A North Carolina Notice of Default on Promissory Note Installment is a legal document that notifies a borrower about their failure to make payments as per the terms of their promissory note agreement. This notice serves as a warning to the borrower that they are in default and provides them an opportunity to rectify the situation. The primary aim of the North Carolina Notice of Default on Promissory Note Installment is to inform the borrower of their delinquency and request immediate payment to bring their account back to good standing. By sending this notice, the lender intends to protect their rights and interests in the loan, highlighting that failure to remedy the default could result in legal actions. Keywords: 1. North Carolina: Indicates that the notice follows the specific regulations and laws applicable in the state of North Carolina. 2. Notice of Default: Refers to the formal notification that informs the borrower about their failure to meet the payment obligations. 3. Promissory Note: The legal contract between the borrower and lender that outlines the terms of the loan, such as repayment amount, installment schedule, and interest rate. 4. Installment: Specifies that the loan is paid back in periodic installments, rather than a lump sum. 5. Delinquency: Describes the borrower's failure to make timely payments. 6. Rectify: Implies the borrower's need to resolve the default by paying the outstanding amount or taking necessary actions to cure the delinquency. 7. Legal actions: Suggests the possible consequences the borrower may face if they do not resolve the default, which may include foreclosure or litigation. There may not be different types of North Carolina Notice of Default on Promissory Note Installment, but the details and format can vary depending on the lender's requirements and the specific terms mentioned in the promissory note agreement.

North Carolina Notice of Default on Promissory Note Installment

Description

How to fill out North Carolina Notice Of Default On Promissory Note Installment?

Are you in a situation the place you will need files for either enterprise or person reasons nearly every day? There are a lot of legal record templates available on the net, but finding ones you can rely is not simple. US Legal Forms delivers a huge number of type templates, much like the North Carolina Notice of Default on Promissory Note Installment, that are published to fulfill state and federal demands.

In case you are already knowledgeable about US Legal Forms internet site and have a merchant account, simply log in. Next, you can acquire the North Carolina Notice of Default on Promissory Note Installment web template.

Should you not come with an bank account and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is for the appropriate city/region.

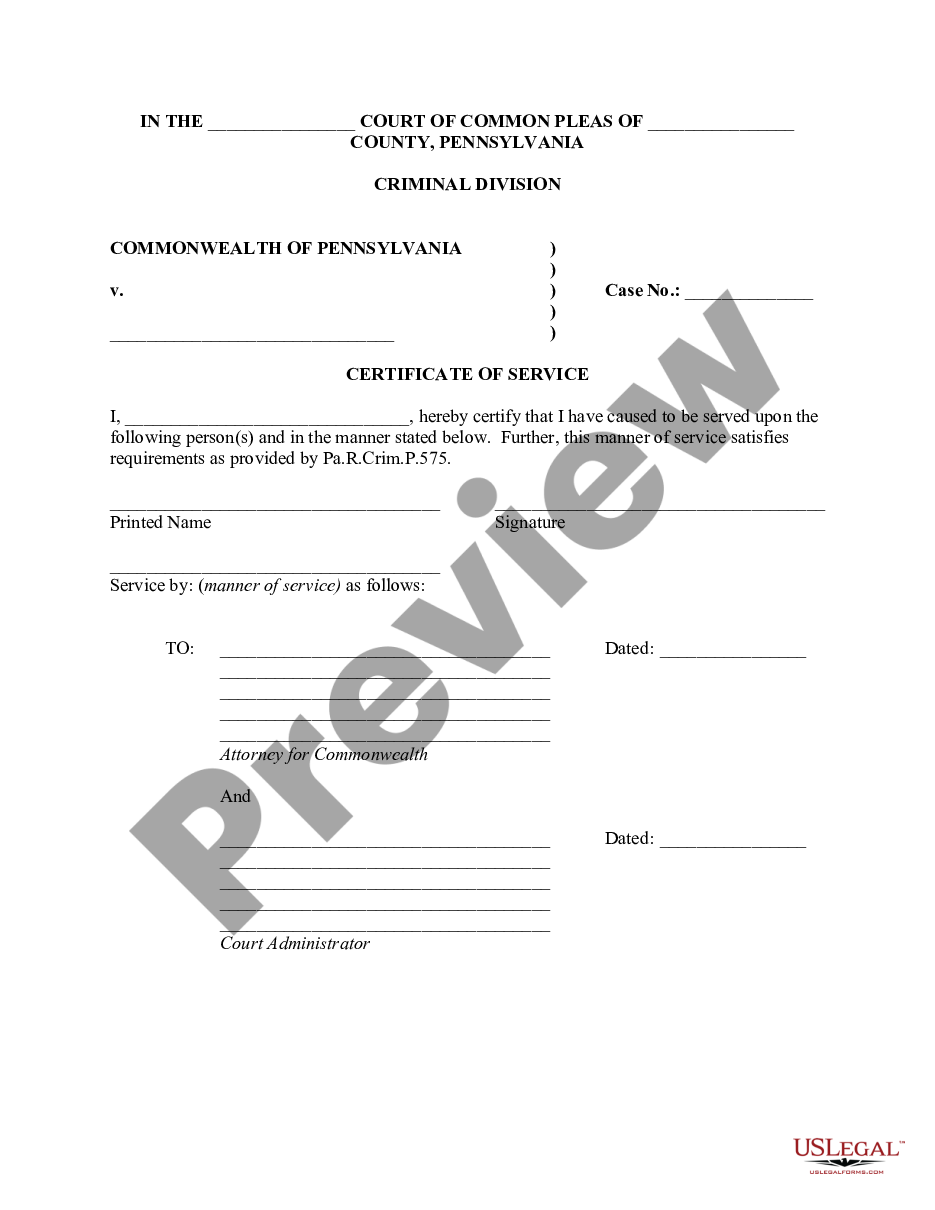

- Use the Review key to review the form.

- Browse the explanation to actually have chosen the proper type.

- In the event the type is not what you are seeking, use the Search industry to get the type that fits your needs and demands.

- Once you get the appropriate type, just click Purchase now.

- Choose the rates plan you want, complete the required info to generate your money, and pay money for your order using your PayPal or charge card.

- Choose a practical data file formatting and acquire your duplicate.

Locate every one of the record templates you may have purchased in the My Forms food list. You can obtain a more duplicate of North Carolina Notice of Default on Promissory Note Installment anytime, if required. Just go through the needed type to acquire or printing the record web template.

Use US Legal Forms, one of the most considerable collection of legal kinds, to save lots of some time and steer clear of faults. The services delivers professionally made legal record templates which can be used for a variety of reasons. Generate a merchant account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms.

Key Takeaways. Delinquency and default are both references to missing payments; however, the implications and consequences of each term are different. Payment delinquency is commonly used to describe a situation in which a borrower misses a single payment owed for a certain type of financing, such as a student loan.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

When a loan defaults, it is sent to a debt collection agency whose job is to contact the borrower and receive the unpaid funds. Defaulting will drastically reduce your credit score, impact your ability to receive future credit, and can lead to the seizure of personal property.

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.