Title: Understanding the North Carolina Letter to Confirm Accounts Receivable Introduction: The North Carolina Letter to Confirm Accounts Receivable is a crucial document used in business and financial transactions. It aims to validate and confirm the accuracy of accounts receivable held by a company or organization. This detailed description delves into the purpose, components, and different types of North Carolina Letters to Confirm Accounts Receivable. Purpose: The primary purpose of a North Carolina Letter to Confirm Accounts Receivable is to ensure accuracy and reliability in financial records. It serves as a formal request sent by one company to another to verify outstanding balances and confirm the validity of debts owed. Components: 1. Date: The letter should specify the date it was written. 2. Address: The sender and recipient's complete addresses should be clearly mentioned. 3. Subject: A concise subject line indicating the purpose of the letter. 4. Salutation: A formal greeting addressing the intended recipient. 5. Introduction: A brief introduction expressing the sender's purpose for writing. 6. Account Details: In this section, the sender outlines the specific accounts to be confirmed, mentioning customer names, account numbers, and outstanding balances. 7. Request for Confirmation: The letter should include a direct request for the recipient to confirm the accuracy of the accounts listed. 8. Contact Information: The sender's contact details, including name, phone number, and email address, should be included to facilitate communication. 9. Closing: A polite and professional closing, followed by the sender's name and designation. 10. Enclosures: If any additional documents are attached, they should be listed in this section. Different Types: While there may not be specific types of North Carolina Letters to Confirm Accounts Receivable, variations can occur based on the purpose or context within which they are used. Some potential variations include: 1. Standard North Carolina Letter to Confirm Accounts Receivable: A general letter requesting confirmation of accounts receivable balances. 2. Year-End North Carolina Letter to Confirm Accounts Receivable: Sent at the end of the fiscal year to confirm outstanding balances and ensure accurate financial reporting. 3. Audit Confirmation North Carolina Letter to Confirm Accounts Receivable: Used during financial audits to verify account balances for increased transparency and accuracy. 4. Acquisition or Merger North Carolina Letter to Confirm Accounts Receivable: Sent during business mergers or acquisitions to reconcile accounts receivable and verify outstanding balances before the transaction can be completed. Conclusion: A North Carolina Letter to Confirm Accounts Receivable plays a vital role in maintaining accurate financial records and verifying debts owed. Its purpose is to foster trust and transparency between businesses, ensuring their financial statements are accurate and reliable. The different variations mentioned above offer flexibility based on the specific context in which the letter is used.

