North Carolina Security Agreement Regarding Aircraft and Equipment

Description

Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

How to fill out Security Agreement Regarding Aircraft And Equipment?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the website’s straightforward and efficient search function to find the documents you require.

A variety of templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to quickly find the North Carolina Security Agreement Regarding Aircraft and Equipment with just a few clicks.

Every legal document template you obtain is yours permanently. You can access any forms you saved within your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the North Carolina Security Agreement Regarding Aircraft and Equipment with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Get button to retrieve the North Carolina Security Agreement Regarding Aircraft and Equipment.

- You can also access forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific area/region.

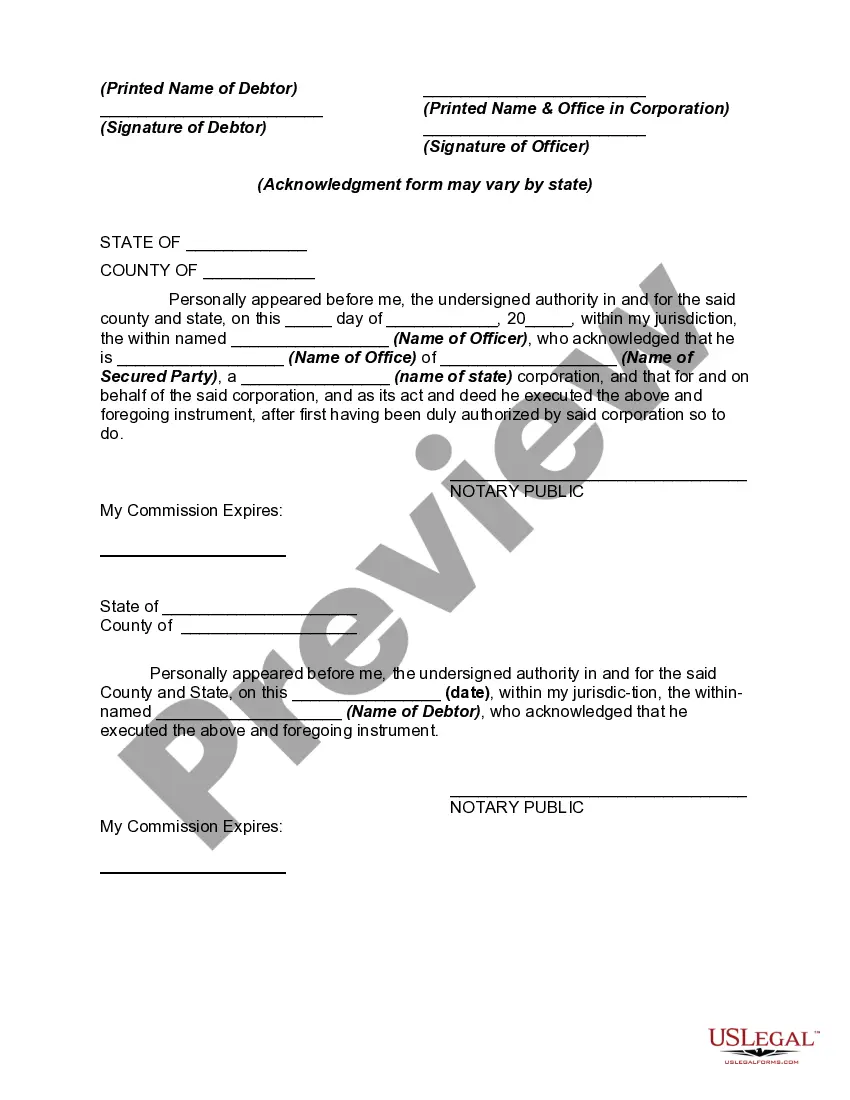

- Step 2. Use the Preview option to examine the form’s contents. Be sure to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Download now button. Choose your preferred pricing plan and input your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the North Carolina Security Agreement Regarding Aircraft and Equipment.

Form popularity

FAQ

While it is not mandatory to record a security agreement regarding aircraft in North Carolina, doing so can offer additional benefits. Recording provides public notice, which may prevent challenges to ownership and protect the lender’s rights. For best practices, consider recording the agreement to secure your interests and avoid future complications.

Several factors can render a security agreement invalid, such as lack of written documentation, failure to include essential terms, or if it does not comply with North Carolina law. Additionally, if the agreement is signed under duress or manipulation, it may also be considered invalid. Ensuring all legal protocols are followed will help maintain the integrity of your security agreement.

To create a valid security agreement in North Carolina, it must include a clear description of the collateral, identify the parties involved, and be signed by the debtor. Additionally, the agreement should comply with state laws regarding security interests. Adhering to these requirements strengthens the enforceability of the agreement in case of disputes.

Yes, for a North Carolina Security Agreement Regarding Aircraft and Equipment to be enforceable, it should be in writing. A written agreement clarifies the terms and conditions, which helps prevent misunderstandings in the future. Additionally, having a formal document provides a solid foundation for legal recourse if necessary.

For an aircraft to be legally operated in North Carolina, it must have a Certificate of Registration and a current Airworthiness Certificate. These documents ensure that the aircraft complies with safety regulations and is registered with the appropriate authorities. Keeping these documents onboard protects the owner and pilot in case of inspections.

In North Carolina, a security agreement regarding aircraft and equipment does not necessarily need to be recorded. However, recording it can provide public notice and additional protection for the lender's interest. It is advisable to document the agreement properly to avoid conflicts regarding ownership or rights, especially in situations of default.

Perfecting a security interest in aircraft involves filing a financing statement and ensuring registration with the FAA. You must provide all necessary documentation, including proof of ownership and any other required forms. By carefully following these steps, as outlined in a North Carolina Security Agreement Regarding Aircraft and Equipment, you can protect your investment effectively.

To perfect a security interest in an airplane, you should file a UCC-1 financing statement, detailing the airplane and your claim to it. Compliance with FAA regulations is also crucial, as registering the aircraft can affect your security rights. A North Carolina Security Agreement Regarding Aircraft and Equipment will guide you through this process smoothly.

To perfect a security interest in a fixture, ensure you file a financing statement that clearly describes the fixture in question. Additionally, check local laws to comply with any specific requirements for fixtures. This process is an important aspect of a North Carolina Security Agreement Regarding Aircraft and Equipment, as it creates a legal claim against the fixture.

When registering an aircraft sale, you need to submit four key items to the FAA: the bill of sale, the application for registration, proof of ownership, and any necessary tax documents. This filing ensures compliance with regulations under a North Carolina Security Agreement Regarding Aircraft and Equipment. These documents show the transfer of ownership and help protect your security interest.