Domicile Affidavit

Description

How to fill out North Carolina Affidavit Of Domicile For Deceased?

You can commit hrs online attempting to find the legal file web template which fits the federal and state specifications you require. US Legal Forms gives a huge number of legal types that happen to be analyzed by professionals. It is possible to download or produce the North Carolina Affidavit of Domicile for Deceased from your services.

If you currently have a US Legal Forms account, it is possible to log in and click on the Download switch. Following that, it is possible to comprehensive, edit, produce, or sign the North Carolina Affidavit of Domicile for Deceased. Every legal file web template you get is your own forever. To have one more duplicate of any purchased type, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms web site the very first time, follow the straightforward directions beneath:

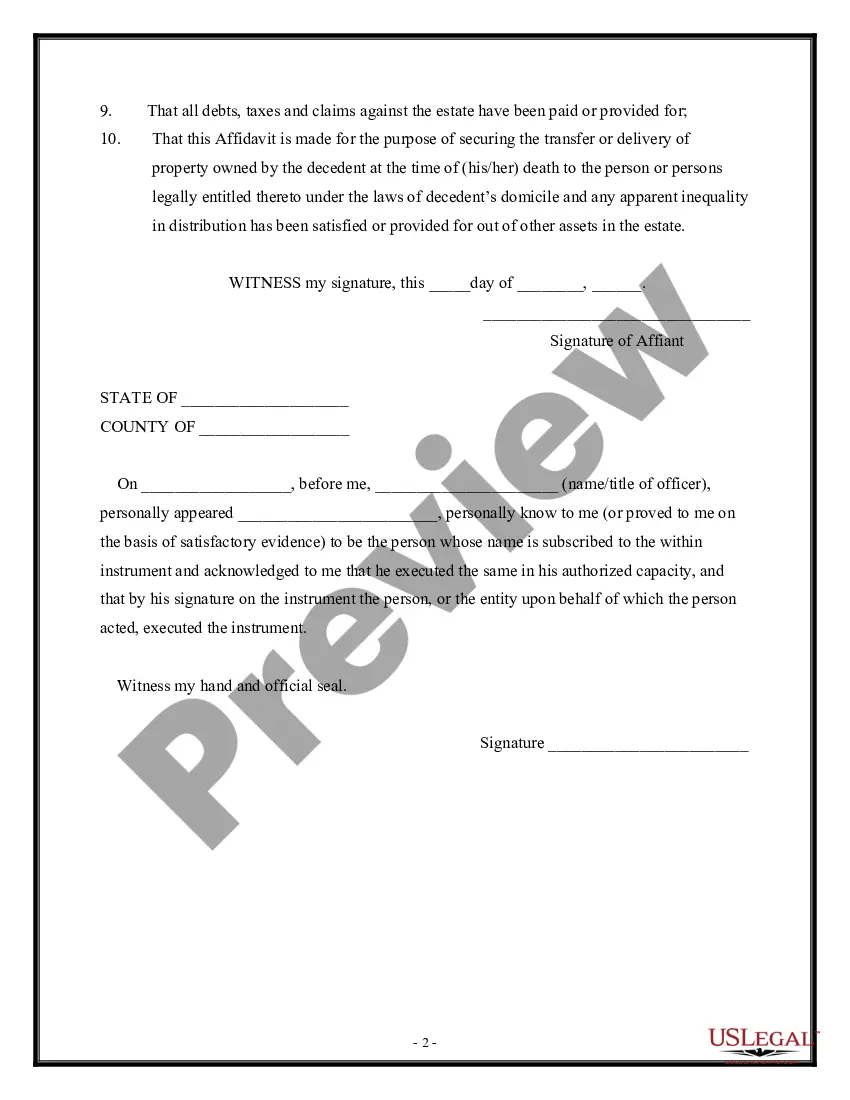

- First, make certain you have selected the best file web template for your state/city of your choice. Browse the type outline to ensure you have picked out the proper type. If offered, take advantage of the Review switch to appear from the file web template as well.

- If you would like locate one more variation from the type, take advantage of the Look for discipline to obtain the web template that fits your needs and specifications.

- Upon having discovered the web template you want, click on Acquire now to proceed.

- Select the rates program you want, key in your references, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal account to pay for the legal type.

- Select the format from the file and download it in your device.

- Make alterations in your file if necessary. You can comprehensive, edit and sign and produce North Carolina Affidavit of Domicile for Deceased.

Download and produce a huge number of file web templates utilizing the US Legal Forms website, that provides the most important variety of legal types. Use expert and state-specific web templates to tackle your organization or person needs.

Form popularity

FAQ

The most useful tool we use to avoid probate is a revocable ?living? trust. A trust is an entity that holds property for the use of individuals known as beneficiaries. The property in the trust is managed by a trustee, but the trustee does not get to use the property for their own benefit.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

Joint tenancy ownership ? If you have assets such as bank accounts or a home or vehicle, adding one or more names to the account or title will allow that individual (or those individuals) to take full ownership of the asset after your death without having to undergo probate.

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding.

Under North Carolina law (NC General Statutes § 28A-25-1), you can opt to use a small estate affidavit instead of probate if the total value of the assets covered by probate are less than $20,000 or less than $30,000 if the spouse is the only heir.

Administering an uncontested probate and estate administration in North Carolina generally takes between six months to a year. The process and time involved can vary depending upon the nature and complexity of the Estate.

Spouse with No Descendants If you die without a will and have a spouse but no children, your spouse will be entitled to the first $100,000 of your personal property and half of your real estate. Your parents will be entitled to the other half of the real estate and personal property.

The most useful tool we use to avoid probate is a revocable ?living? trust. A trust is an entity that holds property for the use of individuals known as beneficiaries. The property in the trust is managed by a trustee, but the trustee does not get to use the property for their own benefit.