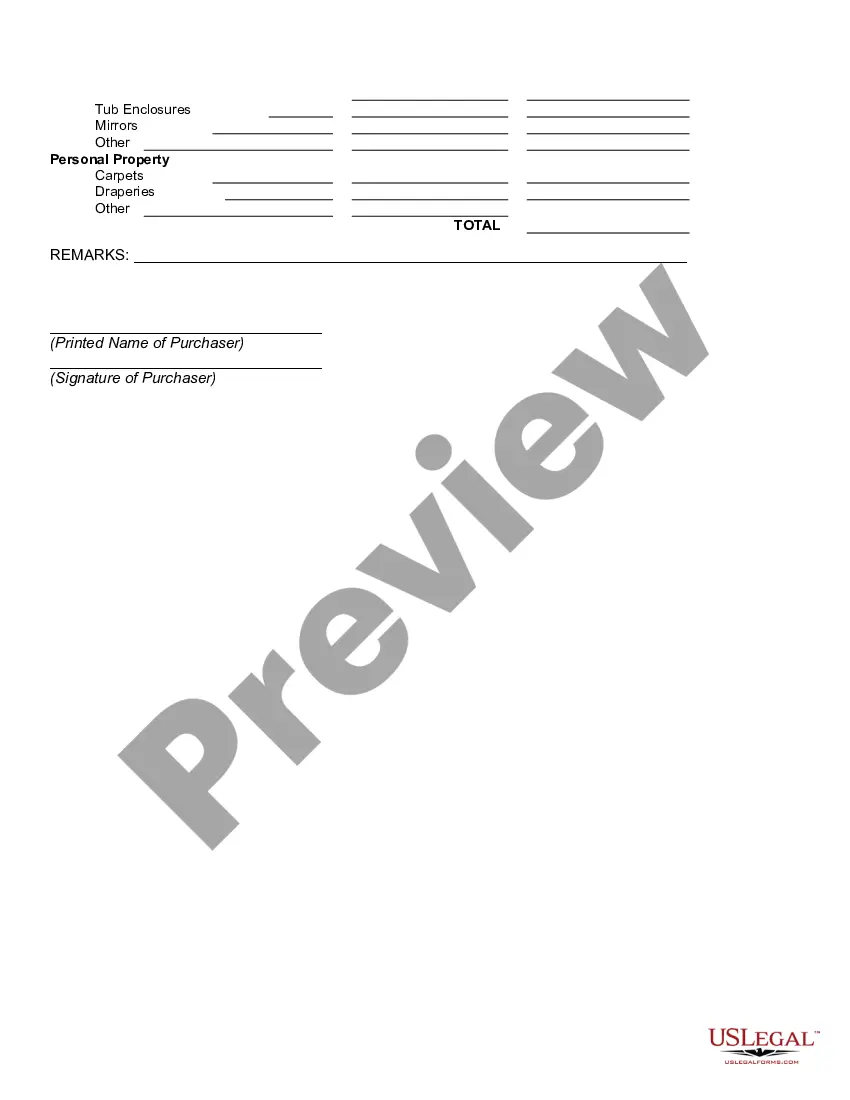

The North Carolina Buyer's Property Inspection Report is a comprehensive document that encompasses a detailed assessment of a property's condition and identifies any potential issues or defects. It serves as a valuable tool for homebuyers in North Carolina to make informed decisions about their potential investment. This inspection report typically covers various crucial aspects of a property, including the foundation, structure, roof, HVAC systems, electrical and plumbing systems, exterior and interior elements, and more. It is performed by a licensed home inspector who thoroughly examines the property to ensure compliance with North Carolina building codes and standards. The report aims to provide an objective evaluation of the property's overall condition, highlighting any areas that require immediate attention, repairs, or further investigation. It allows buyers to negotiate repairs or renegotiate the price based on the findings, ensuring transparency and accountability in the transaction process. Several types of North Carolina Buyer's Property Inspection Reports may exist, each catering to specific needs or circumstances. Some of these include: 1. Pre-Purchase Inspection Report: This report is conducted before the purchase of a property and provides potential buyers with a comprehensive overview of its current condition. It helps buyers make informed decisions and avoid unexpected expenses post-purchase. 2. New Construction Inspection Report: This type of report is specifically tailored for newly constructed properties. It ensures that the property adheres to necessary codes, regulations, and industry standards. It assists buyers in detecting any construction defects or issues before closing the deal. 3. Insurance Inspection Report: Often required by insurance companies, this report assesses the insurability of a property in terms of its safety features and potential risks. It may involve evaluating the property's electrical systems, heating, ventilation, and cooling systems (HVAC), roof condition, and more. 4. Yearly Maintenance Inspection Report: This report aims to identify any maintenance or safety issues that may have arisen since the property's last inspection. It helps homeowners ensure their property remains in good condition over time and may be performed annually or at regular intervals. In conclusion, the North Carolina Buyer's Property Inspection Report is an essential document that enables potential homebuyers to make informed decisions about purchasing a property. Whether it is a pre-purchase, new construction, insurance, or yearly maintenance inspection, each type caters to specific needs and offers detailed insights into a property's condition, giving buyers peace of mind in their decision-making process.

North Carolina Buyer's Property Inspection Report

Description

How to fill out North Carolina Buyer's Property Inspection Report?

It is possible to devote time on the Internet looking for the authorized papers web template that meets the state and federal needs you require. US Legal Forms supplies 1000s of authorized forms that are reviewed by experts. It is possible to acquire or print the North Carolina Buyer's Property Inspection Report from the assistance.

If you already have a US Legal Forms profile, you can log in and then click the Acquire switch. After that, you can complete, change, print, or signal the North Carolina Buyer's Property Inspection Report. Every single authorized papers web template you buy is yours forever. To have yet another duplicate for any purchased kind, visit the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms site the first time, adhere to the straightforward instructions beneath:

- Initially, be sure that you have selected the right papers web template for the county/area that you pick. See the kind information to ensure you have chosen the right kind. If offered, use the Preview switch to check with the papers web template at the same time.

- If you would like discover yet another edition of your kind, use the Look for area to get the web template that meets your needs and needs.

- Upon having identified the web template you would like, click on Get now to carry on.

- Choose the costs program you would like, type your references, and register for an account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal profile to fund the authorized kind.

- Choose the file format of your papers and acquire it to the product.

- Make adjustments to the papers if needed. It is possible to complete, change and signal and print North Carolina Buyer's Property Inspection Report.

Acquire and print 1000s of papers layouts while using US Legal Forms site, that offers the most important collection of authorized forms. Use professional and condition-specific layouts to handle your small business or individual needs.