North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets refers to a legal document that outlines a transfer of assets from a corporation to another entity. This process usually occurs when a corporation decides to sell all or a significant portion of its assets to another business or entity. It is an essential part of the overall transaction as it provides a legal framework for transferring ownership of assets and protects the rights and interests of all parties involved. The North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets typically includes several key components and information. These may include: 1. Parties Involved: The bill of sale should clearly identify the names and contact information of the corporation (seller) and the entity acquiring the assets (buyer). It should also highlight the effective date of the agreement. 2. Description of Assets: A detailed description of the assets being transferred should be included. This can range from tangible assets like real estate, equipment, inventory, and vehicles to intangible assets such as patents, trademarks, copyrights, and contracts. The description should be comprehensive to ensure all assets are adequately transferred. 3. Purchase Price and Payment Terms: The bill of sale should specify the purchase price agreed upon by both parties, along with the payment terms and conditions. This includes details regarding the mode of payment, any installments or deposits, and the timeline for completing the payment. 4. Representations and Warranties: The bill of sale may contain representations and warranties provided by the corporation to the buyer. These assurances ensure that the assets being sold are free from any encumbrances or liabilities and that the corporation has the legal authority to conduct the transaction. 5. Assumption of Liabilities: If the buyer is assuming any existing liabilities associated with the assets, such as loans, contracts, or legal obligations, it should be explicitly stated in the bill of sale. 6. Governing Law: This section identifies North Carolina state law as the governing law for the bill of sale, ensuring that any disputes are resolved according to the state's legal framework. Different types of North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets may vary depending on the nature and complexity of the transaction. Some common variations include: 1. Short Form Bill of Sale: This type of bill of sale may be used for simpler asset transfers where only a few assets are involved, or when the transaction does not require detailed formalities. 2. Long Form Bill of Sale: For more complex transactions involving numerous assets, this type of bill of sale provides a comprehensive and detailed outline of the assets being transferred, the terms of the sale, and the rights and responsibilities of each party. In summary, the North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that facilitates the transfer of assets from a corporation to another entity. It ensures the smooth transfer of ownership, outlines the terms of the transaction, and protects the rights of both the seller and the buyer.