North Carolina Letter to Confirm Accounts Receivable

Description

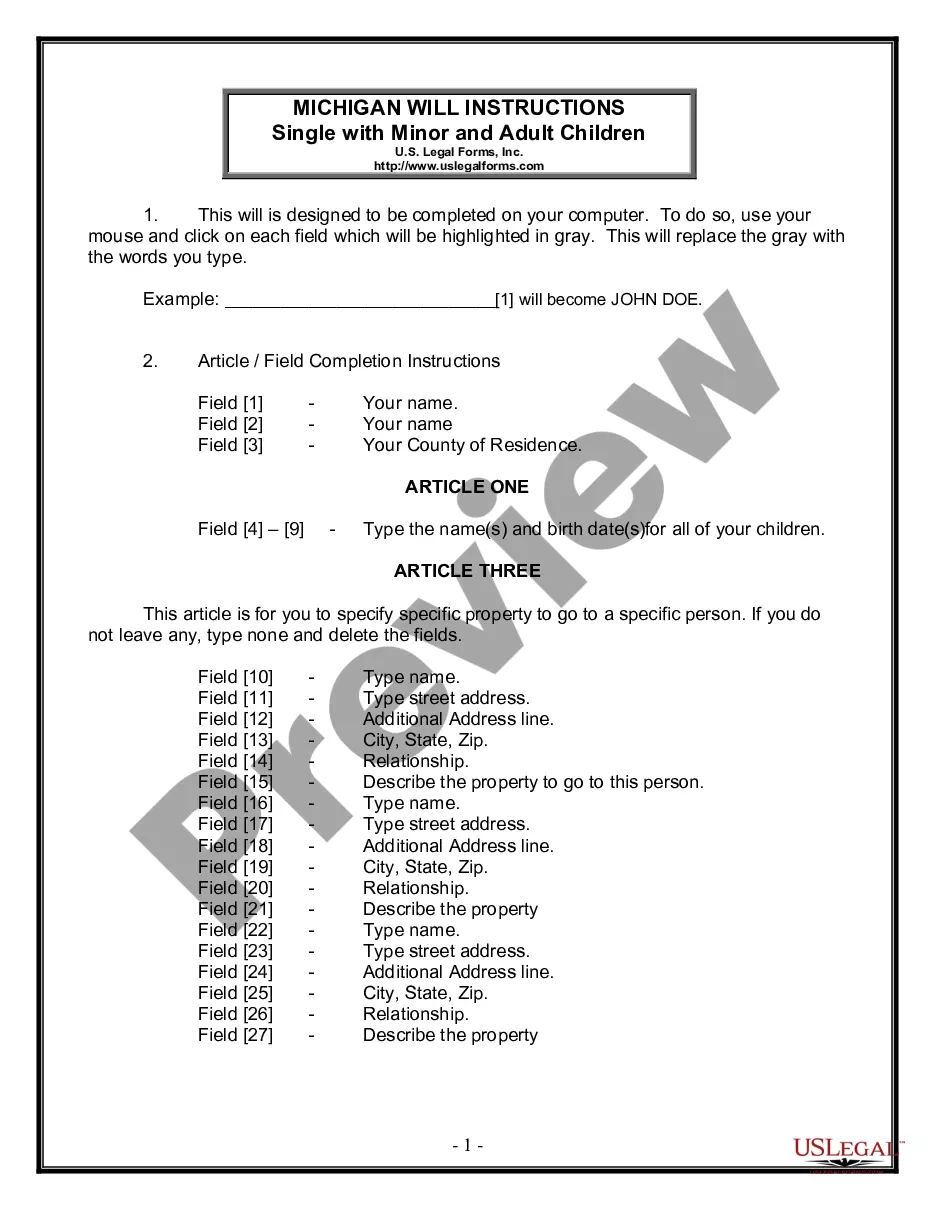

How to fill out North Carolina Letter To Confirm Accounts Receivable?

You are able to invest several hours on-line trying to find the legal papers web template that meets the state and federal specifications you require. US Legal Forms provides a large number of legal varieties that happen to be evaluated by experts. You can easily download or print out the North Carolina Letter to Confirm Accounts Receivable from the service.

If you have a US Legal Forms bank account, you are able to log in and click the Download option. After that, you are able to total, edit, print out, or signal the North Carolina Letter to Confirm Accounts Receivable. Every legal papers web template you acquire is yours permanently. To acquire one more version of any bought kind, visit the My Forms tab and click the related option.

If you are using the US Legal Forms site for the first time, stick to the basic directions below:

- Very first, make certain you have selected the best papers web template for your state/area of your choosing. Read the kind outline to ensure you have picked the right kind. If available, utilize the Review option to appear from the papers web template also.

- In order to discover one more model from the kind, utilize the Search discipline to discover the web template that meets your requirements and specifications.

- Once you have found the web template you want, click on Buy now to proceed.

- Select the costs program you want, key in your qualifications, and register for a free account on US Legal Forms.

- Full the purchase. You may use your credit card or PayPal bank account to cover the legal kind.

- Select the format from the papers and download it for your product.

- Make modifications for your papers if required. You are able to total, edit and signal and print out North Carolina Letter to Confirm Accounts Receivable.

Download and print out a large number of papers layouts using the US Legal Forms site, that offers the largest variety of legal varieties. Use professional and status-certain layouts to take on your small business or individual requirements.

