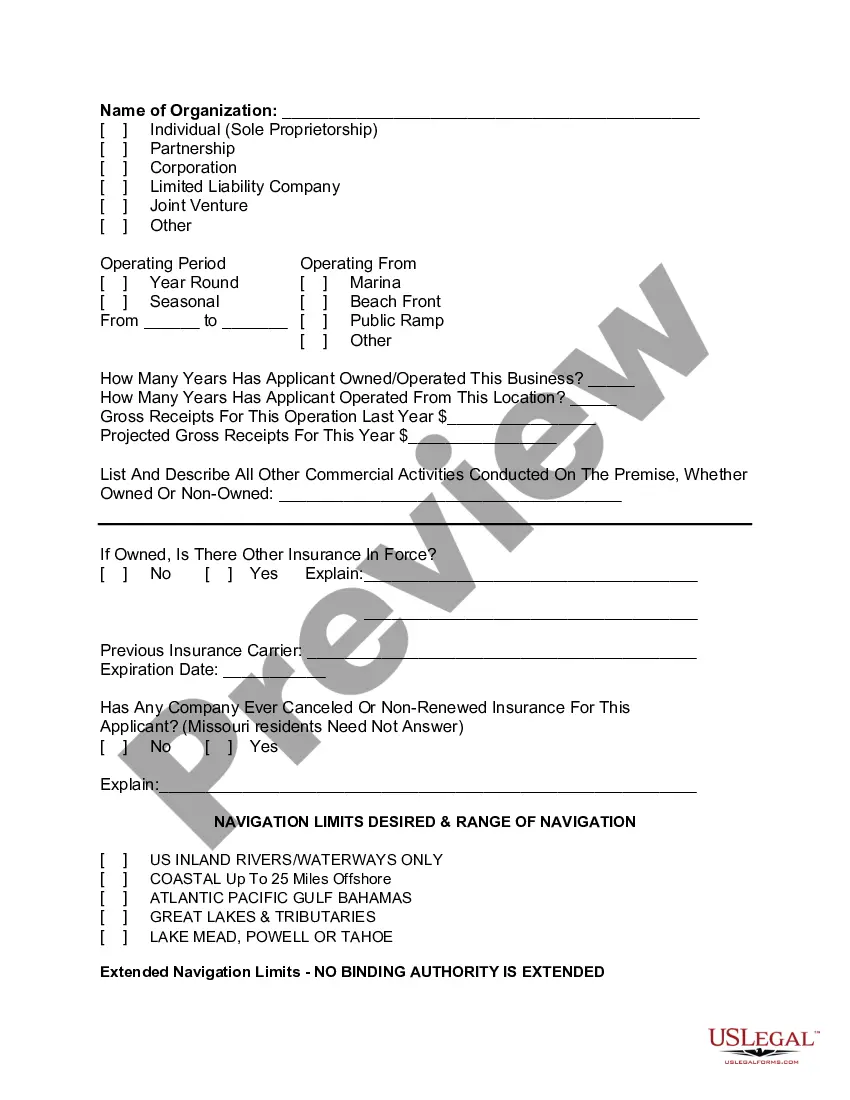

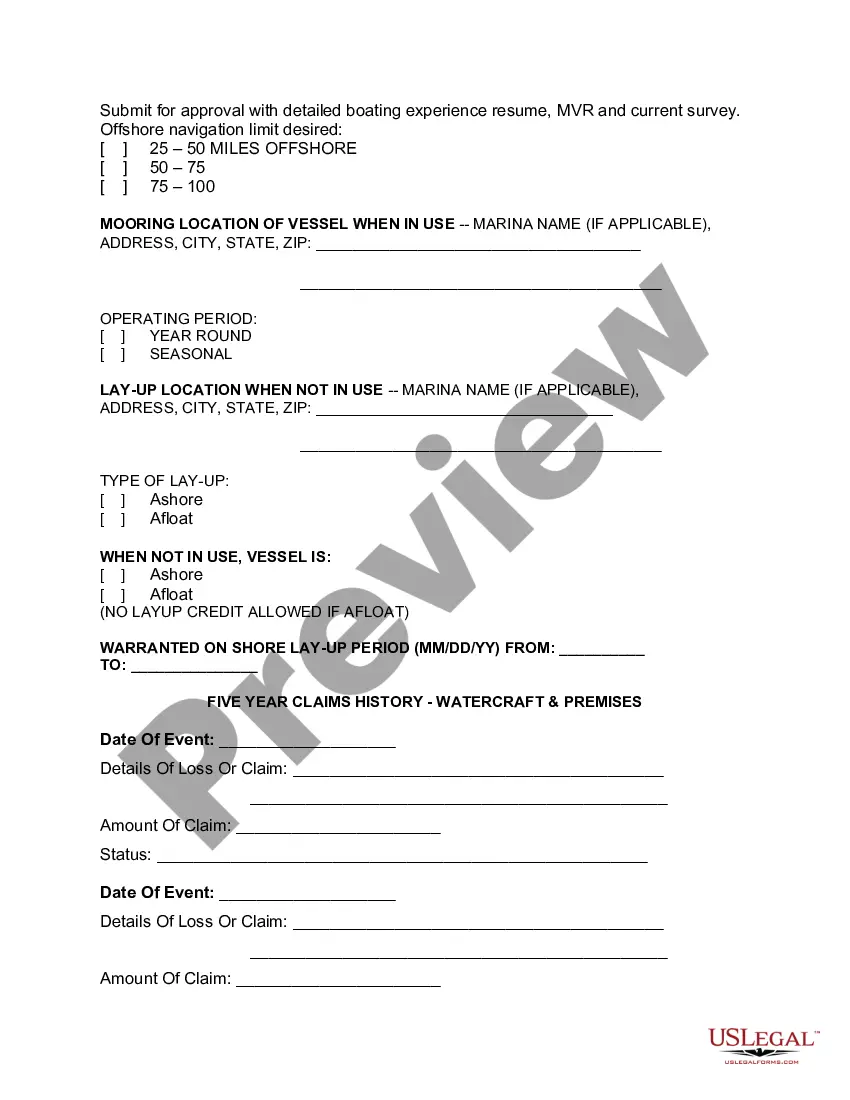

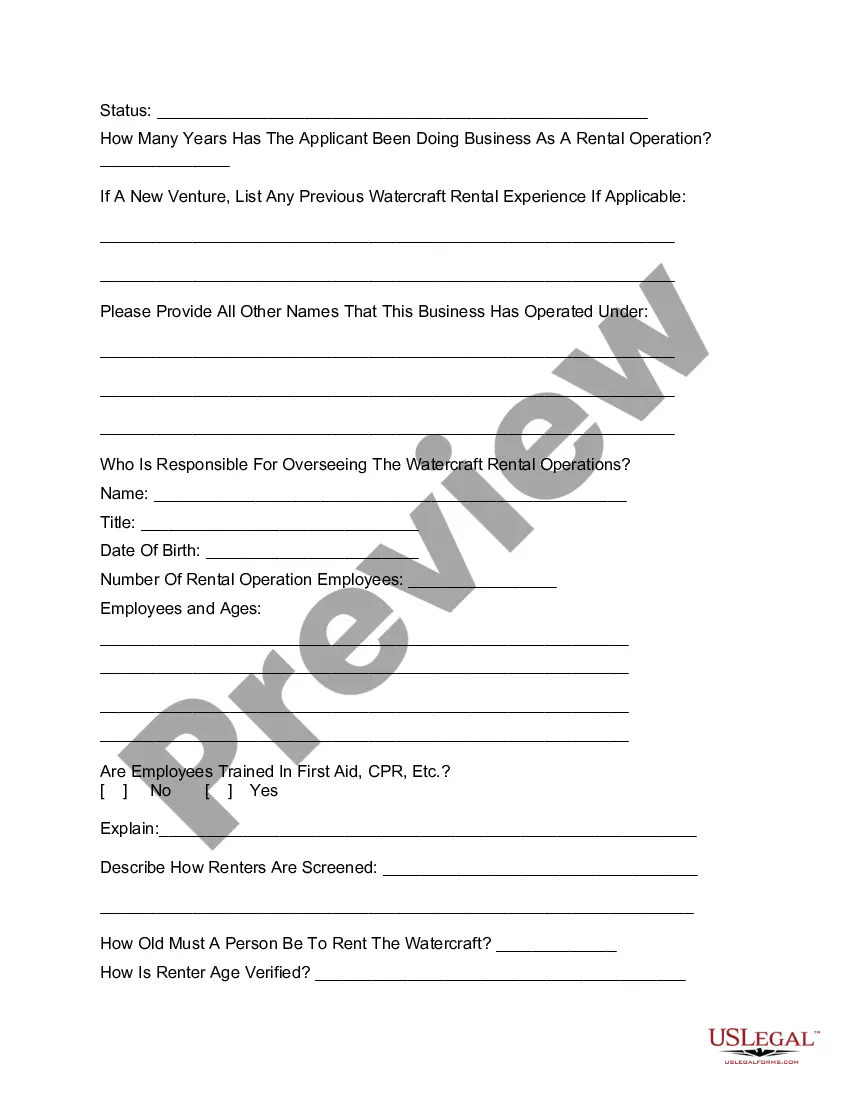

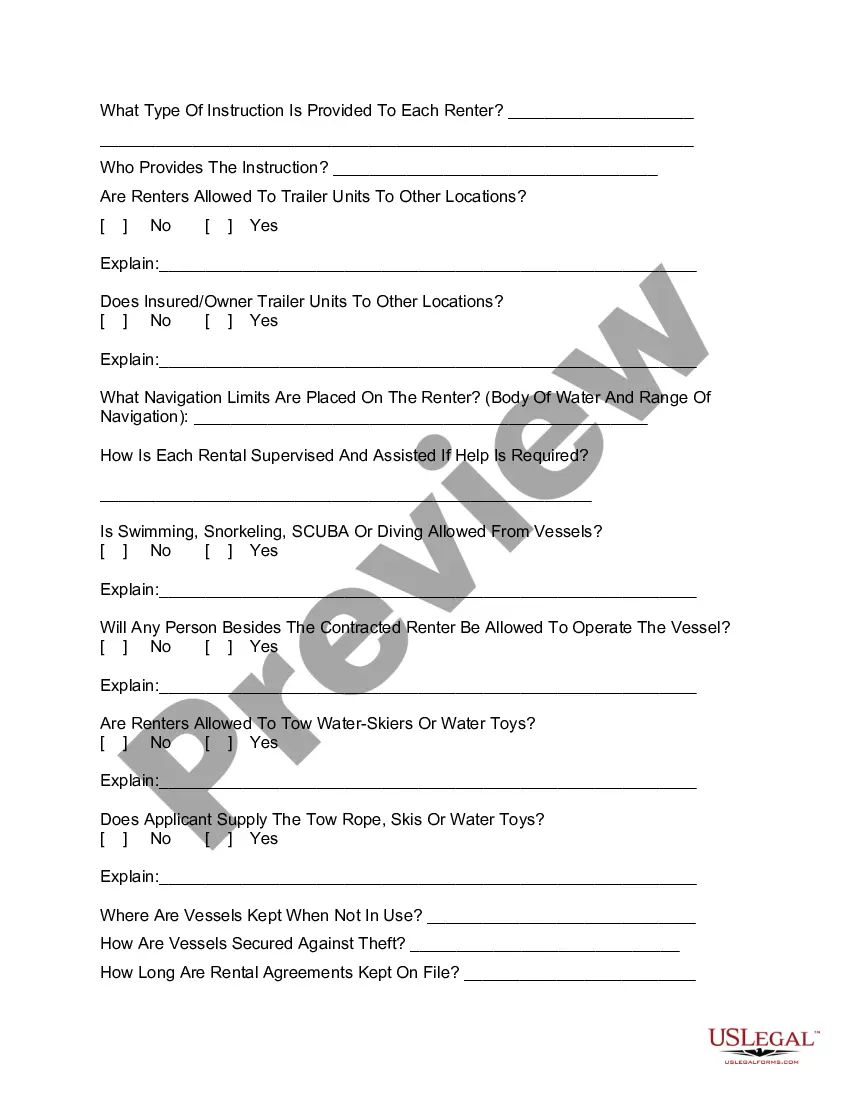

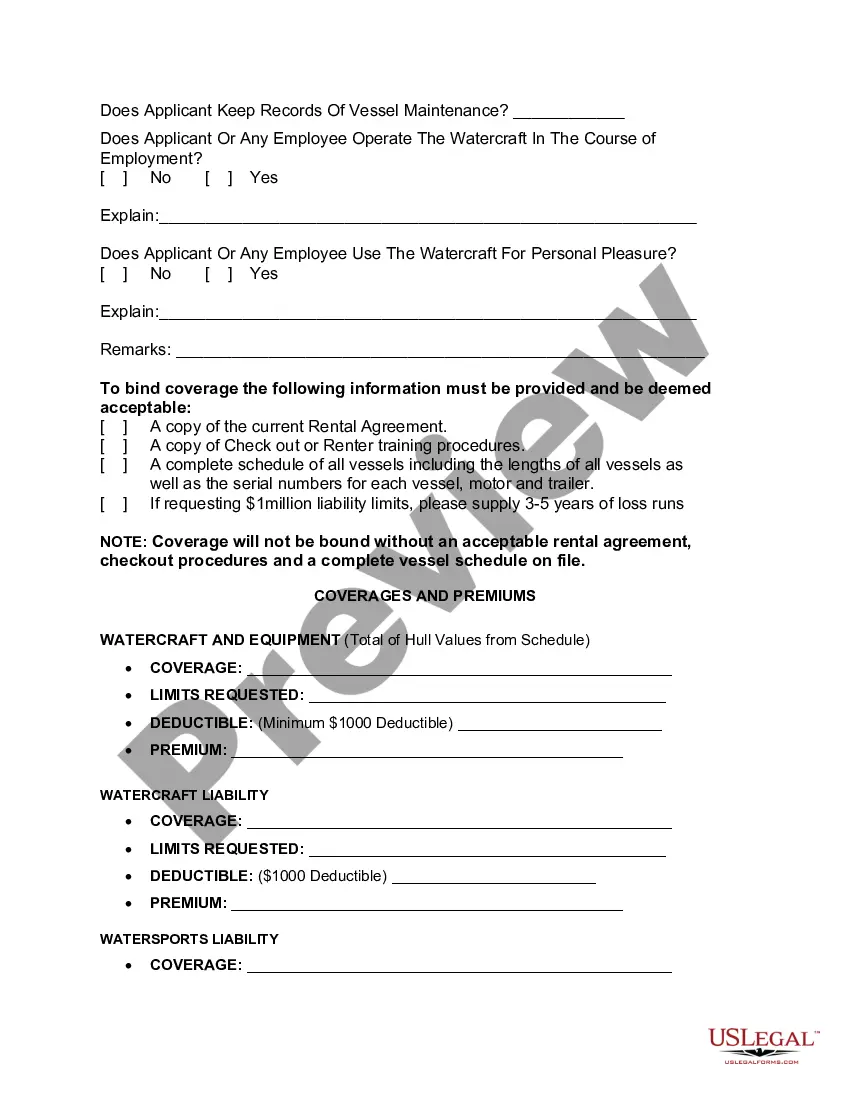

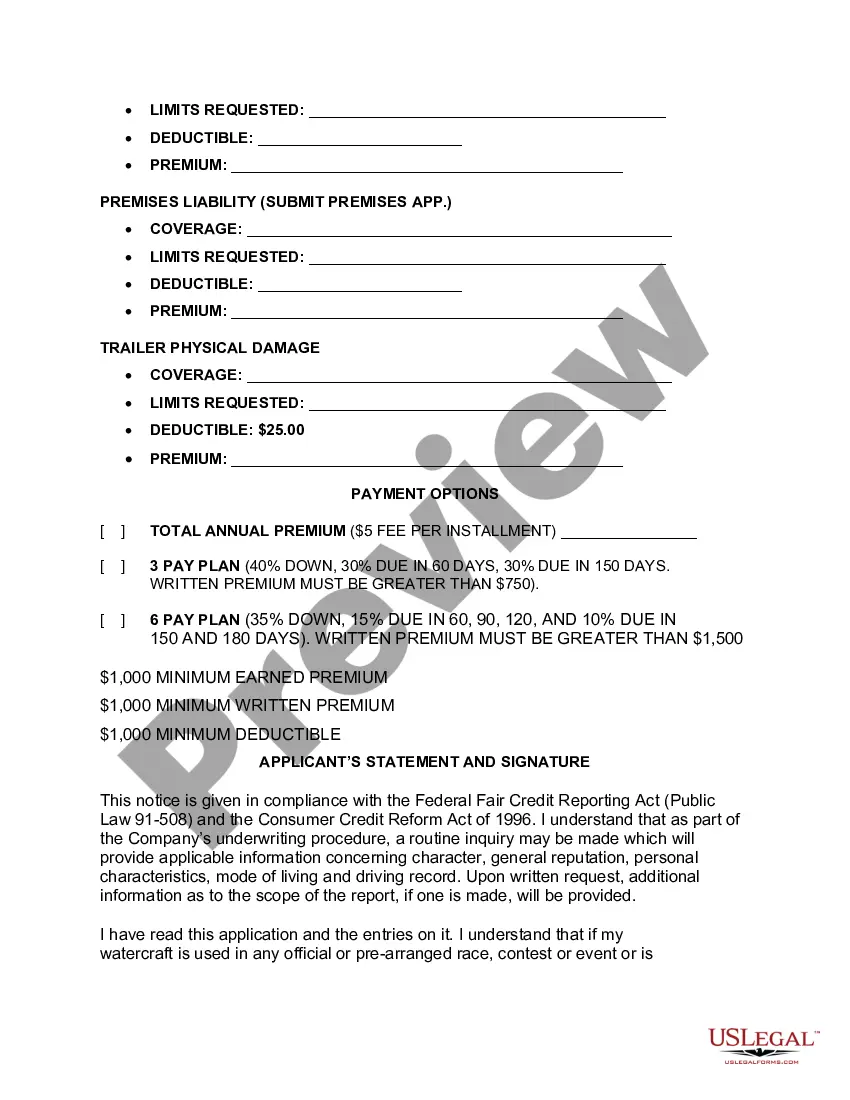

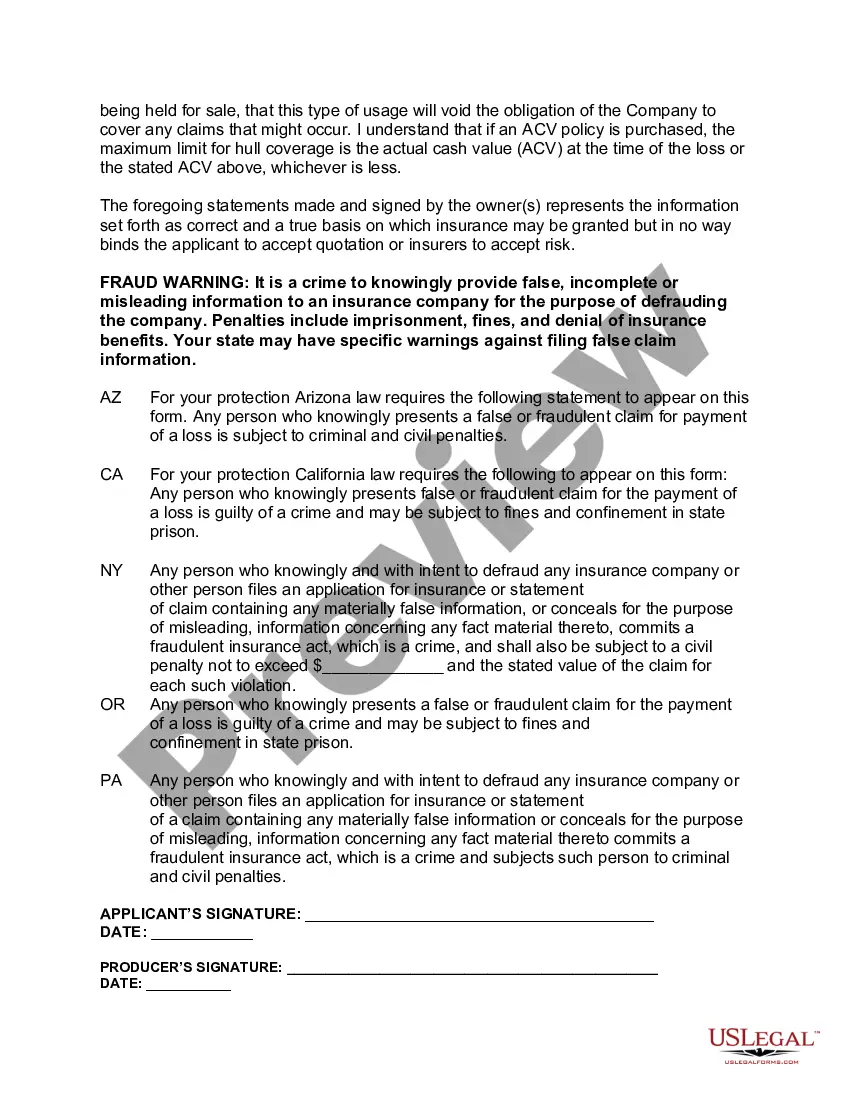

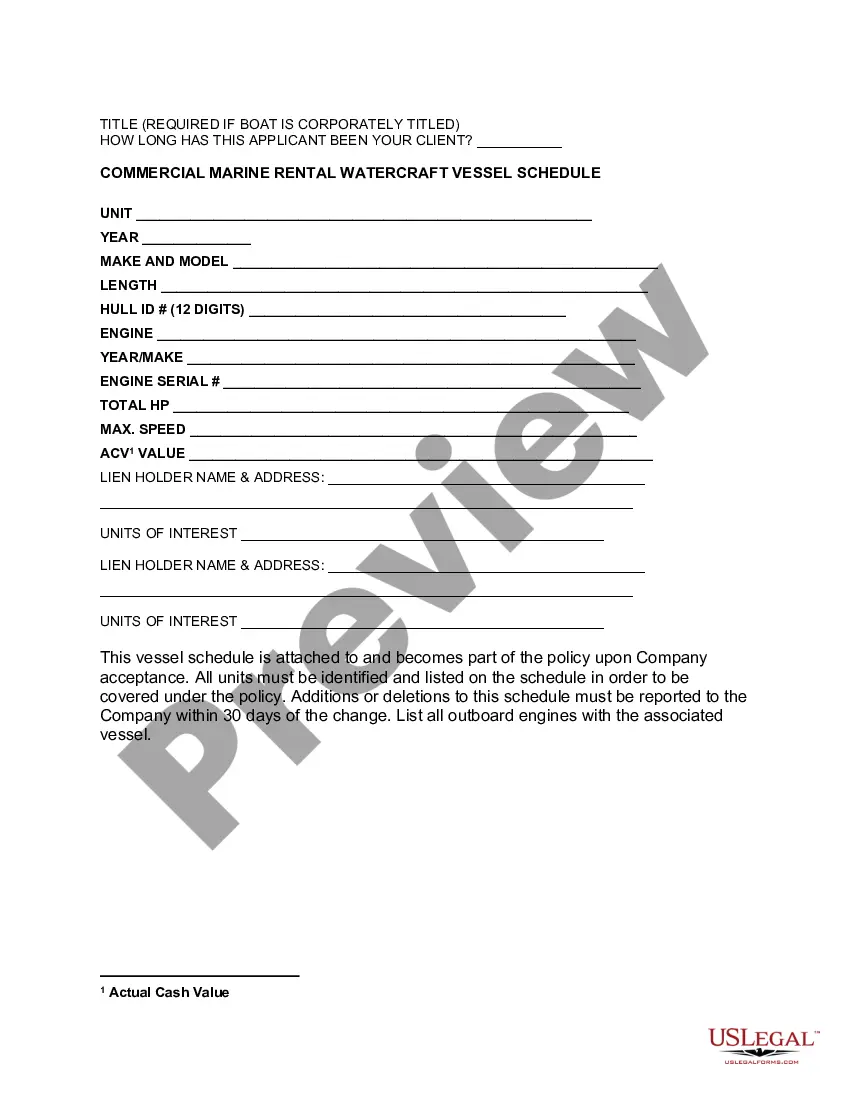

North Carolina Commercial Watercraft Rental Insurance Application is a specific form or document required by insurance providers in the state of North Carolina to obtain insurance coverage for commercial watercraft rentals. This application is designed to gather information about the rental business, watercraft details, and other crucial factors to calculate the insurance policy premium