This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

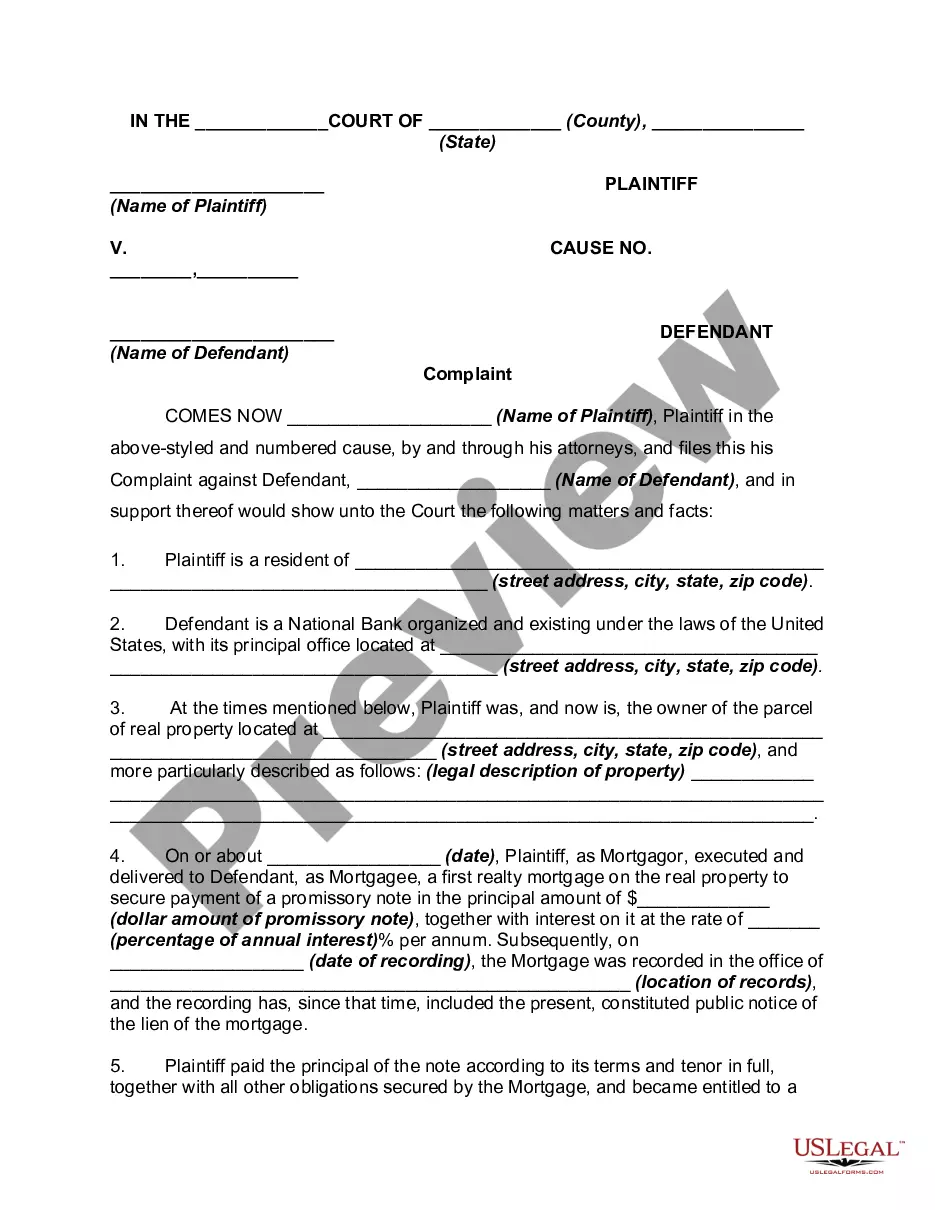

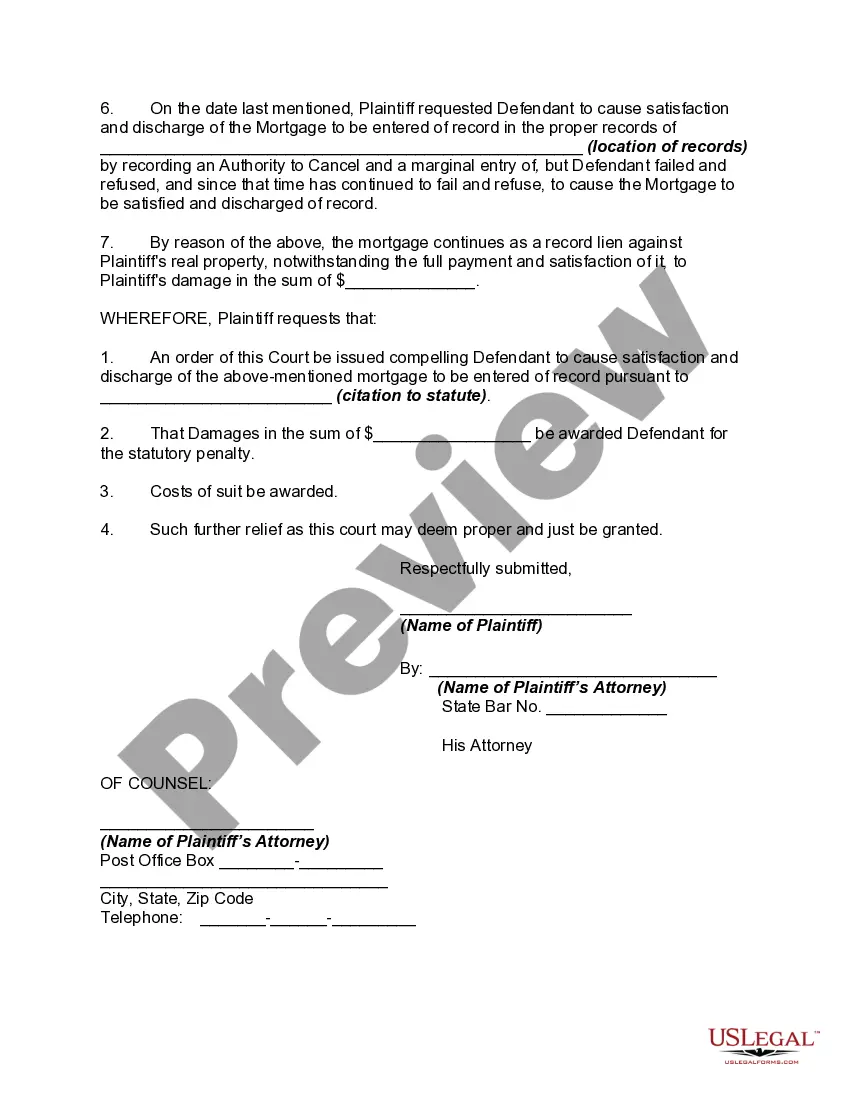

North Carolina Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

Have you been inside a situation in which you require documents for both enterprise or person purposes just about every working day? There are a variety of authorized file templates available on the Internet, but getting ones you can depend on isn`t effortless. US Legal Forms gives a large number of develop templates, just like the North Carolina Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage, which can be created to meet federal and state demands.

In case you are currently acquainted with US Legal Forms internet site and possess an account, basically log in. Following that, it is possible to acquire the North Carolina Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage format.

Should you not offer an accounts and want to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is for that proper metropolis/area.

- Take advantage of the Review option to analyze the shape.

- See the outline to actually have chosen the correct develop.

- In the event the develop isn`t what you are trying to find, take advantage of the Research field to discover the develop that meets your requirements and demands.

- Once you get the proper develop, simply click Get now.

- Opt for the costs plan you want, complete the necessary information to make your money, and pay for your order with your PayPal or credit card.

- Decide on a hassle-free document file format and acquire your duplicate.

Get every one of the file templates you might have bought in the My Forms food list. You can obtain a additional duplicate of North Carolina Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage anytime, if needed. Just go through the needed develop to acquire or printing the file format.

