North Carolina Invoice Template for Personal Training

Description

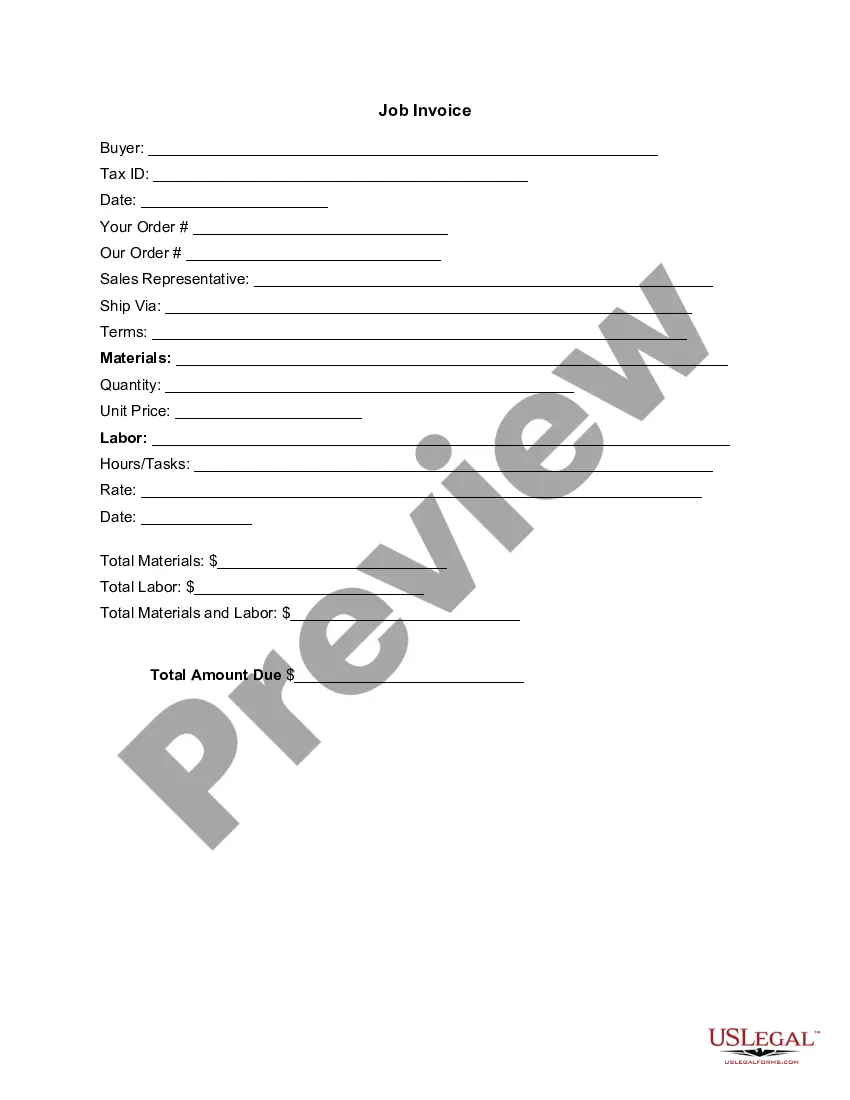

How to fill out Invoice Template For Personal Training?

It is feasible to dedicate hours on the Internet trying to locate the valid document template that meets the state and federal prerequisites you require.

US Legal Forms offers thousands of valid templates that are evaluated by experts.

It is easy to download or print the North Carolina Invoice Template for Personal Training from our service.