accurately. Commercial watercraft rental businesses are required to have insurance coverage to protect themselves and their customers in case of accidents, property damage, or other liabilities that may arise during the rental period. To apply for this insurance, business owners need to complete the North Carolina Commercial Watercraft Rental Insurance Application. Keywords: North Carolina, commercial watercraft rental insurance, application, insurance providers, rental business, watercraft details, insurance coverage, premium, accidents, property damage, liabilities. Different types of North Carolina Commercial Watercraft Rental Insurance Application may include: 1. General Liability Insurance Application: This type of application focuses on gathering information related to general liability coverage for commercial watercraft rental businesses. It includes details about the business operations, customer interactions, and liability risk factors. 2. Property Insurance Application: If business owners want coverage for the physical assets involved in their commercial watercraft rental operations, they will need to fill out a specific application for property insurance. This application will require information about the location, storage facilities, and condition of the watercraft. 3. Hull Insurance Application: Hull insurance protects the watercraft itself from physical damage or loss. Business owners interested in this type of coverage will need to complete a separate application specifically for hull insurance. This application may gather information such as the vessel's type, age, value, and desired coverage limits. 4. Liability Waiver Application: In addition to the insurance coverage, rental businesses may also require customers to sign liability waivers or releases. Although not directly related to the insurance application process, these waivers play a crucial role in mitigating potential liabilities. Such applications may include relevant legal language and information specific to the business. Keywords: General Liability Insurance, Property Insurance, Hull Insurance, Liability Waiver, commercial watercraft rental, application, insurance coverage, rental business, liability risk factors, physical damage, loss.

