading to varying regulations across the country. Some states require marketplace facilitators to collect sales tax, while others do not. When creating a North Carolina contract with a marketing representative, be aware of the state's specific requirements to comply with tax regulations.

In North Carolina, a contract is legally binding when it meets specific requirements, including an offer, acceptance, and mutual consideration. Additionally, both parties must have the capacity to enter into the agreement, and the contract must have a legal purpose. When drafting a North Carolina contract with a marketing representative, ensure that all these elements are present for the contract to be enforceable.

Yes, North Carolina is a marketplace facilitator state. This means that marketplace facilitators must collect and remit sales tax on behalf of the sellers using their platform. If you are entering into a North Carolina contract with a marketing representative, it is crucial to understand how this law impacts your sales strategy.

A typical sales commission contract includes information about the commission structure, performance expectations, and payment terms. It also typically specifies any non-compete clauses and conditions for termination. When drafting a North Carolina Contract with Marketing Representative, it is crucial to cover all these aspects to provide clarity and protection for both parties involved.

The amount of commission a sales rep should make can vary widely, depending on the industry and the specific terms of the contract. On average, sales representatives may earn a commission ranging from 5% to 20% of sales. For those establishing a North Carolina Contract with Marketing Representative, it is essential to assess competitive rates within the industry to ensure fairness and motivation.

In North Carolina, certain contracts, such as those for the sale of goods under a certain amount, do not need to be in writing to be enforceable. However, it is often beneficial to have a written agreement to clarify terms and expectations. When dealing specifically with a North Carolina Contract with Marketing Representative, having everything in writing is usually a good practice to avoid disputes.