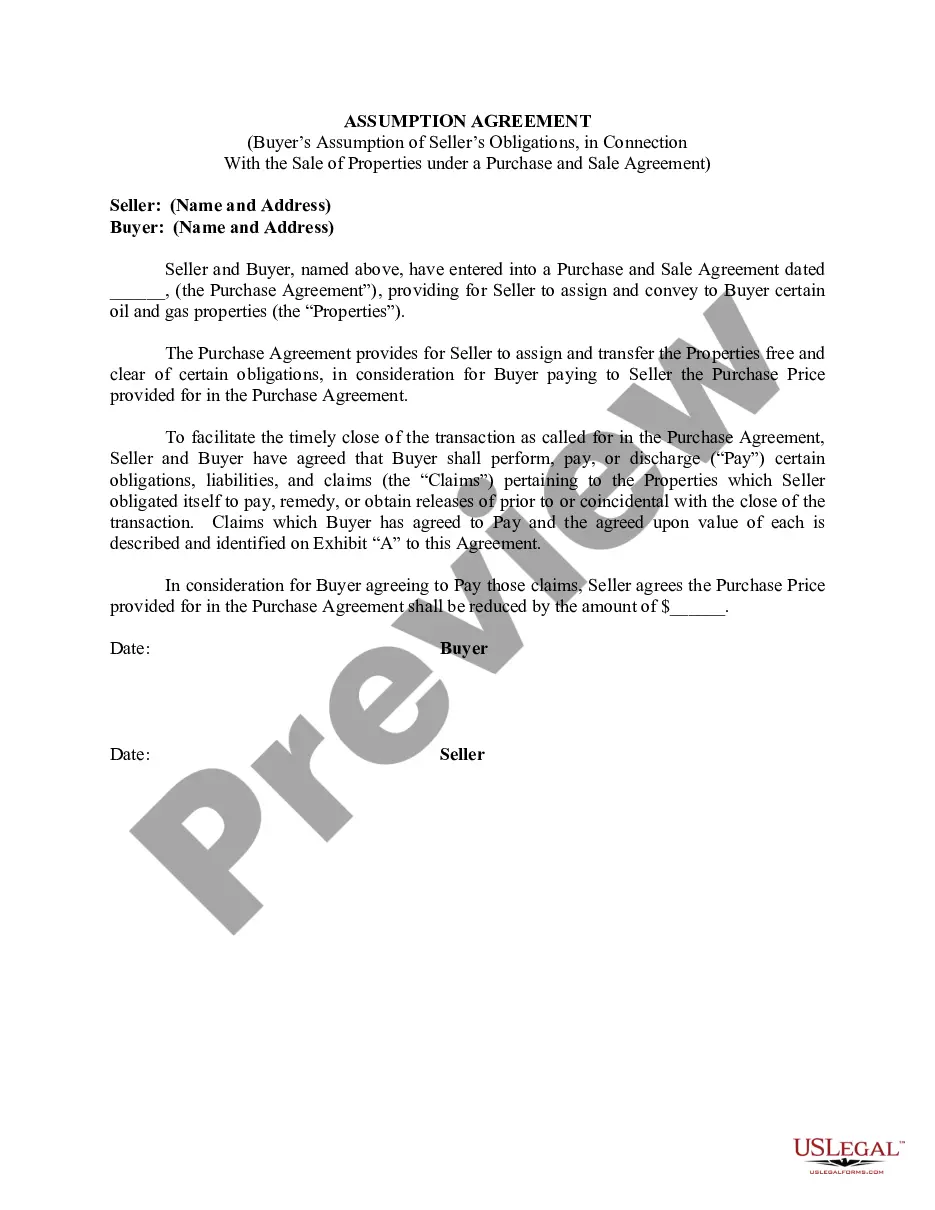

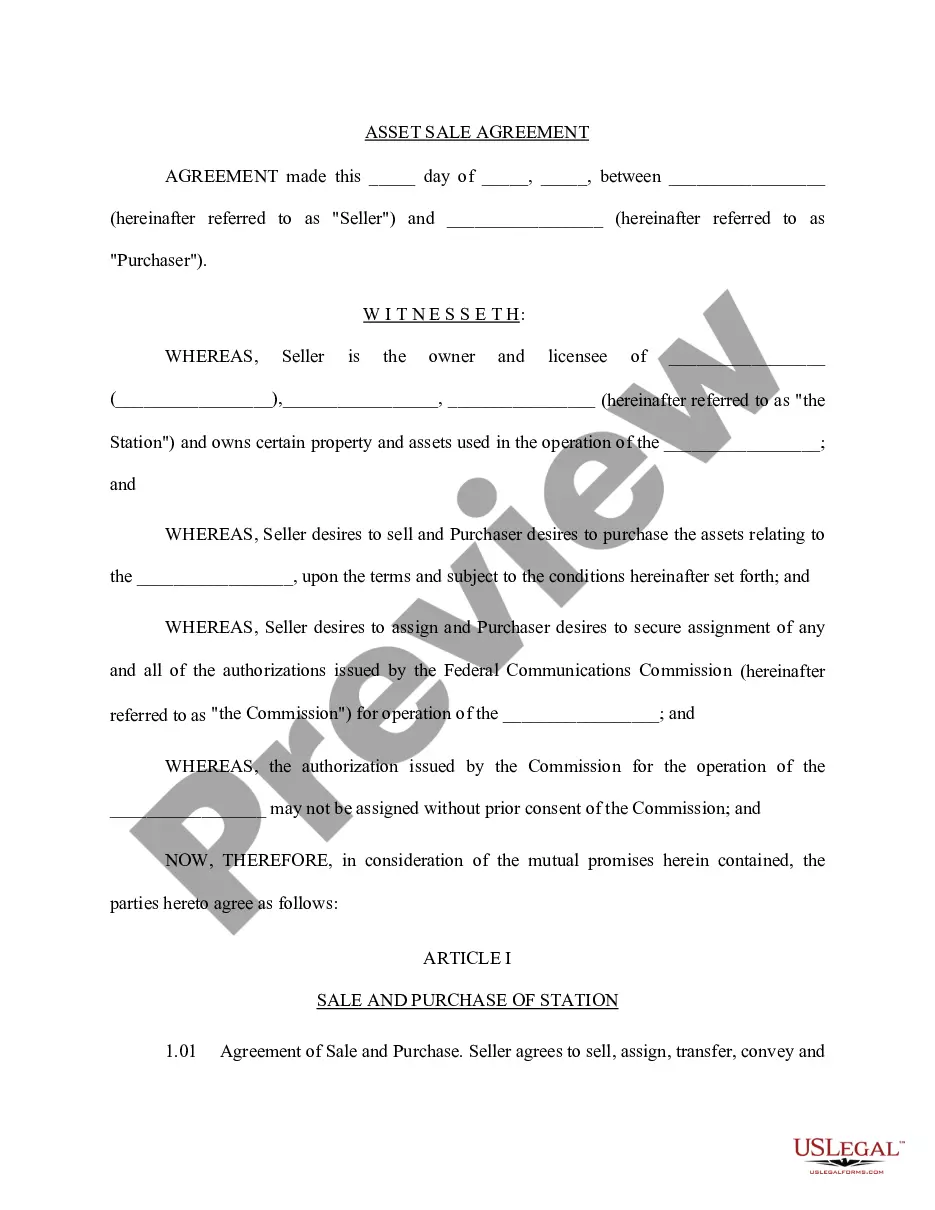

If available, make use of the Preview option to review the document template as well. If you want to find another variation of the template, utilize the Search field to locate the template that suits your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain option.

- After that, you can complete, modify, print, or sign the North Carolina Invoice Template for Personal Training.

- Every valid document template you acquire is your property permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document template for your area/city of preference.

- Check the form outline to confirm that you have selected the proper template.

Form popularity

FAQ

Yes, you can make an invoice without an LLC. Any self-employed individual can create invoices to receive payment for services rendered. To help streamline the process, consider using a North Carolina Invoice Template for Personal Training, which provides a professional layout without requiring a formal business structure.

Yes, it is legal to create your own invoices as long as they contain all necessary information such as your business details and the services offered. Invoices are important for record-keeping and tax purposes. Adopting a North Carolina Invoice Template for Personal Training can help ensure your invoices meet legal standards.

