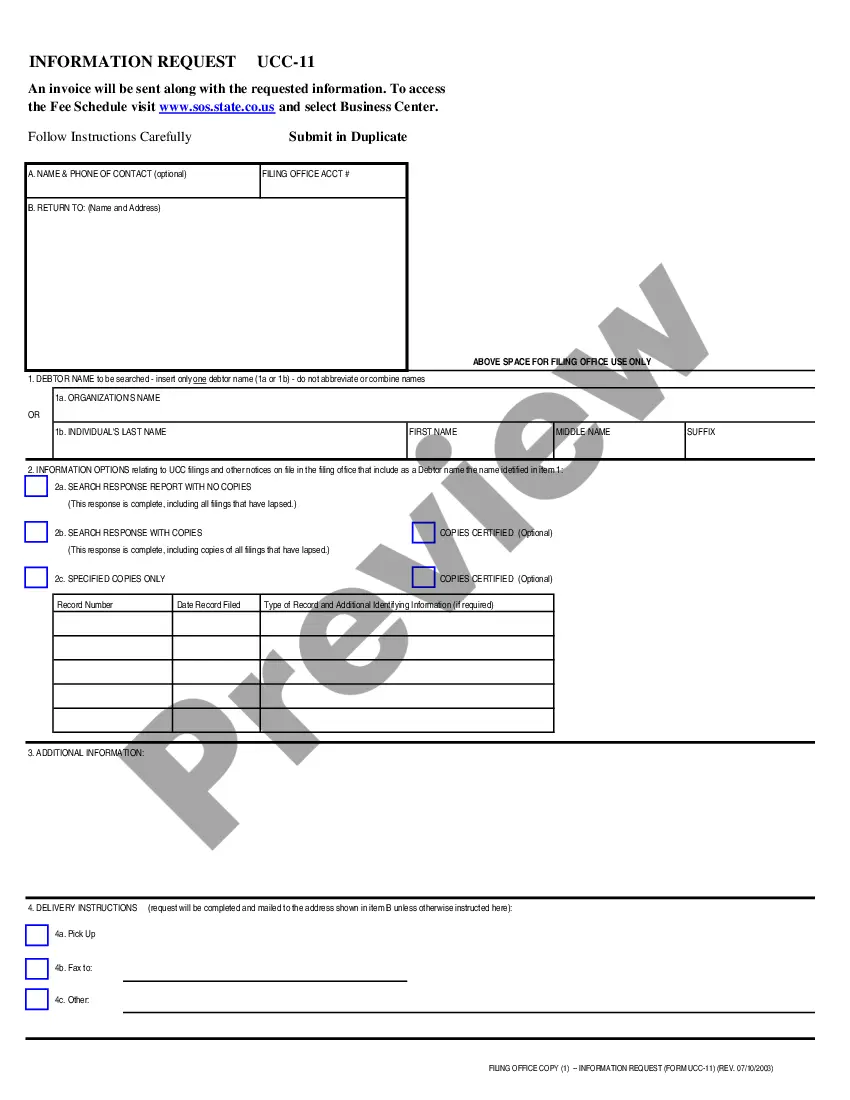

This form is a sample business credit application that can be used to take information from a business seeking a loan.

Title: North Carolina Business Credit Application: Understanding and Types Introduction: The North Carolina Business Credit Application serves as a vital tool for businesses operating within the state to apply for credit from financial institutions or other lending entities. This comprehensive form requires detailed information about the business, enabling lenders to assess creditworthiness and make informed decisions regarding extending credit facilities. In this article, we will delve into the purpose, essential elements, and various types of North Carolina Business Credit Applications. 1. Purpose of a North Carolina Business Credit Application: The primary objective of the North Carolina Business Credit Application is to allow businesses to request credit from lending institutions. Whether it's for working capital, purchasing inventory, expanding operations, or meeting short-term financial needs, these applications are instrumental in enabling businesses to secure the necessary funds. 2. Essential Elements of North Carolina Business Credit Application: To provide a comprehensive understanding, the North Carolina Business Credit Application typically includes the following key sections: a. Business Information: Applicants must furnish details such as business name, legal structure, tax ID number, contact information, and years in operation. Furthermore, it may require specifying the business's primary industry, number of employees, and annual revenue. b. Financial Information: This section necessitates divulging financial details, including bank account information, average monthly balances, outstanding loans, credit references, and financial statements (income statement, balance sheet, and cash flow statement). c. Ownership and Management Details: Applicants must provide information about the business's ownership structure, including names, titles, ownership percentages, and personal financial details of all owners or partners. Additionally, it may require details about the board of directors and key management personnel. d. Trade References and Suppliers: Lenders often seek to evaluate the business's payment history and credibility. Hence, applicants are required to provide trade references, including supplier names, contacts, and credit terms previously extended. e. Purpose and Loan Details: Applicants must specify the purpose of the requested credit, desired loan amount, proposed collateral (if any), and the intended term. This section also covers details about existing loans or lines of credit. 3. Types of North Carolina Business Credit Applications: The North Carolina Business Credit Applications may vary based on the lending institution, purpose, and specific requirements. Some types include: a. General Business Credit Application: This standard application format caters to businesses seeking credit from banks, credit unions, or general lending institutions. It encompasses all essential elements of a credit application. b. Small Business Administration (SBA) Loan Application: Designed specifically for businesses seeking SBA loans, this type of application requires additional information customized as per SBA's guidelines and criteria. c. Vendor/Supplier Credit Application: This application is utilized by businesses seeking credit from specific vendors or suppliers to facilitate purchases on credit terms. It might require specific trade references and supplier-related information. Conclusion: In conclusion, the North Carolina Business Credit Application plays a vital role in empowering businesses to secure credit facilities. By incorporating relevant keywords like North Carolina, business credit, application, types, and lending institutions, this article provides a detailed understanding of the purpose, essential elements, and various types of business credit applications for North Carolina-based businesses.