Form popularity

FAQ

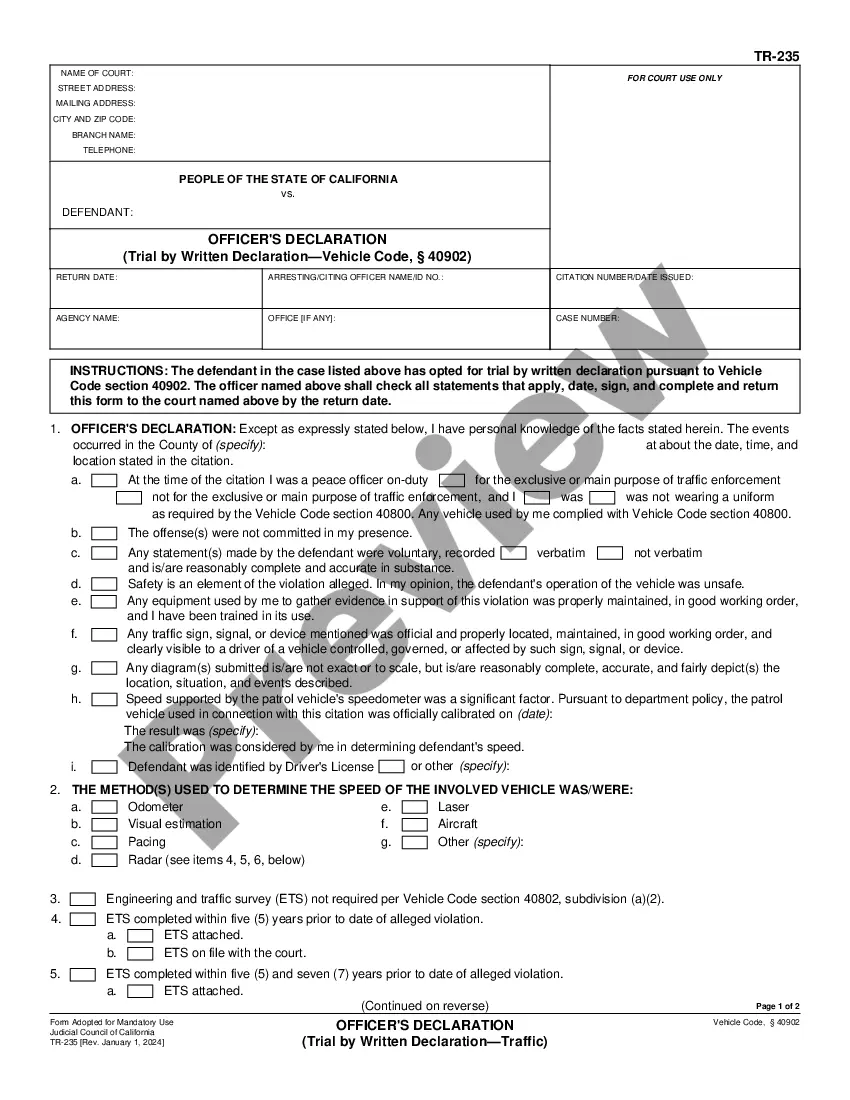

Accounts receivable confirmation is a technique used in the auditing process to verify a company's records. The auditor sends communications directly to customers, asking them to confirm the records maintained by the company.

What is an Accounts Receivable Confirmation? When an auditor is examining the accounting records of a client company, a primary technique for verifying the existence of accounts receivable is to confirm them with the company's customers. The auditor does so with an accounts receivable confirmation.

Once the confirmation is ready to be sent, the auditor is the one who sends the confirmation to the client's customers. The confirmation should not send by the client to its customer. This is to confirm that evidence that is collected from the confirmation is considered third-party information.

Normally, account payable confirmation is used to verify the accuracy and existence of account payable at the end of the accounting period that claims to be existing by the client.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

How to Audit Accounts ReceivableTrace receivable report to general ledger.Calculate the receivable report total.Investigate reconciling items.Test invoices listed in receivable report.Match invoices to shipping log.Confirm accounts receivable.Review cash receipts.Assess the allowance for doubtful accounts.More items...?

The auditor does so with an accounts receivable confirmation. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report.

Thus, there is a presumption that the auditor will request the confirmation of accounts receivable during an audit unless one of the following is true: Accounts receivable are immaterial to the financial statements. The use of confirmations would be ineffective.

With my solid experience in accounts receivable and collections, coupled with keen financial acumen and dedication to quality customer service, I am confident that I could quickly exceed your expectations in this role. I look forward to discussing the position in further detail. Thank you for your consideration.

Is the confirmation of cash and accounts receivable required according to auditing standards? Yes, usually required by auditing standards but auditors can choose not to in certain situations. It then becomes the auditors responsibility to gather evidence which can take much more time.