North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets

Description

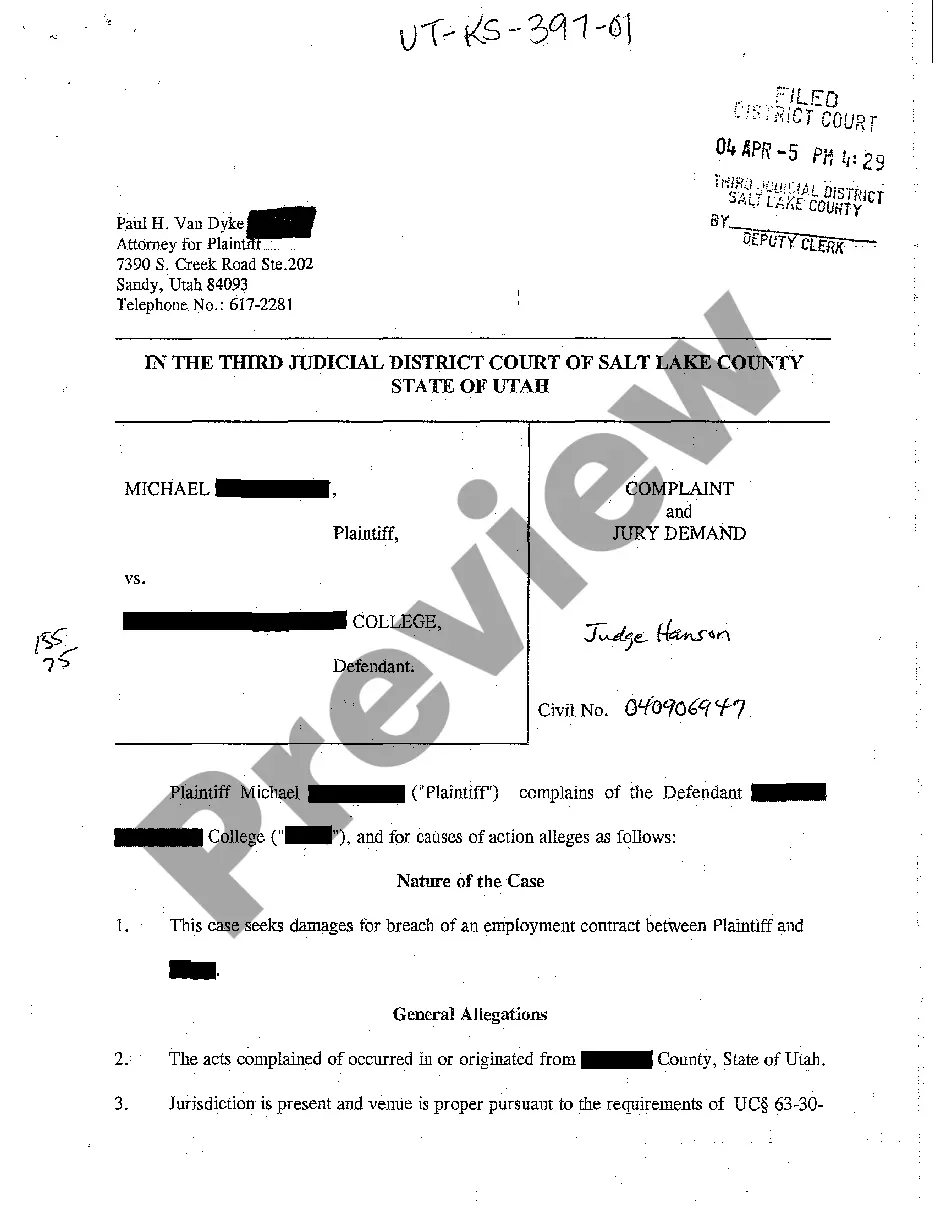

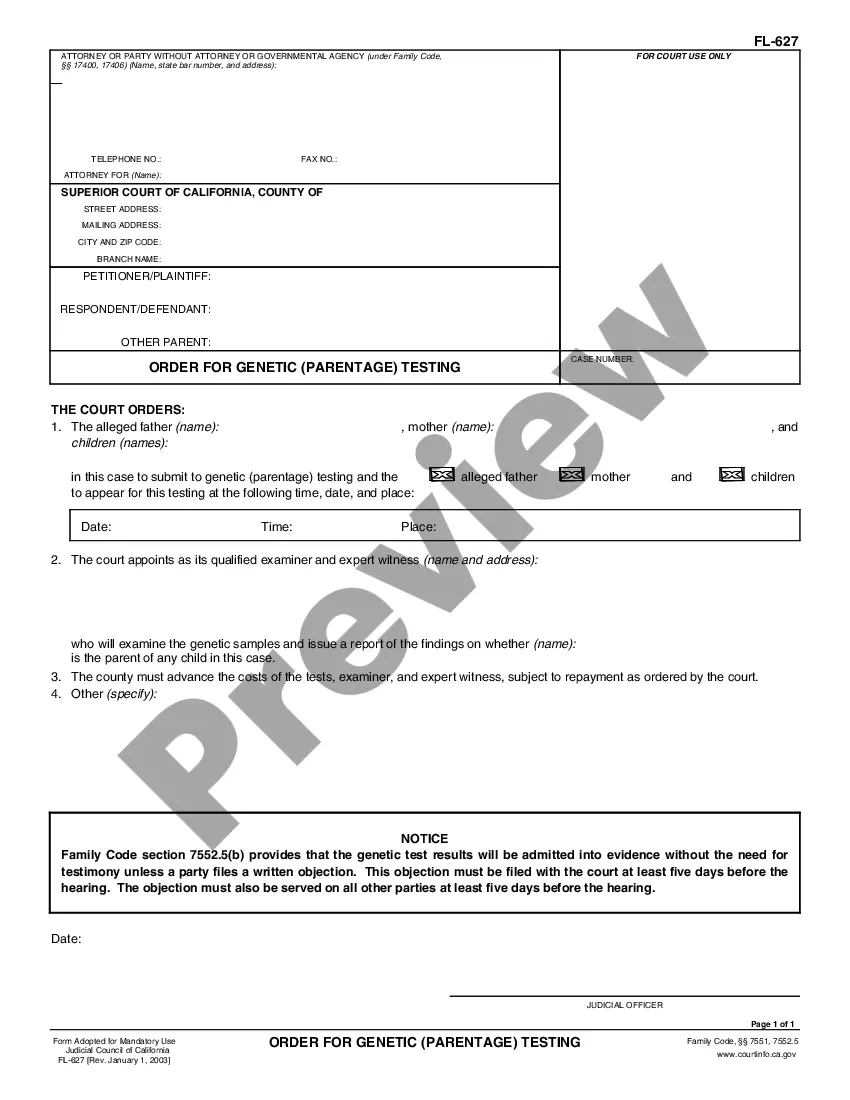

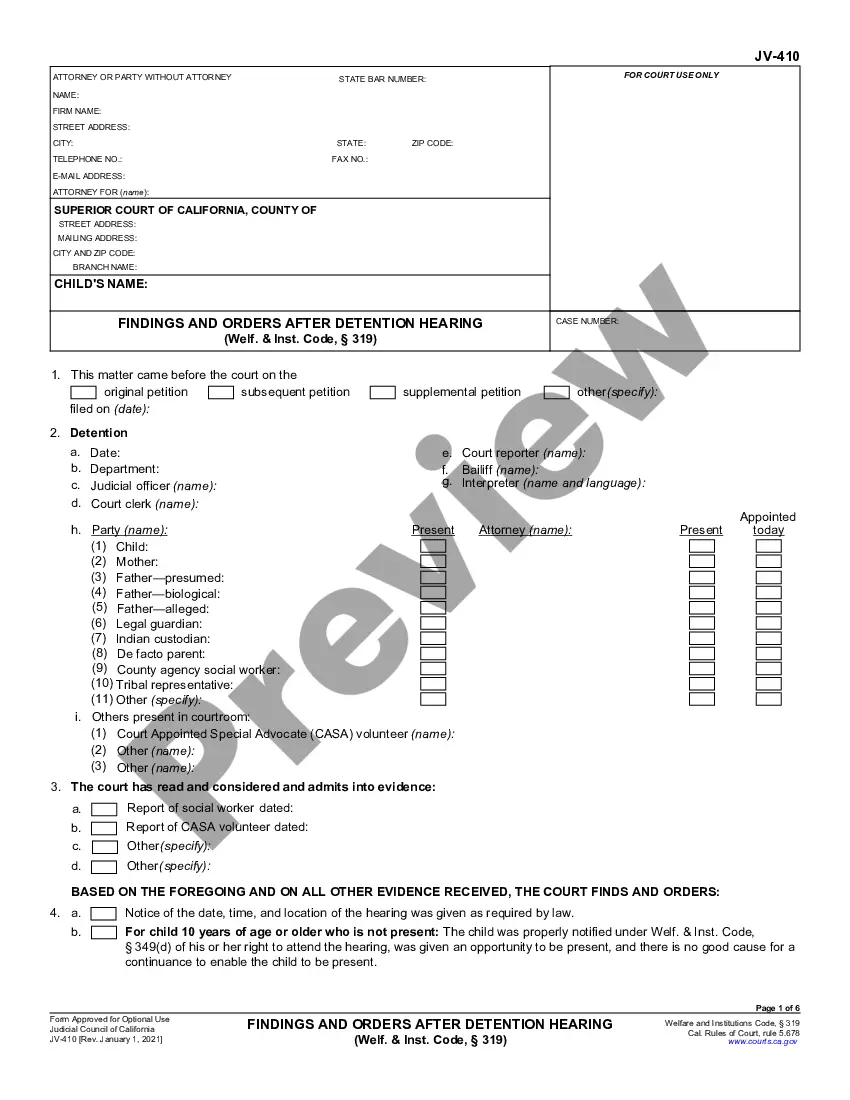

How to fill out North Carolina Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Are you currently in the position in which you require documents for either company or personal purposes virtually every time? There are a variety of legal file themes accessible on the Internet, but discovering types you can rely on isn`t easy. US Legal Forms gives thousands of develop themes, just like the North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, that happen to be published to satisfy federal and state needs.

When you are previously informed about US Legal Forms web site and get a merchant account, simply log in. Next, you may down load the North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets design.

If you do not have an profile and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for the appropriate city/area.

- Utilize the Preview key to check the shape.

- Browse the description to ensure that you have selected the appropriate develop.

- In case the develop isn`t what you are seeking, use the Lookup field to obtain the develop that fits your needs and needs.

- Once you obtain the appropriate develop, click Acquire now.

- Select the rates program you desire, fill out the desired information to produce your account, and buy the transaction with your PayPal or Visa or Mastercard.

- Decide on a hassle-free document file format and down load your copy.

Get all the file themes you may have bought in the My Forms food selection. You can obtain a extra copy of North Carolina Bill of Sale by Corporation of all or Substantially all of its Assets whenever, if necessary. Just click the necessary develop to down load or printing the file design.

Use US Legal Forms, the most extensive assortment of legal forms, in order to save time as well as prevent blunders. The service gives professionally produced legal file themes that you can use for a variety of purposes. Create a merchant account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