Use US Legal Forms, one of the most substantial collection of authorized types, to save time as well as steer clear of errors. The service gives expertly made authorized file templates which can be used for a selection of purposes. Make an account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

The statute applies the ten year period tothe foreclosure of a mortgage, or deed in trust for creditors with a power of sale,of real property, where the mortgagor or grantor has been in possession of the property, within ten years after the forfeiture of the mortgage, or after the power of sale became absolute, or ...

What Are the Options Available for Borrowers During Foreclosure in North Carolina? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before or after the sale, or filing for bankruptcy.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

A deed in lieu of foreclosure is when the mortgage loan servicer and/or mortgage loan holder agrees to accept the deed to the house (accept full legal and actual ownership of the house), typically in return for allowing the homeowner to walk away free and clear of any further obligations.

(a) Except as provided in subsection (b), no person shall exercise any power of sale contained in any mortgage or deed of trust, or provided by statute, when an action to foreclose the mortgage or deed of trust, is barred by the statute of limitations.

The statute applies the ten year period tothe foreclosure of a mortgage, or deed in trust for creditors with a power of sale,of real property, where the mortgagor or grantor has been in possession of the property, within ten years after the forfeiture of the mortgage, or after the power of sale became absolute, or ...

A power of sale foreclosure is a contractual right under the terms of a deed of trust which gives the trustee the power to sell the real property on behalf of the lender if the borrower defaults. The procedure for power of sale foreclosure is contained in Article 2A in Chapter 45 of the North Carolina General Statutes.