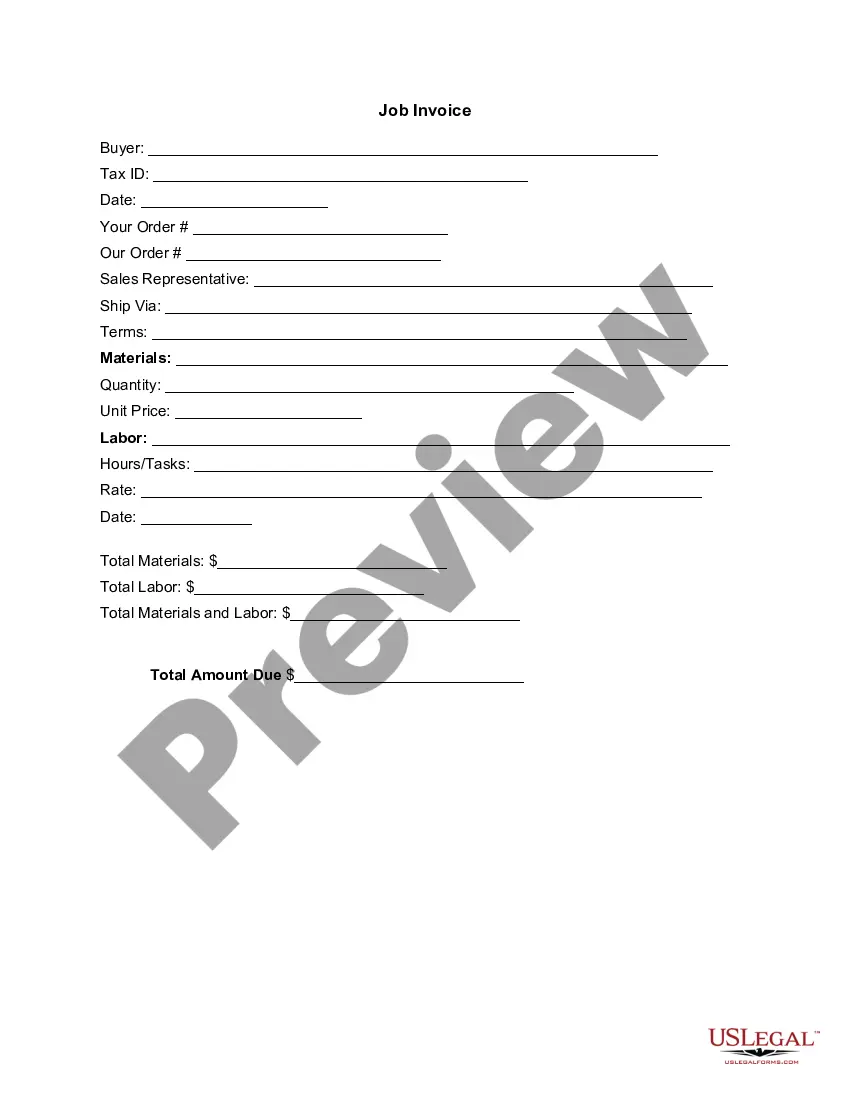

Making a personal invoice involves listing your contact information and detailing the service provided. Add the date and payment details to ensure clarity. A North Carolina Invoice Template for Personal Training will help you organize these details effectively.

To create a self-invoice, include your details along with the services you've performed. Clearly state the amounts due and any necessary payment terms. Utilizing a North Carolina Invoice Template for Personal Training can provide a polished format and save you time.

Making an invoice for self-employed work involves combining your contact information and client details. Specify the services or products provided along with their prices. Using a North Carolina Invoice Template for Personal Training streamlines this process, ensuring you maintain professionalism.

To create a self-employed invoice, list your business name and contact information at the top. Include the client's details, the services provided, the date, and the total amount charged. A North Carolina Invoice Template for Personal Training can help you ensure that you don't miss any important elements.

Creating a gym bill is straightforward. Start by including your business information, such as your gym's name and address. Then, add the client's details, the services rendered, and the total amount due. Using a North Carolina Invoice Template for Personal Training can greatly simplify this process.

The tax business code for personal trainers is 236110, which you should use when filing taxes related to personal training services. By including this code on your North Carolina Invoice Template for Personal Training, you ensure that your business is categorized correctly, which can benefit your overall tax situation. Accurate coding can simplify tax preparation and help in identifying your business for potential deductions.

Yes, you can write off expenses related to personal training on your taxes, but specific conditions apply. If your training supports a business purpose, such as improving your skills or services, you can use the North Carolina Invoice Template for Personal Training to document these expenses accurately. Keep detailed records to substantiate your deductions and consult a tax professional to navigate the rules effectively.

IRS business code 236110 is specifically for personal trainers. This code falls under the broader category of 'Fitness and Recreational Sports Centers.' When using the North Carolina Invoice Template for Personal Training, it's essential to utilize this code for accurate tax reporting and to ensure compliance with IRS regulations. Proper classification helps streamline your business operations and enhances professional credibility.