North Carolina Commercial Watercraft Rental Insurance Application

Description

How to fill out North Carolina Commercial Watercraft Rental Insurance Application?

Are you presently in the position the place you need to have documents for either enterprise or person reasons nearly every time? There are a lot of legal record layouts available on the Internet, but finding types you can rely on isn`t easy. US Legal Forms provides thousands of type layouts, much like the North Carolina Commercial Watercraft Rental Insurance Application, that are created in order to meet federal and state demands.

If you are already knowledgeable about US Legal Forms site and get your account, just log in. Afterward, you can acquire the North Carolina Commercial Watercraft Rental Insurance Application web template.

If you do not provide an profile and need to begin to use US Legal Forms, abide by these steps:

- Obtain the type you will need and ensure it is for that right area/region.

- Utilize the Review option to review the shape.

- Browse the outline to actually have chosen the right type.

- When the type isn`t what you`re looking for, take advantage of the Research field to get the type that meets your needs and demands.

- If you discover the right type, just click Buy now.

- Pick the costs plan you want, fill in the specified details to create your account, and purchase an order utilizing your PayPal or credit card.

- Decide on a hassle-free data file file format and acquire your backup.

Discover all of the record layouts you have bought in the My Forms menu. You can get a extra backup of North Carolina Commercial Watercraft Rental Insurance Application anytime, if possible. Just click the needed type to acquire or printing the record web template.

Use US Legal Forms, probably the most substantial assortment of legal forms, to save time as well as prevent faults. The support provides professionally produced legal record layouts which can be used for an array of reasons. Create your account on US Legal Forms and begin producing your way of life a little easier.