In an asset sale, sellers are subject to potentially higher taxes than in a stock sale. While intangible assets, such as goodwill, are taxed at capital gains rates, other hard assets may be taxed at higher ordinary income tax rates. Currently, federal capital gains rates are around 20%, while state rates vary.

Sale of all or substantially all of the assets means the sale, lease, transfer, conveyance or other disposition in one or more related transactions (other than by way of merger or consolidation by the Company) of assets of the Company and its Restricted Subsidiaries equal to at least 80% of Total Assets.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets.

For IRS ruling purposes, substantially all means 90% of the net assets and 70% of the gross assets, while courts have applied a facts-and-circumstances test focused on operating assets.

The term "Substantial Amount" shall mean an amount of stock, securities or other assets or property having a Fair Market Value equal to ten percent (10%) or more of the Fair Market Value of the total consolidated assets of the Corporation and its Subsidiaries taken as a whole as of the end of the most recent fiscal

What is included in your contract will differ based on your circumstances, but a starting agreement should include:Party information.Definitions.Purchased assets.Purchase price.Additional covenants.Warranties or disclaimers.Indemnification.Breach of contract provisions.More items...

12 provides that a sale or disposal of corporate property and assets amounting to at least 51% of the corporation's total assets shall be considered a sale of all or substantially all of the corporate property and assets, whether such sale accrued in a single transaction or in several transactions taking place within

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Substantially all when used in relation to assets, means assets of the relevant entity or entities having a market value of at least 75% of the market value of all of the assets of such entity or entities at the date of the relevant transactions.